- 2 -

Enlarge image

|

Form 8846 (2024) Page 2

General Instructions Therefore, the amount of tips for any tax wage base of $168,600 subject to

month that are used to figure the the 6.2% rate, check the box on line 4

Section references are to the Internal credit must be reduced by the amount and attach a separate computation

Revenue Code unless otherwise by which the wages that would have showing the amount of tips subject to

noted. been payable during that month at only the Medicare tax rate of 1.45%.

Future Developments $5.15 an hour exceed the wages Subtract these tips from the line 3 tips,

For the latest information about (excluding tips) paid by the employer and multiply the difference by 0.0765.

developments related to Form 8846 during that month. Then, multiply the tips subject only to

and its instructions, such as legislation For example, an employee worked the Medicare tax by 0.0145. Enter the

enacted after they were published, go 100 hours and received $450 in tips sum of these amounts on line 4.

to www.irs.gov/Form8846. for October 2024. The worker received Reduce the income tax deduction

$375 in wages (excluding tips) at the for employer social security and

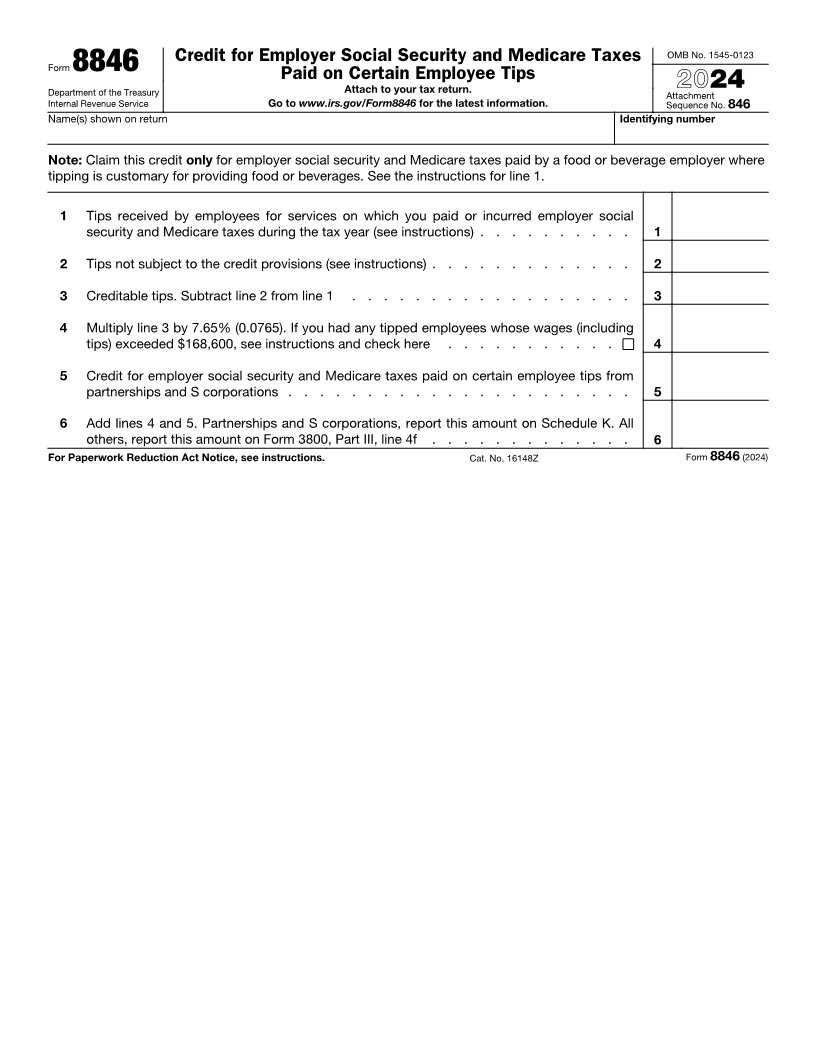

Purpose of Form rate of $3.75 an hour. If the employee Medicare taxes by the amount on line

Certain food and beverage employers had been paid $5.15 an hour, the 4.

