Enlarge image

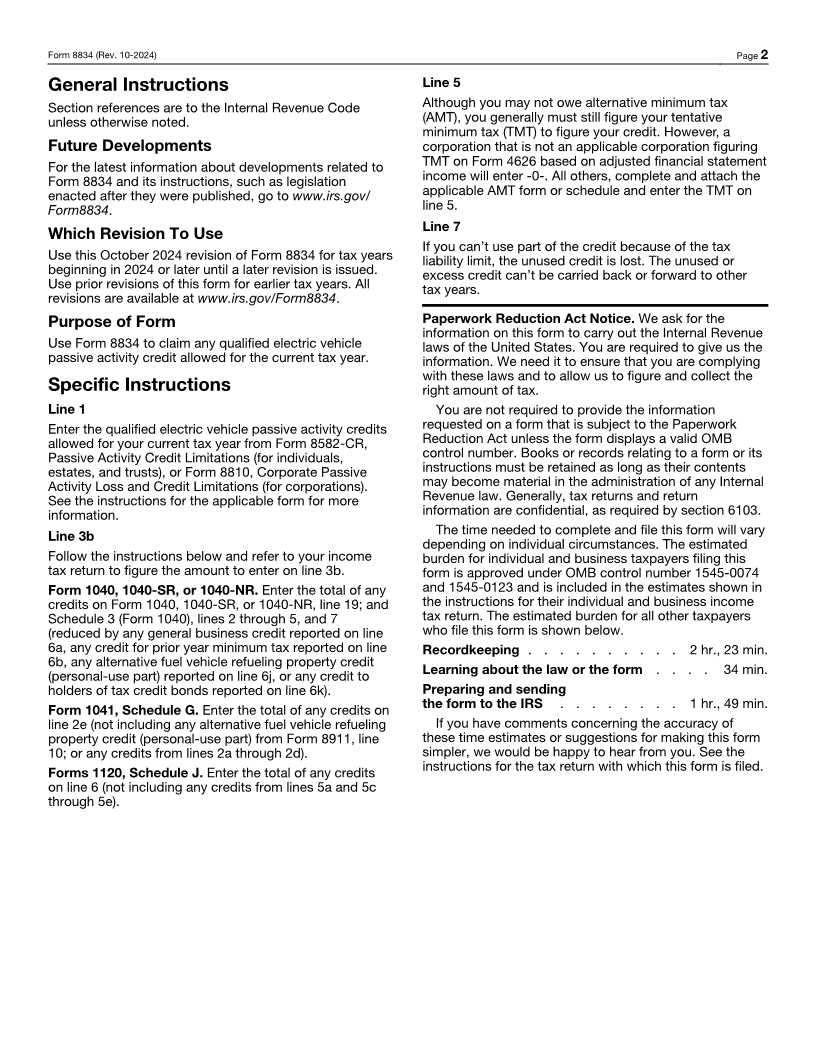

OMB No. 1545-1374

Form 8834 Qualified Electric Vehicle Credit

(Rev. October 2024)

Department of the Treasury Attach to your tax return. Attachment

Internal Revenue Service Go to www.irs.gov/Form8834 for the latest information. Sequence No. 834

Name(s) shown on return Identifying number

Notes:

• Use this form to claim qualified electric vehicle passive activity credits from prior years (allowed on Form 8582-CR or

Form 8810 for the current year). The qualified electric vehicle credit was available for certain vehicles placed in service

before 2007.

• Claim the credit for certain clean vehicles placed in service after 2022 on Form 8936.

1 Qualified electric vehicle passive activity credits allowed for your current tax year (see

instructions). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2 Regular tax before credits:

• Individuals. Enter the sum of the amounts from Form 1040, 1040-SR, or

1040-NR, line 16; and Schedule 2 (Form 1040), line 1z.

• Corporations. Enter the amount from Form 1120, Schedule J, line 2

(excluding the base erosion minimum tax entered on line 1f); or the . . . . 2

applicable line of your return.

• Estates and trusts. Enter the sum of the amounts from Form 1041,

Schedule G, lines 1a, 1b, and 1d, plus any Form 8978 amount included on

line 1e; or the amount from the applicable line of your return. }

3 Credits that reduce regular tax before the qualified electric vehicle credit:

a Foreign tax credit . . . . . . . . . . . . . . . . . . . 3a

b Certain allowable credits (see instructions) . . . . . . . . . . 3b

c Add lines 3a and 3b . . . . . . . . . . . . . . . . . . . . . . . . . . 3c

4 Net regular tax. Subtract line 3c from line 2. If zero or less, enter -0- here and on line 7 . . 4

5 Tentative minimum tax:

• Individuals. Enter the amount from Form 6251, line 9.

• Corporations. Applicable corporations (see Form 4626), enter the amount

from Form 4626, Part II, line 9. Other corporations, enter -0-. . . . . 5

• Estates and trusts. Enter the amount from Schedule I (Form 1041), line 52.

}

6 Subtract line 5 from line 4. If zero or less, enter -0- here and on line 7. . . . . . . . . 6

7 Qualified electric vehicle credit. Enter the smaller of line 1 or line 6. Report this amount

on Schedule 3 (Form 1040), line 6i; Form 1120, Schedule J, line 5b; or the appropriate line

of your return. If line 6 is smaller than line 1, see instructions . . . . . . . . . . . . 7

For Paperwork Reduction Act Notice, see instructions. Cat. No. 14953G Form 8834 (Rev. 10-2024)