Enlarge image

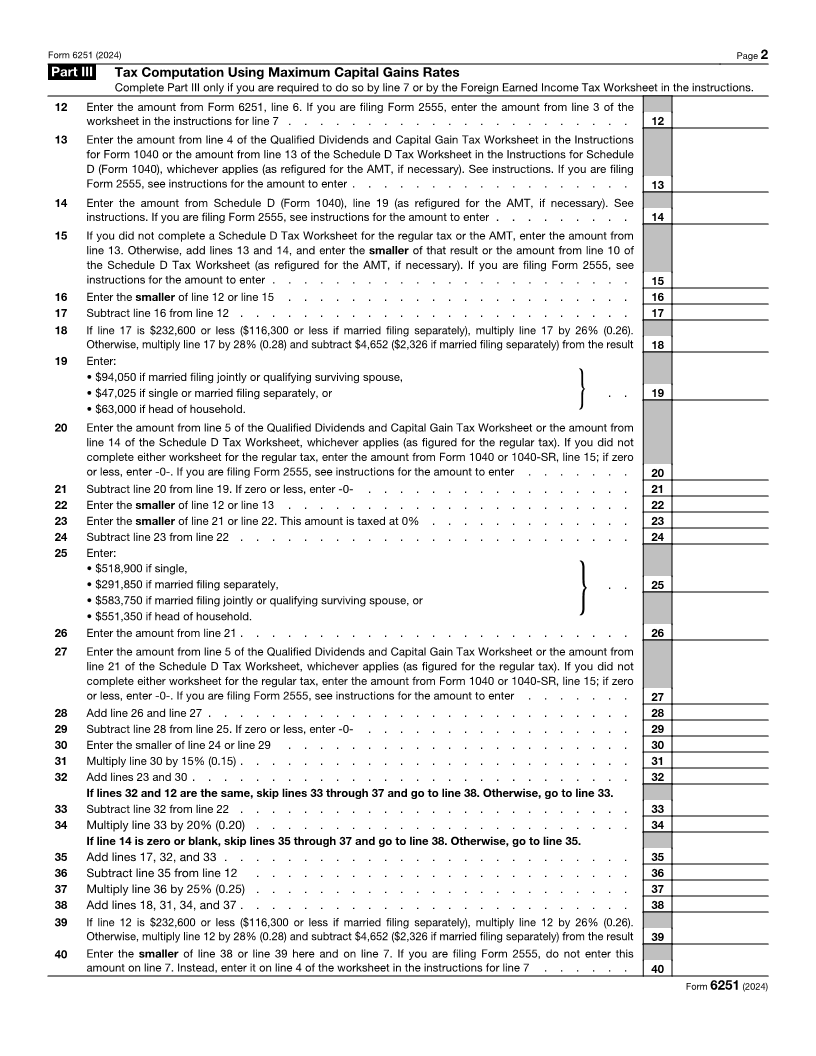

OMB No. 1545-0074

Alternative Minimum Tax—Individuals

Form 6251

Department of the Treasury Attach to Form 1040, 1040-SR, or 1040-NR. 2024

Attachment

Internal Revenue Service Go to www.irs.gov/Form6251 for instructions and the latest information. Sequence No. 32

Name(s) shown on Form 1040, 1040-SR, or 1040-NR Your social security number

Part I Alternative Minimum Taxable Income (See instructions for how to complete each line.)

1 Enter the amount from Form 1040 or 1040-SR, line 15, if more than zero. If Form 1040 or 1040-SR, line 15,

is zero, subtract line 14 of Form 1040 or 1040-SR from line 11 of Form 1040 or 1040-SR and enter the result

here. (If less than zero, enter as a negative amount.) . . . . . . . . . . . . . . . . . . 1

2 a If filing Schedule A (Form 1040), enter the taxes from Schedule A, line 7; otherwise, enter the amount from

