Enlarge image

2024

Oklahoma

Income Tax

Withholding

Tables

Effective Date: January 1, 2024

Packet OW-2 • Revised 8-2024

Enlarge image |

2024

Oklahoma

Income Tax

Withholding

Tables

Effective Date: January 1, 2024

Packet OW-2 • Revised 8-2024

|

Enlarge image |

Table of Contents

General Information ............................................................................................................................ 2-5

How to Compute Oklahoma Withholding............................................................................................ 5-6

Sample Computation: Percentage Formula Example .......................................................................... 7

Percentage Method of Withholding .................................................................................................... 8-9

Withholding Tables:

Weekly Payroll: Single Persons .................................................................. 10

Married Persons .................................................................11

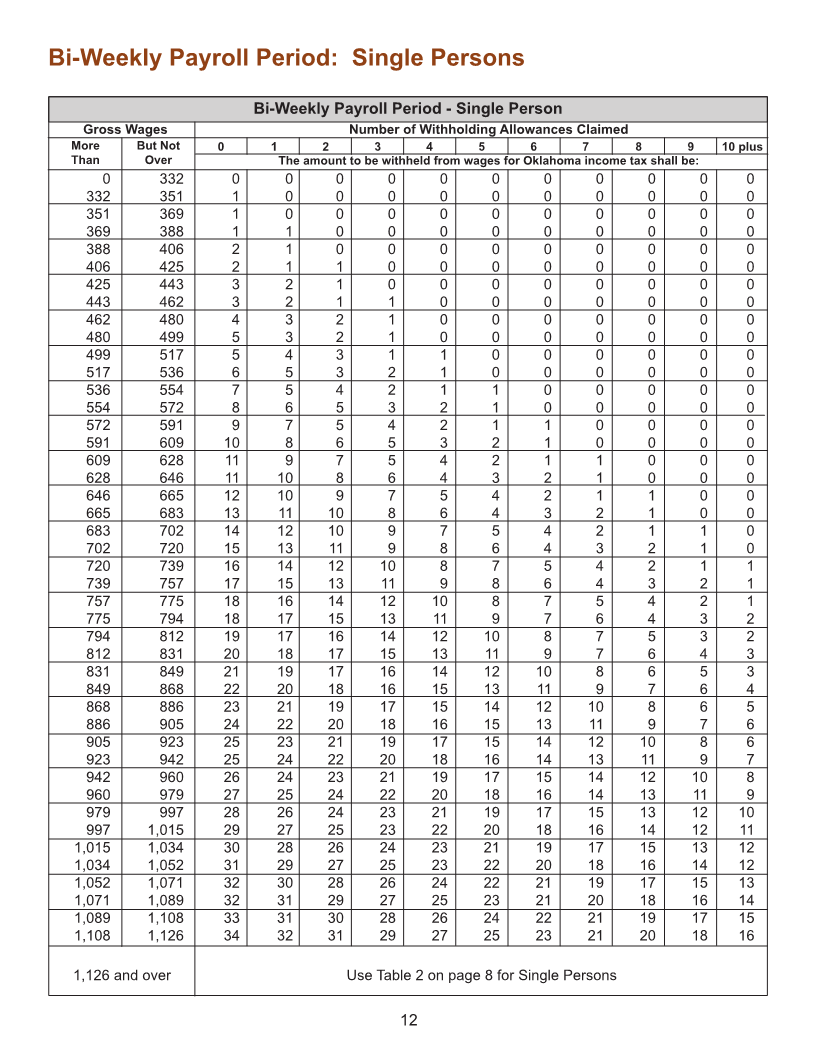

Bi-Weekly Payroll: Single Persons .................................................................. 12

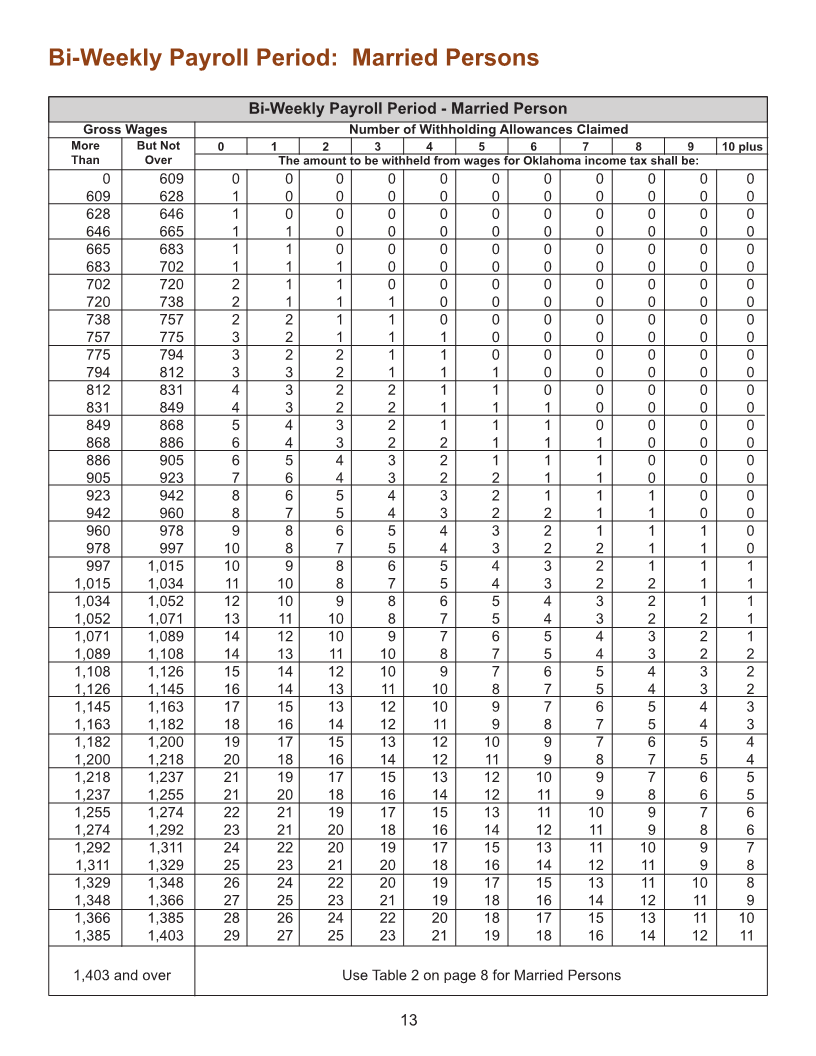

Married Persons ................................................................ 13

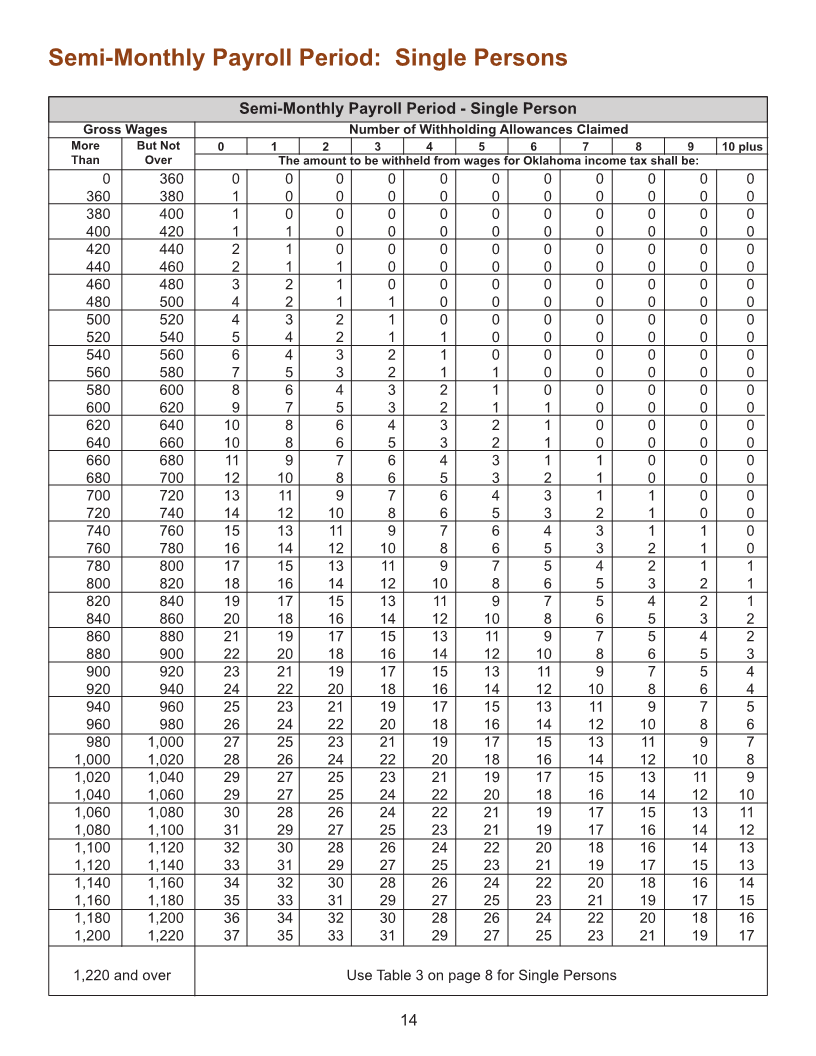

Semi-Monthly Payroll: Single Persons .................................................................. 14

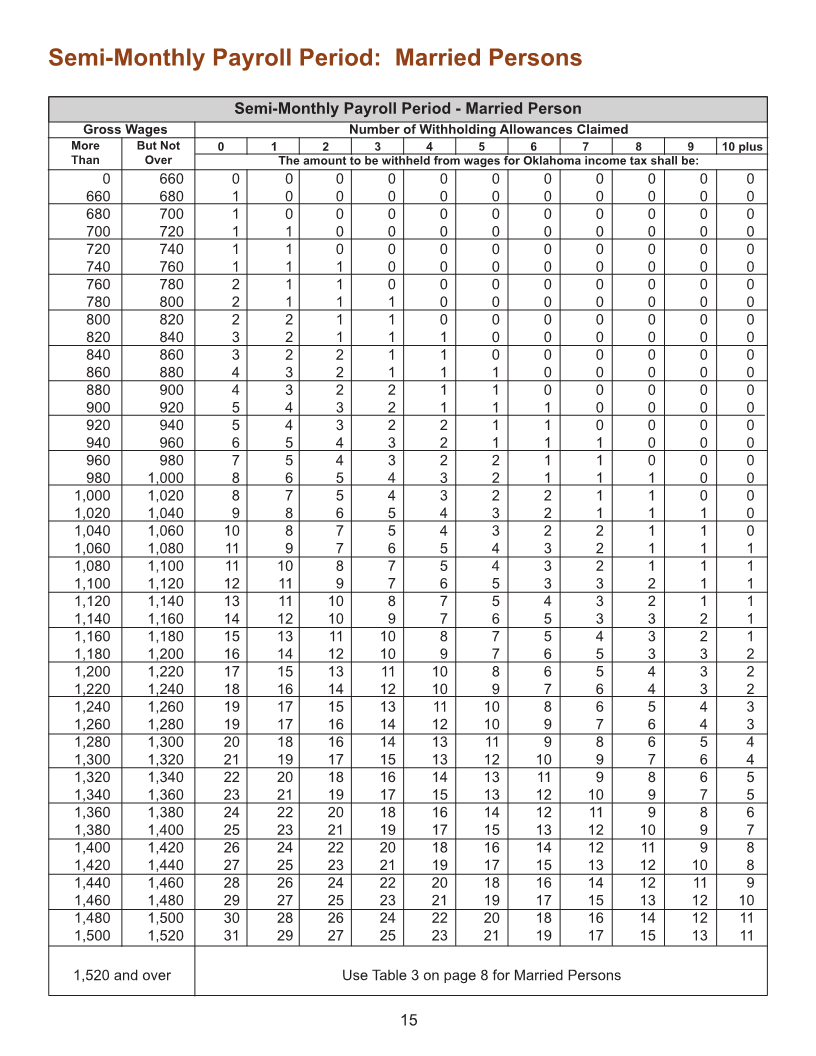

Married Persons ................................................................ 15

