Enlarge image

Alternative Minimum Tax—Corporations OMB No. 1545-0123

DepartmentForm 4626of the Treasury Attach to your tax return.

Internal Revenue Service Go to www.irs.gov/Form4626 for instructions and the latest information. 2024

Name of corporation Employer identification number (EIN)

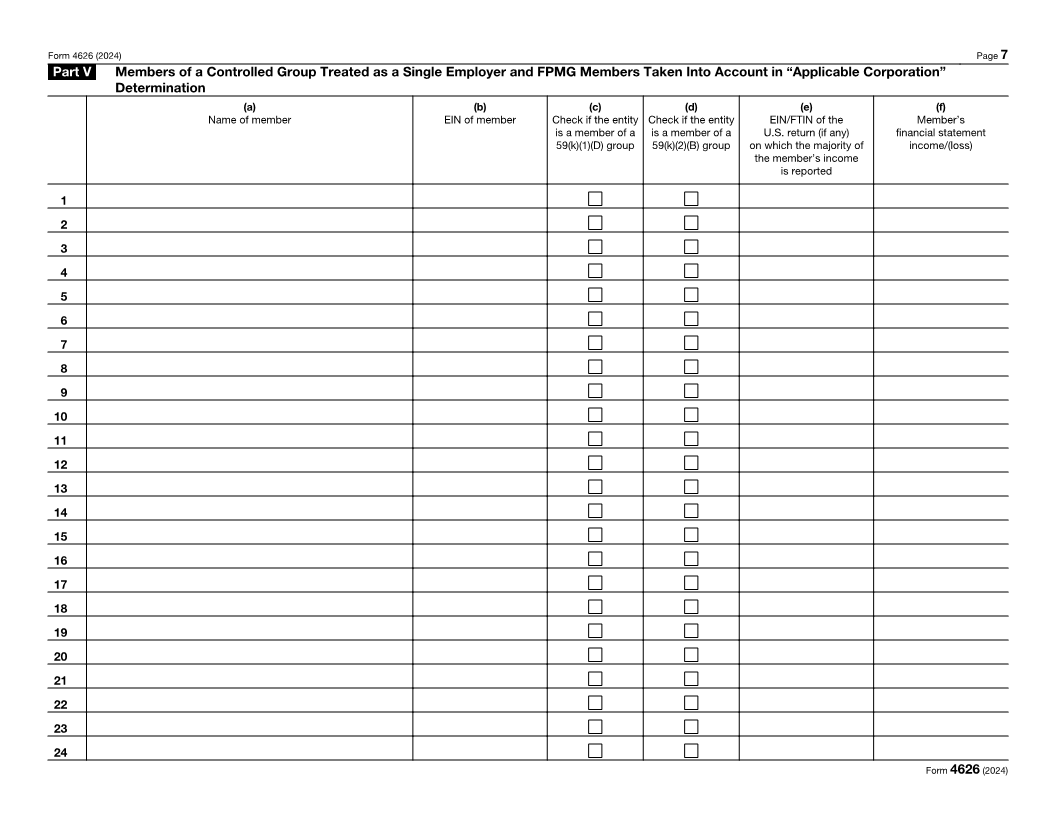

A Is the corporation filing this form a member of a controlled group treated as a single employer under

sections 59(k)(1)(D) and 52? . . . . . . . . . . . . . . . . . . . . . . . . . . . Yes No

If “Yes,” the corporation must complete Part V listing the names, EINs, and separate company financial

statement income or loss for each member of the controlled group treated as a single employer taken into

account in the determination of “applicable corporation” under section 59(k)(1)(D).

B Is the corporation filing this form a member of a foreign-parented multinational group (FPMG) within the

meaning of section 59(k)(2)(B)? . . . . . . . . . . . . . . . . . . . . . . . . . . Yes No

If “Yes,” the corporation must complete Part V listing the names, EINs, and separate company financial

statement income or loss for each member of the FPMG under section 59(k)(2)(B).

