- 2 -

Enlarge image

|

Form 5754 (Rev. 11-2024) Page 2

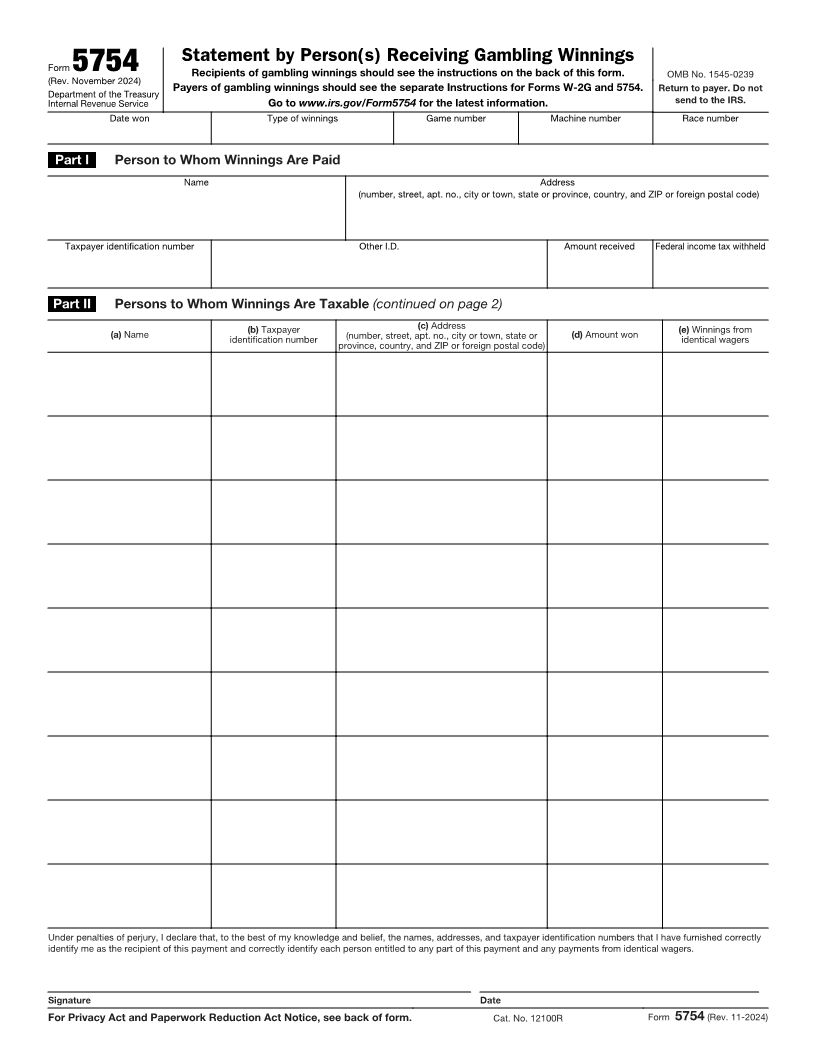

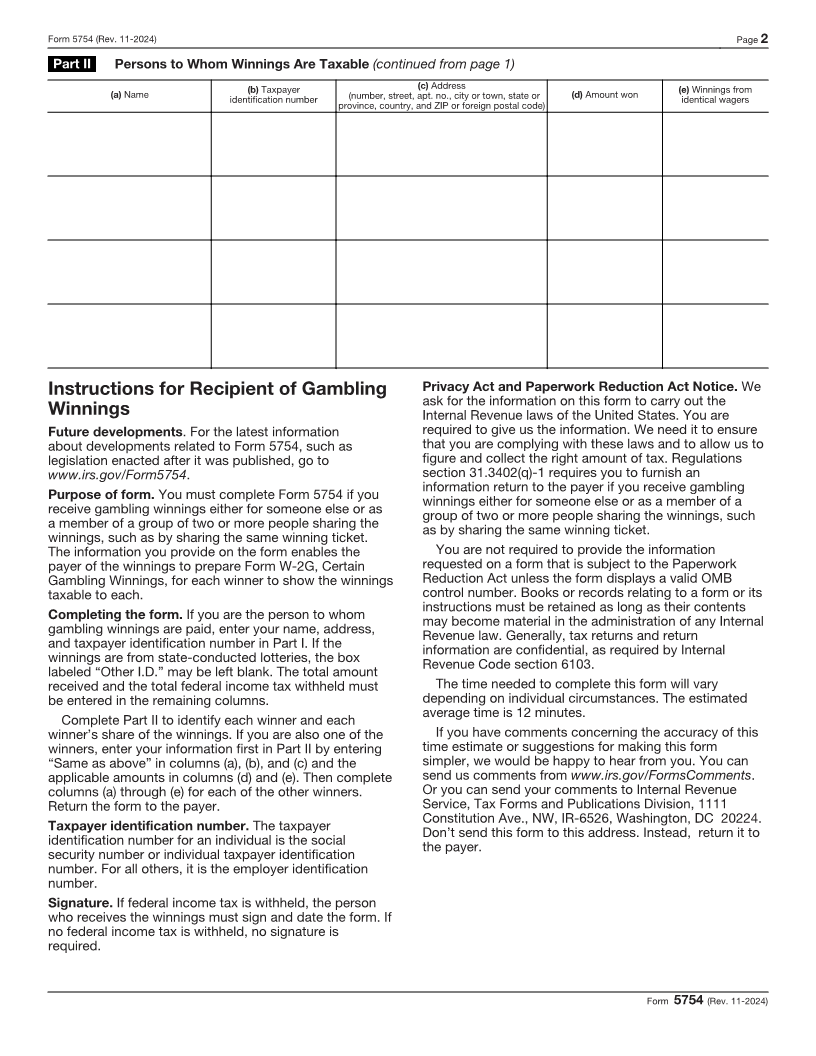

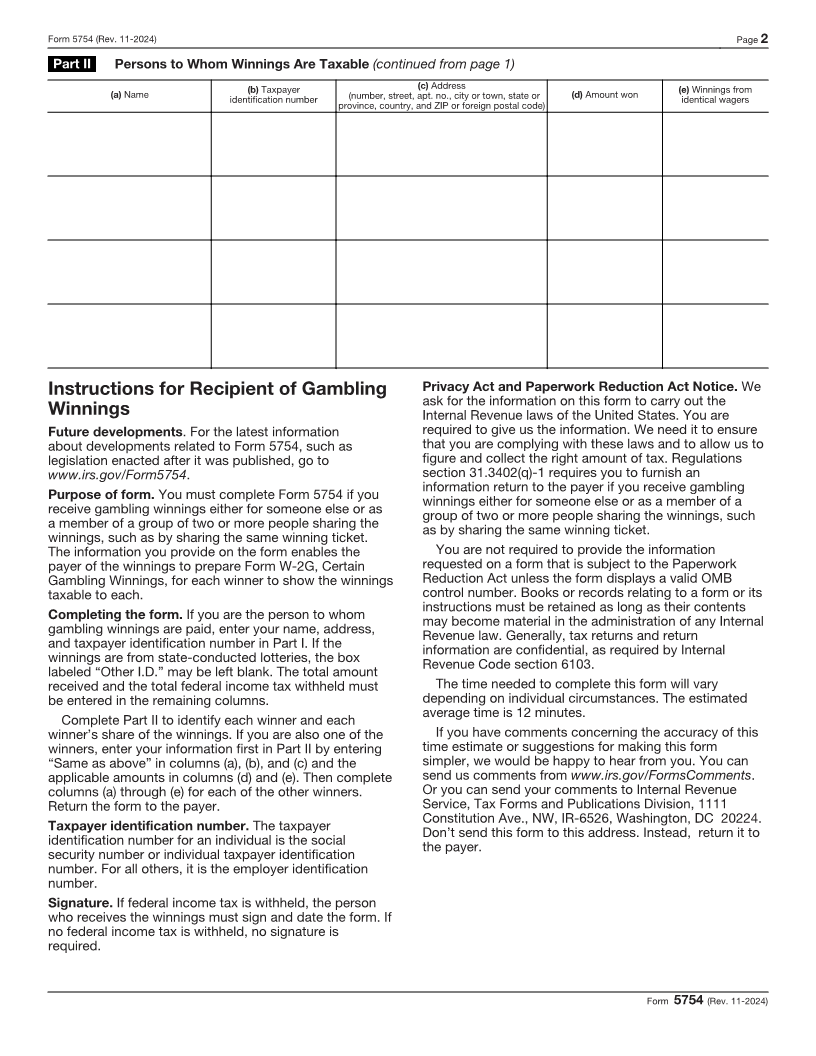

Part II Persons to Whom Winnings Are Taxable (continued from page 1)

(a) Name (b) Taxpayer (c) Address (e) Winnings from

identification number (number, street, apt. no., city or town, state or (d) Amount won identical wagers

province, country, and ZIP or foreign postal code)

Instructions for Recipient of Gambling Privacy Act and Paperwork Reduction Act Notice. We

ask for the information on this form to carry out the

Winnings Internal Revenue laws of the United States. You are

Future developments. For the latest information required to give us the information. We need it to ensure

about developments related to Form 5754, such as that you are complying with these laws and to allow us to

legislation enacted after it was published, go to figure and collect the right amount of tax. Regulations

www.irs.gov/Form5754. section 31.3402(q)-1 requires you to furnish an

information return to the payer if you receive gambling

Purpose of form. You must complete Form 5754 if you winnings either for someone else or as a member of a

receive gambling winnings either for someone else or as group of two or more people sharing the winnings, such