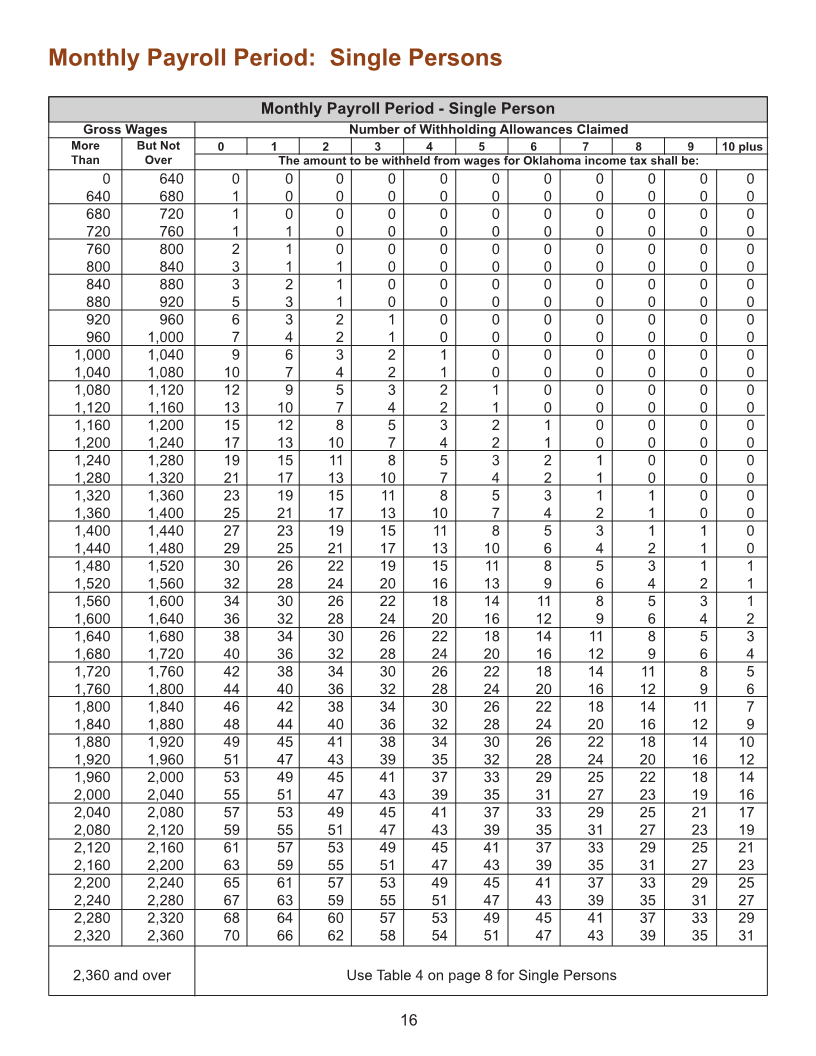

Monthly Payroll: Single Persons .................................................................. 16

Married Persons ................................................................ 17

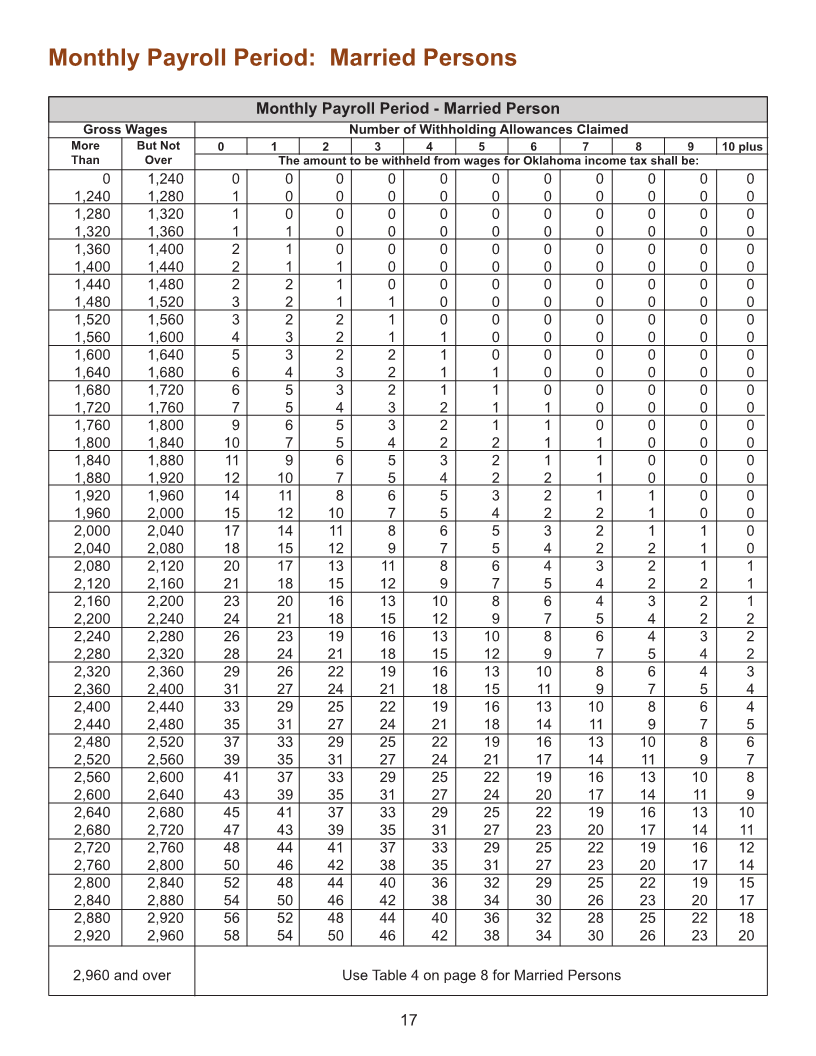

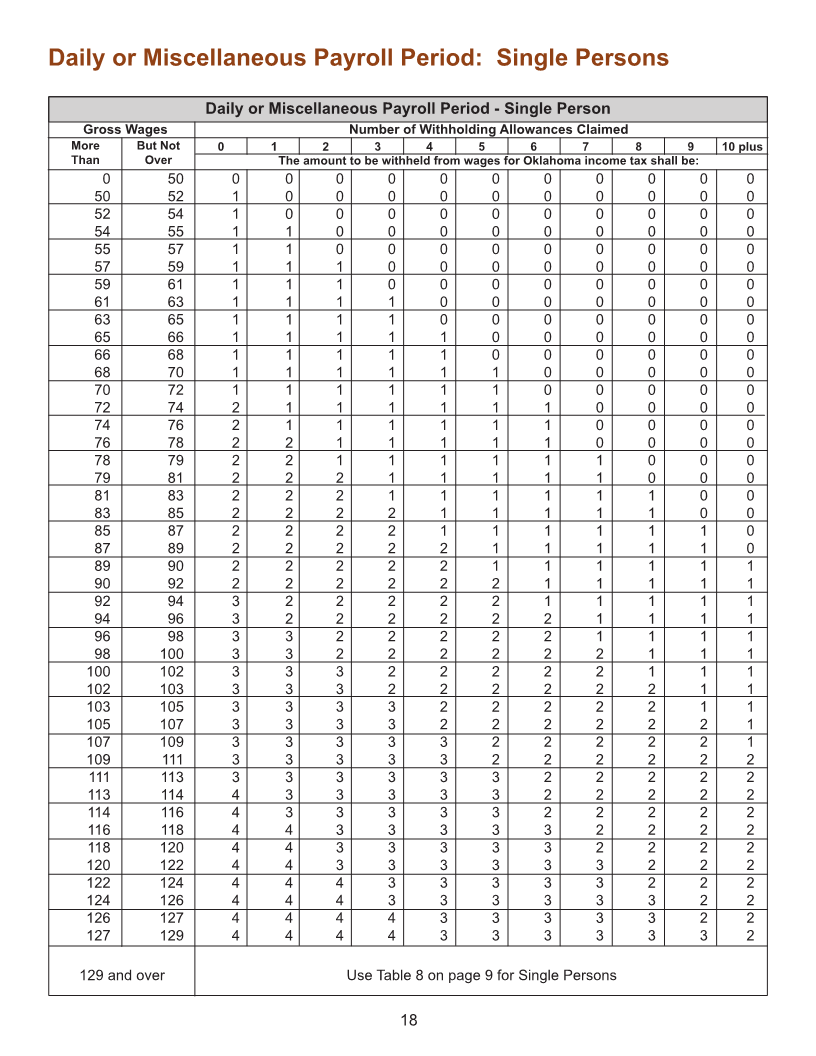

Daily or Miscellaneous Payroll: Single Persons .................................................................. 18

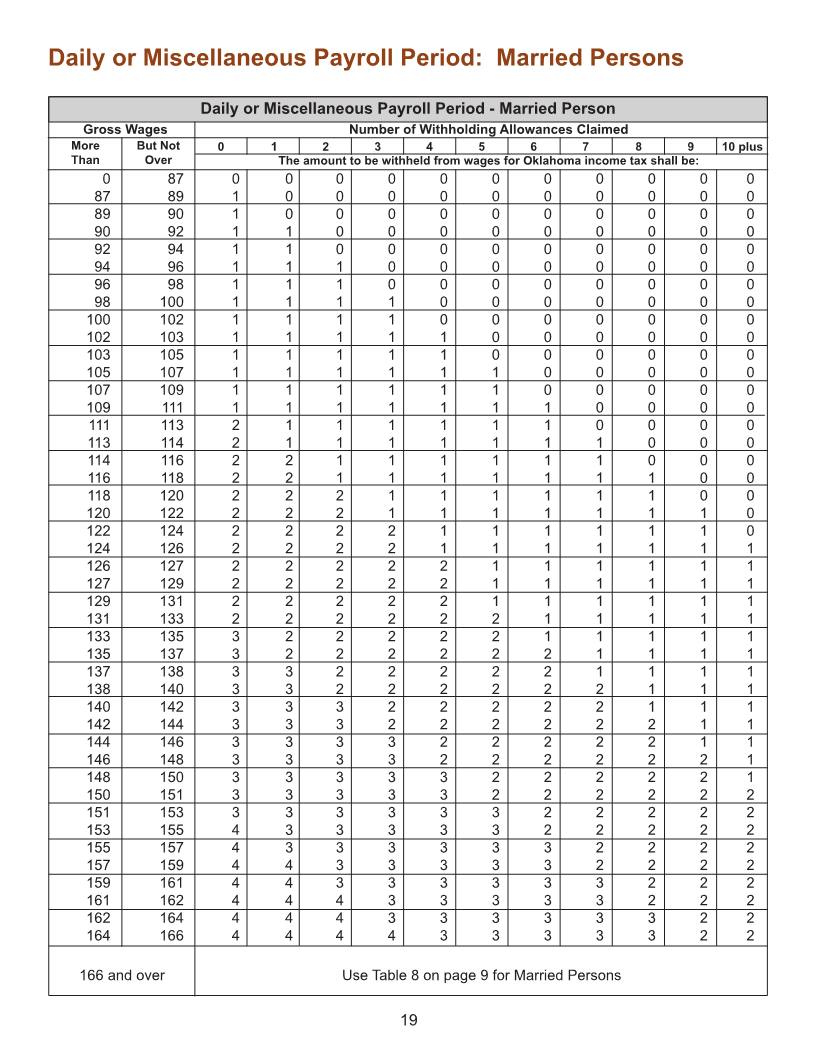

Married Persons ................................................................ 19

General Information: Income Tax Withholding

In general the withholding law will apply to everyone receiving compensation for services rendered in

Oklahoma with the exception of those services specifically excluded under Section 2385.1, Title 68,

Oklahoma Statutes as amended:

(1) for services paid to an employee in connection with farming activities where the amount paid is

$900.00 or less monthly; or

(2) for domestic services in a private home, local college, club or local chapter of a college

fraternity or sorority; or

(3) for services not in the course of the employer’s trade or business performed in any calendar

quarter by an employee, unless the cash remuneration paid for such service is $200.00 or

more; or

(4) for services performed in the state by a person who is not a “resident individual”, whose

income in any calendar quarter is not more than $300.00; or

(5) for services performed by a duly ordained, commissioned, or licensed minister of a church

in the exercise of his ministry or by a member of a religious order in the exercise of duties

required by such order.

Registration, Identification and Account Number

Every employer must have a Federal Employers Identification Number (FEIN) as issued by the

Internal Revenue Service. Employers may obtain a FEIN by making application with the Internal

Revenue Service on Form SS-4 or by calling (800) 829-4933.

Upon receipt of the FEIN employers need to establish an Oklahoma employer’s withholding tax

acccount. Oklahoma employer’s withholding tax accounts can be established online at tax.ok.gov.

During the online registration process, you will be given a choice for a payroll or retirement account.

After registration with the Oklahoma Tax Commission (OTC) employers will be assigned an account

number for each registered account. Account numbers must be used by the employer for all returns

and correspondence with the OTC.