Form 1040 or 1040-SR, line 12 . . . . . . . . . . . . . . . . . . . . . . . . 2a

b Tax refund from Schedule 1 (Form 1040), line 1 or line 8z . . . . . . . . . . . . . . . . 2b ( )

c Investment interest expense (difference between regular tax and AMT) . . . . . . . . . . . . 2c

d Depletion (difference between regular tax and AMT) . . . . . . . . . . . . . . . . . . 2d

e Net operating loss deduction from Schedule 1 (Form 1040), line 8a. Enter as a positive amount . . . . 2e

f Alternative tax net operating loss deduction . . . . . . . . . . . . . . . . . . . . 2f ( )

g Interest from specified private activity bonds exempt from the regular tax . . . . . . . . . . . 2g

h Qualified small business stock, see instructions . . . . . . . . . . . . . . . . . . . 2h

i Exercise of incentive stock options (excess of AMT income over regular tax income) . . . . . . . . 2i

j Estates and trusts (amount from Schedule K-1 (Form 1041), box 12, code A) . . . . . . . . . . 2j

k Disposition of property (difference between AMT and regular tax gain or loss) . . . . . . . . . . 2k

l Depreciation on assets placed in service after 1986 (difference between regular tax and AMT) . . . . . 2l

m Passive activities (difference between AMT and regular tax income or loss) . . . . . . . . . . 2m

n Loss limitations (difference between AMT and regular tax income or loss) . . . . . . . . . . . 2n

o Circulation costs (difference between regular tax and AMT) . . . . . . . . . . . . . . . 2o

p Long-term contracts (difference between AMT and regular tax income) . . . . . . . . . . . . 2p

q Mining costs (difference between regular tax and AMT) . . . . . . . . . . . . . . . . . 2q

r Research and experimental costs (difference between regular tax and AMT) . . . . . . . . . . 2r

s Income from certain installment sales before January 1, 1987 . . . . . . . . . . . . . . . 2s ( )

t Intangible drilling costs preference . . . . . . . . . . . . . . . . . . . . . . . 2t

3 Other adjustments, including income-based related adjustments . . . . . . . . . . . . . . 3

4 Alternative minimum taxable income. Combine lines 1 through 3. (If married filing separately and line 4 is

more than $875,950, see instructions.) . . . . . . . . . . . . . . . . . . . . . . 4

Part II Alternative Minimum Tax (AMT)

5 Exemption.

IF your filing status is... AND line 4 is not over... THEN enter on line 5...

Single or head of household . . . . . $ 609,350 . . . . . $ 85,700

Married filing jointly or qualifying surviving spouse 1,218,700 . . . . . 133,300

Married filing separately . . . . . . 609,350 . . . . . 66,650 . . 5

If line 4 is over the amount shown above for your filing status, see instructions. }

6 Subtract line 5 from line 4. If more than zero, go to line 7. If zero or less, enter -0- here and on lines 7, 9, and

11, and go to line 10 . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

7 • If you are filing Form 2555, see instructions for the amount to enter.

• If you reported capital gain distributions directly on Form 1040 or 1040-SR, line 7; you reported

qualified dividends on Form 1040 or 1040-SR, line 3a; oryou had a gain on both lines 15 and

16 of Schedule D (Form 1040) (as refigured for the AMT, if necessary), complete Part III on the . . 7

back and enter the amount from line 40 here.

• All others: If line 6 is $232,600 or less ($116,300 or less if married filing separately), multiply

line 6 by 26% (0.26). Otherwise, multiply line 6 by 28% (0.28) and subtract $4,652 ($2,326 if

married filing separately) from the result. }

8 Alternative minimum tax foreign tax credit (see instructions) . . . . . . . . . . . . . . . 8

9 Tentative minimum tax. Subtract line 8 from line 7 . . . . . . . . . . . . . . . . . . 9

10 Add Form 1040 or 1040-SR, line 16 (minus any tax from Form 4972), and Schedule 2 (Form 1040), line 1z.

Subtract from the result Schedule 3 (Form 1040), line 1 and any negative amount reported on Form 8978,

line 14 (treated as a positive number). If zero or less, enter -0-. If you used Schedule J to figure your tax on

Form 1040 or 1040-SR, line 16, refigure that tax without using Schedule J before completing this line. See

instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

11 AMT. Subtract line 10 from line 9. If zero or less, enter -0-. Enter here and on Schedule 2 (Form 1040), line 2 11

For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 13600G Form 6251 (2024)