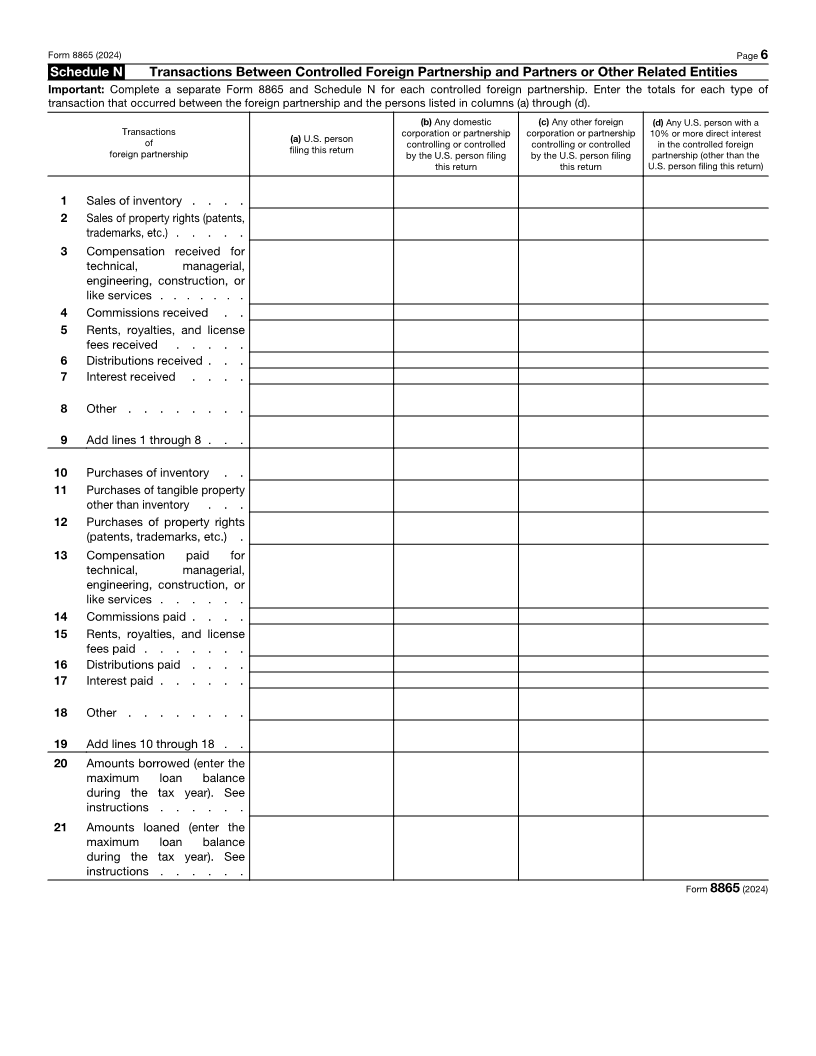

Enlarge image

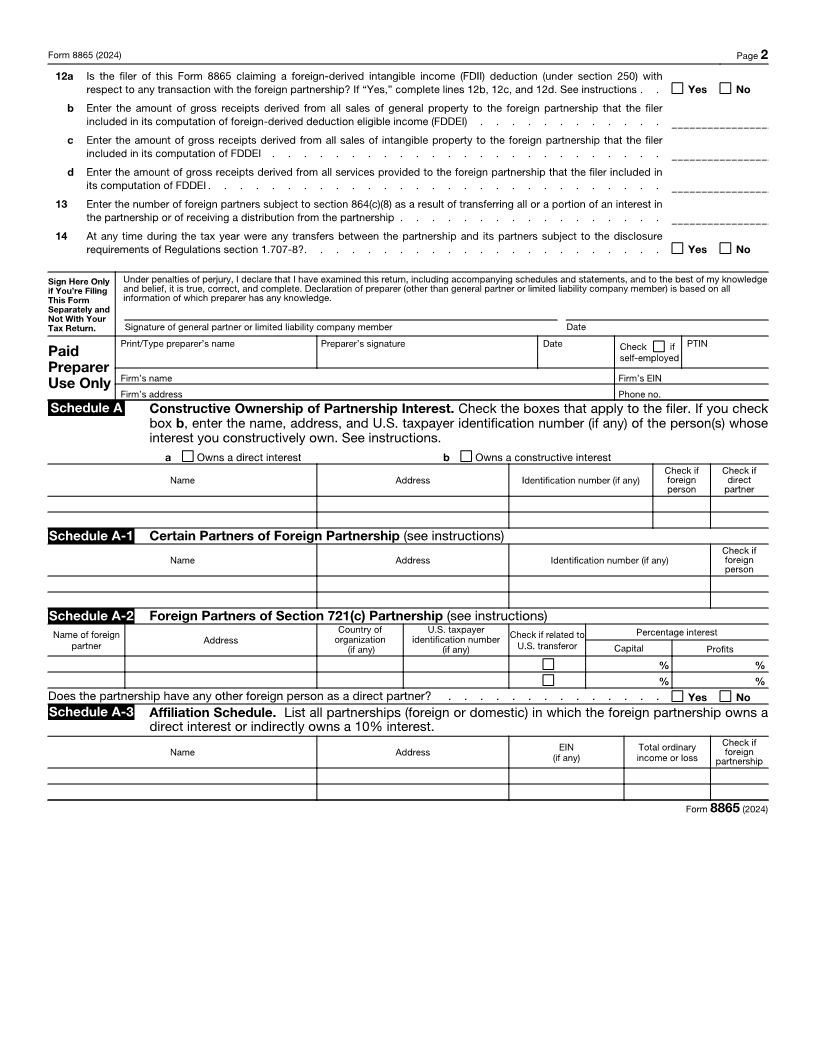

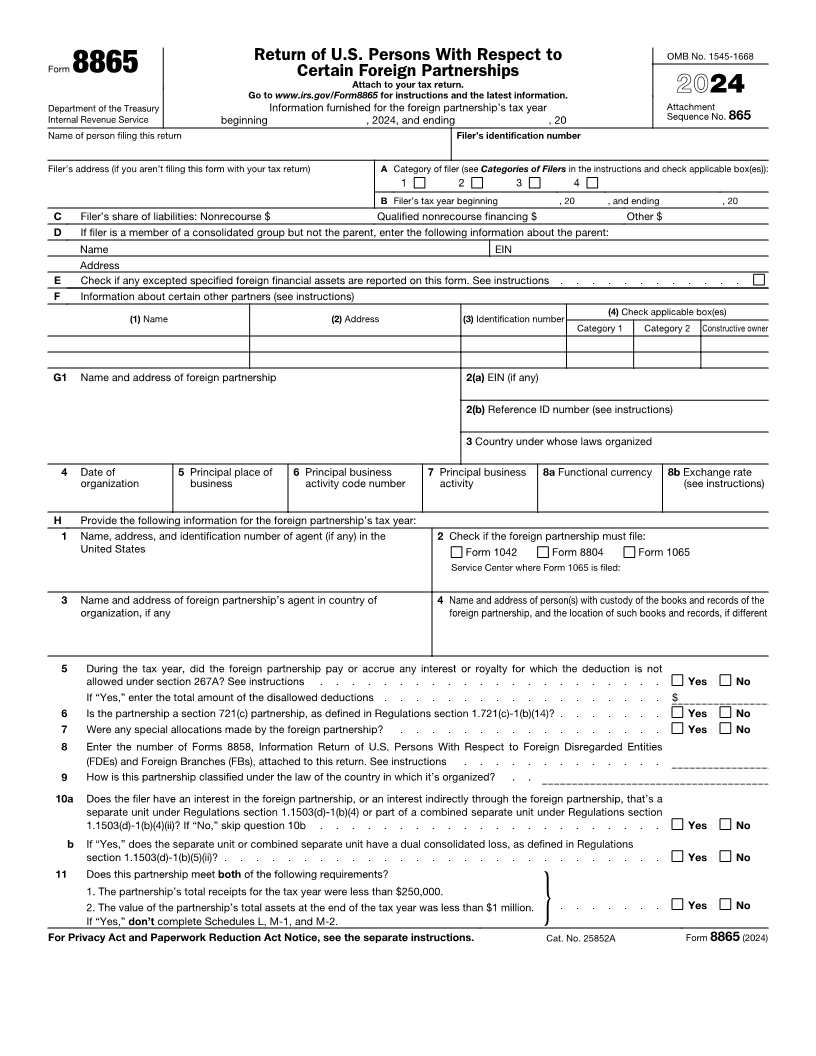

Return of U.S. Persons With Respect to OMB No. 1545-1668

Form 8865 Certain Foreign Partnerships

Attach to your tax return.