2

|

Enlarge image |

General Information (continued)

Requirements

Filing of Returns: Employers will report the total number of employees paid during the quarter, total

amount of wages paid during the quarter and total amount of state tax withheld from wages for the

entire quarter.

Remittances: Every employer required to deduct and withhold Oklahoma income tax from an

employee’s wages must remit the tax withheld each calendar quarter on or before the 20th day of the

month following the close of the quarter, except where the amount withheld is more than $500.00 per

quarter. Where the tax withheld is in excess of $500.00 per quarter, but less than $5,000.00, the tax

withheld must be remitted on a monthly basis on or before the 20th of the following month. Where the

tax withheld is $5,000.00 or more per month in the previous fiscal year every employer must remit the

tax withheld electronically.

Every employer owing an average of $10,000.00 or more in taxes per month in the previous fiscal

year shall remit the amount withheld on the same dates as required under the federal semi-weekly

deposit schedule for federal withholding taxes. All remitters of Oklahoma income tax withholding that

are on the federal semi-weekly deposit schedule must remit Oklahoma withholding tax at the same

time using the federal semi-weekly deposit schedule. For employers making payments other than by

electronic funds transfer, a withholding payment voucher shall be filed with each payment.

Filing and Payment Methods

To efficiently process your payments and returns and avoid possible penalty and interest on

delinquent payments, we encourage you to register and use Oklahoma Taxpayer Access Point

(OkTAP), our online filing system, by logging on to our website at tax.ok.gov. OkTAP provides you

the opportunity to make remittances and file your reports without the burden of preparing paper

returns and mailing your check.

For those who have not elected to file electronically, forms are available to download and mail in at

tax.ok.gov. For those not paying electronically, payment coupons are available to download and mail

in at tax.ok.gov.

General Information for W-2, W-2c, W-3 and W-3c Transmittal to the Oklahoma Tax

Commission

Employers with Oklahoma withholding/wage detail will be required to submit both W-2 and W-3

information to the OTC for tax year 2023 no later than January 31, 2024.

Employers or their payroll providers are required to use OkTAP to either upload files or manually

enter the information directly into OkTAP. Wage detail will follow the same electronic submission and

file layout requirements as defined by EFW2 (Social Security Administration Publication No. 42-007);

with few exceptions.

It should be noted that manually developed forms, flash drives, diskettes or Form G-141 OTC -

Transmittal of Magnetic Media Tax Return in their place will not be accepted. Those that are received

will be returned and considered not filed.

W-2 and W-3 FAQs can be found on tax.ok.gov.

3

|

Enlarge image |

General Information (continued)

Penalty/Interest for Failure to Withhold or Pay Taxes Withheld

Penalty for failure to pay the tax withheld when due is 10% of the amount of tax, or 10% of the

amount of underpayment of tax, if not paid on or before the due date (20th day of the month when

due). Penalty will be imposed when taxpayer fails to pay tax when due, and such failure is not

corrected within 15 days after the tax becomes delinquent. Interest at the rate of 1.25% per month is

due on any amount not paid by the due date.

Under the Income Withholding Tax Law of Oklahoma, every person who, as an officer of a

corporation, a member of a partnership or as an individual employer, is under a duty to withhold and

remit Oklahoma income withholding tax may be personally liable to the State of Oklahoma for the

taxes withheld. Sums withheld shall be deemed to be held in trust for the State of Oklahoma.

If an employer fails to withhold the tax required to be withheld, and thereafter the income tax is paid

by the employee, the employer shall be subject to penalties and interest only.

If the OTC, in any case, has justifiable reason to believe that the collection of the tax is in jeopardy,

the OTC may require the employer to file a return and pay the tax at any time.

Common Law Employees

An employer-employee relationship exists for Oklahoma income tax withholding purposes when the

person for whom services are performed has the right to control the manner and means of performing

the work. It does not matter that the employer gives the employee substantial discretion and freedom

to act, so long as the employer has the right to control the method and result of the service.

Common law rules provide the factors examined to determine whether an employer-employee

relationship exists. These factors include, but are not limited to:

• Method of Payment: Workers paid on a regular basis (e.g. hourly, weekly, monthly), are more

likely to be considered employees than persons paid a fixed amount for a specific service. The

providing of fringe benefits is also typical of an employer-employee relationship.

• Set Hours of Work: An employer-employee relationship generally exists when the hours of

work are set by the person for whom the services are provided. If fixed hours are not practical,

the requirement to work at certain times would likely indicate an element of control.

• Materials and Tools: Persons who furnish their own tools and materials are less likely to be

considered employees than persons who use tools and materials furnished by the hiring entity.

Skilled workers who customarily use their own small tools for their trade may be considered an

employee if the hiring entity has control over the service performed.

• Right of Discharge: The ability of a hiring entity to discharge a worker and the conditions

under which discharge may occur are factors examined in determining an employer-employee

relationship.

If an employer-employee relationship exists Oklahoma income tax is required to be withheld and paid

to the OTC regardless of the description given to workers, regardless of how payments are made or

what they are called, and regardless of whether the person works full or part time. No single factor

determines whether an employer-employee relationship exists. Examination of all facts and factors of

each case is necessary to determine the existence of an employer-employee relationship.

4

|

Enlarge image |

General Information (continued)

Independent Contractors

Persons who follow an independent trade, business or profession in which their services are offered

to the general public are considered independent contractors and not employees. Independent

contractors realize a profit or suffer a loss as a result of their services and are legally obligated to

complete a specific service in a specific manner. Examples include: self-employed attorneys, doctors,

contractors, subcontractors and auctioneers. However, whether such persons are employees or

independent contractors depends on the facts of each case.

Generally, an individual is considered an independent contractor if the entity receiving the person’s

services has the right to control the result of the work but does not have the legal right to control the

manner and means of accomplishing the result.

How to Compute Oklahoma Withholding

There are two methods you may use to determine the amount of Oklahoma income tax to be withheld

from wage payments subject to Oklahoma income tax withholding - the percentage formula method

and the wage bracket tables. Both methods use a series of tables for single and married taxpayers for

each type of payroll period frequency (weekly, monthly, etc.).

Important: You must use the correct table for your payroll frequency and the marital status of the

payee in order to arrive at an accurate amount of Oklahoma withholding tax.

Using the wage bracket tables is considered to be the easier of the two methods. However, if you

have highly paid employees/payees or are using a computerized payroll system, you (or your

software) may use the percentage formula. Both methods are acceptable and produce almost

identical results. Choose the method that best suits your payroll situation.

Percentage Formula Method:

The percentage formula is a mathematical formula based on the Oklahoma personal income tax

rates. This method uses the tables that are on pages 8 and 9.

The percentage rate tables are based on the net wage amount. To compute the net amount of the

payment, you must first calculate the employee’s/payee’s withholding allowance amount and deduct it

from the gross wage or payment for the period before using the percentage rate tables. The number

of withholding allowances claimed on Oklahoma Form OK-W-4 must be used.

5

|

Enlarge image |

How to Compute Oklahoma Withholding (continued)

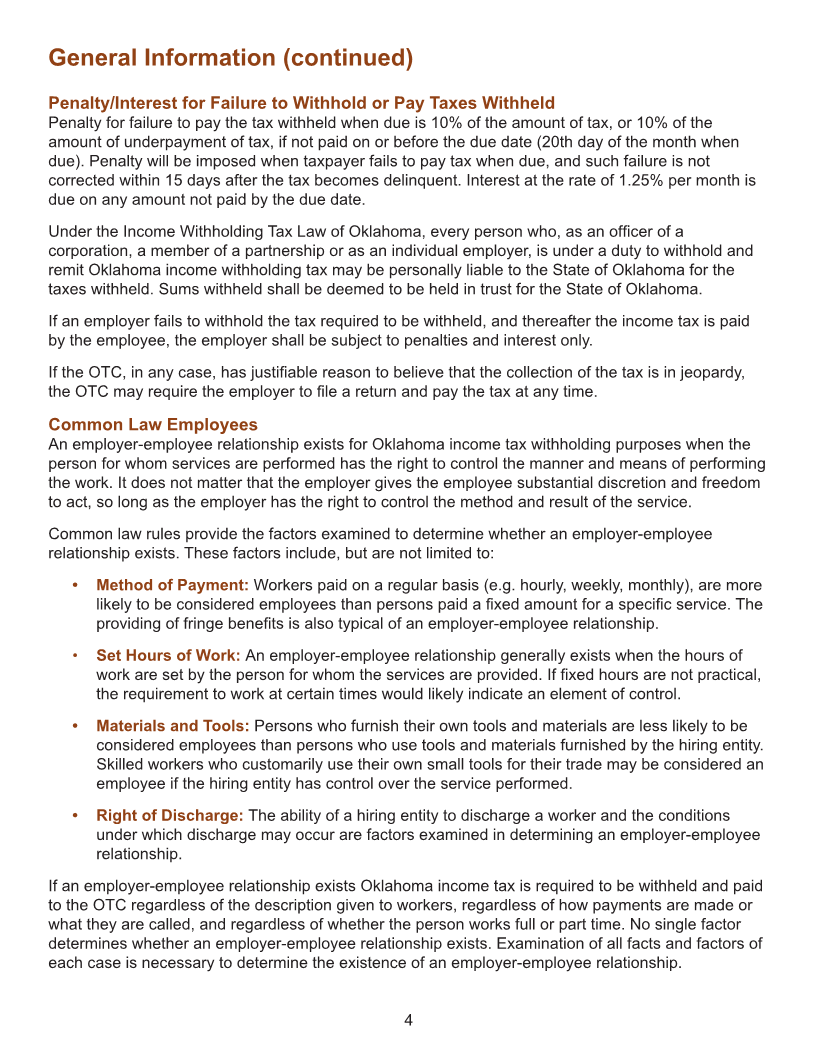

Withholding Allowance Amount

An individual’s withholding allowance amount is the Oklahoma individual income tax personal

exemption amount of $1,000 divided by the number of payroll periods in the calendar year. Thus,

an employee paid monthly has a withholding allowance of $1,000 divided by 12, or $83.33, per pay

period for each withholding allowance claimed. The Oklahoma withholding allowance amounts for

each payroll frequency are shown in the table below.

Table of Withholding Allowance Amounts

Number of Pay Periods Amount of Each Withholding

Payroll Frequency

Per year Allowance

Weekly 52 $ 19.23

Bi-Weekly 26 $ 38.46

Semi-Monthly 24 $ 41.67

Monthly 12 $ 83.33

Quarterly 4 $ 250.00

Semi-Annual 2 $ 500.00

Annual 1 $ 1,000.00

Daily or Miscellaneous 260 $ 3.85

(Each day of the payroll period)

Rounding

Oklahoma withholding computed using the percentage method must be rounded. Round to the

nearest whole dollar by dropping any amount under 50 cents and increasing amounts from 50 to 99

cents to the next higher dollar. For example, $2.49 becomes $2.00, and $2.50 becomes $3.00.

Wage Bracket Tables Method:

This method uses the series of tables that begin on page 10. The wage bracket tables are calculated

using the percentage formula, with the results rounded and placed in convenient brackets for you.

Withholding is computed by plotting the gross wage and the number of withholding allowances

(number of withholding allowances claimed on Oklahoma Form OK-W-4) on the table that

corresponds with your payroll frequency and the individual’s marital status.

Important: When the payment for the period exceeds the last bracket or line of a wage bracket table,

you must use the percentage formula to calculate the amount of Oklahoma tax to withhold on the

entire payment.

Withholding Calculations for Married Persons with Dual Incomes

Since Oklahoma married taxpayers are taxed on combined incomes, many married taxpayers do

not have sufficient withholding to cover the annual liability. If a taxpayer has elected the option of

“Married”, but withhold at higher “Single” rate on Oklahoma Form OK-W-4, use the appropriate

Oklahoma Single withholding table.

