Enlarge image

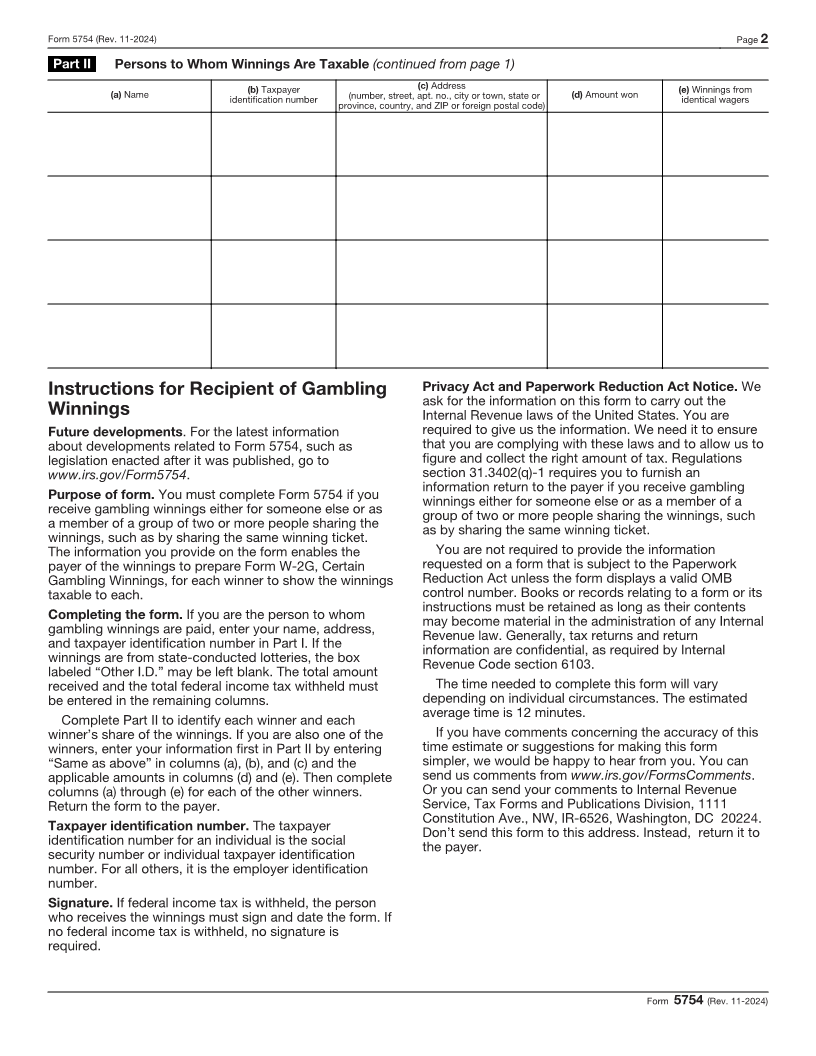

Statement by Person(s) Receiving Gambling Winnings

Form 5754 Recipients of gambling winnings should see the instructions on the back of this form. OMB No. 1545-0239

(Rev. November 2024)

Department of the Treasury Payers of gambling winnings should see the separate Instructions for Forms W-2G and 5754. Return to payer. Do not

Internal Revenue Service Go to www.irs.gov/Form5754 for the latest information. send to the IRS.

Date won Type of winnings Game number Machine number Race number

Part I Person to Whom Winnings Are Paid

Name Address

(number, street, apt. no., city or town, state or province, country, and ZIP or foreign postal code)

Taxpayer identification number Other I.D. Amount received Federal income tax withheld

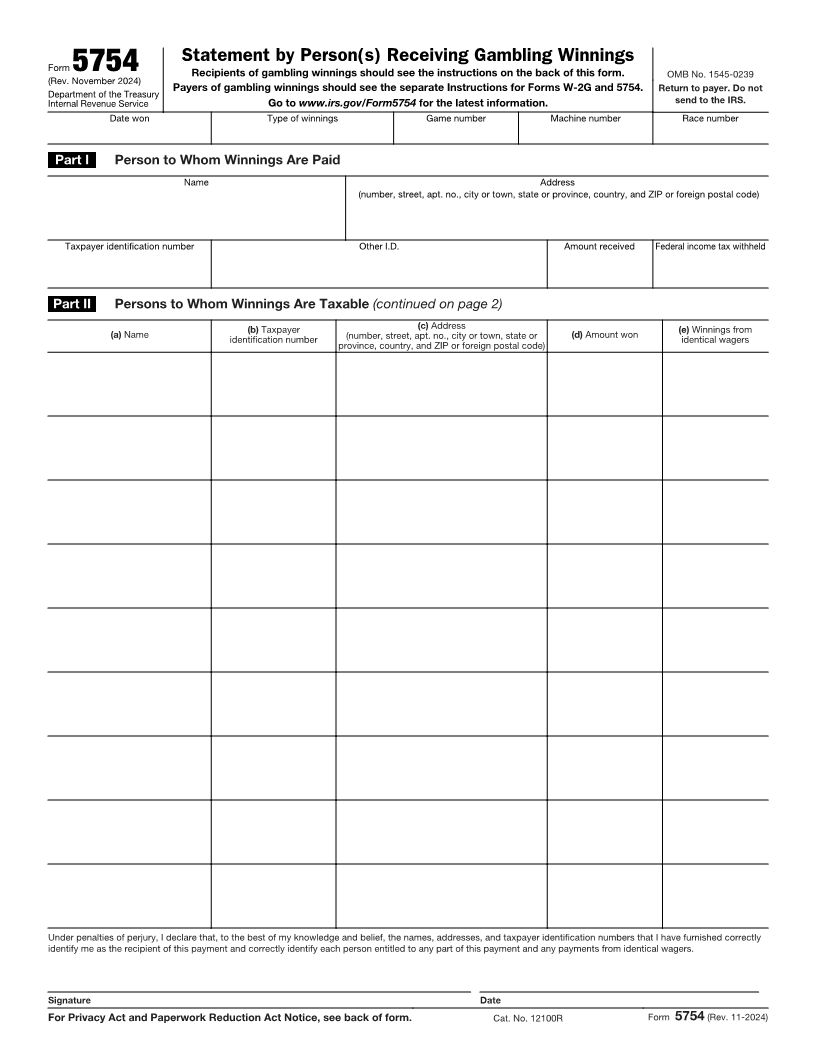

Part II Persons to Whom Winnings Are Taxable (continued on page 2)

(a) Name (b) Taxpayer (c) Address (e) Winnings from

identification number (number, street, apt. no., city or town, state or (d) Amount won identical wagers

province, country, and ZIP or foreign postal code)

Under penalties of perjury, I declare that, to the best of my knowledge and belief, the names, addresses, and taxpayer identification numbers that I have furnished correctly

identify me as the recipient of this payment and correctly identify each person entitled to any part of this payment and any payments from identical wagers.

Signature Date

For Privacy Act and Paperwork Reduction Act Notice, see back of form. Cat. No. 12100R Form 5754 (Rev. 11-2024)