Enlarge image

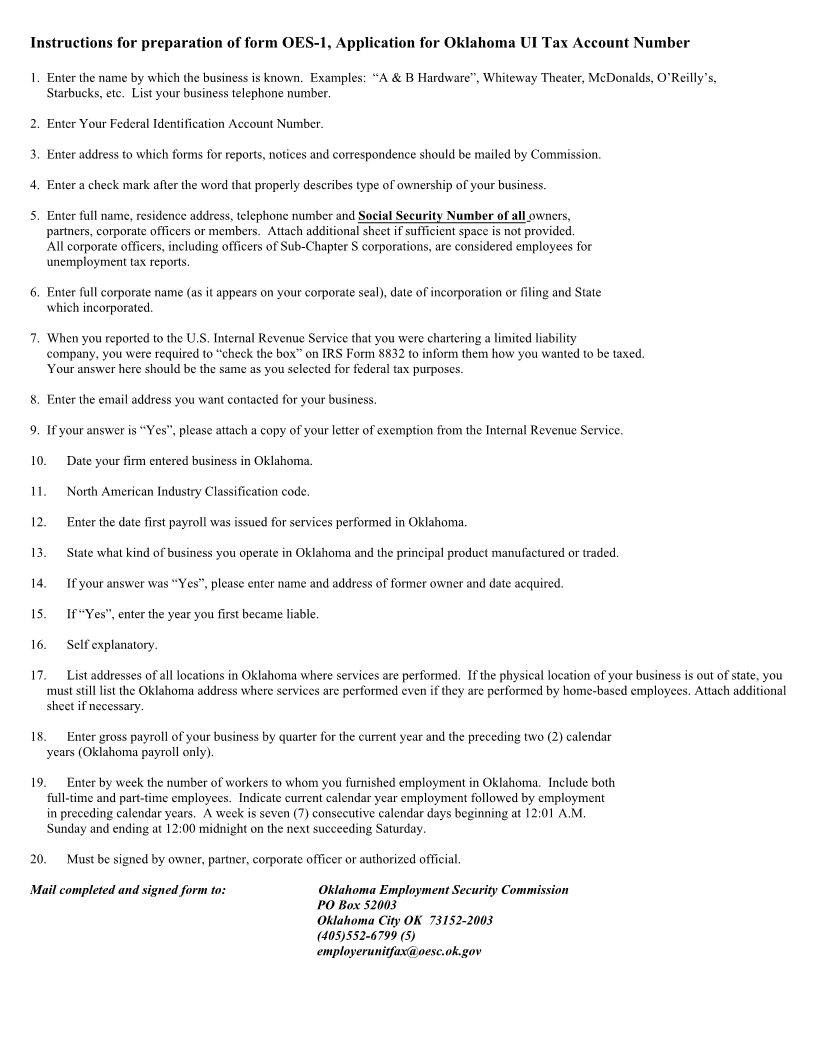

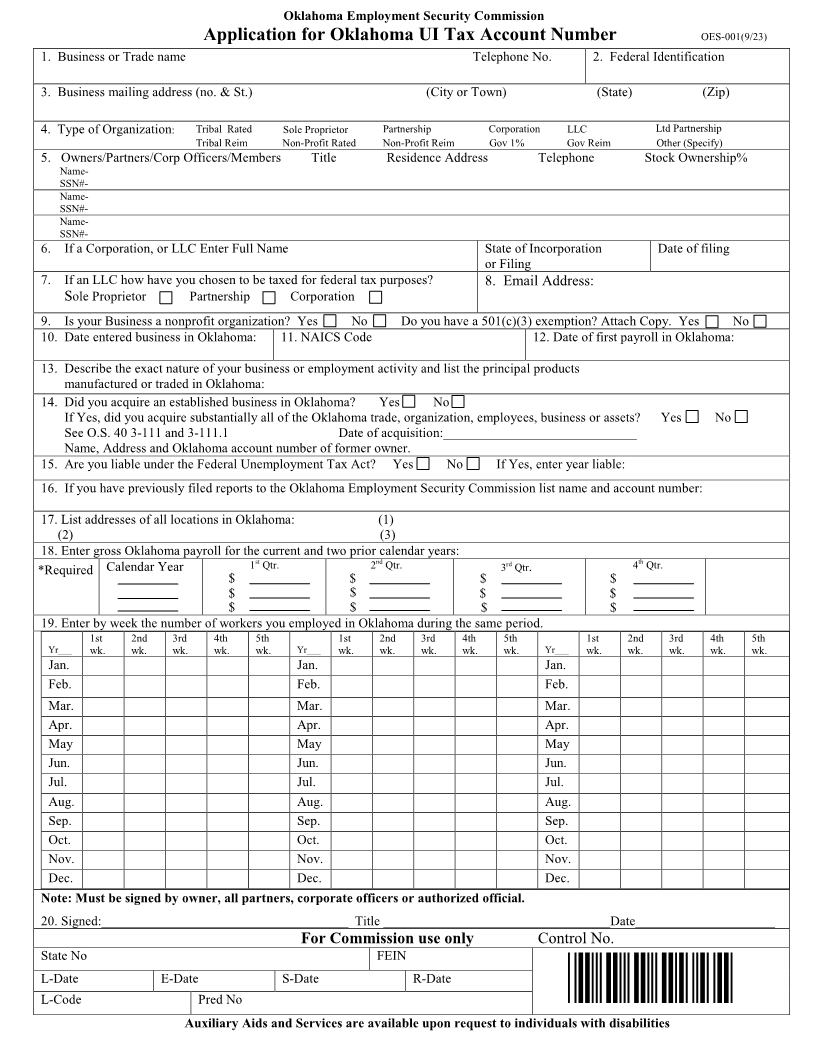

Oklahoma Employment Security Commission

Application for Oklahoma UI Tax Account Number OES-001(9/23)

1. Business or Trade name Telephone No. 2. Federal Identification

3. Business mailing address (no. & St.) (City or Town) (State) (Zip)

4. Type of Organization: Tribal Rated Sole Proprietor Partnership Corporation LLC Ltd Partnership

Tribal Reim Non-Profit Rated Non-Profit Reim Gov 1% Gov Reim Other (Specify)

5. Owners/Partners/Corp Officers/Members Title Residence Address Telephone Stock Ownership%

Name-

SSN#-

Name-

SSN#-

Name-

SSN#-

6. If a Corporation, or LLC Enter Full Name State of Incorporation Date of filing

or Filing

7. If an LLC how have you chosen to be taxed for federal tax purposes? 8. Email Address:

Sole Proprietor Partnership Corporation

9. Is your Business a nonprofit organization? Yes No Do you have a 501(c)(3) exemption? Attach Copy. Yes No

10. Date entered business in Oklahoma: 11. NAICS Code 12. Date of first payroll in Oklahoma:

13. Describe the exact nature of your business or employment activity and list the principal products

manufactured or traded in Oklahoma:

14. Did you acquire an established business in Oklahoma? Yes No

If Yes, did you acquire substantially all of the Oklahoma trade, organization, employees, business or assets? Yes No

