Enlarge image

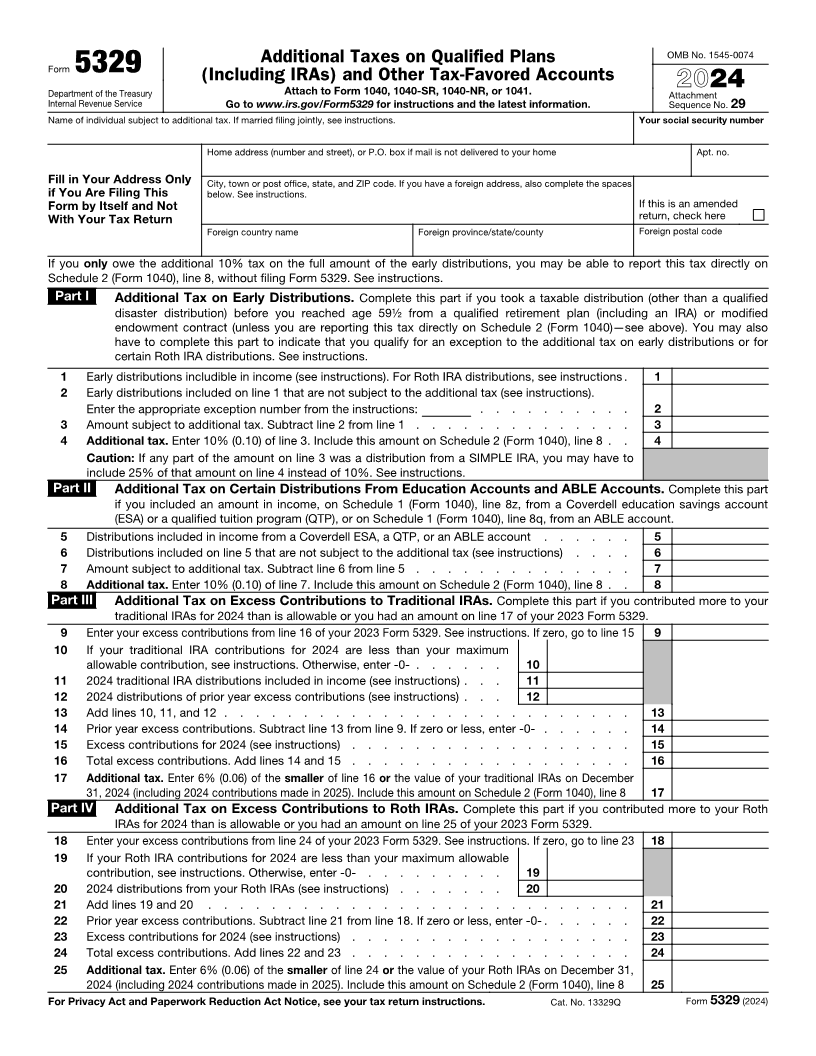

OMB No. 1545-0074

Additional Taxes on Qualified Plans

Form 5329 (Including IRAs) and Other Tax-Favored Accounts

Department of the Treasury Attach to Form 1040, 1040-SR, 1040-NR, or 1041. 2024

Attachment

Internal Revenue Service Go to www.irs.gov/Form5329 for instructions and the latest information. Sequence No. 29

Name of individual subject to additional tax. If married filing jointly, see instructions. Your social security number

Home address (number and street), or P.O. box if mail is not delivered to your home Apt. no.

Fill in Your Address Only City, town or post office, state, and ZIP code. If you have a foreign address, also complete the spaces

if You Are Filing This below. See instructions.

Form by Itself and Not If this is an amended

With Your Tax Return return, check here

Foreign country name Foreign province/state/county Foreign postal code

If you only owe the additional 10% tax on the full amount of the early distributions, you may be able to report this tax directly on

Schedule 2 (Form 1040), line 8, without filing Form 5329. See instructions.

Part I Additional Tax on Early Distributions. Complete this part if you took a taxable distribution (other than a qualified

disaster distribution) before you reached age 59½ from a qualified retirement plan (including an IRA) or modified

endowment contract (unless you are reporting this tax directly on Schedule 2 (Form 1040)—see above). You may also

have to complete this part to indicate that you qualify for an exception to the additional tax on early distributions or for

certain Roth IRA distributions. See instructions.

1 Early distributions includible in income (see instructions). For Roth IRA distributions, see instructions. 1

2 Early distributions included on line 1 that are not subject to the additional tax (see instructions).

Enter the appropriate exception number from the instructions: . . . . . . . . . . 2

3 Amount subject to additional tax. Subtract line 2 from line 1 . . . . . . . . . . . . . . 3

4 Additional tax. Enter 10% (0.10) of line 3. Include this amount on Schedule 2 (Form 1040), line 8 . . 4

Caution: If any part of the amount on line 3 was a distribution from a SIMPLE IRA, you may have to

include 25% of that amount on line 4 instead of 10%. See instructions.