a member of a group of two or more people sharing the as by sharing the same winning ticket.

winnings, such as by sharing the same winning ticket.

The information you provide on the form enables the You are not required to provide the information

payer of the winnings to prepare Form W-2G, Certain requested on a form that is subject to the Paperwork

Gambling Winnings, for each winner to show the winnings Reduction Act unless the form displays a valid OMB

taxable to each. control number. Books or records relating to a form or its

instructions must be retained as long as their contents

Completing the form. If you are the person to whom may become material in the administration of any Internal

gambling winnings are paid, enter your name, address, Revenue law. Generally, tax returns and return

and taxpayer identification number in Part I. If the information are confidential, as required by Internal

winnings are from state-conducted lotteries, the box Revenue Code section 6103.

labeled “Other I.D.” may be left blank. The total amount

received and the total federal income tax withheld must The time needed to complete this form will vary

be entered in the remaining columns. depending on individual circumstances. The estimated

average time is 12 minutes.

Complete Part II to identify each winner and each

winner’s share of the winnings. If you are also one of the If you have comments concerning the accuracy of this

winners, enter your information first in Part II by entering time estimate or suggestions for making this form

“Same as above” in columns (a), (b), and (c) and the simpler, we would be happy to hear from you. You can

applicable amounts in columns (d) and (e). Then complete send us comments from www.irs.gov/FormsComments.

columns (a) through (e) for each of the other winners. Or you can send your comments to Internal Revenue

Return the form to the payer. Service, Tax Forms and Publications Division, 1111

Constitution Ave., NW, IR-6526, Washington, DC 20224.

Taxpayer identification number. The taxpayer Don’t send this form to this address. Instead, return it to

identification number for an individual is the social the payer.

security number or individual taxpayer identification

number. For all others, it is the employer identification

number.

Signature. If federal income tax is withheld, the person

who receives the winnings must sign and date the form. If

no federal income tax is withheld, no signature is

required.

Form 5754 (Rev. 11-2024)

|