Enlarge image

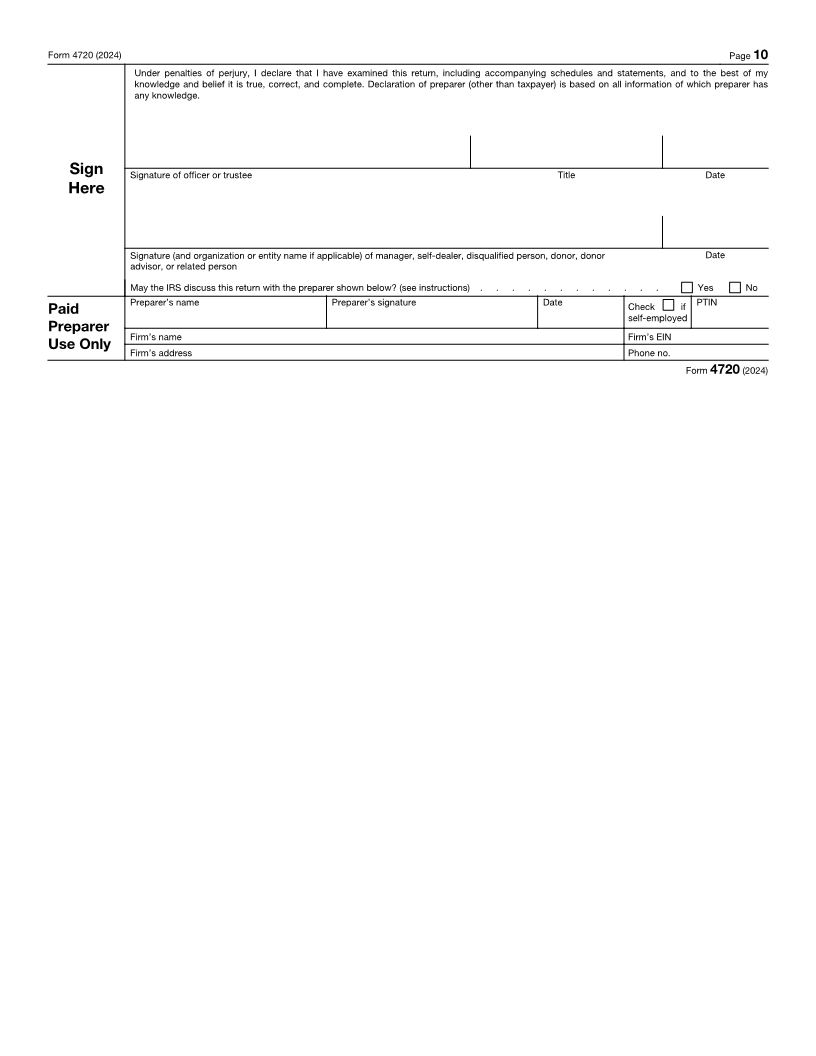

Return of Certain Excise Taxes Under Chapters OMB No. 1545-0047

Form 4720 41 and 42 of the Internal Revenue Code

(Sections 170(f)(10), 664(c)(2), 4911, 4912, 4941, 4942, 4943, 4944,

Department of the Treasury 4945, 4955, 4958, 4959, 4960, 4965, 4966, 4967, and 4968) 2024

Internal Revenue Service Go to www.irs.gov/Form4720 for instructions and the latest information.

For calendar year 2024 or other tax year beginning , 2024, and ending , 20

Name of organization, entity, or person subject to tax EIN or SSN

Number, street, and room or suite no. (or P.O. box if mail is not delivered to street address) Amended return

Check box for type of annual return:

City or town, state or province, country, and ZIP or foreign postal code Form 990 Form 990-EZ

Form 990-PF Other

Form 5227

Yes No

A Is the organization a foreign private foundation within the meaning of section 4948(b)? . . . . . . . . .