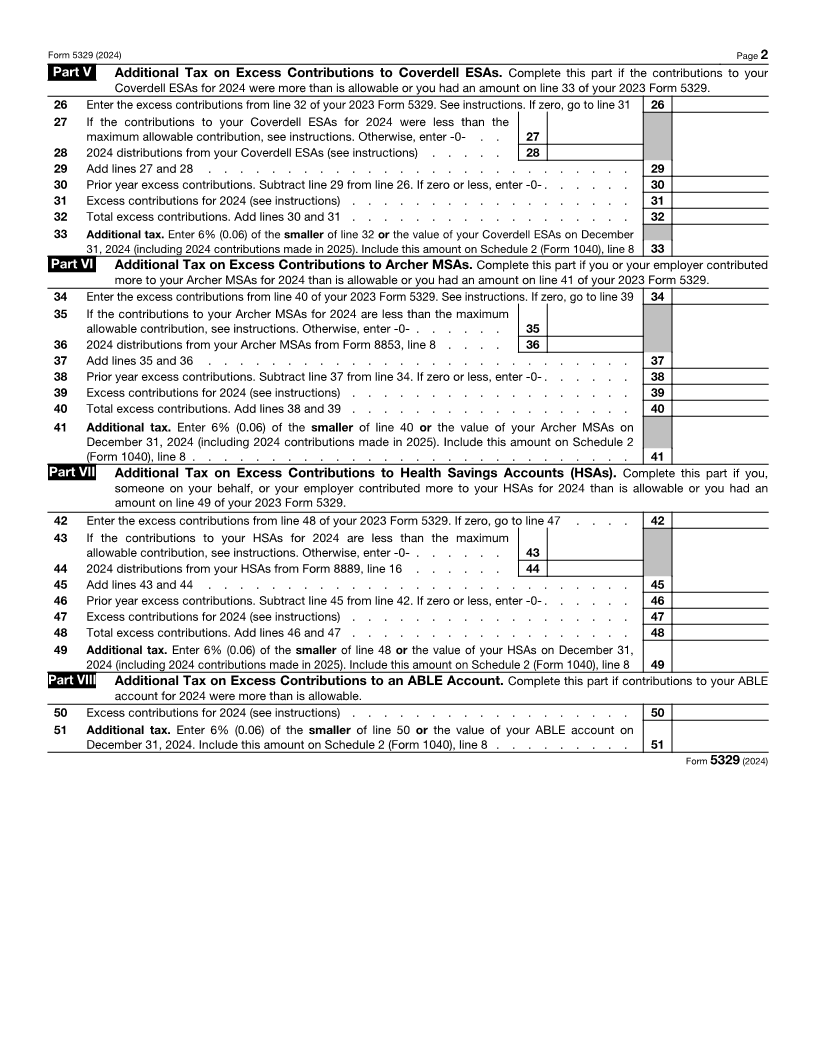

Part II Additional Tax on Certain Distributions From Education Accounts and ABLE Accounts. Complete this part

if you included an amount in income, on Schedule 1 (Form 1040), line 8z, from a Coverdell education savings account

(ESA) or a qualified tuition program (QTP), or on Schedule 1 (Form 1040), line 8q, from an ABLE account.

5 Distributions included in income from a Coverdell ESA, a QTP, or an ABLE account . . . . . . 5

6 Distributions included on line 5 that are not subject to the additional tax (see instructions) . . . . 6

7 Amount subject to additional tax. Subtract line 6 from line 5 . . . . . . . . . . . . . . 7

8 Additional tax. Enter 10% (0.10) of line 7. Include this amount on Schedule 2 (Form 1040), line 8 . . 8

Part III Additional Tax on Excess Contributions to Traditional IRAs. Complete this part if you contributed more to your

traditional IRAs for 2024 than is allowable or you had an amount on line 17 of your 2023 Form 5329.

9 Enter your excess contributions from line 16 of your 2023 Form 5329. See instructions. If zero, go to line 15 9

10 If your traditional IRA contributions for 2024 are less than your maximum

allowable contribution, see instructions. Otherwise, enter -0- . . . . . . 10

11 2024 traditional IRA distributions included in income (see instructions) . . . 11

12 2024 distributions of prior year excess contributions (see instructions) . . . 12

13 Add lines 10, 11, and 12 . . . . . . . . . . . . . . . . . . . . . . . . . . 13

14 Prior year excess contributions. Subtract line 13 from line 9. If zero or less, enter -0- . . . . . . 14

15 Excess contributions for 2024 (see instructions) . . . . . . . . . . . . . . . . . . 15

16 Total excess contributions. Add lines 14 and 15 . . . . . . . . . . . . . . . . . . 16

17 Additional tax. Enter 6% (0.06) of the smaller of line 16 or the value of your traditional IRAs on December

31, 2024 (including 2024 contributions made in 2025). Include this amount on Schedule 2 (Form 1040), line178

Part IV Additional Tax on Excess Contributions to Roth IRAs. Complete this part if you contributed more to your Roth

IRAs for 2024 than is allowable or you had an amount on line 25 of your 2023 Form 5329.

18 Enter your excess contributions from line 24 of your 2023 Form 5329. See instructions. If zero, go to line 23 18

19 If your Roth IRA contributions for 2024 are less than your maximum allowable

contribution, see instructions. Otherwise, enter -0- . . . . . . . . . 19

20 2024 distributions from your Roth IRAs (see instructions) . . . . . . . 20

21 Add lines 19 and 20 . . . . . . . . . . . . . . . . . . . . . . . . . . . 21

22 Prior year excess contributions. Subtract line 21 from line 18. If zero or less, enter -0- . . . . . . 22

23 Excess contributions for 2024 (see instructions) . . . . . . . . . . . . . . . . . . 23

24 Total excess contributions. Add lines 22 and 23 . . . . . . . . . . . . . . . . . . 24

25 Additional tax. Enter 6% (0.06) of the smaller of line 24 or the value of your Roth IRAs on December 31,

2024 (including 2024 contributions made in 2025). Include this amount on Schedule 2 (Form 1040), line 825

For Privacy Act and Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 13329Q Form 5329 (2024)