Enlarge image

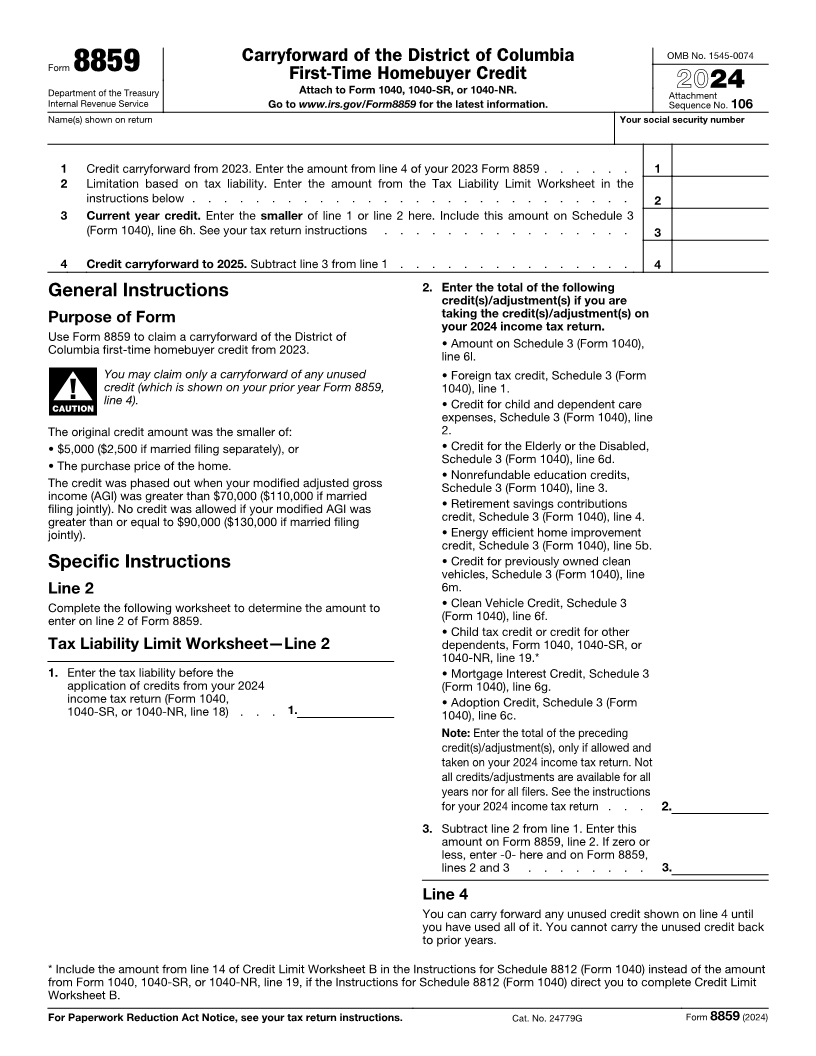

Carryforward of the District of Columbia OMB No. 1545-0074

Form 8859 First-Time Homebuyer Credit

Department of the Treasury Attach to Form 1040, 1040-SR, or 1040-NR. 2024

Attachment

Internal Revenue Service Go to www.irs.gov/Form8859 for the latest information. Sequence No. 106

Name(s) shown on return Your social security number

1 Credit carryforward from 2023. Enter the amount from line 4 of your 2023 Form 8859 . . . . . . 1

2 Limitation based on tax liability. Enter the amount from the Tax Liability Limit Worksheet in the

instructions below . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3 Current year credit. Enter the smaller of line 1 or line 2 here. Include this amount on Schedule 3

(Form 1040), line 6h. See your tax return instructions . . . . . . . . . . . . . . . . 3

4 Credit carryforward to 2025. Subtract line 3 from line 1 . . . . . . . . . . . . . . . 4

General Instructions 2. Enter the total of the following

credit(s)/adjustment(s) if you are

Purpose of Form taking the credit(s)/adjustment(s) on

your 2024 income tax return.

Use Form 8859 to claim a carryforward of the District of

Columbia first-time homebuyer credit from 2023. • Amount on Schedule 3 (Form 1040),

line 6l.

You may claim only a carryforward of any unused • Foreign tax credit, Schedule 3 (Form

credit (which is shown on your prior year Form 8859, 1040), line 1.

▲! line 4). • Credit for child and dependent care

CAUTION

expenses, Schedule 3 (Form 1040), line

The original credit amount was the smaller of: 2.

• $5,000 ($2,500 if married filing separately), or • Credit for the Elderly or the Disabled,

Schedule 3 (Form 1040), line 6d.

• The purchase price of the home.

• Nonrefundable education credits,

The credit was phased out when your modified adjusted gross Schedule 3 (Form 1040), line 3.

income (AGI) was greater than $70,000 ($110,000 if married

filing jointly). No credit was allowed if your modified AGI was • Retirement savings contributions

greater than or equal to $90,000 ($130,000 if married filing credit, Schedule 3 (Form 1040), line 4.

jointly). • Energy efficient home improvement

credit, Schedule 3 (Form 1040), line 5b.

Specific Instructions • Credit for previously owned clean

vehicles, Schedule 3 (Form 1040), line

Line 2 6m.

Complete the following worksheet to determine the amount to • Clean Vehicle Credit, Schedule 3

enter on line 2 of Form 8859. (Form 1040), line 6f.

• Child tax credit or credit for other

Tax Liability Limit Worksheet—Line 2 dependents, Form 1040, 1040-SR, or

1040-NR, line 19.*

1. Enter the tax liability before the • Mortgage Interest Credit, Schedule 3

application of credits from your 2024 (Form 1040), line 6g.

income tax return (Form 1040, • Adoption Credit, Schedule 3 (Form

1040-SR, or 1040-NR, line 18) . . . 1. 1040), line 6c.

Note: Enter the total of the preceding

credit(s)/adjustment(s), only if allowed and

taken on your 2024 income tax return. Not

all credits/adjustments are available for all

years nor for all filers. See the instructions

for your 2024 income tax return . . . 2.

3. Subtract line 2 from line 1. Enter this

amount on Form 8859, line 2. If zero or

less, enter -0- here and on Form 8859,

lines 2 and 3 . . . . . . . . 3.

Line 4

You can carry forward any unused credit shown on line 4 until

you have used all of it. You cannot carry the unused credit back

to prior years.

* Include the amount from line 14 of Credit Limit Worksheet B in the Instructions for Schedule 8812 (Form 1040) instead of the amount

from Form 1040, 1040-SR, or 1040-NR, line 19, if the Instructions for Schedule 8812 (Form 1040) direct you to complete Credit Limit

Worksheet B.

For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 24779G Form 8859 (2024)