Enlarge image

OMB No. 1545-1362

Renewable Electricity Production Credit

Form 8835

Attach to your tax return.

Department of the Treasury 2024

Internal Revenue Service Go to www.irs.gov/Form8835 for instructions and the latest information. Attachment

Sequence No. 835

Name(s) shown on return Identifying number

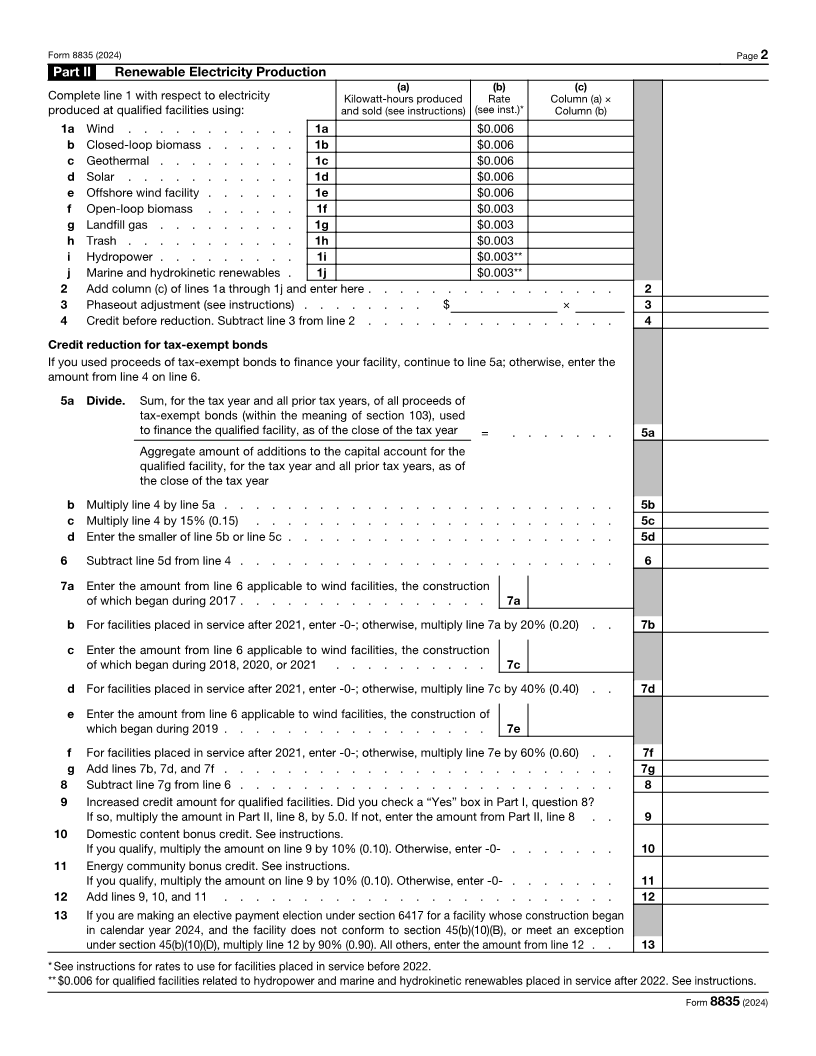

Part I Information on Qualified Property or Qualified Facility

1 If making an elective payment election or transfer election, enter the IRS-issued registration number for the facility:

2a Type (wind, closed-loop biomass, geothermal, solar, open-loop biomass, landfill gas, etc.):

2b If different than filer, enter (i) owner’s name

and (ii) owner’s TIN:

3a Address of the facility (if applicable):

3b Coordinates. (i) Latitude: . (ii) Longitude: .

Enter a “+” (plus) or “-” (minus) sign in the first box. Enter a “+” (plus) or “-” (minus) sign in the first box.

4 Date construction began (MM/DD/YYYY):

5 Date placed in service (MM/DD/YYYY):

6 Is this facility an expansion of an existing closed-loop biomass or open-loop biomass facility? Yes No

7 Reserved for future use.

Yes.

No.

8 Does the project satisfy one of the qualified facility requirements? See instructions.

a Yes, the facility’s maximum net output is less than 1 megawatt (as measured in alternating current).

b Yes, the facility’s construction began before January 29, 2023.

c Yes, the facility meets the prevailing wage requirements of section 45(b)(7)(A) and the apprenticeship requirements of section

45(b)(8).

d No, the facility does not meet the qualified facility requirements.

9 Does the property qualify for the domestic bonus credit?

a Yes, and section 45(b)(9)(B) is satisfied (10% bonus). Attach the required information. See instructions.

b No.

10 Does the project qualify for an energy community bonus credit?

a Yes, and section 45(b)(11)(B) is satisfied (10% bonus). See instructions.

b No.

c Not applicable.

11 Enter the nameplate capacity direct current (dc) in kW for:

a Solar energy property facility:

b Not applicable.

12 Enter the nameplate capacity, alternating current (ac) for all electricity generating energy properties or facilities in kW:

a Solar energy property or facility:

b Wind energy property or facility:

c Other:

d Not applicable.

For Paperwork Reduction Act Notice, see separate instructions. Cat. No. 14954R Form 8835 (2024)