Enlarge image

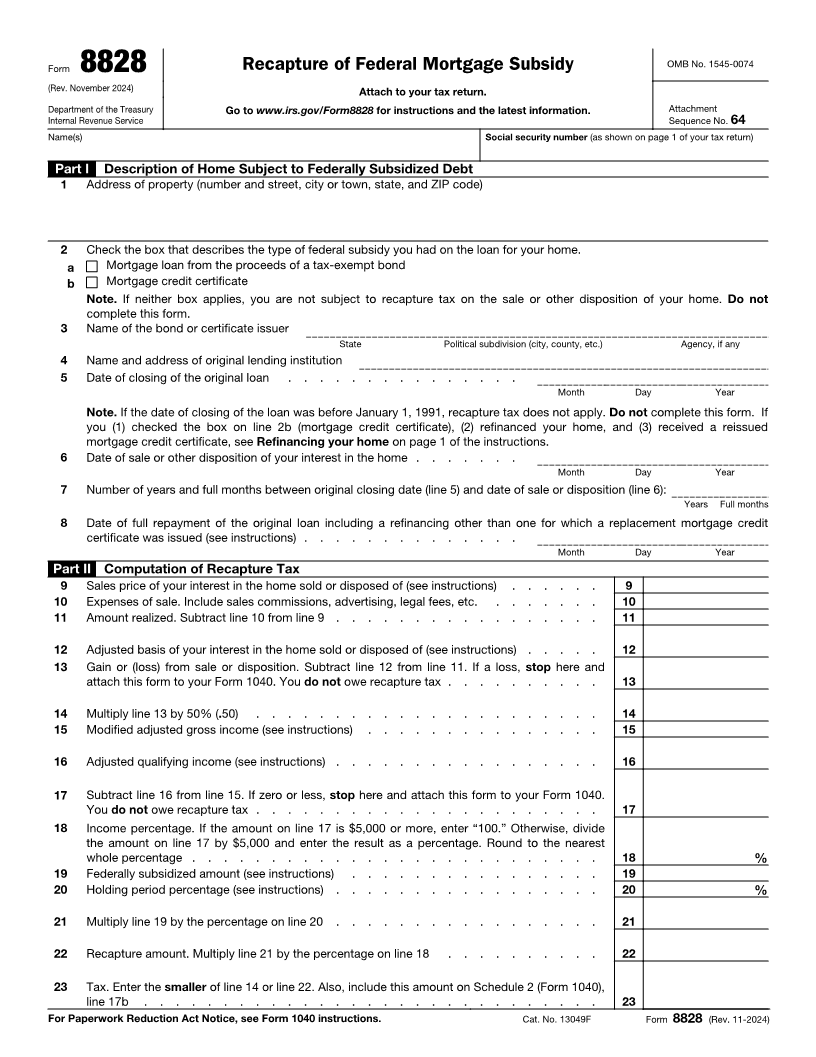

Form 8828 Recapture of Federal Mortgage Subsidy OMB No. 1545-0074 (Rev. November 2024) Attach to your tax return. Department of the Treasury Go to www.irs.gov/Form8828 for instructions and the latest information. Attachment Internal Revenue Service Sequence No. 64 Name(s) Social security number (as shown on page 1 of your tax return) Part I Description of Home Subject to Federally Subsidized Debt 1 Address of property (number and street, city or town, state, and ZIP code) 2 Check the box that describes the type of federal subsidy you had on the loan for your home. a Mortgage loan from the proceeds of a tax-exempt bond b Mortgage credit certificate Note. If neither box applies, you are not subject to recapture tax on the sale or other disposition of your home. Do not complete this form. 3 Name of the bond or certificate issuer State Political subdivision (city, county, etc.) Agency, if any 4 Name and address of original lending institution 5 Date of closing of the original loan . . . . . . . . . . . . . . . Month Day Year Note. If the date of closing of the loan was before January 1, 1991, recapture tax does not apply. Do not complete this form. If you (1) checked the box on line 2b (mortgage credit certificate), (2) refinanced your home, and (3) received a reissued mortgage credit certificate, see Refinancing your home on page 1 of the instructions. 6 Date of sale or other disposition of your interest in the home . . . . . . . Month Day Year 7 Number of years and full months between original closing date (line 5) and date of sale or disposition (line 6): Years Full months 8 Date of full repayment of the original loan including a refinancing other than one for which a replacement mortgage credit certificate was issued (see instructions) . . . . . . . . . . . . . . Month Day Year Part II Computation of Recapture Tax 9 Sales price of your interest in the home sold or disposed of (see instructions) . . . . . . 9 10 Expenses of sale. Include sales commissions, advertising, legal fees, etc. . . . . . . . 10 11 Amount realized. Subtract line 10 from line 9 . . . . . . . . . . . . . . . . . 11 12 Adjusted basis of your interest in the home sold or disposed of (see instructions) . . . . . 12 13 Gain or (loss) from sale or disposition. Subtract line 12 from line 11. If a loss, stop here and attach this form to your Form 1040. You do not owe recapture tax . . . . . . . . . . 13 14 Multiply line 13 by 50% (.50) . . . . . . . . . . . . . . . . . . . . . . 14 15 Modified adjusted gross income (see instructions) . . . . . . . . . . . . . . . 15 16 Adjusted qualifying income (see instructions) . . . . . . . . . . . . . . . . . 16 17 Subtract line 16 from line 15. If zero or less, stop here and attach this form to your Form 1040. You do not owe recapture tax . . . . . . . . . . . . . . . . . . . . . . 17 18 Income percentage. If the amount on line 17 is $5,000 or more, enter “100.” Otherwise, divide the amount on line 17 by $5,000 and enter the result as a percentage. Round to the nearest whole percentage . . . . . . . . . . . . . . . . . . . . . . . . . . 18 % 19 Federally subsidized amount (see instructions) . . . . . . . . . . . . . . . . 19 20 Holding period percentage (see instructions) . . . . . . . . . . . . . . . . . 20 % 21 Multiply line 19 by the percentage on line 20 . . . . . . . . . . . . . . . . . 21 22 Recapture amount. Multiply line 21 by the percentage on line 18 . . . . . . . . . . 22 23 Tax. Enter the smaller of line 14 or line 22. Also, include this amount on Schedule 2 (Form 1040), line 17b . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23 For Paperwork Reduction Act Notice, see Form 1040 instructions. Cat. No. 13049F Form 8828 (Rev. 11-2024)