6

|

Enlarge image |

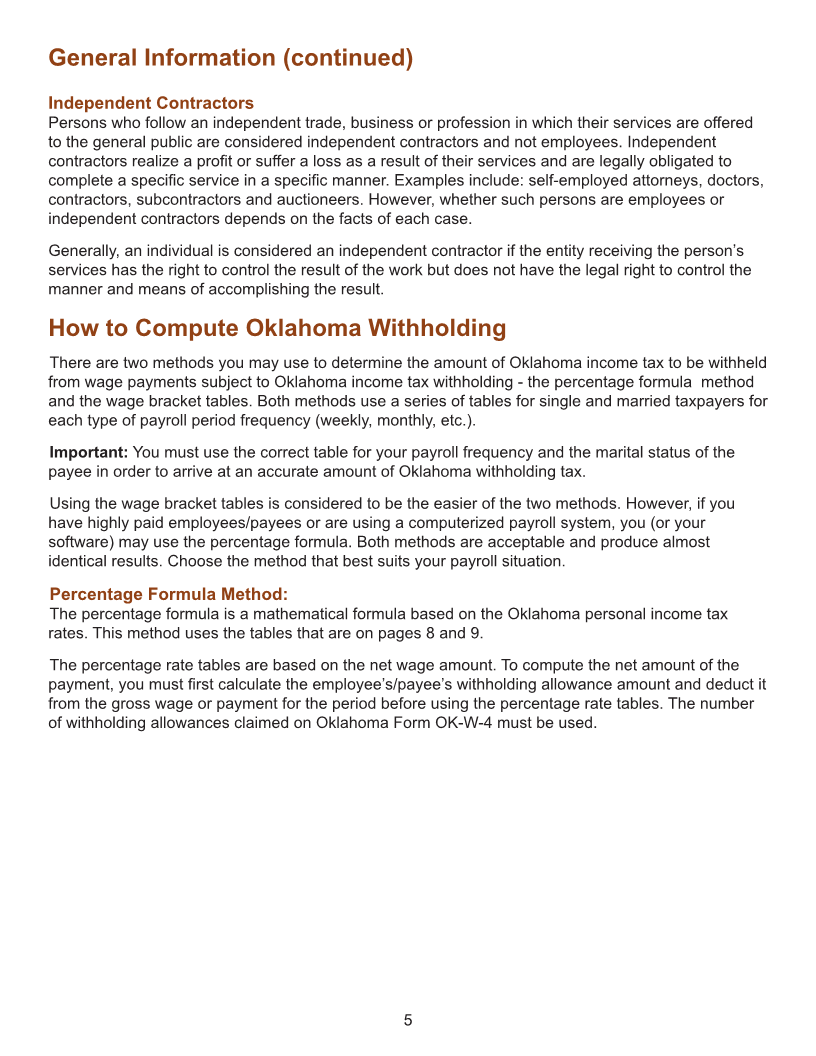

Sample Computation: Percentage Formula Example

Example

An individual is paid $1,825 semi-monthly. He/she is married and claims two withholding

allowances on his/her Oklahoma Form OK-W-4.

Step 1

Multiply the withholding allowance amount for your payroll frequency (see table on page 6) by the

total number of withholding allowances claimed on the individual’s Oklahoma Form OK-W-4.

The Semi-Monthly withholding allowance is $41.67; the individual is claiming two withholding allowances.

$41.67 X 2 = $83.34

Step 2

Subtract this amount from the individual’s gross payment for the period to arrive at the net payment

amount.

$1,825 - $83.34 = $1,741.66

Step 3

Use the appropriate rate table on page 8 (Table 3 for Semi-Monthly payroll) to figure the amount to be

withheld. Since the individual is married use Table 3 for a “Married Person”.

The withholding rate is $12.19 plus 4.75% of the net amount of the wage payment that is over

$1,129.00.

$1,741.66 - $1,129.00 = $612.66

$612.66 X 4.75% = $29.10 plus $12.79 (from table)

The Oklahoma withholding amount is $41.89, which must be rounded to $42.00.

Example Table from Pages 8-9:

Table 3: SEMI-MONTHLY Payroll Period

A: SINGLE person: B: MARRIED person:

If the amount of wages is: If the amount of wages is:

(after subtracting withholding allowances) (after subtracting withholding allowances)

Over but less than The amount of income tax to withhold is: Over but less than The amount of income tax to withhold is:

$0 $265 $ 0 $0 $529 $ 0

$265 $306 $ 0 +(0.25% of the excess over $265) $529 $613 $ 0 +(0.25% of the excess over $529)

$306 $369 $ 0.10 +(0.75% of the excess over $306) $613 $738 $ 0.21 +(0.75% of the excess over $613)

$369 $421 $ 0.57 +(1.75% of the excess over $369) $738 $842 $ 1.15 +(1.75% of the excess over $738)

$421 $469 $ 1.48 +(2.75% of the excess over $421) $842 $938 $ 2.97 +(2.75% of the excess over $842)

$469 $565 $ 2.80 +(3.75% of the excess over $469) $938 $1,129 $ 5.60 +(3.75% of the excess over $938)

$565 and above $ 6.40 +(4.75% of the excess over $565) $1,129 and above $ 12.79 +(4.75% of the excess over $1,129)

7

|

Enlarge image |

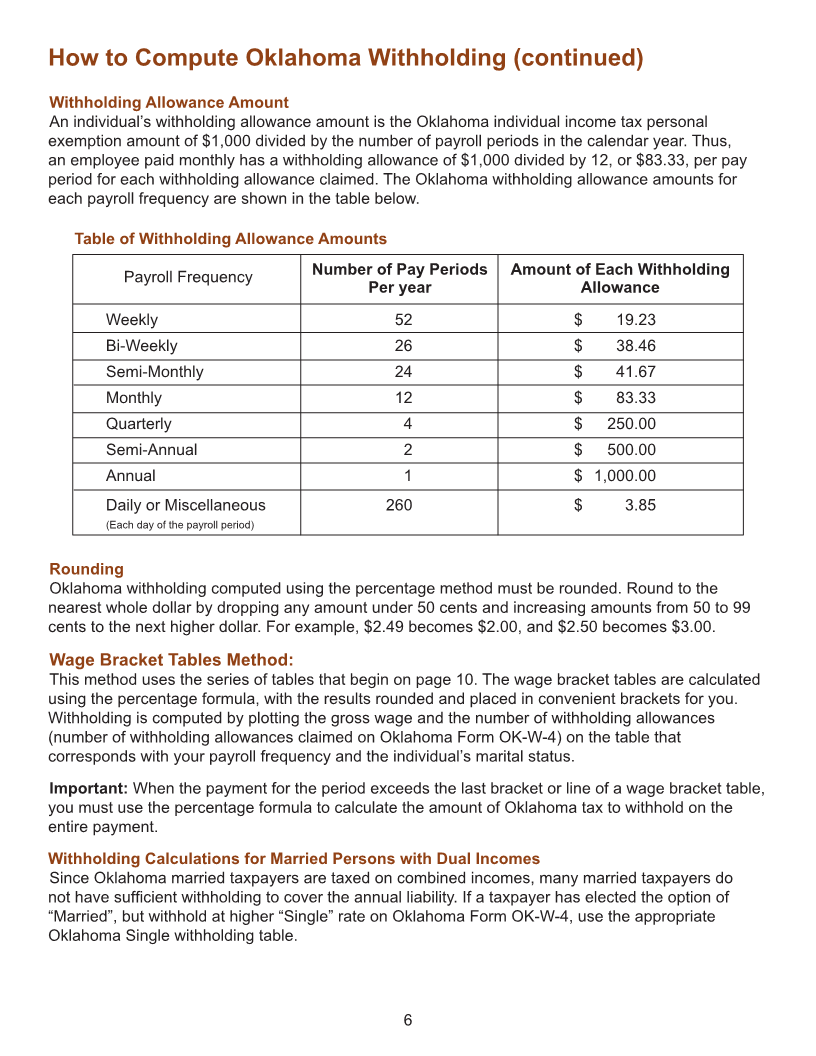

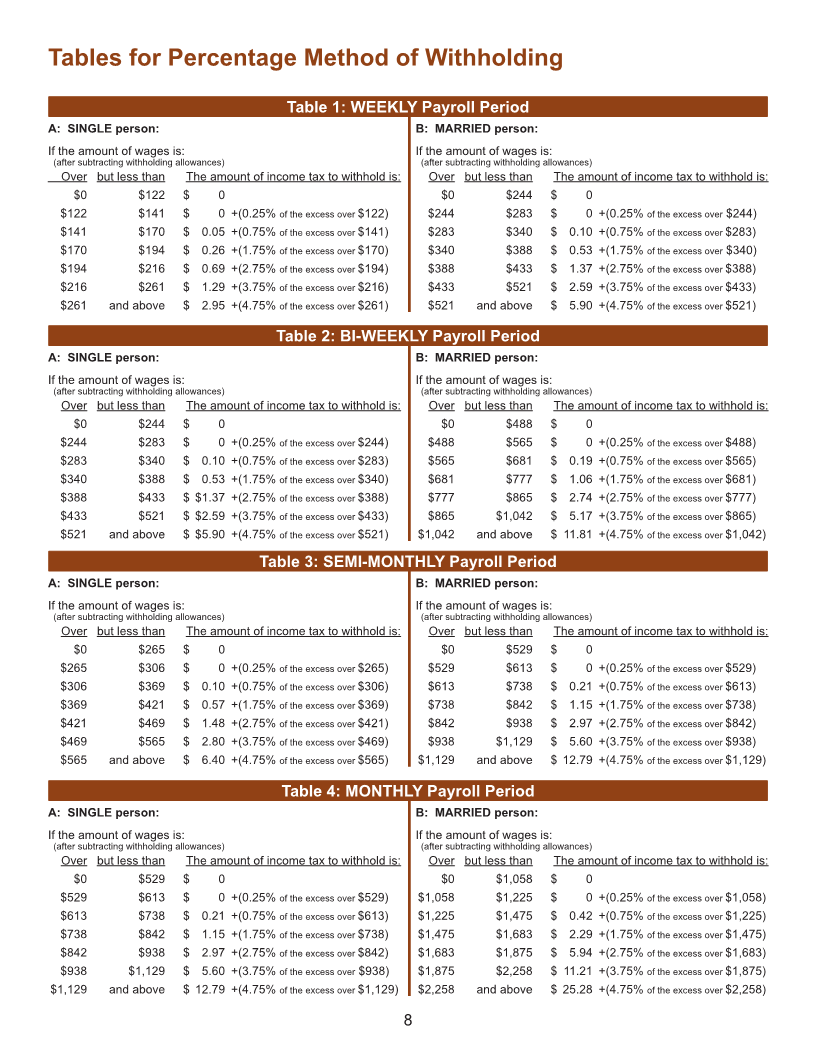

Tables for Percentage Method of Withholding

Table 1: WEEKLY Payroll Period

A: SINGLE person: B: MARRIED person:

If the amount of wages is: If the amount of wages is:

(after subtracting withholding allowances) (after subtracting withholding allowances)

Over but less than The amount of income tax to withhold is: Over but less than The amount of income tax to withhold is:

$0 $122 $ 0 $0 $244 $ 0

$122 $141 $ 0 +(0.25% of the excess over $122) $244 $283 $ 0 +(0.25% of the excess over $244)

$141 $170 $ 0.05 +(0.75% of the excess over $141) $283 $340 $ 0.10 +(0.75% of the excess over $283)

$170 $194 $ 0.26 +(1.75% of the excess over $170) $340 $388 $ 0.53 +(1.75% of the excess over $340)

$194 $216 $ 0.69 +(2.75% of the excess over $194) $388 $433 $ 1.37 +(2.75% of the excess over $388)

$216 $261 $ 1.29 +(3.75% of the excess over $216) $433 $521 $ 2.59 +(3.75% of the excess over $433)

$261 and above $ 2.95 +(4.75% of the excess over $261) $521 and above $ 5.90 +(4.75% of the excess over $521)

Table 2: BI-WEEKLY Payroll Period

A: SINGLE person: B: MARRIED person:

If the amount of wages is: If the amount of wages is:

(after subtracting withholding allowances) (after subtracting withholding allowances)

Over but less than The amount of income tax to withhold is: Over but less than The amount of income tax to withhold is:

$0 $244 $ 0 $0 $488 $ 0

$244 $283 $ 0 +(0.25% of the excess over $244) $488 $565 $ 0 +(0.25% of the excess over $488)

$283 $340 $ 0.10 +(0.75% of the excess over $283) $565 $681 $ 0.19 +(0.75% of the excess over $565)

$340 $388 $ 0.53 +(1.75% of the excess over $340) $681 $777 $ 1.06 +(1.75% of the excess over $681)

$388 $433 $ $1.37 +(2.75% of the excess over $388) $777 $865 $ 2.74 +(2.75% of the excess over $777)

$433 $521 $ $2.59 +(3.75% of the excess over $433) $865 $1,042 $ 5.17 +(3.75% of the excess over $865)

$521 and above $ $5.90 +(4.75% of the excess over $521) $1,042 and above $ 11.81 +(4.75% of the excess over $1,042)

Table 3: SEMI-MONTHLY Payroll Period

A: SINGLE person: B: MARRIED person:

If the amount of wages is: If the amount of wages is:

