Enlarge image

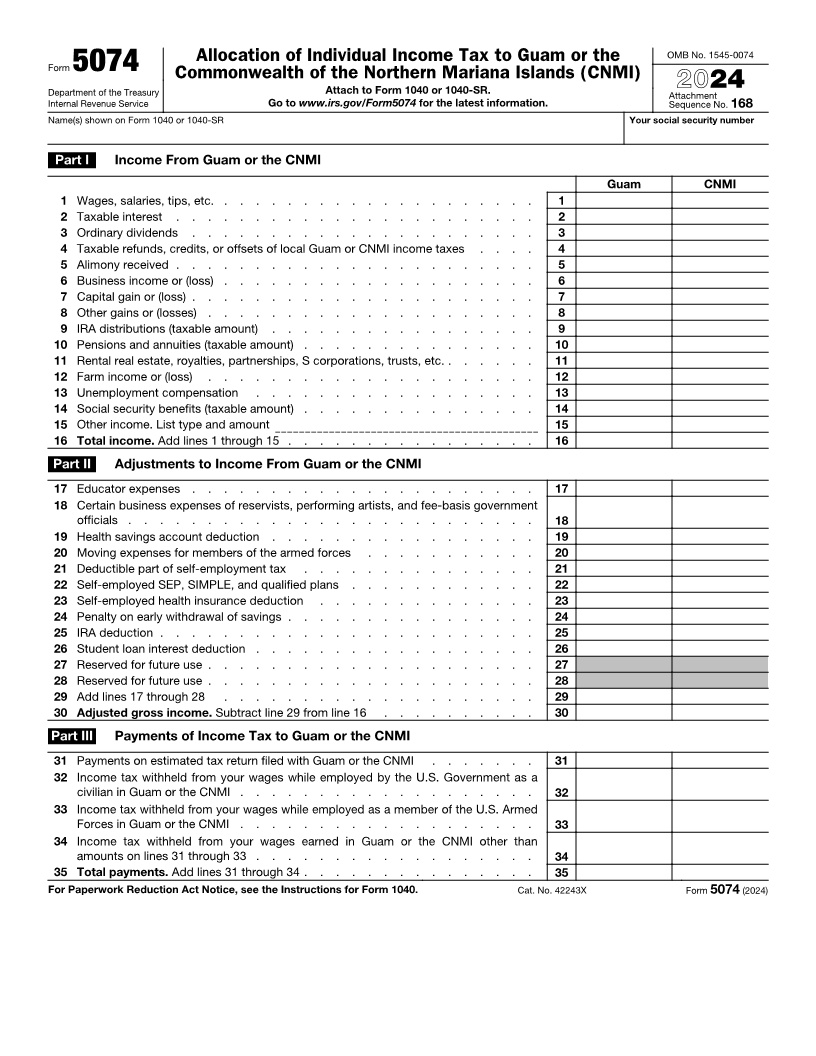

Allocation of Individual Income Tax to Guam or the OMB No. 1545-0074

Form 5074 Commonwealth of the Northern Mariana Islands (CNMI)

Department of the Treasury Attach to Form 1040 or 1040-SR. 2024

Attachment

Internal Revenue Service Go to www.irs.gov/Form5074 for the latest information. Sequence No. 168

Name(s) shown on Form 1040 or 1040-SR Your social security number

Part I Income From Guam or the CNMI

Guam CNMI

1 Wages, salaries, tips, etc. . . . . . . . . . . . . . . . . . . . . 1

2 Taxable interest . . . . . . . . . . . . . . . . . . . . . . . 2

3 Ordinary dividends . . . . . . . . . . . . . . . . . . . . . . 3

4 Taxable refunds, credits, or offsets of local Guam or CNMI income taxes . . . . 4

5 Alimony received . . . . . . . . . . . . . . . . . . . . . . . 5

6 Business income or (loss) . . . . . . . . . . . . . . . . . . . . 6

7 Capital gain or (loss) . . . . . . . . . . . . . . . . . . . . . . 7

8 Other gains or (losses) . . . . . . . . . . . . . . . . . . . . . 8

9 IRA distributions (taxable amount) . . . . . . . . . . . . . . . . . 9

10 Pensions and annuities (taxable amount) . . . . . . . . . . . . . . . 10

11 Rental real estate, royalties, partnerships, S corporations, trusts, etc. . . . . . . 11

12 Farm income or (loss) . . . . . . . . . . . . . . . . . . . . . 12

13 Unemployment compensation . . . . . . . . . . . . . . . . . . 13

14 Social security benefits (taxable amount) . . . . . . . . . . . . . . . 14

15 Other income. List type and amount 15

16 Total income. Add lines 1 through 15 . . . . . . . . . . . . . . . . 16

Part II Adjustments to Income From Guam or the CNMI

17 Educator expenses . . . . . . . . . . . . . . . . . . . . . . 17

18 Certain business expenses of reservists, performing artists, and fee-basis government

officials . . . . . . . . . . . . . . . . . . . . . . . . . . 18

19 Health savings account deduction . . . . . . . . . . . . . . . . . 19

20 Moving expenses for members of the armed forces . . . . . . . . . . . 20

21 Deductible part of self-employment tax . . . . . . . . . . . . . . . 21

22 Self-employed SEP, SIMPLE, and qualified plans . . . . . . . . . . . . 22

23 Self-employed health insurance deduction . . . . . . . . . . . . . . 23

24 Penalty on early withdrawal of savings . . . . . . . . . . . . . . . . 24

25 IRA deduction . . . . . . . . . . . . . . . . . . . . . . . . 25

26 Student loan interest deduction . . . . . . . . . . . . . . . . . . 26

27 Reserved for future use . . . . . . . . . . . . . . . . . . . . . 27

28 Reserved for future use . . . . . . . . . . . . . . . . . . . . . 28

29 Add lines 17 through 28 . . . . . . . . . . . . . . . . . . . . 29

30 Adjusted gross income. Subtract line 29 from line 16 . . . . . . . . . . 30

Part III Payments of Income Tax to Guam or the CNMI

31 Payments on estimated tax return filed with Guam or the CNMI . . . . . . . 31

32 Income tax withheld from your wages while employed by the U.S. Government as a

civilian in Guam or the CNMI . . . . . . . . . . . . . . . . . . . 32

33 Income tax withheld from your wages while employed as a member of the U.S. Armed

Forces in Guam or the CNMI . . . . . . . . . . . . . . . . . . . 33

34 Income tax withheld from your wages earned in Guam or the CNMI other than

amounts on lines 31 through 33 . . . . . . . . . . . . . . . . . . 34

35 Total payments. Add lines 31 through 34 . . . . . . . . . . . . . . . 35

For Paperwork Reduction Act Notice, see the Instructions for Form 1040. Cat. No. 42243X Form 5074 (2024)