Enlarge image

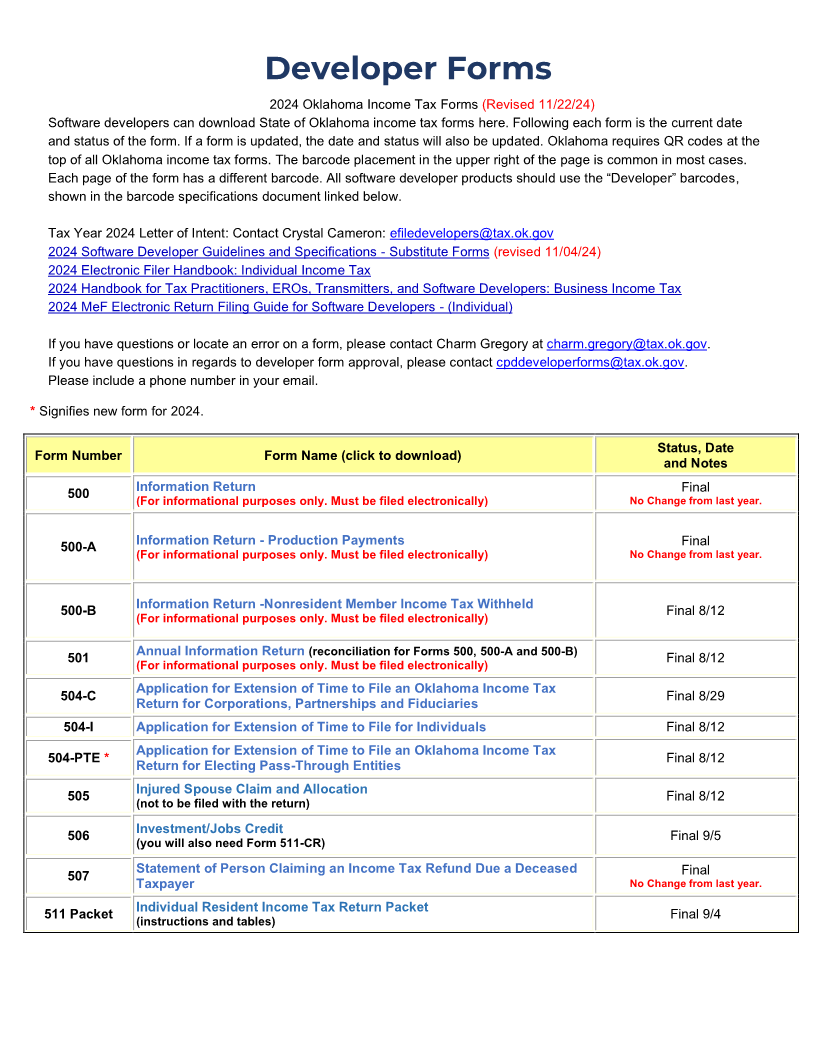

Developer Forms

2024 Oklahoma Income Tax Forms (Revised 11/22/24)

Software developers can download State of Oklahoma income tax forms here. Following each form is the current date

and status of the form. If a form is updated, the date and status will also be updated. Oklahoma requires QR codes at the

top of all Oklahoma income tax forms. The barcode placement in the upper right of the page is common in most cases.

Each page of the form has a different barcode. All software developer products should use the “Developer” barcodes,

shown in the barcode specifications document linked below.

Tax Year 2024 Letter of Intent: Contact Crystal Cameron: efiledevelopers@tax.ok.gov

2024 Software Developer Guidelines and Specifications - Substitute Forms (revised 11/04/24)

2024 Electronic Filer Handbook: Individual Income Tax

2024 Handbook for Tax Practitioners, EROs, Transmitters, and Software Developers: Business Income Tax

2024 MeF Electronic Return Filing Guide for Software Developers - (Individual)

If you have questions or locate an error on a form, please contact Charm Gregory at charm.gregory@tax.ok.gov.

If you have questions in regards to developer form approval, please contact cpddeveloperforms@tax.ok.gov.

Please include a phone number in your email.

* Signifies new form for 2024.