(after subtracting withholding allowances) (after subtracting withholding allowances)

Over but less than The amount of income tax to withhold is: Over but less than The amount of income tax to withhold is:

$0 $265 $ 0 $0 $529 $ 0

$265 $306 $ 0 +(0.25% of the excess over $265) $529 $613 $ 0 +(0.25% of the excess over $529)

$306 $369 $ 0.10 +(0.75% of the excess over $306) $613 $738 $ 0.21 +(0.75% of the excess over $613)

$369 $421 $ 0.57 +(1.75% of the excess over $369) $738 $842 $ 1.15 +(1.75% of the excess over $738)

$421 $469 $ 1.48 +(2.75% of the excess over $421) $842 $938 $ 2.97 +(2.75% of the excess over $842)

$469 $565 $ 2.80 +(3.75% of the excess over $469) $938 $1,129 $ 5.60 +(3.75% of the excess over $938)

$565 and above $ 6.40 +(4.75% of the excess over $565) $1,129 and above $ 12.79 +(4.75% of the excess over $1,129)

Table 4: MONTHLY Payroll Period

A: SINGLE person: B: MARRIED person:

If the amount of wages is: If the amount of wages is:

(after subtracting withholding allowances) (after subtracting withholding allowances)

Over but less than The amount of income tax to withhold is: Over but less than The amount of income tax to withhold is:

$0 $529 $ 0 $0 $1,058 $ 0

$529 $613 $ 0 +(0.25% of the excess over $529) $1,058 $1,225 $ 0 +(0.25% of the excess over $1,058)

$613 $738 $ 0.21 +(0.75% of the excess over $613) $1,225 $1,475 $ 0.42 +(0.75% of the excess over $1,225)

$738 $842 $ 1.15 +(1.75% of the excess over $738) $1,475 $1,683 $ 2.29 +(1.75% of the excess over $1,475)

$842 $938 $ 2.97 +(2.75% of the excess over $842) $1,683 $1,875 $ 5.94 +(2.75% of the excess over $1,683)

$938 $1,129 $ 5.60 +(3.75% of the excess over $938) $1,875 $2,258 $ 11.21 +(3.75% of the excess over $1,875)

$1,129 and above $ 12.79 +(4.75% of the excess over $1,129) $2,258 and above $ 25.28 +(4.75% of the excess over $2,258)

8

|

Enlarge image |

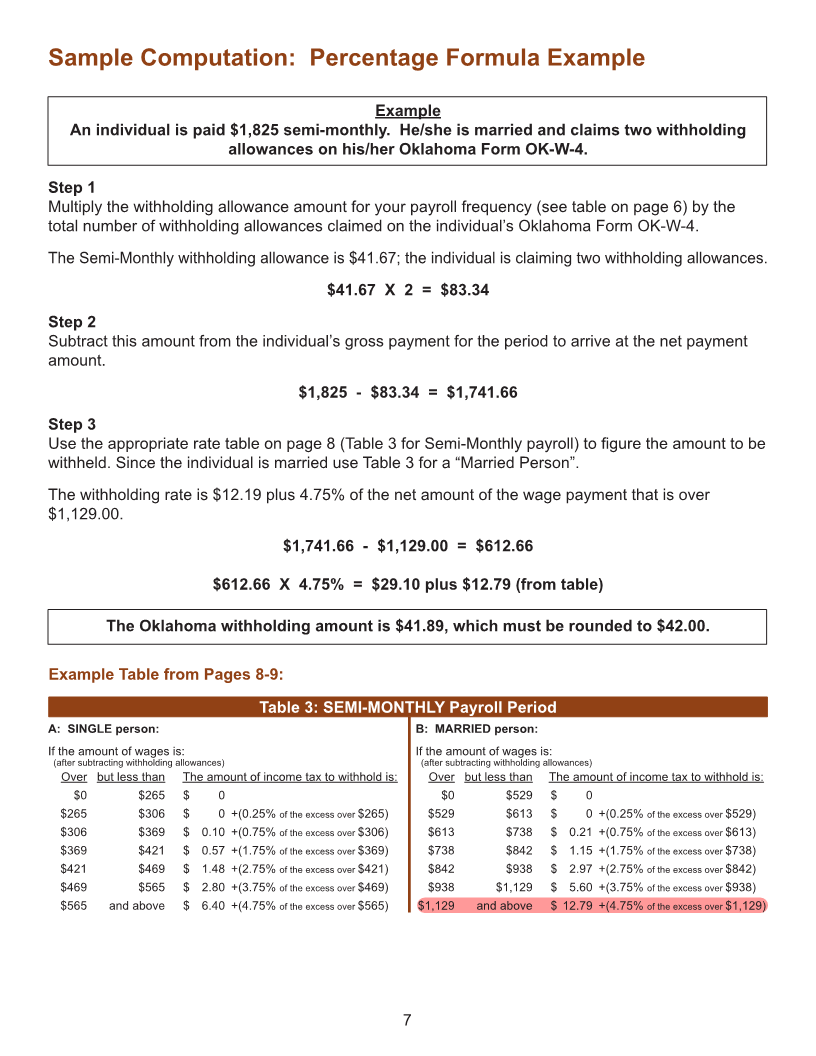

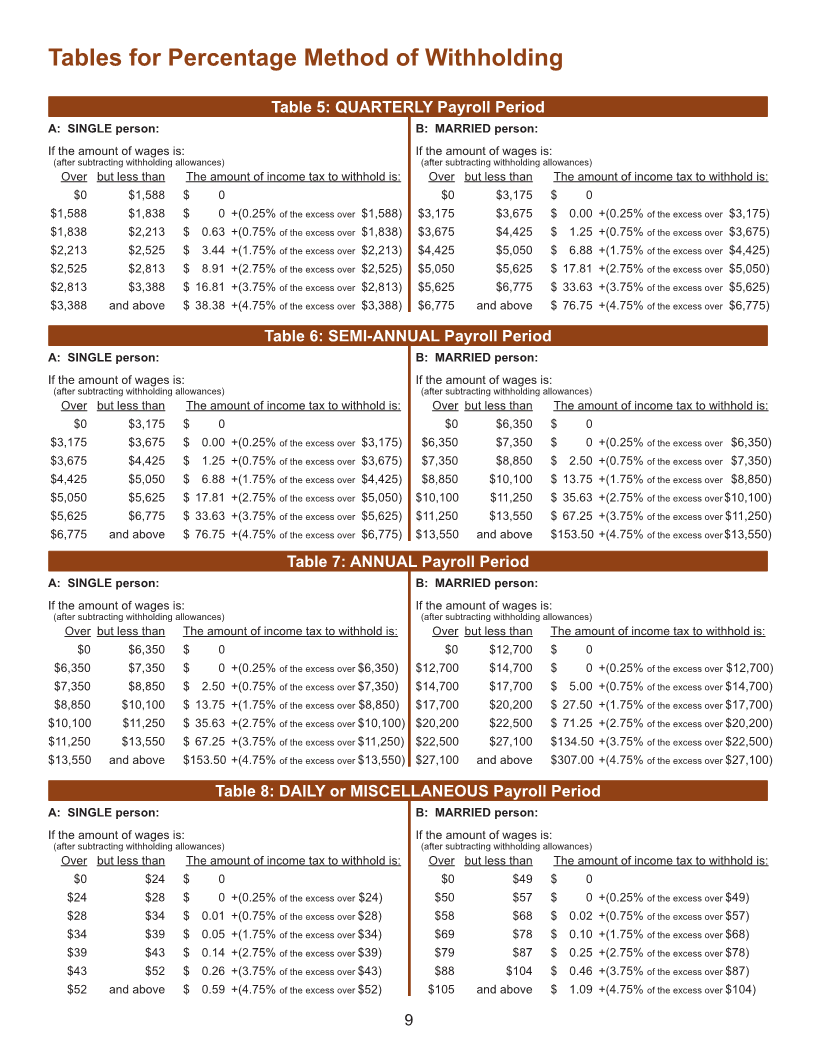

Tables for Percentage Method of Withholding

Table 5: QUARTERLY Payroll Period

A: SINGLE person: B: MARRIED person:

If the amount of wages is: If the amount of wages is:

(after subtracting withholding allowances) (after subtracting withholding allowances)

Over but less than The amount of income tax to withhold is: Over but less than The amount of income tax to withhold is:

$0 $1,588 $ 0 $0 $3,175 $ 0

$1,588 $1,838 $ 0 +(0.25% of the excess over $1,588) $3,175 $3,675 $ 0.00 +(0.25% of the excess over $3,175)

$1,838 $2,213 $ 0.63 +(0.75% of the excess over $1,838) $3,675 $4,425 $ 1.25 +(0.75% of the excess over $3,675)

$2,213 $2,525 $ 3.44 +(1.75% of the excess over $2,213) $4,425 $5,050 $ 6.88 +(1.75% of the excess over $4,425)

$2,525 $2,813 $ 8.91 +(2.75% of the excess over $2,525) $5,050 $5,625 $ 17.81 +(2.75% of the excess over $5,050)

$2,813 $3,388 $ 16.81 +(3.75% of the excess over $2,813) $5,625 $6,775 $ 33.63 +(3.75% of the excess over $5,625)

$3,388 and above $ 38.38 +(4.75% of the excess over $3,388) $6,775 and above $ 76.75 +(4.75% of the excess over $6,775)

Table 6: SEMI-ANNUAL Payroll Period

A: SINGLE person: B: MARRIED person:

If the amount of wages is: If the amount of wages is:

(after subtracting withholding allowances) (after subtracting withholding allowances)

Over but less than The amount of income tax to withhold is: Over but less than The amount of income tax to withhold is:

$0 $3,175 $ 0 $0 $6,350 $ 0

$3,175 $3,675 $ 0.00 +(0.25% of the excess over $3,175) $6,350 $7,350 $ 0 +(0.25% of the excess over $6,350)

$3,675 $4,425 $ 1.25 +(0.75% of the excess over $3,675) $7,350 $8,850 $ 2.50 +(0.75% of the excess over $7,350)

$4,425 $5,050 $ 6.88 +(1.75% of the excess over $4,425) $8,850 $10,100 $ 13.75 +(1.75% of the excess over $8,850)

$5,050 $5,625 $ 17.81 +(2.75% of the excess over $5,050) $10,100 $11,250 $ 35.63 +(2.75% of the excess over $10,100)

$5,625 $6,775 $ 33.63 +(3.75% of the excess over $5,625) $11,250 $13,550 $ 67.25 +(3.75% of the excess over $11,250)

$6,775 and above $ 76.75 +(4.75% of the excess over $6,775) $13,550 and above $ 153.50 +(4.75% of the excess over $13,550)

Table 7: ANNUAL Payroll Period

A: SINGLE person: B: MARRIED person:

If the amount of wages is: If the amount of wages is:

(after subtracting withholding allowances) (after subtracting withholding allowances)

Over but less than The amount of income tax to withhold is: Over but less than The amount of income tax to withhold is:

$0 $6,350 $ 0 $0 $12,700 $ 0

$6,350 $7,350 $ 0 +(0.25% of the excess over $6,350) $12,700 $14,700 $ 0 +(0.25% of the excess over $12,700)

$7,350 $8,850 $ 2.50 +(0.75% of the excess over $7,350) $14,700 $17,700 $ 5.00 +(0.75% of the excess over $14,700)

$8,850 $10,100 $ 13.75 +(1.75% of the excess over $8,850) $17,700 $20,200 $ 27.50 +(1.75% of the excess over $17,700)

$10,100 $11,250 $ 35.63 +(2.75% of the excess over $10,100) $20,200 $22,500 $ 71.25 +(2.75% of the excess over $20,200)

$11,250 $13,550 $ 67.25 +(3.75% of the excess over $11,250) $22,500 $27,100 $134.50 +(3.75% of the excess over $22,500)

$13,550 and above $ 153.50 +(4.75% of the excess over $13,550) $27,100 and above $307.00 +(4.75% of the excess over $27,100)

Table 8: DAILY or MISCELLANEOUS Payroll Period

A: SINGLE person: B: MARRIED person:

If the amount of wages is: If the amount of wages is:

(after subtracting withholding allowances) (after subtracting withholding allowances)

Over but less than The amount of income tax to withhold is: Over but less than The amount of income tax to withhold is:

$0 $24 $ 0 $0 $49 $ 0

$24 $28 $ 0 +(0.25% of the excess over $24) $50 $57 $ 0 +(0.25% of the excess over $49)

$28 $34 $ 0.01 +(0.75% of the excess over $28) $58 $68 $ 0.02 +(0.75% of the excess over $57)