Show conversion rate to U.S. dollars. See instructions . . . . . . . . . . .

B Entity (other than the organization) or person subject to tax: Are you required to file Form 4720 with respect to

more than one organization in the current tax year? See instructions . . . . . . . . . . . . . . .

If “Yes,” attach a list showing the name and EIN for each organization with respect to which you will file Form 4720 for the

current tax year.

Part I Taxes on Organization(Sections 170(f)(10), 664(c)(2), 4911(a), 4912(a), 4942(a), 4943(a), 4944(a)(1), 4945(a)(1),

4955(a)(1), 4959, 4960(a), 4965(a)(1), 4966(a)(1), and 4968(a))

1 Tax on undistributed income—Schedule B, line 4 . . . . . . . . . . . . . . . 1

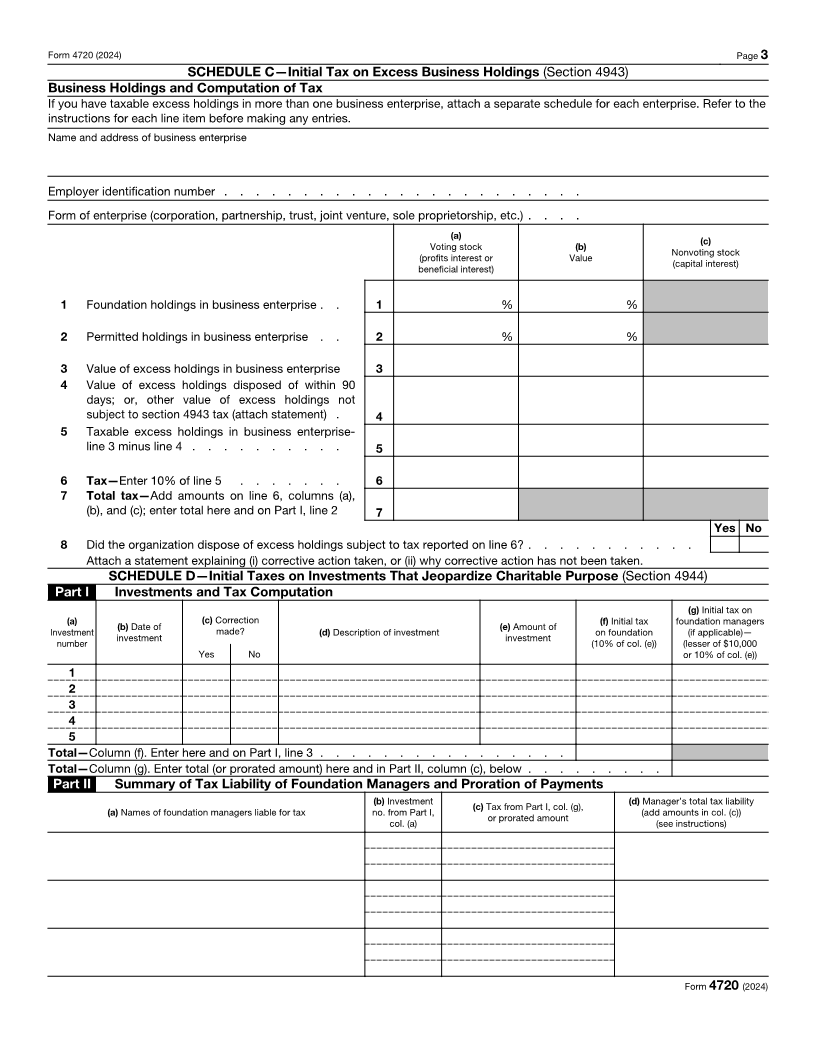

2 Tax on excess business holdings—Schedule C, line 7 . . . . . . . . . . . . . 2

3 Tax on investments that jeopardize charitable purpose—Schedule D, Part I, column (f) . . 3

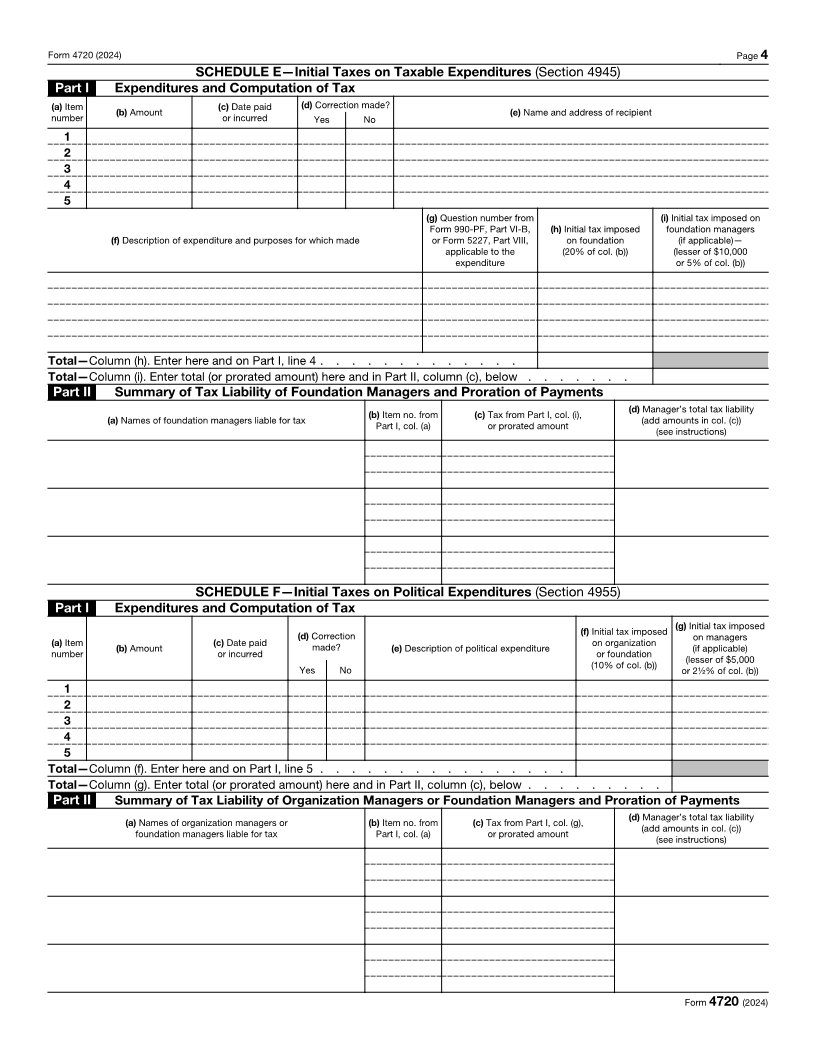

4 Tax on taxable expenditures—Schedule E, Part I, column (h) . . . . . . . . . . . 4

5 Tax on political expenditures—Schedule F, Part I, column (f) . . . . . . . . . . . 5

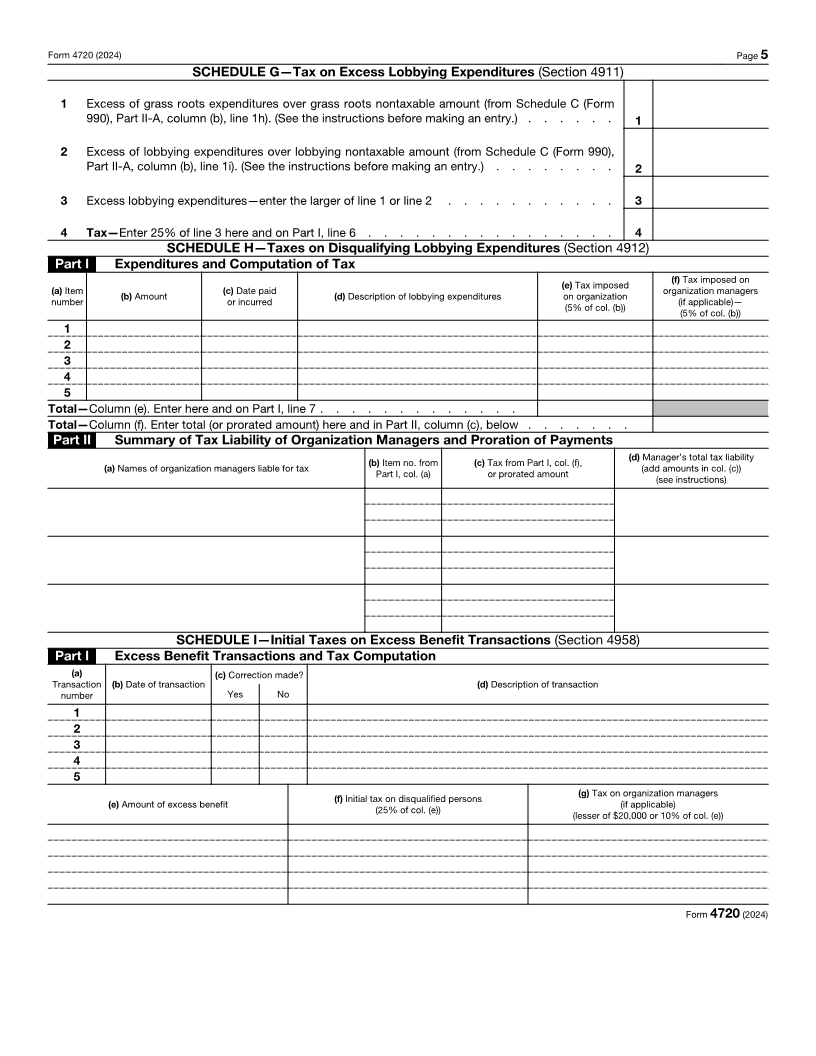

6 Tax on excess lobbying expenditures—Schedule G, line 4 . . . . . . . . . . . . 6