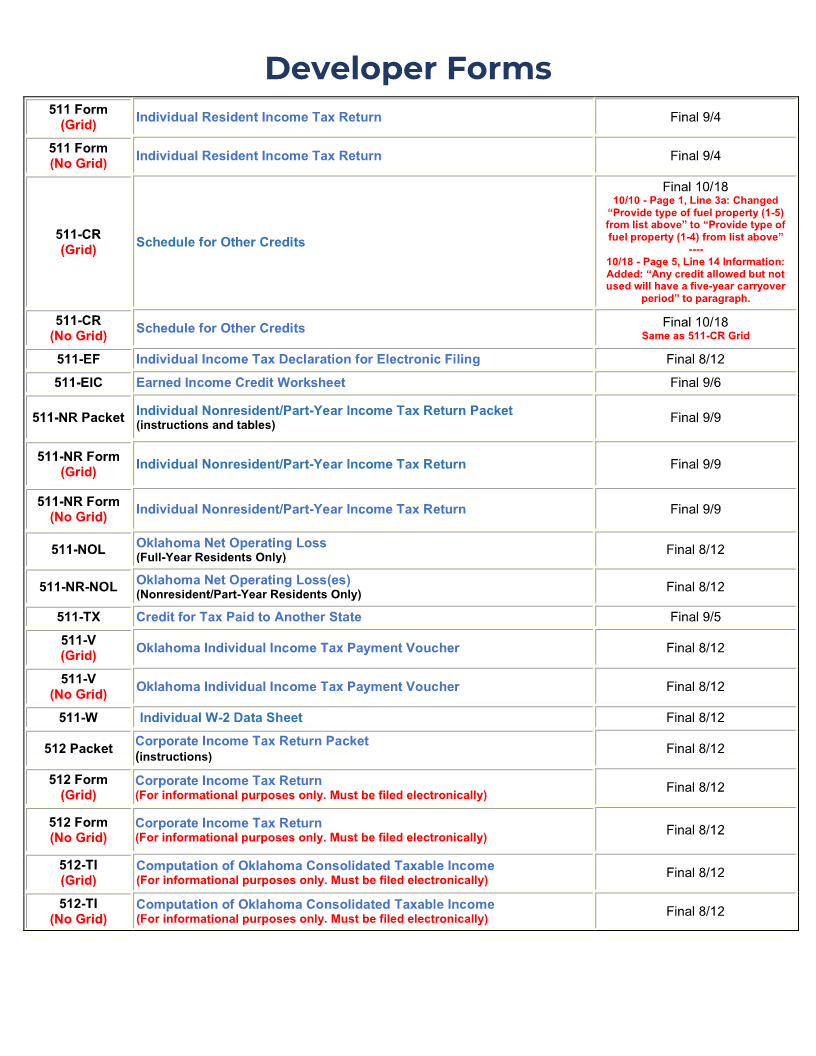

Status, Date

Form Number Form Name (click to download)

and Notes

Information Return Final

500 (For informational purposes only. Must be filed electronically) No Change from last year.

Information Return - Production Payments Final

500-A (For informational purposes only. Must be filed electronically) No Change from last year.

Information Return -Nonresident Member Income Tax Withheld

Final 8/12

500-B (For informational purposes only. Must be filed electronically)

Annual Information Return (reconciliation for Forms 500, 500-A and 500-B)

Final 8/12

501 (For informational purposes only. Must be filed electronically)

Application for Extension of Time to File an Oklahoma Income Tax

504-C Final 8/29

Return for Corporations, Partnerships and Fiduciaries

504-I Application for Extension of Time to File for Individuals Final 8/12

Application for Extension of Time to File an Oklahoma Income Tax

504-PTE * Final 8/12

Return for Electing Pass-Through Entities

Injured Spouse Claim and Allocation

Final 8/12

505 (not to be filed with the return)

Investment/Jobs Credit

Final 9/5

506 (you will also need Form 511-CR)

Statement of Person Claiming an Income Tax Refund Due a Deceased Final

Taxpayer

507 No Change from last year.

Individual Resident Income Tax Return Packet

511 Packet Final 9/4

(instructions and tables)