$34 $39 $ 0.05 +(1.75% of the excess over $34) $69 $78 $ 0.10 +(1.75% of the excess over $68)

$39 $43 $ 0.14 +(2.75% of the excess over $39) $79 $87 $ 0.25 +(2.75% of the excess over $78)

$43 $52 $ 0.26 +(3.75% of the excess over $43) $88 $104 $ 0.46 +(3.75% of the excess over $87)

$52 and above $ 0.59 +(4.75% of the excess over $52) $105 and above $ 1.09 +(4.75% of the excess over $104)

9

|

Enlarge image |

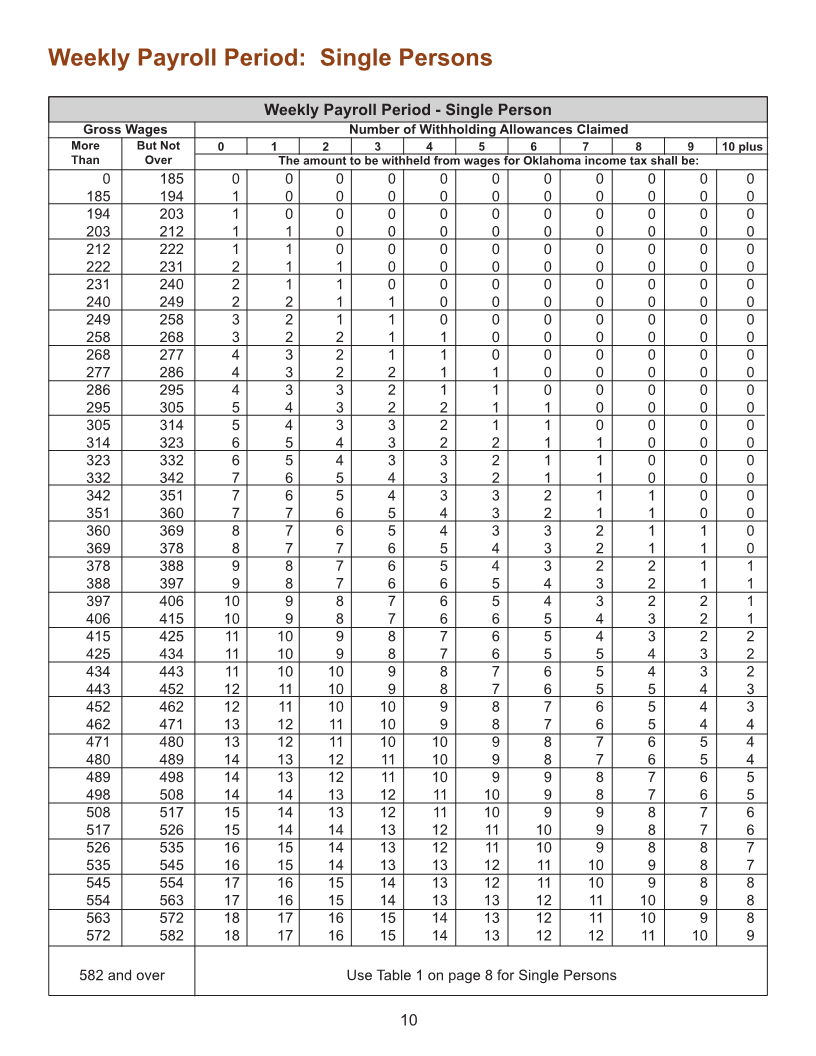

Weekly Payroll Period: Single Persons

Weekly Payroll Period - Single Person

Gross Wages Number of Withholding Allowances Claimed

More But Not 0 1 2 3 4 5 6 7 8 9 10 plus

Than Over The amount to be withheld from wages for Oklahoma income tax shall be:

0 185 0 0 0 0 0 0 0 0 0 0 0

185 194 1 0 0 0 0 0 0 0 0 0 0

194 203 1 0 0 0 0 0 0 0 0 0 0

203 212 1 1 0 0 0 0 0 0 0 0 0

212 222 1 1 0 0 0 0 0 0 0 0 0

222 231 2 1 1 0 0 0 0 0 0 0 0

231 240 2 1 1 0 0 0 0 0 0 0 0

240 249 2 2 1 1 0 0 0 0 0 0 0

249 258 3 2 1 1 0 0 0 0 0 0 0

258 268 3 2 2 1 1 0 0 0 0 0 0

268 277 4 3 2 1 1 0 0 0 0 0 0

277 286 4 3 2 2 1 1 0 0 0 0 0

286 295 4 3 3 2 1 1 0 0 0 0 0

295 305 5 4 3 2 2 1 1 0 0 0 0

305 314 5 4 3 3 2 1 1 0 0 0 0

314 323 6 5 4 3 2 2 1 1 0 0 0

323 332 6 5 4 3 3 2 1 1 0 0 0

332 342 7 6 5 4 3 2 1 1 0 0 0

342 351 7 6 5 4 3 3 2 1 1 0 0

351 360 7 7 6 5 4 3 2 1 1 0 0

360 369 8 7 6 5 4 3 3 2 1 1 0

369 378 8 7 7 6 5 4 3 2 1 1 0

378 388 9 8 7 6 5 4 3 2 2 1 1

388 397 9 8 7 6 6 5 4 3 2 1 1

397 406 10 9 8 7 6 5 4 3 2 2 1

406 415 10 9 8 7 6 6 5 4 3 2 1

415 425 11 10 9 8 7 6 5 4 3 2 2

425 434 11 10 9 8 7 6 5 5 4 3 2

434 443 11 10 10 9 8 7 6 5 4 3 2

443 452 12 11 10 9 8 7 6 5 5 4 3

452 462 12 11 10 10 9 8 7 6 5 4 3

462 471 13 12 11 10 9 8 7 6 5 4 4

471 480 13 12 11 10 10 9 8 7 6 5 4

480 489 14 13 12 11 10 9 8 7 6 5 4

489 498 14 13 12 11 10 9 9 8 7 6 5

498 508 14 14 13 12 11 10 9 8 7 6 5

508 517 15 14 13 12 11 10 9 9 8 7 6

517 526 15 14 14 13 12 11 10 9 8 7 6

526 535 16 15 14 13 12 11 10 9 8 8 7

535 545 16 15 14 13 13 12 11 10 9 8 7

545 554 17 16 15 14 13 12 11 10 9 8 8

554 563 17 16 15 14 13 13 12 11 10 9 8

563 572 18 17 16 15 14 13 12 11 10 9 8

572 582 18 17 16 15 14 13 12 12 11 10 9

582 and over Use Table 1 on page 8 for Single Persons

10

|

Enlarge image |

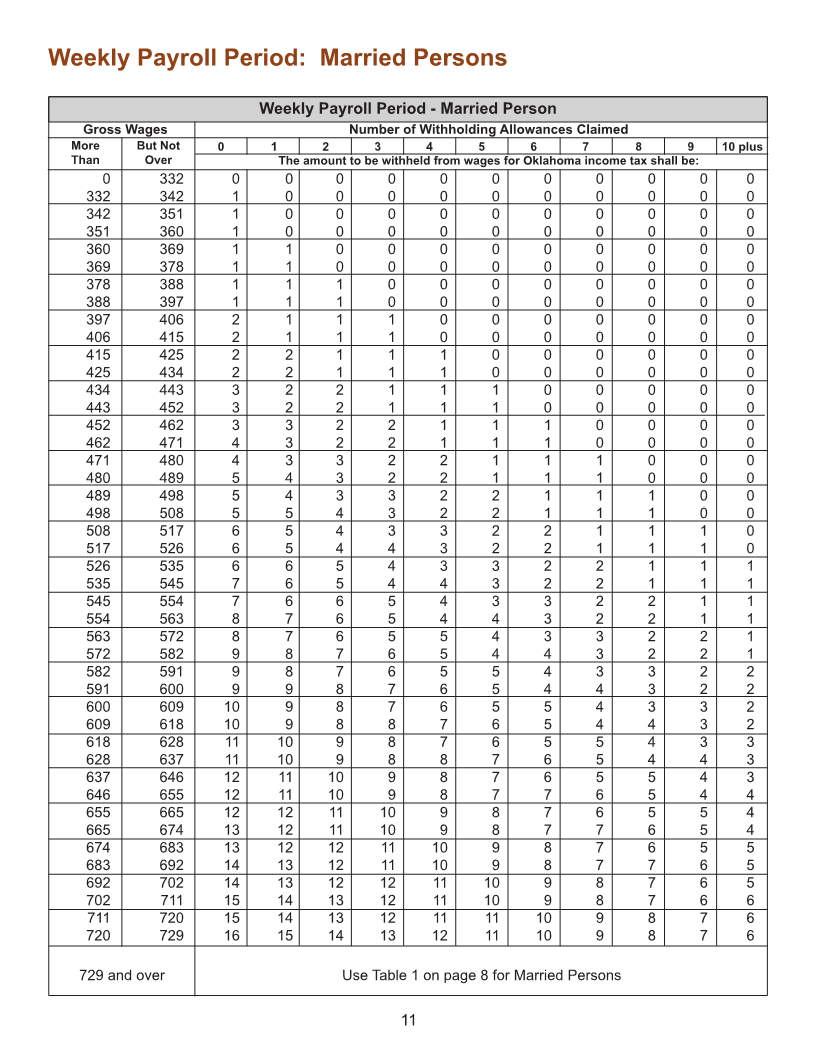

Weekly Payroll Period: Married Persons

Weekly Payroll Period - Married Person

Gross Wages Number of Withholding Allowances Claimed

More But Not 0 1 2 3 4 5 6 7 8 9 10 plus

Than Over The amount to be withheld from wages for Oklahoma income tax shall be:

0 332 0 0 0 0 0 0 0 0 0 0 0

332 342 1 0 0 0 0 0 0 0 0 0 0

342 351 1 0 0 0 0 0 0 0 0 0 0

351 360 1 0 0 0 0 0 0 0 0 0 0

360 369 1 1 0 0 0 0 0 0 0 0 0

369 378 1 1 0 0 0 0 0 0 0 0 0

378 388 1 1 1 0 0 0 0 0 0 0 0

388 397 1 1 1 0 0 0 0 0 0 0 0

397 406 2 1 1 1 0 0 0 0 0 0 0

406 415 2 1 1 1 0 0 0 0 0 0 0

415 425 2 2 1 1 1 0 0 0 0 0 0

425 434 2 2 1 1 1 0 0 0 0 0 0

434 443 3 2 2 1 1 1 0 0 0 0 0

443 452 3 2 2 1 1 1 0 0 0 0 0

452 462 3 3 2 2 1 1 1 0 0 0 0

462 471 4 3 2 2 1 1 1 0 0 0 0

471 480 4 3 3 2 2 1 1 1 0 0 0

480 489 5 4 3 2 2 1 1 1 0 0 0

489 498 5 4 3 3 2 2 1 1 1 0 0

498 508 5 5 4 3 2 2 1 1 1 0 0

508 517 6 5 4 3 3 2 2 1 1 1 0

517 526 6 5 4 4 3 2 2 1 1 1 0

526 535 6 6 5 4 3 3 2 2 1 1 1

535 545 7 6 5 4 4 3 2 2 1 1 1

545 554 7 6 6 5 4 3 3 2 2 1 1

554 563 8 7 6 5 4 4 3 2 2 1 1

563 572 8 7 6 5 5 4 3 3 2 2 1

572 582 9 8 7 6 5 4 4 3 2 2 1

582 591 9 8 7 6 5 5 4 3 3 2 2

591 600 9 9 8 7 6 5 4 4 3 2 2

600 609 10 9 8 7 6 5 5 4 3 3 2

609 618 10 9 8 8 7 6 5 4 4 3 2

618 628 11 10 9 8 7 6 5 5 4 3 3

628 637 11 10 9 8 8 7 6 5 4 4 3

637 646 12 11 10 9 8 7 6 5 5 4 3

646 655 12 11 10 9 8 7 7 6 5 4 4

655 665 12 12 11 10 9 8 7 6 5 5 4

665 674 13 12 11 10 9 8 7 7 6 5 4

674 683 13 12 12 11 10 9 8 7 6 5 5

683 692 14 13 12 11 10 9 8 7 7 6 5

692 702 14 13 12 12 11 10 9 8 7 6 5

702 711 15 14 13 12 11 10 9 8 7 6 6

711 720 15 14 13 12 11 11 10 9 8 7 6

720 729 16 15 14 13 12 11 10 9 8 7 6

729 and over Use Table 1 on page 8 for Married Persons

11

|

Enlarge image |

Bi-Weekly Payroll Period: Single Persons

Bi-Weekly Payroll Period - Single Person

Gross Wages Number of Withholding Allowances Claimed

More But Not 0 1 2 3 4 5 6 7 8 9 10 plus

Than Over The amount to be withheld from wages for Oklahoma income tax shall be:

