Enlarge image

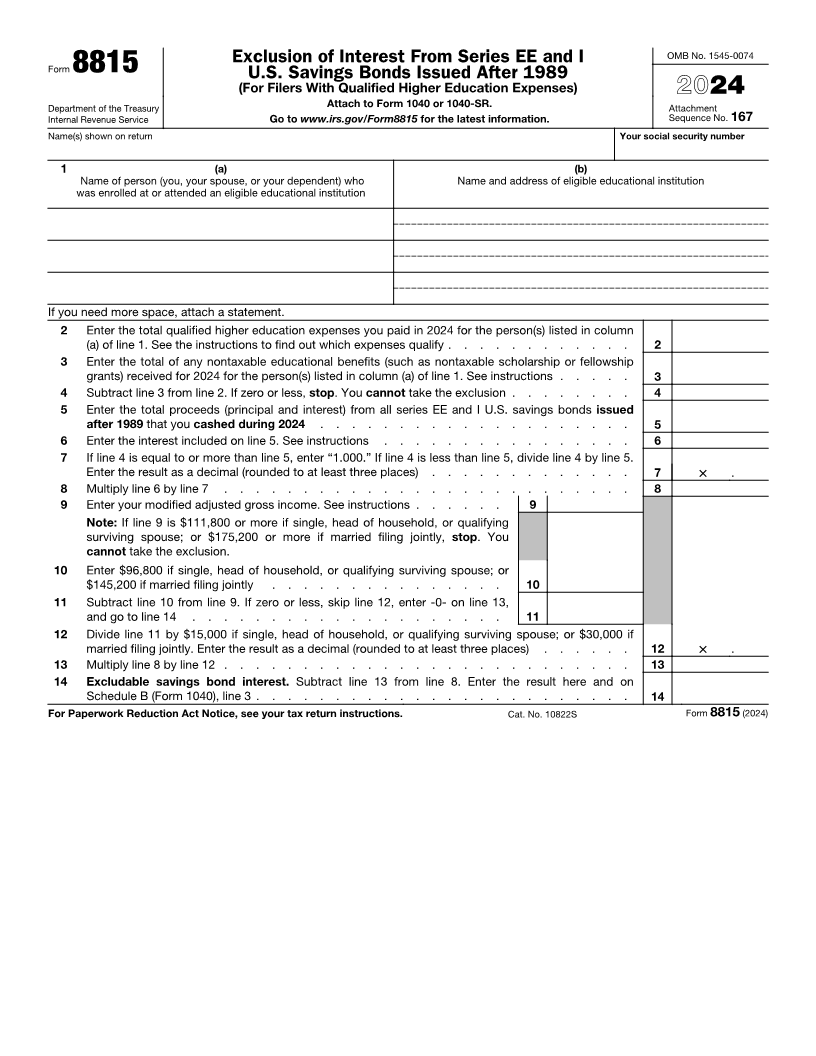

Exclusion of Interest From Series EE and I OMB No. 1545-0074

Form 8815 U.S. Savings Bonds Issued After 1989

(For Filers With Qualified Higher Education Expenses) 2024

Department of the Treasury Attach to Form 1040 or 1040-SR. Attachment

Internal Revenue Service Go to www.irs.gov/Form8815 for the latest information. Sequence No. 167

Name(s) shown on return Your social security number

1 (a) (b)

Name of person (you, your spouse, or your dependent) who Name and address of eligible educational institution

was enrolled at or attended an eligible educational institution

If you need more space, attach a statement.

2 Enter the total qualified higher education expenses you paid in 2024 for the person(s) listed in column

(a) of line 1. See the instructions to find out which expenses qualify . . . . . . . . . . . . 2

3 Enter the total of any nontaxable educational benefits (such as nontaxable scholarship or fellowship

grants) received for 2024 for the person(s) listed in column (a) of line 1. See instructions . . . . . 3

4 Subtract line 3 from line 2. If zero or less, stop. You cannot take the exclusion . . . . . . . . 4

5 Enter the total proceeds (principal and interest) from all series EE and I U.S. savings bonds issued

after 1989 that you cashed during 2024 . . . . . . . . . . . . . . . . . . . . 5

6 Enter the interest included on line 5. See instructions . . . . . . . . . . . . . . . . 6

7 If line 4 is equal to or more than line 5, enter “1.000.” If line 4 is less than line 5, divide line 4 by line 5.

Enter the result as a decimal (rounded to at least three places) . . . . . . . . . . . . . 7 × .

8 Multiply line 6 by line 7 . . . . . . . . . . . . . . . . . . . . . . . . . . 8

9 Enter your modified adjusted gross income. See instructions . . . . . . 9

Note: If line 9 is $111,800 or more if single, head of household, or qualifying

surviving spouse; or $175,200 or more if married filing jointly, stop . You

cannot take the exclusion.

10 Enter $96,800 if single, head of household, or qualifying surviving spouse; or

$145,200 if married filing jointly . . . . . . . . . . . . . . . 10

11 Subtract line 10 from line 9. If zero or less, skip line 12, enter -0- on line 13,

and go to line 14 . . . . . . . . . . . . . . . . . . . . 11

12 Divide line 11 by $15,000 if single, head of household, or qualifying surviving spouse; or $30,000 if

married filing jointly. Enter the result as a decimal (rounded to at least three places) . . . . . . 12 × .

13 Multiply line 8 by line 12 . . . . . . . . . . . . . . . . . . . . . . . . . . 13

14 Excludable savings bond interest. Subtract line 13 from line 8. Enter the result here and on

Schedule B (Form 1040), line 3 . . . . . . . . . . . . . . . . . . . . . . . . 14

For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 10822S Form 8815 (2024)