See O.S. 40 3-111 and 3-111.1 Date of acquisition:_____________________________

Name, Address and Oklahoma account number of former owner.

15. Are you liable under the Federal Unemployment Tax Act? Yes No If Yes, enter year liable:

16. If you have previously filed reports to the Oklahoma Employment Security Commission list name and account number:

17. List addresses of all locations in Oklahoma: (1)

(2) (3)

18. Enter gross Oklahoma payroll for the current and two prior calendar years:

Calendar Year 1stQtr. 2ndQtr. rd . 4thQtr.

*Required 3 Qtr

$ $ $ $

$ $ $ $

$ $ $ $

19. Enter by week the number of workers you employed in Oklahoma during the same period.

1st 2nd 3rd 4th 5th 1st 2nd 3rd 4th 5th 1st 2nd 3rd 4th 5th

Yr___ wk. wk. wk. wk. wk. Yr___ wk. wk. wk. wk. wk. Yr___ wk. wk. wk. wk. wk.

Jan. Jan. Jan.

Feb. Feb. Feb.

Mar. Mar. Mar.

Apr. Apr. Apr.

May May May

Jun. Jun. Jun.

Jul. Jul. Jul.

Aug. Aug. Aug.

Sep. Sep. Sep.

Oct. Oct. Oct.

Nov. Nov. Nov.

Dec. Dec. Dec.

Note: Must be signed by owner, all partners, corporate officers or authorized official.

20. Signed:_____________________________________ Title __________________________________Date_____________________

For Commission use only Control No.

State No FEIN

L-Date E-Date S-Date R-Date

L-Code Pred No

Auxiliary Aids and Services are available upon request to individuals with disabilities