0 332 0 0 0 0 0 0 0 0 0 0 0

332 351 1 0 0 0 0 0 0 0 0 0 0

351 369 1 0 0 0 0 0 0 0 0 0 0

369 388 1 1 0 0 0 0 0 0 0 0 0

388 406 2 1 0 0 0 0 0 0 0 0 0

406 425 2 1 1 0 0 0 0 0 0 0 0

425 443 3 2 1 0 0 0 0 0 0 0 0

443 462 3 2 1 1 0 0 0 0 0 0 0

462 480 4 3 2 1 0 0 0 0 0 0 0

480 499 5 3 2 1 0 0 0 0 0 0 0

499 517 5 4 3 1 1 0 0 0 0 0 0

517 536 6 5 3 2 1 0 0 0 0 0 0

536 554 7 5 4 2 1 1 0 0 0 0 0

554 572 8 6 5 3 2 1 0 0 0 0 0

572 591 9 7 5 4 2 1 1 0 0 0 0

591 609 10 8 6 5 3 2 1 0 0 0 0

609 628 11 9 7 5 4 2 1 1 0 0 0

628 646 11 10 8 6 4 3 2 1 0 0 0

646 665 12 10 9 7 5 4 2 1 1 0 0

665 683 13 11 10 8 6 4 3 2 1 0 0

683 702 14 12 10 9 7 5 4 2 1 1 0

702 720 15 13 11 9 8 6 4 3 2 1 0

720 739 16 14 12 10 8 7 5 4 2 1 1

739 757 17 15 13 11 9 8 6 4 3 2 1

757 775 18 16 14 12 10 8 7 5 4 2 1

775 794 18 17 15 13 11 9 7 6 4 3 2

794 812 19 17 16 14 12 10 8 7 5 3 2

812 831 20 18 17 15 13 11 9 7 6 4 3

831 849 21 19 17 16 14 12 10 8 6 5 3

849 868 22 20 18 16 15 13 11 9 7 6 4

868 886 23 21 19 17 15 14 12 10 8 6 5

886 905 24 22 20 18 16 15 13 11 9 7 6

905 923 25 23 21 19 17 15 14 12 10 8 6

923 942 25 24 22 20 18 16 14 13 11 9 7

942 960 26 24 23 21 19 17 15 14 12 10 8

960 979 27 25 24 22 20 18 16 14 13 11 9

979 997 28 26 24 23 21 19 17 15 13 12 10

997 1,015 29 27 25 23 22 20 18 16 14 12 11

1,015 1,034 30 28 26 24 23 21 19 17 15 13 12

1,034 1,052 31 29 27 25 23 22 20 18 16 14 12

1,052 1,071 32 30 28 26 24 22 21 19 17 15 13

1,071 1,089 32 31 29 27 25 23 21 20 18 16 14

1,089 1,108 33 31 30 28 26 24 22 21 19 17 15

1,108 1,126 34 32 31 29 27 25 23 21 20 18 16

1,126 and over Use Table 2 on page 8 for Single Persons

12

|

Enlarge image |

Bi-Weekly Payroll Period: Married Persons

Bi-Weekly Payroll Period - Married Person

Gross Wages Number of Withholding Allowances Claimed

More But Not 0 1 2 3 4 5 6 7 8 9 10 plus

Than Over The amount to be withheld from wages for Oklahoma income tax shall be:

0 609 0 0 0 0 0 0 0 0 0 0 0

609 628 1 0 0 0 0 0 0 0 0 0 0

628 646 1 0 0 0 0 0 0 0 0 0 0

646 665 1 1 0 0 0 0 0 0 0 0 0

665 683 1 1 0 0 0 0 0 0 0 0 0

683 702 1 1 1 0 0 0 0 0 0 0 0

702 720 2 1 1 0 0 0 0 0 0 0 0

720 738 2 1 1 1 0 0 0 0 0 0 0

738 757 2 2 1 1 0 0 0 0 0 0 0

757 775 3 2 1 1 1 0 0 0 0 0 0

775 794 3 2 2 1 1 0 0 0 0 0 0

794 812 3 3 2 1 1 1 0 0 0 0 0

812 831 4 3 2 2 1 1 0 0 0 0 0

831 849 4 3 2 2 1 1 1 0 0 0 0

849 868 5 4 3 2 1 1 1 0 0 0 0

868 886 6 4 3 2 2 1 1 1 0 0 0

886 905 6 5 4 3 2 1 1 1 0 0 0

905 923 7 6 4 3 2 2 1 1 0 0 0

923 942 8 6 5 4 3 2 1 1 1 0 0

942 960 8 7 5 4 3 2 2 1 1 0 0

960 978 9 8 6 5 4 3 2 1 1 1 0

978 997 10 8 7 5 4 3 2 2 1 1 0

997 1,015 10 9 8 6 5 4 3 2 1 1 1

1,015 1,034 11 10 8 7 5 4 3 2 2 1 1

1,034 1,052 12 10 9 8 6 5 4 3 2 1 1

1,052 1,071 13 11 10 8 7 5 4 3 2 2 1

1,071 1,089 14 12 10 9 7 6 5 4 3 2 1

1,089 1,108 14 13 11 10 8 7 5 4 3 2 2

1,108 1,126 15 14 12 10 9 7 6 5 4 3 2

1,126 1,145 16 14 13 11 10 8 7 5 4 3 2

1,145 1,163 17 15 13 12 10 9 7 6 5 4 3

1,163 1,182 18 16 14 12 11 9 8 7 5 4 3

1,182 1,200 19 17 15 13 12 10 9 7 6 5 4

1,200 1,218 20 18 16 14 12 11 9 8 7 5 4

1,218 1,237 21 19 17 15 13 12 10 9 7 6 5

1,237 1,255 21 20 18 16 14 12 11 9 8 6 5

1,255 1,274 22 21 19 17 15 13 11 10 9 7 6

1,274 1,292 23 21 20 18 16 14 12 11 9 8 6

1,292 1,311 24 22 20 19 17 15 13 11 10 9 7

1,311 1,329 25 23 21 20 18 16 14 12 11 9 8

1,329 1,348 26 24 22 20 19 17 15 13 11 10 8

1,348 1,366 27 25 23 21 19 18 16 14 12 11 9

1,366 1,385 28 26 24 22 20 18 17 15 13 11 10

1,385 1,403 29 27 25 23 21 19 18 16 14 12 11

1,403 and over Use Table 2 on page 8 for Married Persons

13

|

Enlarge image |

Semi-Monthly Payroll Period: Single Persons

Semi-Monthly Payroll Period - Single Person

Gross Wages Number of Withholding Allowances Claimed

More But Not 0 1 2 3 4 5 6 7 8 9 10 plus

Than Over The amount to be withheld from wages for Oklahoma income tax shall be:

0 360 0 0 0 0 0 0 0 0 0 0 0

360 380 1 0 0 0 0 0 0 0 0 0 0

380 400 1 0 0 0 0 0 0 0 0 0 0

400 420 1 1 0 0 0 0 0 0 0 0 0

420 440 2 1 0 0 0 0 0 0 0 0 0

440 460 2 1 1 0 0 0 0 0 0 0 0

460 480 3 2 1 0 0 0 0 0 0 0 0

480 500 4 2 1 1 0 0 0 0 0 0 0

500 520 4 3 2 1 0 0 0 0 0 0 0

520 540 5 4 2 1 1 0 0 0 0 0 0

540 560 6 4 3 2 1 0 0 0 0 0 0

560 580 7 5 3 2 1 1 0 0 0 0 0

580 600 8 6 4 3 2 1 0 0 0 0 0

600 620 9 7 5 3 2 1 1 0 0 0 0

620 640 10 8 6 4 3 2 1 0 0 0 0

640 660 10 8 6 5 3 2 1 0 0 0 0

660 680 11 9 7 6 4 3 1 1 0 0 0

680 700 12 10 8 6 5 3 2 1 0 0 0

700 720 13 11 9 7 6 4 3 1 1 0 0

720 740 14 12 10 8 6 5 3 2 1 0 0

740 760 15 13 11 9 7 6 4 3 1 1 0

760 780 16 14 12 10 8 6 5 3 2 1 0

780 800 17 15 13 11 9 7 5 4 2 1 1

800 820 18 16 14 12 10 8 6 5 3 2 1

820 840 19 17 15 13 11 9 7 5 4 2 1

840 860 20 18 16 14 12 10 8 6 5 3 2

860 880 21 19 17 15 13 11 9 7 5 4 2

880 900 22 20 18 16 14 12 10 8 6 5 3

900 920 23 21 19 17 15 13 11 9 7 5 4

920 940 24 22 20 18 16 14 12 10 8 6 4

940 960 25 23 21 19 17 15 13 11 9 7 5

960 980 26 24 22 20 18 16 14 12 10 8 6

980 1,000 27 25 23 21 19 17 15 13 11 9 7

1,000 1,020 28 26 24 22 20 18 16 14 12 10 8

1,020 1,040 29 27 25 23 21 19 17 15 13 11 9

1,040 1,060 29 27 25 24 22 20 18 16 14 12 10

1,060 1,080 30 28 26 24 22 21 19 17 15 13 11

1,080 1,100 31 29 27 25 23 21 19 17 16 14 12

1,100 1,120 32 30 28 26 24 22 20 18 16 14 13

1,120 1,140 33 31 29 27 25 23 21 19 17 15 13

1,140 1,160 34 32 30 28 26 24 22 20 18 16 14

1,160 1,180 35 33 31 29 27 25 23 21 19 17 15

1,180 1,200 36 34 32 30 28 26 24 22 20 18 16

1,200 1,220 37 35 33 31 29 27 25 23 21 19 17

1,220 and over Use Table 3 on page 8 for Single Persons

14

|

Enlarge image |

Semi-Monthly Payroll Period: Married Persons

Semi-Monthly Payroll Period - Married Person

Gross Wages Number of Withholding Allowances Claimed

More But Not 0 1 2 3 4 5 6 7 8 9 10 plus

Than Over The amount to be withheld from wages for Oklahoma income tax shall be:

0 660 0 0 0 0 0 0 0 0 0 0 0

660 680 1 0 0 0 0 0 0 0 0 0 0

680 700 1 0 0 0 0 0 0 0 0 0 0

700 720 1 1 0 0 0 0 0 0 0 0 0

720 740 1 1 0 0 0 0 0 0 0 0 0

740 760 1 1 1 0 0 0 0 0 0 0 0

760 780 2 1 1 0 0 0 0 0 0 0 0

780 800 2 1 1 1 0 0 0 0 0 0 0

800 820 2 2 1 1 0 0 0 0 0 0 0

820 840 3 2 1 1 1 0 0 0 0 0 0

840 860 3 2 2 1 1 0 0 0 0 0 0

860 880 4 3 2 1 1 1 0 0 0 0 0

880 900 4 3 2 2 1 1 0 0 0 0 0

900 920 5 4 3 2 1 1 1 0 0 0 0

920 940 5 4 3 2 2 1 1 0 0 0 0

940 960 6 5 4 3 2 1 1 1 0 0 0

960 980 7 5 4 3 2 2 1 1 0 0 0

980 1,000 8 6 5 4 3 2 1 1 1 0 0

1,000 1,020 8 7 5 4 3 2 2 1 1 0 0

1,020 1,040 9 8 6 5 4 3 2 1 1 1 0

1,040 1,060 10 8 7 5 4 3 2 2 1 1 0

1,060 1,080 11 9 7 6 5 4 3 2 1 1 1

1,080 1,100 11 10 8 7 5 4 3 2 1 1 1

1,100 1,120 12 11 9 7 6 5 3 3 2 1 1

1,120 1,140 13 11 10 8 7 5 4 3 2 1 1

1,140 1,160 14 12 10 9 7 6 5 3 3 2 1

1,160 1,180 15 13 11 10 8 7 5 4 3 2 1

1,180 1,200 16 14 12 10 9 7 6 5 3 3 2

1,200 1,220 17 15 13 11 10 8 6 5 4 3 2

1,220 1,240 18 16 14 12 10 9 7 6 4 3 2

1,240 1,260 19 17 15 13 11 10 8 6 5 4 3

1,260 1,280 19 17 16 14 12 10 9 7 6 4 3

1,280 1,300 20 18 16 14 13 11 9 8 6 5 4

1,300 1,320 21 19 17 15 13 12 10 9 7 6 4

1,320 1,340 22 20 18 16 14 13 11 9 8 6 5

1,340 1,360 23 21 19 17 15 13 12 10 9 7 5

1,360 1,380 24 22 20 18 16 14 12 11 9 8 6

1,380 1,400 25 23 21 19 17 15 13 12 10 9 7

1,400 1,420 26 24 22 20 18 16 14 12 11 9 8

1,420 1,440 27 25 23 21 19 17 15 13 12 10 8

1,440 1,460 28 26 24 22 20 18 16 14 12 11 9

1,460 1,480 29 27 25 23 21 19 17 15 13 12 10

1,480 1,500 30 28 26 24 22 20 18 16 14 12 11

1,500 1,520 31 29 27 25 23 21 19 17 15 13 11

1,520 and over Use Table 3 on page 8 for Married Persons

15

|

Enlarge image |

Monthly Payroll Period: Single Persons

Monthly Payroll Period - Single Person

Gross Wages Number of Withholding Allowances Claimed

More But Not 0 1 2 3 4 5 6 7 8 9 10 plus

Than Over The amount to be withheld from wages for Oklahoma income tax shall be:

