Enlarge image

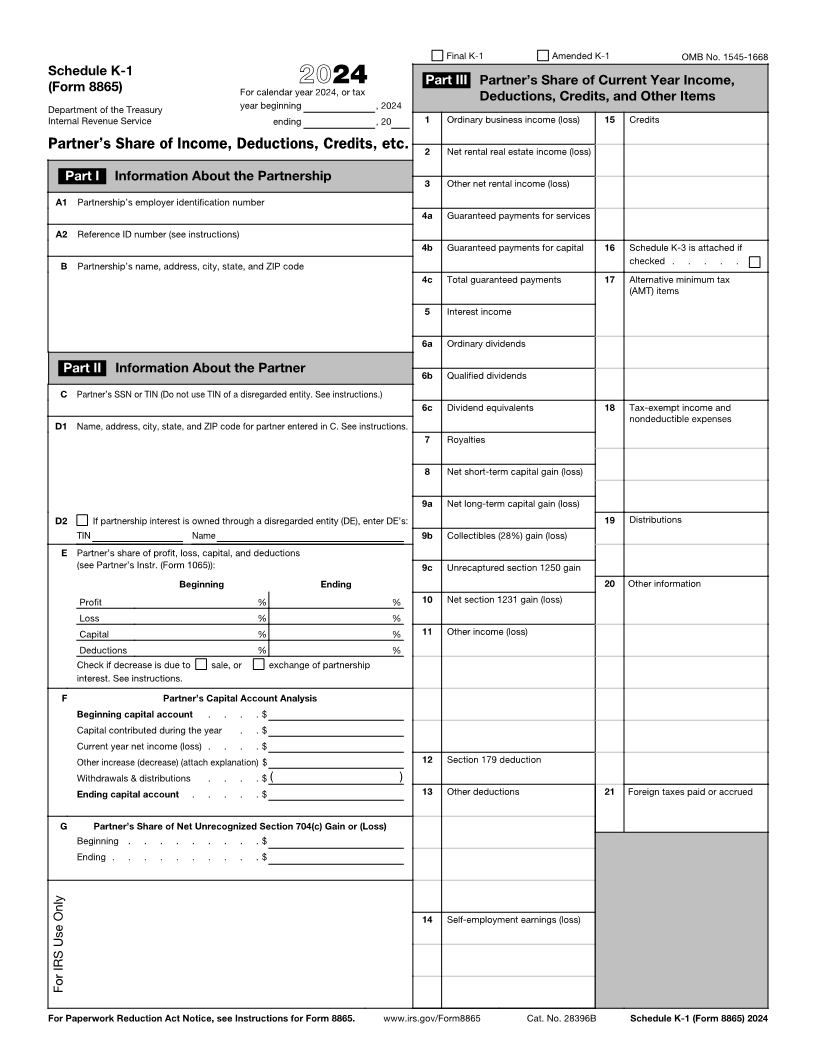

Final K-1 Amended K-1 OMB No. 1545-1668

Schedule K-1

(Form 8865) 2024 Part III Partner’s Share of Current Year Income,

For calendar year 2024, or tax Deductions, Credits, and Other Items

Department of the Treasury year beginning , 2024

Internal Revenue Service ending , 20 1 Ordinary business income (loss) 15 Credits

Partner’s Share of Income, Deductions, Credits, etc. 2 Net rental real estate income (loss)

Part I Information About the Partnership 3 Other net rental income (loss)

A1 Partnership’s employer identification number

4a Guaranteed payments for services

A2 Reference ID number (see instructions)

4b Guaranteed payments for capital 16 Schedule K-3 is attached if

B Partnership’s name, address, city, state, and ZIP code checked . . . . .

4c Total guaranteed payments 17 Alternative minimum tax

(AMT) items

5 Interest income

6a Ordinary dividends

Part II Information About the Partner 6b Qualified dividends

C Partner’s SSN or TIN (Do not use TIN of a disregarded entity. See instructions.)

6c Dividend equivalents 18 Tax-exempt income and

nondeductible expenses

D1 Name, address, city, state, and ZIP code for partner entered in C. See instructions.

7 Royalties

8 Net short-term capital gain (loss)

9a Net long-term capital gain (loss)

D2 If partnership interest is owned through a disregarded entity (DE), enter DE’s: 19 Distributions

TIN Name 9b Collectibles (28%) gain (loss)

E Partner’s share of profit, loss, capital, and deductions

(see Partner’s Instr. (Form 1065)): 9c Unrecaptured section 1250 gain

Beginning Ending 20 Other information

Profit % % 10 Net section 1231 gain (loss)

Loss % %

Capital % % 11 Other income (loss)

Deductions % %

Check if decrease is due to sale, or exchange of partnership

interest. See instructions.

F Partner’s Capital Account Analysis

Beginning capital account . . . . $

Capital contributed during the year . . $

Current year net income (loss) . . . . $

Other increase (decrease) (attach explanation) $ 12 Section 179 deduction

Withdrawals & distributions . . . . $ ( )

Ending capital account . . . . . $ 13 Other deductions 21 Foreign taxes paid or accrued

G Partner’s Share of Net Unrecognized Section 704(c) Gain or (Loss)

Beginning . . . . . . . . . $

Ending . . . . . . . . . . $

14 Self-employment earnings (loss)

For IRS Use Only

For Paperwork Reduction Act Notice, see Instructions for Form 8865. www.irs.gov/Form8865 Cat. No. 28396B Schedule K-1 (Form 8865) 2024