Enlarge image

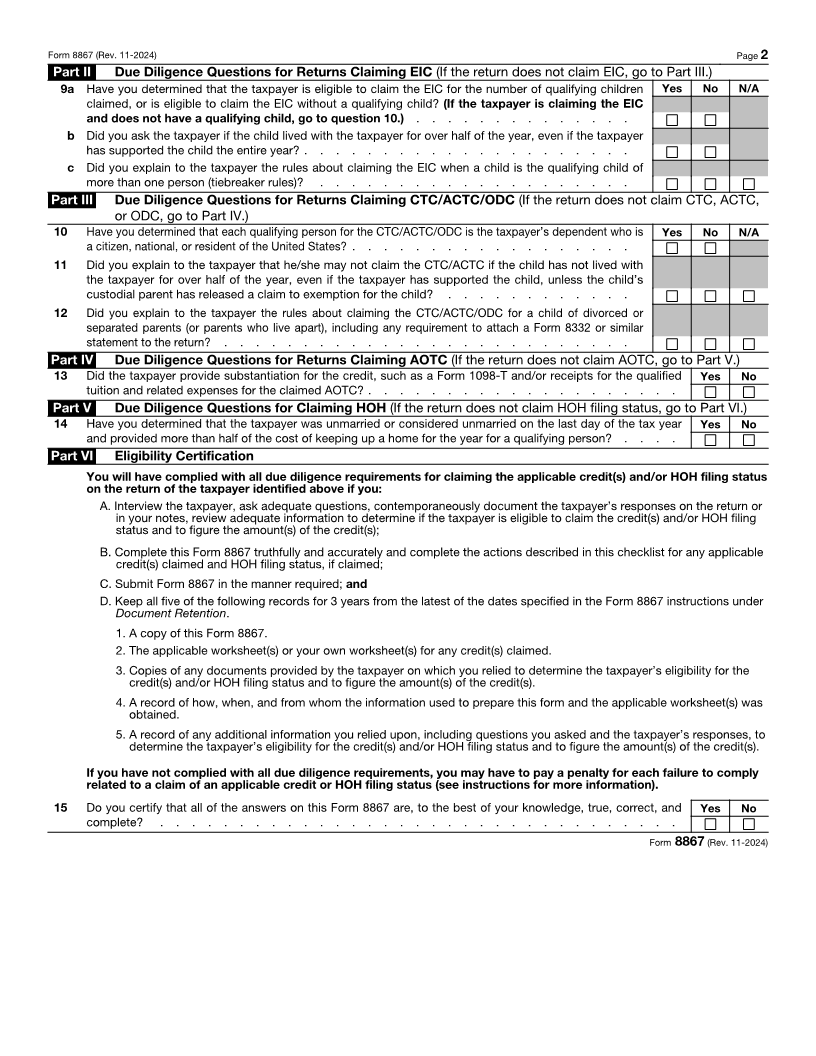

OMB No. 1545-0074

Paid Preparer’s Due Diligence Checklist

Form 8867 Earned Income Credit (EIC), American Opportunity Tax Credit (AOTC), For tax year

(Rev. November 2024) Child Tax Credit (CTC) (including the Additional Child Tax Credit (ACTC) and 20

Credit for Other Dependents (ODC)), and Head of Household (HOH) Filing Status

Department of the Treasury To be completed by preparer and filed with Form 1040, 1040-SR, 1040-NR, or 1040-SS. Attachment

Internal Revenue Service Go to www.irs.gov/Form8867 for instructions and the latest information. Sequence No. 70

Taxpayer name(s) shown on return Taxpayer identification number

Preparer’s name Preparer tax identification number

Part I Due Diligence Requirements

Please check the appropriate box for the credit(s) and/or HOH filing status claimed on the return and complete the related Parts I–V

for the benefit(s) claimed (check all that apply). EIC CTC/ACTC/ODC AOTC HOH

1 Did you complete the return based on information for the applicable tax year provided by the taxpayer Yes No N/A

or reasonably obtained by you? . . . . . . . . . . . . . . . . . . . . . . .

2 If credits are claimed on the return, did you complete the applicable EIC and/or CTC/ACTC/ODC

worksheets found in the Form 1040, 1040-SR, 1040-NR, 1040-SS, or Schedule 8812 (Form 1040)

instructions, and/or the AOTC worksheet found in the Form 8863 instructions, or your own worksheet(s)

that provides the same information, and all related forms and schedules for each credit claimed? . .

3 Did you satisfy the knowledge requirement? To meet the knowledge requirement, you must do both of

the following.

• Interview the taxpayer, ask questions, and contemporaneously document the taxpayer’s responses to

determine that the taxpayer is eligible to claim the credit(s) and/or HOH filing status.

• Review information to determine that the taxpayer is eligible to claim the credit(s) and/or HOH filing

status and to figure the amount(s) of any credit(s) . . . . . . . . . . . . . . . . .

4 Did any information provided by the taxpayer or a third party for use in preparing the return, or

information reasonably known to you, appear to be incorrect, incomplete, or inconsistent? (If “Yes,”

answer questions 4a and 4b. If “No ,” go to question 5.) . . . . . . . . . . . . . . .

a Did you make reasonable inquiries to determine the correct, complete, and consistent information? .

b Did you contemporaneously document your inquiries? (Documentation should include the questions

you asked, whom you asked, when you asked, the information that was provided, and the impact the

information had on your preparation of the return.) . . . . . . . . . . . . . . . . .

5 Did you satisfy the record retention requirement? To meet the record retention requirement, you must

keep a copy of your documentation referenced in question 4b, a copy of this Form 8867, a copy of any

applicable worksheet(s), a record of how, when, and from whom the information used to prepare Form

8867 and any applicable worksheet(s) was obtained, and a copy of any document(s) provided by the

taxpayer that you relied on to determine eligibility for the credit(s) and/or HOH filing status or to figure

the amount(s) of the credit(s) . . . . . . . . . . . . . . . . . . . . . . . .

List those documents provided by the taxpayer, if any, that you relied on:

6 Did you ask the taxpayer whether he/she could provide documentation to substantiate eligibility for the

credit(s) and/or HOH filing status and the amount(s) of any credit(s) claimed on the return if his/her

return is selected for audit? . . . . . . . . . . . . . . . . . . . . . . . . .

7 Did you ask the taxpayer if any of these credits were disallowed or reduced in a previous year? . .

(If credits were disallowed or reduced, go to question 7a; if not, go to question 8.)

a Did you complete the required recertification Form 8862? . . . . . . . . . . . . . . .

8 If the taxpayer is reporting self-employment income, did you ask questions to prepare a complete and

correct Schedule C (Form 1040)? . . . . . . . . . . . . . . . . . . . . . . .

For Paperwork Reduction Act Notice, see separate instructions. Cat. No. 26142H Form 8867 (Rev. 11-2024)