Enlarge image

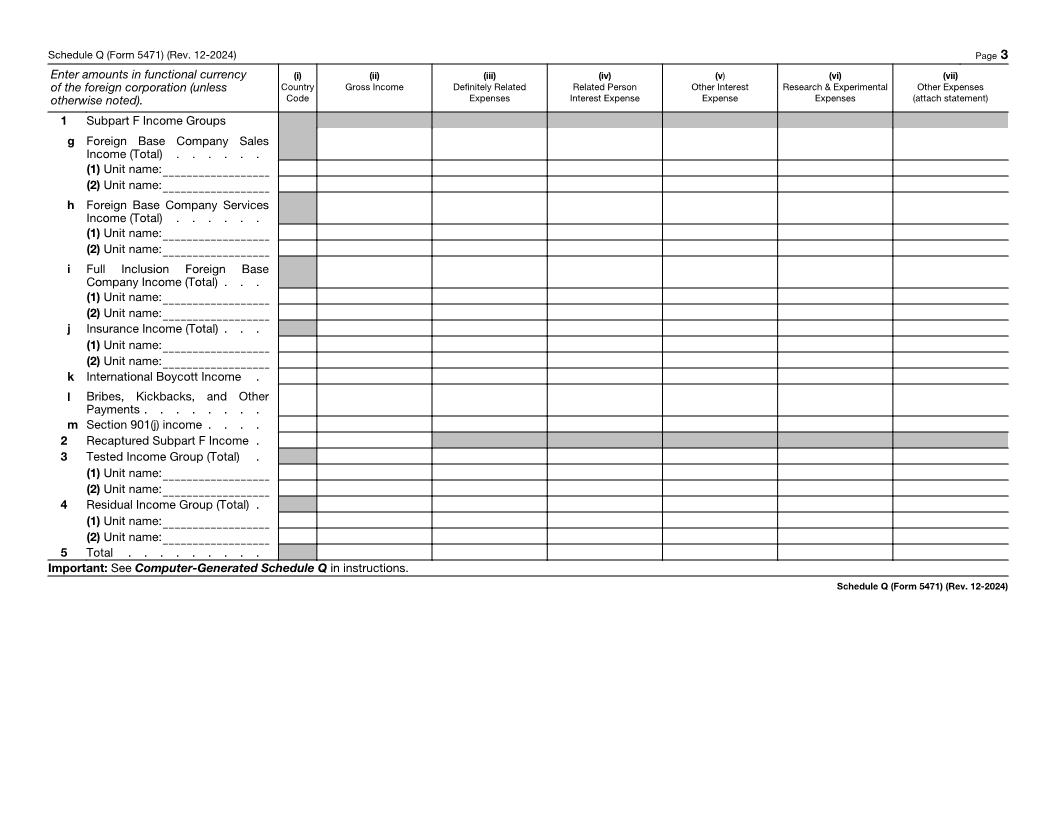

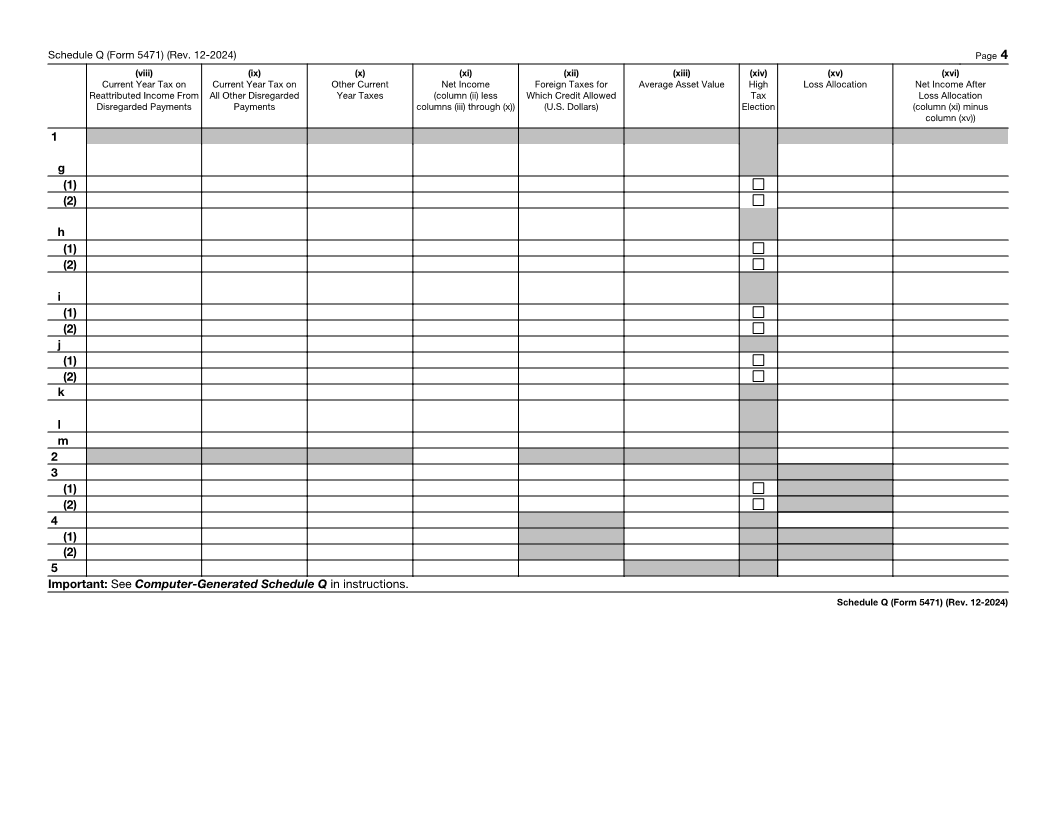

SCHEDULE Q CFC Income by CFC Income Groups (Form 5471) (Rev. December 2024) Attach to Form 5471. OMB No. 1545-0123 Department of the Treasury Go to www.irs.gov/Form5471 for instructions and the latest information. Internal Revenue Service Name of person filing Form 5471 Identifying number Name of foreign corporation EIN (if any) Reference ID number (see instructions) Complete a separate Schedule Q with respect to each applicable category of income (see instructions). A Enter separate category code with respect to which this Schedule Q is being completed (see instructions for codes) . . . . . . . . . . B If category code “PAS” is entered on line A, enter the applicable grouping code (see instructions) . . . . . . . . . . . . . . . . . C If code “901j” is entered on line A, enter the country code for the sanctioned country (see instructions) . . . . . . . . . . . . . . . Complete a separate Schedule Q for U.S. source income and foreign source income (see instructions for an exception). D Indicate whether this Schedule Q is being completed for: U.S. source income or Foreign source income Complete a separate Schedule Q for FOGEI or FORI income. E If this Schedule Q is being completed for FOGEI or FORI income, check this box . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Enter amounts in functional currency (i) (ii) (iii) (iv) (v) (vi) (vii) of the foreign corporation (unless Country Gross Income Definitely Related Related Person Other Interest Research & Experimental Other Expenses otherwise noted). Code Expenses Interest Expense Expense Expenses (attach statement) 1 Subpart F Income Groups a Dividends, Interest, Rents, Royalties, & Annuities (Total) . (1) Unit name: (2) Unit name: b Net Gain From Certain Property Transactions (Total) . . . . (1) Unit name: (2) Unit name: c Net Gain From Commodities Transactions (Total) . . . . (1) Unit name: (2) Unit name: d Net Foreign Currency Gain (Total) (1) Unit name: (2) Unit name: e Income Equivalent to Interest (Total) (1) Unit name: (2) Unit name: f Other Foreign Personal Holding Company Income (Total) (attach statement—see instructions) . (1) Unit name: (2) Unit name: Important: See Computer-Generated Schedule Q in instructions. For Paperwork Reduction Act Notice, see instructions. Cat. No. 73414U Schedule Q (Form 5471) (Rev. 12-2024)