Enlarge image

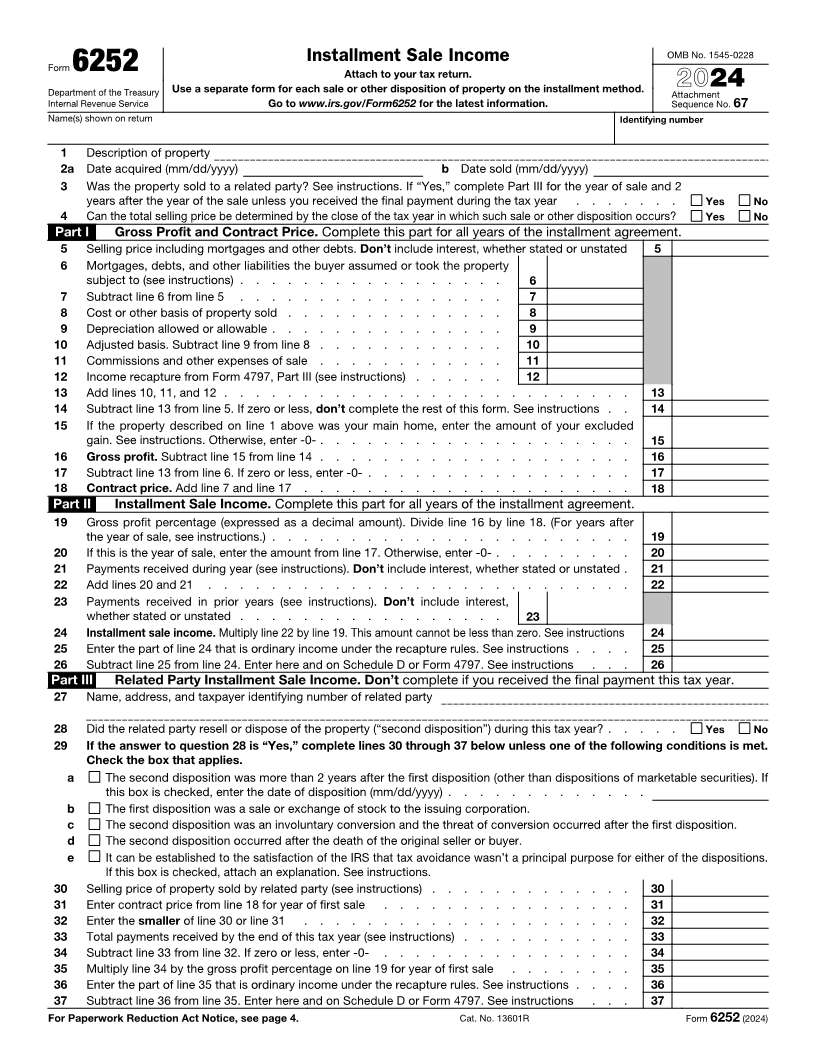

Installment Sale Income OMB No. 1545-0228

Form 6252 Attach to your tax return.

Department of the Treasury Use a separate form for each sale or other disposition of property on the installment method. Attachment 2024

Internal Revenue Service Go to www.irs.gov/Form6252 for the latest information. Sequence No. 67

Name(s) shown on return Identifying number

1 Description of property

2 a Date acquired (mm/dd/yyyy) b Date sold (mm/dd/yyyy)

3 Was the property sold to a related party? See instructions. If “Yes,” complete Part III for the year of sale and 2

years after the year of the sale unless you received the final payment during the tax year . . . . . . . Yes No

4 Can the total selling price be determined by the close of the tax year in which such sale or other disposition occurs? Yes No

Part I Gross Profit and Contract Price. Complete this part for all years of the installment agreement.

