Enlarge image

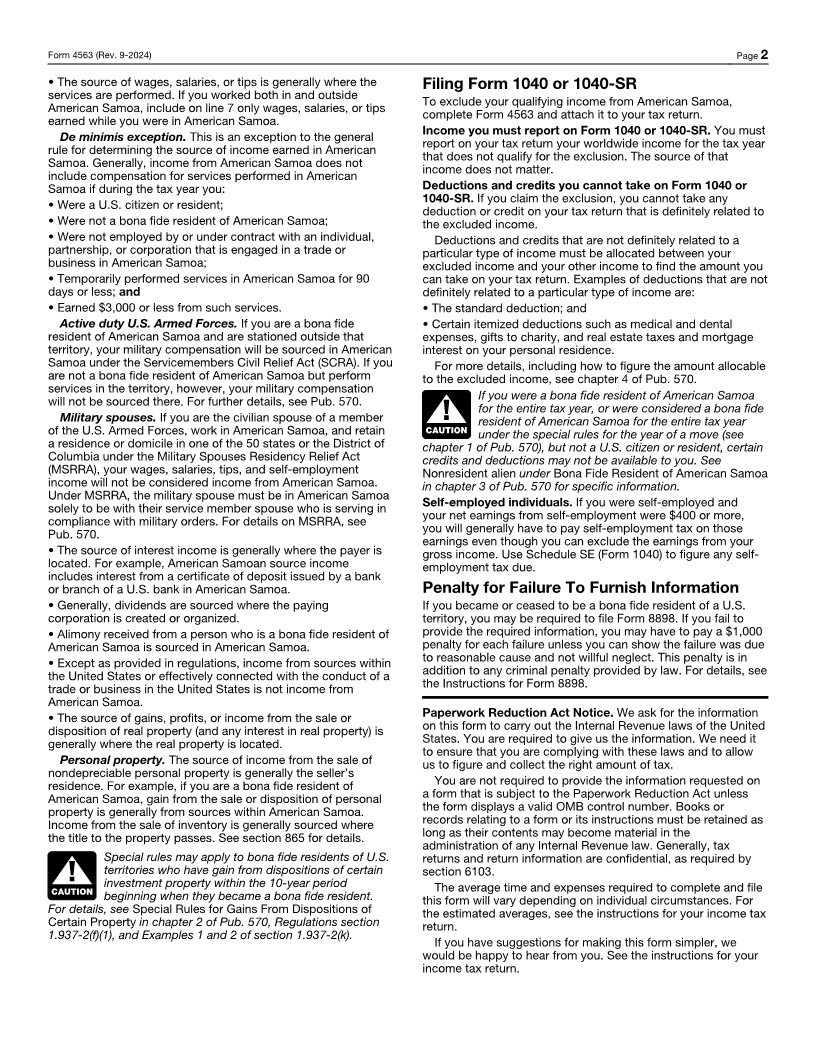

Exclusion of Income for Bona Fide Residents OMB No. 1545-0074

Form 4563

(Rev. September 2024) of American Samoa

Attach to Form 1040 or 1040-SR. Attachment

Department of the Treasury Go to www.irs.gov/Form4563 for the latest information. Sequence No. 563

Internal Revenue Service

Name(s) shown on Form 1040 or 1040-SR Your social security number

Part I General Information

1 Date bona fide residence began , and ended

2 Type of living quarters in American Samoa

Rented room Rented house or apartment Quarters furnished by employer Purchased home

3 a Did any of your family live with you in American Samoa during any part of the tax year? . . . . . . . Yes No

b If “Yes,” who and for what period?

4 a Did you maintain any home(s) outside American Samoa? . . . . . . . . . . . . . . . . . Yes No

b If “Yes,” show address of your home(s), whether it was rented, the name of each occupant, and their relationship to you.

5 Name and address of employer (state if self-employed)

6 Complete columns (a) through (d) below for days absent from American Samoa during the tax year.

(a) Date left (b) Date (c) Number of (d) Reason for absence

returned days absent

Part II Figure Your Exclusion. Include only income that qualifies for the exclusion. See instructions.

7 Wages, salaries, tips, etc. . . . . . . . . . . . . . . . . . . . . . . . . . 7

8 Taxable interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

9 Ordinary dividends . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

10 Business income . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

11 Capital gain . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

12 Rental real estate, royalties, etc. . . . . . . . . . . . . . . . . . . . . . . . 12

13 Farm income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

14 Other income. List type and amount

14

15 Add lines 7 through 14. This is the amount you may exclude from your gross income this tax year . . 15

Section references are to the Internal Revenue Code unless If you are including a check or money order, file your tax

otherwise noted. return with the Internal Revenue Service, P.O. Box 1303,

Charlotte, NC 28201-1303 USA.

Instructions Note: If you do not qualify for the exclusion, follow the

Purpose of form. Use Form 4563 to figure the amount of instructions for your tax return. Report all your taxable income,

income from American Samoa you may exclude from your including income from U.S., foreign, and territory sources. Send

gross income on your Form 1040 or 1040-SR (your tax return). your tax return to the address shown in the instructions for your

Who qualifies. You generally qualify for the exclusion if you tax return.

were a bona fide resident of American Samoa for the entire tax Additional information. Pub. 570 has more information on the

year and your income was: general and special rules for completing Form 4563. To get Pub.

• From sources within American Samoa, or 570, go to www.irs.gov/Pub570.

• Effectively connected with the conduct of a trade or business Part II—Figure Your Exclusion

in American Samoa. On lines 7 through 14 include only income that is from sources

Employees of the United States. You may not exclude within American Samoa or effectively connected with the

amounts paid to you for services you performed as an employee conduct of a trade or business in American Samoa. For details

of the U.S. Government or any of its agencies. This applies to on how to determine the source of income, see Source of

both civilian and military employees, but does not include income next.

employees of the American Samoa government. Source of income. The rules for determining the source of

Where to file. If you are not enclosing a check or money order, income are explained in sections 861 through 865 and section

file your tax return (including Form 4563) with the Department of 937, Regulations section 1.937-2, and chapter 2 of Pub. 570.

the Treasury, Internal Revenue Service, Austin, TX 73301-0215 Some general rules are the following.

USA.

For Paperwork Reduction Act Notice, see instructions. Cat. No. 12909U Form 4563 (Rev. 9-2024)