7 Tax on disqualifying lobbying expenditures—Schedule H, Part I, column (e) . . . . . . 7

8 Tax on premiums paid on personal benefit contracts . . . . . . . . . . . . . 8

9 Tax on being a party to prohibited tax shelter transactions—Schedule J, Part I, column (h) . 9

10 Tax on taxable distributions—Schedule K, Part I, column (f) . . . . . . . . . . . 10

11 Tax on a charitable remainder trust’s unrelated business taxable income. Attach statement . 11

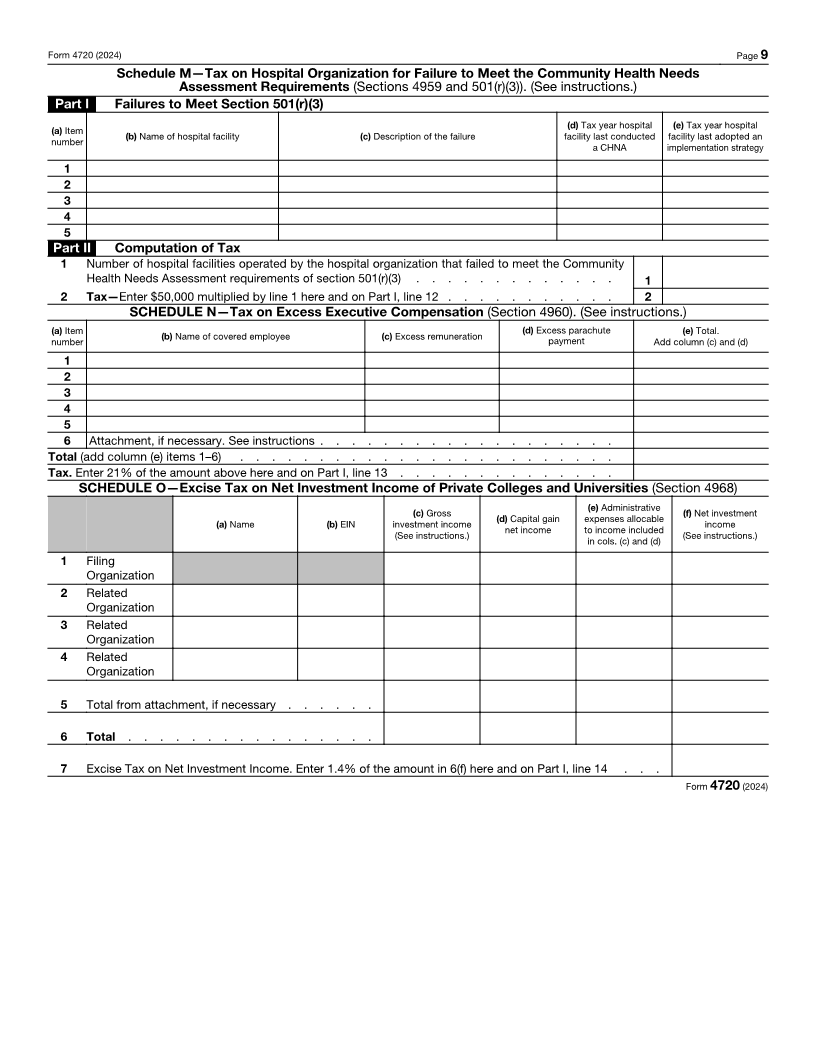

12 Tax on failure to meet the requirements of section 501(r)(3)—Schedule M, Part II, line 2 . . 12

13 Tax on excess executive compensation—Schedule N . . . . . . . . . . . . . 13

14 Tax on net investment income of private colleges and universities—Schedule O . . . . 14

15 Total (add lines 1–14) . . . . . . . . . . . . . . . . . . . . . . . . 15

Part II Taxes on a Manager, Self-Dealer, Disqualified Person, Donor, Donor Advisor, or Related Person

(Sections 4912(b), 4941(a), 4944(a)(2), 4945(a)(2), 4955(a)(2), 4958(a), 4965(a)(2), 4966(a)(2), and 4967(a))

Name and address of related organization; city or town, state or province, country, ZIP or foreign postal code Employer identification number