Go to www.irs.gov/Form8865 for instructions and the latest information. 2024

Department of the Treasury Information furnished for the foreign partnership’s tax year Attachment

Internal Revenue Service beginning , 2024, and ending , 20 Sequence No. 865

Name of person filing this return Filer’s identification number

Filer’s address (if you aren’t filing this form with your tax return) A Category of filer (see Categories of Filers in the instructions and check applicable box(es)):

1 2 3 4

B Filer’s tax year beginning , 20 , and ending , 20

C Filer’s share of liabilities: Nonrecourse $ Qualified nonrecourse financing $ Other $

D If filer is a member of a consolidated group but not the parent, enter the following information about the parent:

Name EIN

Address

E Check if any excepted specified foreign financial assets are reported on this form. See instructions . . . . . . . . . . . .

F Information about certain other partners (see instructions)

(4) Check applicable box(es)

(1) Name (2) Address (3) Identification number

Category 1 Category 2 Constructive owner

G1 Name and address of foreign partnership 2(a) EIN (if any)

2(b) Reference ID number (see instructions)

3 Country under whose laws organized

4 Date of 5 Principal place of 6 Principal business 7 Principal business 8a Functional currency 8b Exchange rate

organization business activity code number activity (see instructions)

H Provide the following information for the foreign partnership’s tax year:

1 Name, address, and identification number of agent (if any) in the 2 Check if the foreign partnership must file:

United States Form 1042 Form 8804 Form 1065

Service Center where Form 1065 is filed:

3 Name and address of foreign partnership’s agent in country of 4 Name and address of person(s) with custody of the books and records of the

organization, if any foreign partnership, and the location of such books and records, if different

5 During the tax year, did the foreign partnership pay or accrue any interest or royalty for which the deduction is not

allowed under section 267A? See instructions . . . . . . . . . . . . . . . . . . . . . . Yes No

If “Yes,” enter the total amount of the disallowed deductions . . . . . . . . . . . . . . . . . . $

6 Is the partnership a section 721(c) partnership, as defined in Regulations section 1.721(c)-1(b)(14)? . . . . . . . Yes No

7 Were any special allocations made by the foreign partnership? . . . . . . . . . . . . . . . . . Yes No

8 Enter the number of Forms 8858, Information Return of U.S. Persons With Respect to Foreign Disregarded Entities

(FDEs) and Foreign Branches (FBs), attached to this return. See instructions . . . . . . . . . . . . .

9 How is this partnership classified under the law of the country in which it’s organized? . .

10 a Does the filer have an interest in the foreign partnership, or an interest indirectly through the foreign partnership, that’s a

separate unit under Regulations section 1.1503(d)-1(b)(4) or part of a combined separate unit under Regulations section

1.1503(d)-1(b)(4)(ii)? If “No,” skip question 10b . . . . . . . . . . . . . . . . . . . . . . Yes No

b If “Yes,” does the separate unit or combined separate unit have a dual consolidated loss, as defined in Regulations

section 1.1503(d)-1(b)(5)(ii)? . . . . . . . . . . . . . . . . . . . . . . . . . . . . Yes No

11 Does this partnership meet both of the following requirements?

1. The partnership’s total receipts for the tax year were less than $250,000.

2. The value of the partnership’s total assets at the end of the tax year was less than $1 million. . . . . . . . Yes No

If “Yes,” don’t complete Schedules L, M-1, and M-2. }

For Privacy Act and Paperwork Reduction Act Notice, see the separate instructions. Cat. No. 25852A Form 8865 (2024)