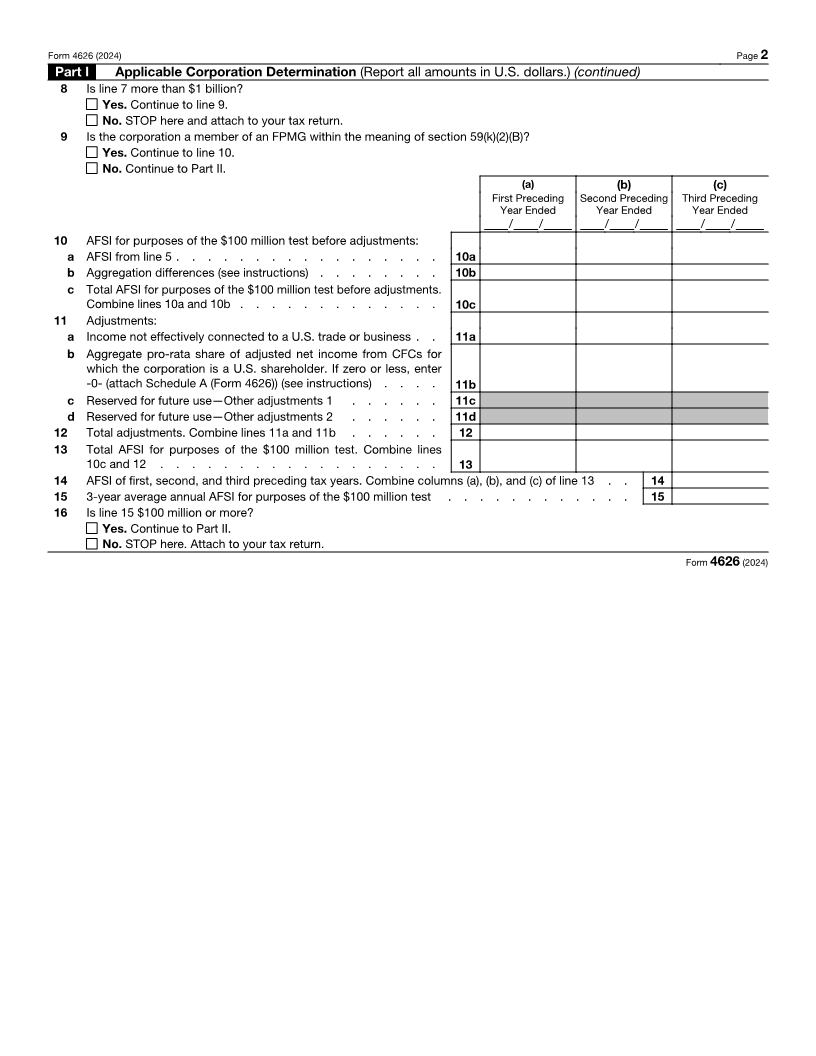

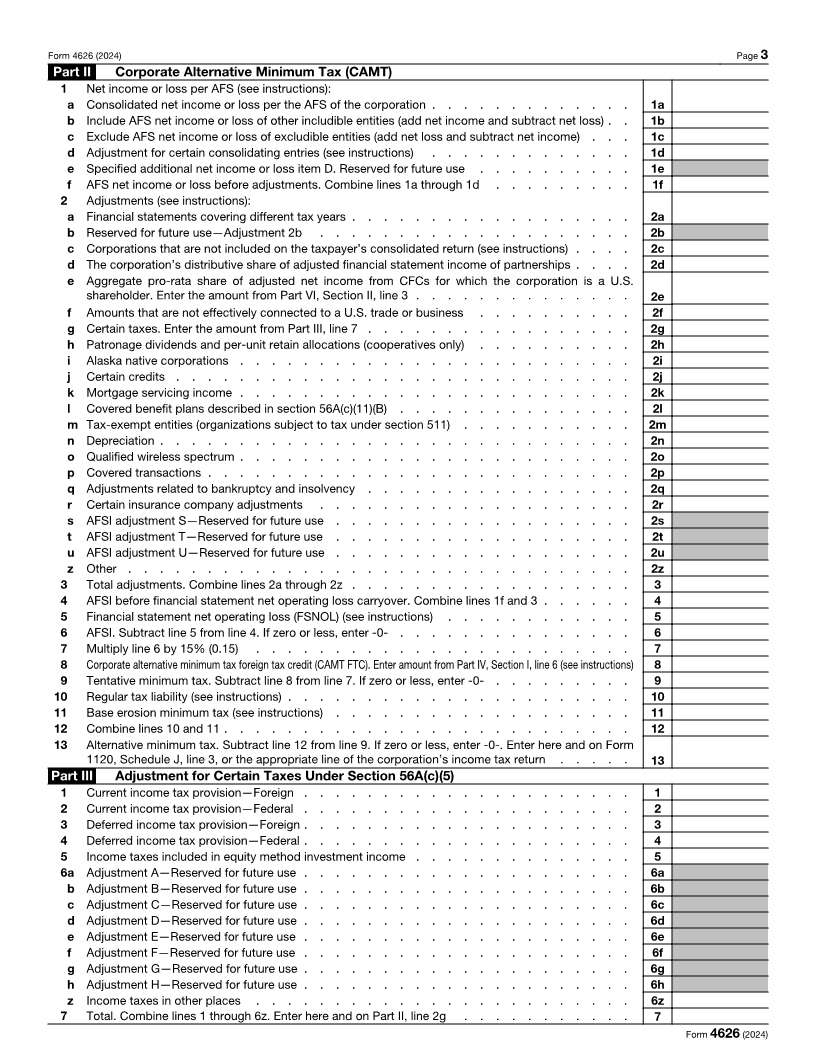

Part I Applicable Corporation Determination (Report all amounts in U.S. dollars.)

If you have already determined in current or prior years you are an applicable corporation, skip Part I and continue to Part II.

(a) (b) (c)

First Preceding Second Preceding Third Preceding

Year Ended Year Ended Year Ended

/ / / / / /

1 Net income or loss per applicable financial statement(s) (AFS) (see

instructions):