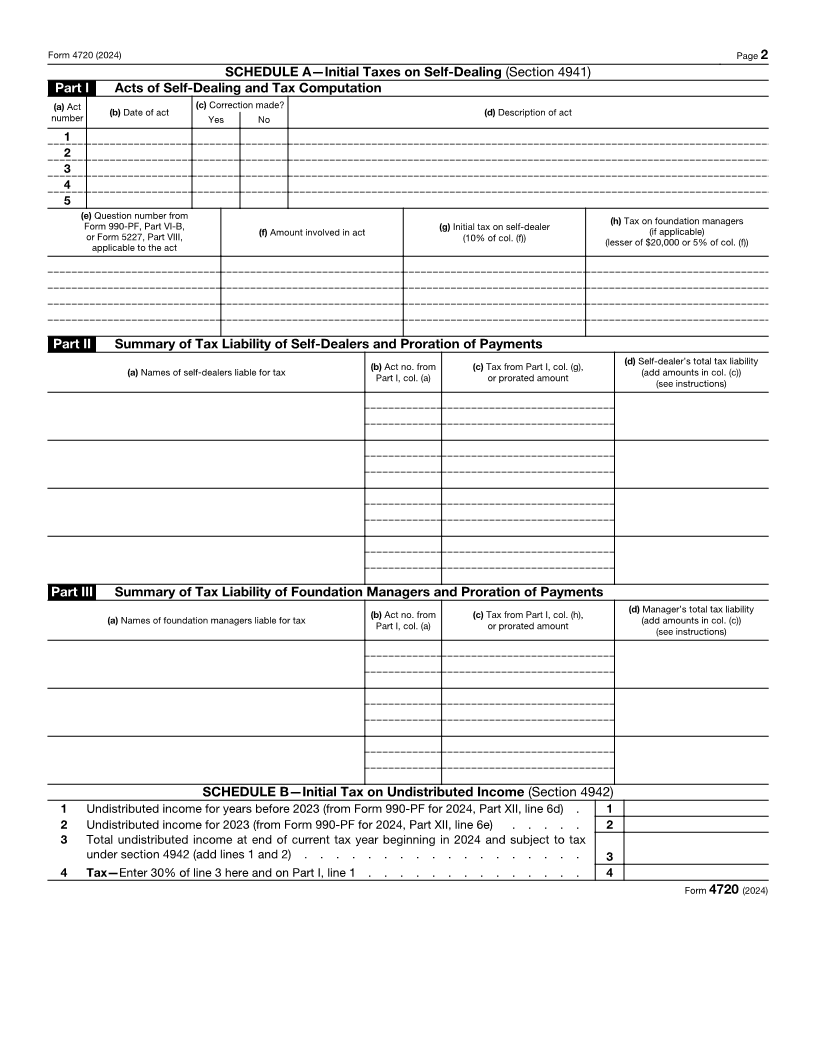

1 Tax on self-dealing—Schedule A, Part II, column (d); and Part III, column (d) . . . . . . 1

2 Tax on investments that jeopardize charitable purposes—Schedule D, Part II, column (d) . 2

3 Tax on taxable expenditures—Schedule E, Part II, column (d) . . . . . . . . . . . 3

4 Tax on political expenditures—Schedule F, Part II, column (d) . . . . . . . . . . 4

5 Tax on disqualifying lobbying expenditures—Schedule H, Part II, column (d) . . . . . . 5

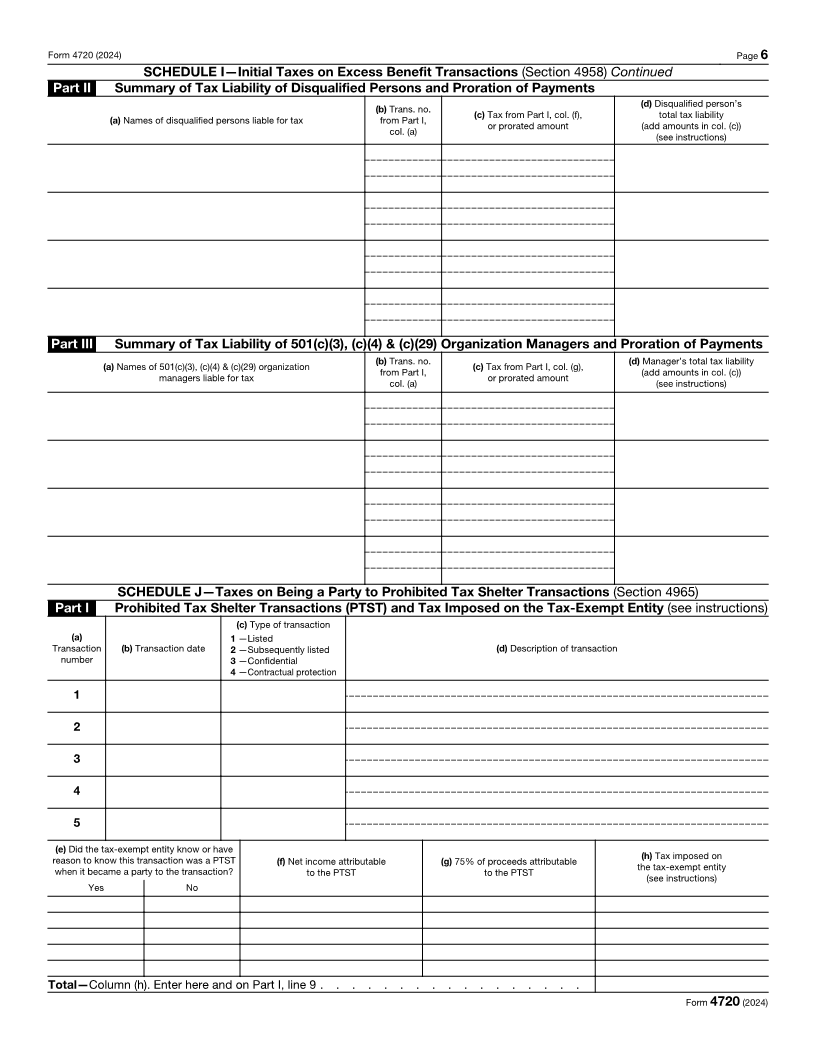