(see Who Should File below) use Form employee would have received wages, Fiscal year taxpayers. If you have an

8846 to claim a credit for social excluding tips, of $515. For credit employee with wages and tips paid in

security and Medicare taxes paid or purposes, the $450 in tips is reduced 2025 that exceeded the 2025 social

incurred by the employer on certain by $140 (the difference between $515 security wage base of $176,100 by the

employees’ tips. The credit is part of and $375), and only $310 of the end of the 2024 fiscal year, follow the

the general business credit. employee’s tips for October 2024 is Line 4 instructions above to determine

You can claim or elect not to claim taken into account. the amount to enter on that line. The

the credit any time within 3 years from A 0.9% Additional Medicare Tax determination whether the tipped

the due date of your return on either applies to Medicare wages and tips. employee’s wages exceed the social

your original return or on an amended However, Additional Medicare Tax is security wage base is made for each

return. only imposed on the employee. There calendar year.

Partnerships and S corporations is no employer share of Additional

must file this form to claim the credit. Medicare Tax. Thus, there is no effect Paperwork Reduction Act Notice.

All other taxpayers are not required to on the credit for employer social We ask for the information on this form

complete or file this form if their only security and Medicare taxes on certain to carry out the Internal Revenue laws

source for this credit is a partnership employee tips. of the United States. You are required

or S corporation. Instead, they can to give us the information. We need it

report this credit directly on line 4f in Specific Instructions to ensure that you are complying with

Part III of Form 3800, General Figure the current year credit from these laws and to allow us to figure

Business Credit. your trade or business on lines 1 and collect the right amount of tax.

For information regarding taxes through 4. You are not required to provide the

imposed on tips, including information Line 1 information requested on a form that is

on the difference between tips and Enter the tips received by employees subject to the Paperwork Reduction

service charges, see Rev. Rul. for services on which you paid or Act unless the form displays a valid

2012-18, 2012-26 I.R.B., at www.irs. incurred employer social security and OMB control number. Books or

gov/irb/2012-26_IRB#RR-2012-18. Medicare taxes during the tax year. records relating to a form or its

instructions must be retained as long

Who Should File Include tips received from as their contents may become material

File Form 8846 if you meet both of the customers for providing, delivering, or in the administration of any Internal

following conditions. serving food or beverages for Revenue law. Generally, tax returns

consumption if tipping of employees and return information are confidential,

1. You had employees who received for delivering or serving food or as required by section 6103.

tips from customers for providing, beverages is customary.

delivering, or serving food or The time needed to complete and

beverages for consumption if tipping Line 2 file this form will vary depending on

of employees for delivering or serving If you pay each tipped employee individual circumstances. The

food or beverages is customary. wages (excluding tips) equal to or estimated burden for individual and

2. During the tax year, you paid or more than $5.15 an hour, enter zero on business taxpayers filing this form is

incurred employer social security and line 2. approved under OMB control number

Medicare taxes on those tips. Figure the amount of tips included 1545-0074 and 1545-0123 and is

on line 1 that are not creditable for included in the estimates shown in the

How the Credit Is Figured each employee on a monthly basis. instructions for their individual and

Generally, the credit equals the This is the total amount that would be business income tax return.

amount of employer social security payable to the employee at $5.15 an If you have comments concerning

and Medicare taxes paid or incurred hour reduced by the wages (excluding the accuracy of these time estimates

by the employer on tips received by tips) actually paid to the employee or suggestions for making this form

the employee. However, employers during the month. Enter on line 2 the simpler, we would be happy to hear

cannot claim the credit for taxes on total amounts figured for all from you. See the instructions for the

any tips that are used to meet the employees. tax return with which this form is filed.

federal minimum wage rate in effect on

January 1, 2007, of $5.15 an hour. Line 4

If any tipped employee’s wages and

tips exceeded the 2024 social security

|