Enlarge image

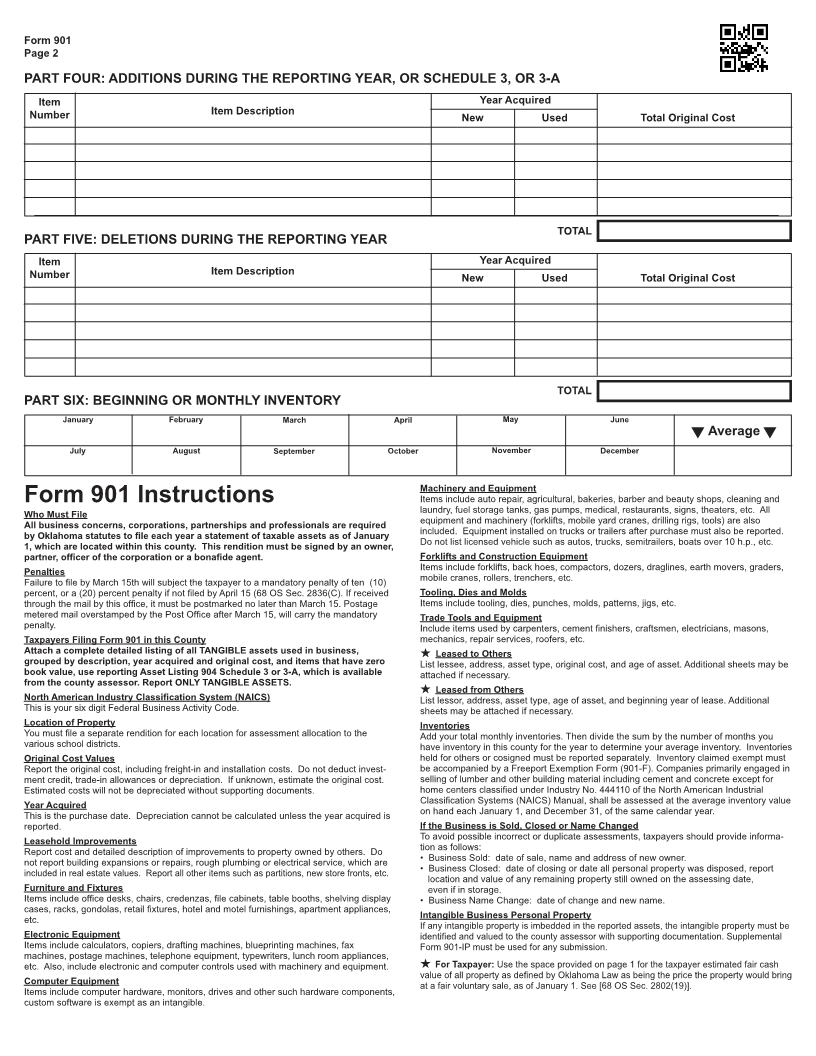

OTC 901 State of Oklahoma Tax Year 2025 Business Personal Property Rendition Revised 11-2024 Return to County Assessor - Filing Date: January 1 - Delinquent Penalties after March 15 REPORT ONLY TANGIBLE ASSETS RE# PP# FEIN: ________________________________________________________ Phone Number Type of Business: _______________________________________________ Email Address North American Industry Classification System Owner/DBA Are other businesses included in this rendition? Yes No Mailing Address If yes, please list: _______________________________________________ Physical location if different from mailing address: City, State, ZIP PART ONE: START HERE ______________________________________________________________ Are you renting or leasing this business location? Yes No Are you still in business at this location? Yes No If Yes, do you own any real estate If No, current location? ____________________________________________________________ improvements at this location? Yes No If No, do you still own the business personal property? Yes No When did you start business at this location? Date _____/_____/_____ If No, date disposed/sold: ______/______/______ If sold, buyer name: __________________________________________________________ What is the occupied square footage at this location? _______________ Buyer address: ______________________________________________________________ If disposed or sold, stop here. Sign and return. PART TWO: OKLAHOMA TAXABLE FIXED ASSETS, FROM FORM 904 SCHEDULE 3 OR 3-A Beginning Total Additions to Total Deletions to Total Ending Total Description Original Cost Original Cost Original Cost Original Cost Assessor Use Not Book Value Not Book Value Not Book Value Not Book Value Reconciled Assessed Value Leasehold Improvements Original Cost Furniture and Fixtures Original Cost Electronic Equipment Original Cost Computer Equipment Original Cost Machinery and Equipment Original Cost Forklifts and Construction Original Cost Tooling, Dies and Molds Original Cost Other Assets and Trade Tools Original Cost Leased to Others Original Cost ( See★Instructions) ➔ Column Totals ➔ Total Total Leased from Others ➔ A) Total Fixed Assets ➔ Original Cost ( See★Instructions) PART THREE: OKLAHOMA TAXABLE INVENTORY Inventories: Total supplies, parts, equipment, Average Inventory (From Part 6) ................ Net Inventory etc. stored and/or not currently in use including raw Total Assessed materials, work in progress, finished goods, etc. Less Freeport Exemption (Form 901-F) – Consignment and/or Floorplan Inventory – Penalty Total Net B) Net Taxable Inventory = Date Filed C) Grand Total (add A+ ) B = _____ / _____ / _____ State of Oklahoma For Taxpayer (*See instructions) Fair Cash Value (Market): $ Assessment % School District County of ________________________________________ I, _________________________________________________________________________ under penalties of perjury, do hereby depose and say that I am _____________________________________________ of _______________________________________________________________ company; that as such I am acquainted with the books, accounts, and affairs of said company and know the accompanying statement to be true, correct, and complete and that all information requested herein has been fully and correctly given to the best of my knowledge. (68 OS Sec. 2945 provides penalties for false oaths) Don’t Forget Signature of preparer if other than taxpayer Date Preparer’s address to Sign ✍ Signature of taxpayer Date Preparer’s identification number Preparer’s phone number