5 Selling price including mortgages and other debts. Don’t include interest, whether stated or unstated 5

6 Mortgages, debts, and other liabilities the buyer assumed or took the property

subject to (see instructions) . . . . . . . . . . . . . . . . . 6

7 Subtract line 6 from line 5 . . . . . . . . . . . . . . . . . 7

8 Cost or other basis of property sold . . . . . . . . . . . . . . 8

9 Depreciation allowed or allowable . . . . . . . . . . . . . . . 9

10 Adjusted basis. Subtract line 9 from line 8 . . . . . . . . . . . . 10

11 Commissions and other expenses of sale . . . . . . . . . . . . 11

12 Income recapture from Form 4797, Part III (see instructions) . . . . . . 12

13 Add lines 10, 11, and 12 . . . . . . . . . . . . . . . . . . . . . . . . . . 13

14 Subtract line 13 from line 5. If zero or less, don’t complete the rest of this form. See instructions . . 14

15 If the property described on line 1 above was your main home, enter the amount of your excluded

gain. See instructions. Otherwise, enter -0- . . . . . . . . . . . . . . . . . . . . 15

16 Gross profit. Subtract line 15 from line 14 . . . . . . . . . . . . . . . . . . . . 16

17 Subtract line 13 from line 6. If zero or less, enter -0- . . . . . . . . . . . . . . . . . 17

18 Contract price. Add line 7 and line 17 . . . . . . . . . . . . . . . . . . . . . 18

Part II Installment Sale Income. Complete this part for all years of the installment agreement.

19 Gross profit percentage (expressed as a decimal amount). Divide line 16 by line 18. (For years after

the year of sale, see instructions.) . . . . . . . . . . . . . . . . . . . . . . . 19

20 If this is the year of sale, enter the amount from line 17. Otherwise, enter -0- . . . . . . . . . 20

21 Payments received during year (see instructions). Don’t include interest, whether stated or unstated . 21

22 Add lines 20 and 21 . . . . . . . . . . . . . . . . . . . . . . . . . . . 22

23 Payments received in prior years (see instructions). Don’t include interest,

whether stated or unstated . . . . . . . . . . . . . . . . . 23

24 Installment sale income. Multiply line 22 by line 19. This amount cannot be less than zero. See instructions 24

25 Enter the part of line 24 that is ordinary income under the recapture rules. See instructions . . . . 25

26 Subtract line 25 from line 24. Enter here and on Schedule D or Form 4797. See instructions . . . 26

Part III Related Party Installment Sale Income. Don’t complete if you received the final payment this tax year.

27 Name, address, and taxpayer identifying number of related party

28 Did the related party resell or dispose of the property (“second disposition”) during this tax year? . . . . . Yes No

29 If the answer to question 28 is “Yes,” complete lines 30 through 37 below unless one of the following conditions is met.

Check the box that applies.

a The second disposition was more than 2 years after the first disposition (other than dispositions of marketable securities). If

this box is checked, enter the date of disposition (mm/dd/yyyy) . . . . . . . . . . . . .

b The first disposition was a sale or exchange of stock to the issuing corporation.

c The second disposition was an involuntary conversion and the threat of conversion occurred after the first disposition.

d The second disposition occurred after the death of the original seller or buyer.

e It can be established to the satisfaction of the IRS that tax avoidance wasn’t a principal purpose for either of the dispositions.

If this box is checked, attach an explanation. See instructions.

30 Selling price of property sold by related party (see instructions) . . . . . . . . . . . . . 30

31 Enter contract price from line 18 for year of first sale . . . . . . . . . . . . . . . . 31

32 Enter the smaller of line 30 or line 31 . . . . . . . . . . . . . . . . . . . . . 32

33 Total payments received by the end of this tax year (see instructions) . . . . . . . . . . . 33

34 Subtract line 33 from line 32. If zero or less, enter -0- . . . . . . . . . . . . . . . . 34

35 Multiply line 34 by the gross profit percentage on line 19 for year of first sale . . . . . . . . 35

36 Enter the part of line 35 that is ordinary income under the recapture rules. See instructions . . . . 36

37 Subtract line 36 from line 35. Enter here and on Schedule D or Form 4797. See instructions . . . 37

For Paperwork Reduction Act Notice, see page 4. Cat. No. 13601R Form 6252 (2024)