a Consolidated net income or loss per the AFS of the corporation . 1a

b Include AFS net income or loss of other includible entities (add

net income and subtract net loss) . . . . . . . . . . 1b

c Exclude AFS net income or loss of excludible entities (add net

loss and subtract net income) . . . . . . . . . . . . 1c

d Adjustment for certain consolidating entries (see instructions) . 1d

e Specified additional net income or loss item B. Reserved for future use 1e

f AFS net income or loss of all entities in the test group before

adjustments. Combine lines 1a through 1d . . . . . . . . 1f

2 Adjustments (see instructions):

a Financial statements covering different tax years . . . . . . 2a

b Corporations that are not included on the taxpayer’s consolidated

return . . . . . . . . . . . . . . . . . . . . 2b

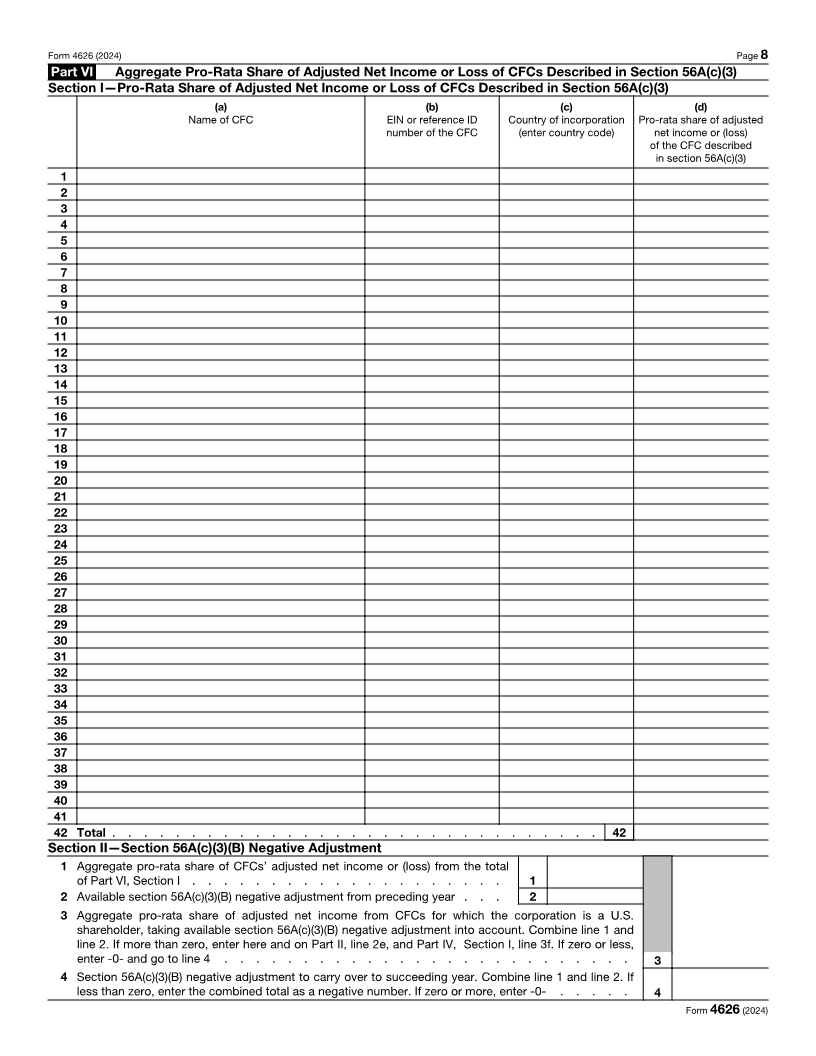

c Aggregate pro-rata share of adjusted net income from controlled

foreign corporations (CFCs) for which the corporation is a U.S.

shareholder. If zero or less, enter -0- (attach Schedule A (Form 4626))

(see instructions for special rules if completing this form for an FPMG) 2c

d Amounts that are not effectively connected to a U.S. trade or business

(see instructions for special rules if completing this form for an FPMG) 2d ( )( )( )

e Certain taxes . . . . . . . . . . . . . . . . . 2e

f Patronage dividends and per-unit retain allocations (cooperatives only) 2f

g Alaska native corporations . . . . . . . . . . . . . 2g

h Certain credits . . . . . . . . . . . . . . . . . 2h

i Mortgage servicing income . . . . . . . . . . . . . 2i

j Tax-exempt entities (organizations subject to tax under section 511) 2j

k Depreciation . . . . . . . . . . . . . . . . . . 2k

l Qualified wireless spectrum . . . . . . . . . . . . . 2l

m Covered transactions . . . . . . . . . . . . . . . 2m

n Adjustments related to bankruptcy and insolvency . . . . . 2n

o Certain insurance company adjustments . . . . . . . . 2o

p Adjustment P—Reserved for future use . . . . . . . . . 2p

q Adjustment Q—Reserved for future use . . . . . . . . . 2q

r Adjustment R—Reserved for future use . . . . . . . . . 2r

s Adjustment S—Reserved for future use . . . . . . . . . 2s

z Other . . . . . . . . . . . . . . . . . . . . 2z

3 Specified adjustment. Reserved for future use . . . . . . . 3

4 Total adjustments. Combine lines 2a through 2z . . . . . . 4

5 AFSI. Combine lines 1f and 4 . . . . . . . . . . . . 5

6 AFSI of first, second, and third preceding tax years. Combine columns (a), (b), and (c) of line 5 . . . 6

7 3-year average annual AFSI (see instructions) . . . . . . . . . . . . . . . . . . . 7

For Paperwork Reduction Act Notice, see separate instructions. Cat. No. 12955I Form 4626 (2024)