6 Tax on excess benefit transactions—Schedule I, Part II, column (d); and Part III, column (d) . 6

7 Tax on being a party to prohibited tax shelter transactions—Schedule J, Part II, column (d) . 7

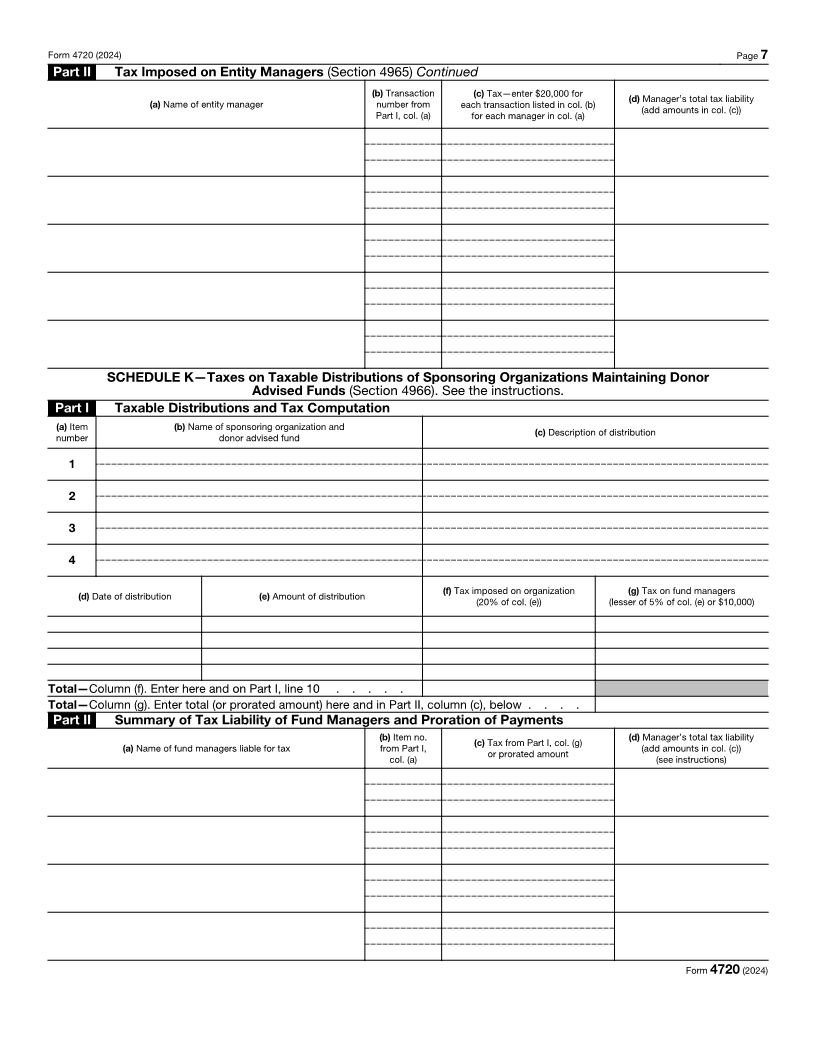

8 Tax on taxable distributions—Schedule K, Part II, column (d) . . . . . . . . . . . 8

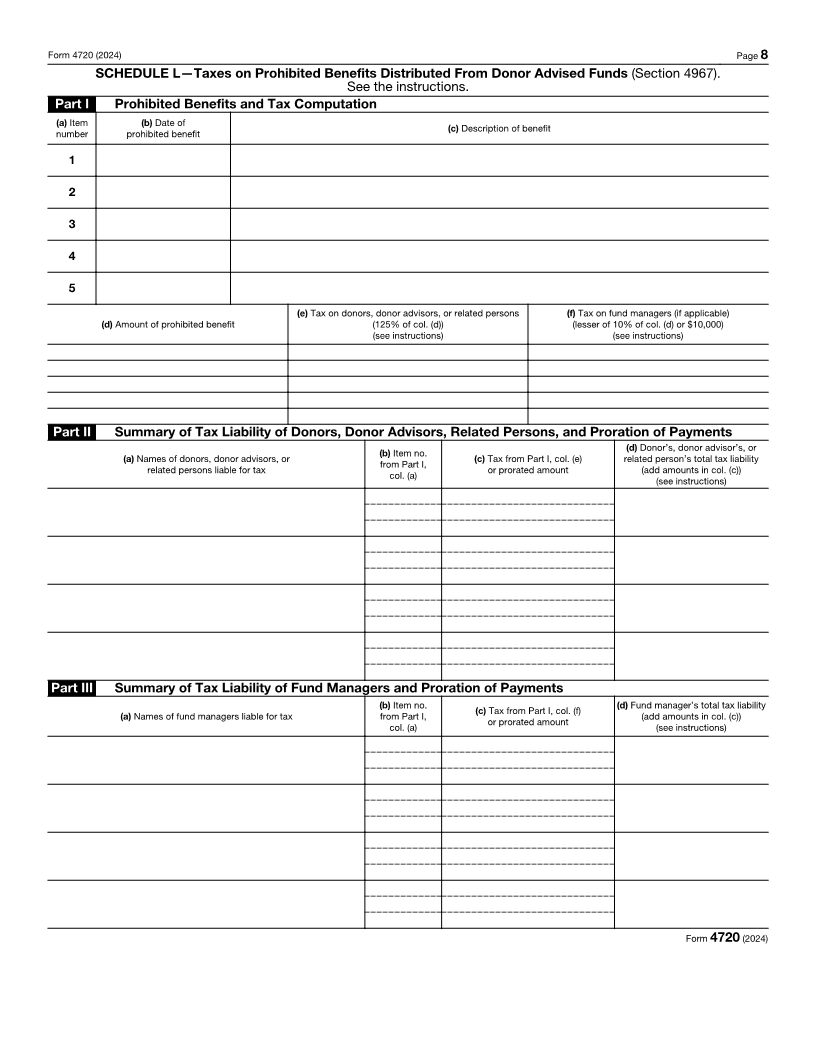

9 Tax on prohibited benefits—Schedule L, Part II, column (d); and Part III, column (d) . . . 9

10 Total—Add lines 1 through 9 . . . . . . . . . . . . . . . . . . . . . 10

Part III Tax Payments

1 Total tax (Part I, line 15 or Part II, line 10) . . . . . . . . . . . . . . . . . 1

2 Total payments including amount paid with Form 8868 (see instructions) . . . . . . . 2

3 Tax due. If line 1 is larger than line 2, enter amount owed (see instructions) . . . . . . 3

4 Overpayment. If line 1 is smaller than line 2, enter the difference. This is your refund . . . 4

For Privacy Act and Paperwork Reduction Act Notice, see the separate instructions. Cat. No. 13021D Form 4720 (2024)