0 640 0 0 0 0 0 0 0 0 0 0 0

640 680 1 0 0 0 0 0 0 0 0 0 0

680 720 1 0 0 0 0 0 0 0 0 0 0

720 760 1 1 0 0 0 0 0 0 0 0 0

760 800 2 1 0 0 0 0 0 0 0 0 0

800 840 3 1 1 0 0 0 0 0 0 0 0

840 880 3 2 1 0 0 0 0 0 0 0 0

880 920 5 3 1 0 0 0 0 0 0 0 0

920 960 6 3 2 1 0 0 0 0 0 0 0

960 1,000 7 4 2 1 0 0 0 0 0 0 0

1,000 1,040 9 6 3 2 1 0 0 0 0 0 0

1,040 1,080 10 7 4 2 1 0 0 0 0 0 0

1,080 1,120 12 9 5 3 2 1 0 0 0 0 0

1,120 1,160 13 10 7 4 2 1 0 0 0 0 0

1,160 1,200 15 12 8 5 3 2 1 0 0 0 0

1,200 1,240 17 13 10 7 4 2 1 0 0 0 0

1,240 1,280 19 15 11 8 5 3 2 1 0 0 0

1,280 1,320 21 17 13 10 7 4 2 1 0 0 0

1,320 1,360 23 19 15 11 8 5 3 1 1 0 0

1,360 1,400 25 21 17 13 10 7 4 2 1 0 0

1,400 1,440 27 23 19 15 11 8 5 3 1 1 0

1,440 1,480 29 25 21 17 13 10 6 4 2 1 0

1,480 1,520 30 26 22 19 15 11 8 5 3 1 1

1,520 1,560 32 28 24 20 16 13 9 6 4 2 1

1,560 1,600 34 30 26 22 18 14 11 8 5 3 1

1,600 1,640 36 32 28 24 20 16 12 9 6 4 2

1,640 1,680 38 34 30 26 22 18 14 11 8 5 3

1,680 1,720 40 36 32 28 24 20 16 12 9 6 4

1,720 1,760 42 38 34 30 26 22 18 14 11 8 5

1,760 1,800 44 40 36 32 28 24 20 16 12 9 6

1,800 1,840 46 42 38 34 30 26 22 18 14 11 7

1,840 1,880 48 44 40 36 32 28 24 20 16 12 9

1,880 1,920 49 45 41 38 34 30 26 22 18 14 10

1,920 1,960 51 47 43 39 35 32 28 24 20 16 12

1,960 2,000 53 49 45 41 37 33 29 25 22 18 14

2,000 2,040 55 51 47 43 39 35 31 27 23 19 16

2,040 2,080 57 53 49 45 41 37 33 29 25 21 17

2,080 2,120 59 55 51 47 43 39 35 31 27 23 19

2,120 2,160 61 57 53 49 45 41 37 33 29 25 21

2,160 2,200 63 59 55 51 47 43 39 35 31 27 23

2,200 2,240 65 61 57 53 49 45 41 37 33 29 25

2,240 2,280 67 63 59 55 51 47 43 39 35 31 27

2,280 2,320 68 64 60 57 53 49 45 41 37 33 29

2,320 2,360 70 66 62 58 54 51 47 43 39 35 31

2,360 and over Use Table 4 on page 8 for Single Persons

16

|

Enlarge image |

Monthly Payroll Period: Married Persons

Monthly Payroll Period - Married Person

Gross Wages Number of Withholding Allowances Claimed

More But Not 0 1 2 3 4 5 6 7 8 9 10 plus

Than Over The amount to be withheld from wages for Oklahoma income tax shall be:

0 1,240 0 0 0 0 0 0 0 0 0 0 0

1,240 1,280 1 0 0 0 0 0 0 0 0 0 0

1,280 1,320 1 0 0 0 0 0 0 0 0 0 0

1,320 1,360 1 1 0 0 0 0 0 0 0 0 0

1,360 1,400 2 1 0 0 0 0 0 0 0 0 0

1,400 1,440 2 1 1 0 0 0 0 0 0 0 0

1,440 1,480 2 2 1 0 0 0 0 0 0 0 0

1,480 1,520 3 2 1 1 0 0 0 0 0 0 0

1,520 1,560 3 2 2 1 0 0 0 0 0 0 0

1,560 1,600 4 3 2 1 1 0 0 0 0 0 0

1,600 1,640 5 3 2 2 1 0 0 0 0 0 0

1,640 1,680 6 4 3 2 1 1 0 0 0 0 0

1,680 1,720 6 5 3 2 1 1 0 0 0 0 0

1,720 1,760 7 5 4 3 2 1 1 0 0 0 0

1,760 1,800 9 6 5 3 2 1 1 0 0 0 0

1,800 1,840 10 7 5 4 2 2 1 1 0 0 0

1,840 1,880 11 9 6 5 3 2 1 1 0 0 0

1,880 1,920 12 10 7 5 4 2 2 1 0 0 0

1,920 1,960 14 11 8 6 5 3 2 1 1 0 0

1,960 2,000 15 12 10 7 5 4 2 2 1 0 0

2,000 2,040 17 14 11 8 6 5 3 2 1 1 0

2,040 2,080 18 15 12 9 7 5 4 2 2 1 0

2,080 2,120 20 17 13 11 8 6 4 3 2 1 1

2,120 2,160 21 18 15 12 9 7 5 4 2 2 1

2,160 2,200 23 20 16 13 10 8 6 4 3 2 1

2,200 2,240 24 21 18 15 12 9 7 5 4 2 2

2,240 2,280 26 23 19 16 13 10 8 6 4 3 2

2,280 2,320 28 24 21 18 15 12 9 7 5 4 2

2,320 2,360 29 26 22 19 16 13 10 8 6 4 3

2,360 2,400 31 27 24 21 18 15 11 9 7 5 4

2,400 2,440 33 29 25 22 19 16 13 10 8 6 4

2,440 2,480 35 31 27 24 21 18 14 11 9 7 5

2,480 2,520 37 33 29 25 22 19 16 13 10 8 6

2,520 2,560 39 35 31 27 24 21 17 14 11 9 7

2,560 2,600 41 37 33 29 25 22 19 16 13 10 8

2,600 2,640 43 39 35 31 27 24 20 17 14 11 9

2,640 2,680 45 41 37 33 29 25 22 19 16 13 10

2,680 2,720 47 43 39 35 31 27 23 20 17 14 11

2,720 2,760 48 44 41 37 33 29 25 22 19 16 12

2,760 2,800 50 46 42 38 35 31 27 23 20 17 14

2,800 2,840 52 48 44 40 36 32 29 25 22 19 15

2,840 2,880 54 50 46 42 38 34 30 26 23 20 17

2,880 2,920 56 52 48 44 40 36 32 28 25 22 18

2,920 2,960 58 54 50 46 42 38 34 30 26 23 20

2,960 and over Use Table 4 on page 8 for Married Persons

17

|

Enlarge image |

Daily or Miscellaneous Payroll Period: Single Persons

Daily or Miscellaneous Payroll Period - Single Person

Gross Wages Number of Withholding Allowances Claimed

More But Not 0 1 2 3 4 5 6 7 8 9 10 plus

Than Over The amount to be withheld from wages for Oklahoma income tax shall be:

0 50 0 0 0 0 0 0 0 0 0 0 0

50 52 1 0 0 0 0 0 0 0 0 0 0

52 54 1 0 0 0 0 0 0 0 0 0 0

54 55 1 1 0 0 0 0 0 0 0 0 0

55 57 1 1 0 0 0 0 0 0 0 0 0

57 59 1 1 1 0 0 0 0 0 0 0 0

59 61 1 1 1 0 0 0 0 0 0 0 0

61 63 1 1 1 1 0 0 0 0 0 0 0

63 65 1 1 1 1 0 0 0 0 0 0 0

65 66 1 1 1 1 1 0 0 0 0 0 0

66 68 1 1 1 1 1 0 0 0 0 0 0

68 70 1 1 1 1 1 1 0 0 0 0 0

70 72 1 1 1 1 1 1 0 0 0 0 0

72 74 2 1 1 1 1 1 1 0 0 0 0

74 76 2 1 1 1 1 1 1 0 0 0 0

76 78 2 2 1 1 1 1 1 0 0 0 0

78 79 2 2 1 1 1 1 1 1 0 0 0

79 81 2 2 2 1 1 1 1 1 0 0 0

81 83 2 2 2 1 1 1 1 1 1 0 0

83 85 2 2 2 2 1 1 1 1 1 0 0

85 87 2 2 2 2 1 1 1 1 1 1 0

87 89 2 2 2 2 2 1 1 1 1 1 0

89 90 2 2 2 2 2 1 1 1 1 1 1

90 92 2 2 2 2 2 2 1 1 1 1 1

92 94 3 2 2 2 2 2 1 1 1 1 1

94 96 3 2 2 2 2 2 2 1 1 1 1

96 98 3 3 2 2 2 2 2 1 1 1 1

98 100 3 3 2 2 2 2 2 2 1 1 1

100 102 3 3 3 2 2 2 2 2 1 1 1

102 103 3 3 3 2 2 2 2 2 2 1 1

103 105 3 3 3 3 2 2 2 2 2 1 1

105 107 3 3 3 3 2 2 2 2 2 2 1

107 109 3 3 3 3 3 2 2 2 2 2 1

109 111 3 3 3 3 3 2 2 2 2 2 2

111 113 3 3 3 3 3 3 2 2 2 2 2

113 114 4 3 3 3 3 3 2 2 2 2 2

114 116 4 3 3 3 3 3 2 2 2 2 2

116 118 4 4 3 3 3 3 3 2 2 2 2

118 120 4 4 3 3 3 3 3 2 2 2 2

120 122 4 4 3 3 3 3 3 3 2 2 2

122 124 4 4 4 3 3 3 3 3 2 2 2

124 126 4 4 4 3 3 3 3 3 3 2 2

126 127 4 4 4 4 3 3 3 3 3 2 2

127 129 4 4 4 4 3 3 3 3 3 3 2

129 and over Use Table 8 on page 9 for Single Persons

18

|

Enlarge image |

Daily or Miscellaneous Payroll Period: Married Persons

Daily or Miscellaneous Payroll Period - Married Person

Gross Wages Number of Withholding Allowances Claimed

More But Not 0 1 2 3 4 5 6 7 8 9 10 plus

Than Over The amount to be withheld from wages for Oklahoma income tax shall be:

0 87 0 0 0 0 0 0 0 0 0 0 0

87 89 1 0 0 0 0 0 0 0 0 0 0

89 90 1 0 0 0 0 0 0 0 0 0 0

90 92 1 1 0 0 0 0 0 0 0 0 0

92 94 1 1 0 0 0 0 0 0 0 0 0

94 96 1 1 1 0 0 0 0 0 0 0 0

96 98 1 1 1 0 0 0 0 0 0 0 0

98 100 1 1 1 1 0 0 0 0 0 0 0

100 102 1 1 1 1 0 0 0 0 0 0 0

102 103 1 1 1 1 1 0 0 0 0 0 0

103 105 1 1 1 1 1 0 0 0 0 0 0

105 107 1 1 1 1 1 1 0 0 0 0 0

107 109 1 1 1 1 1 1 0 0 0 0 0

109 111 1 1 1 1 1 1 1 0 0 0 0

111 113 2 1 1 1 1 1 1 0 0 0 0

113 114 2 1 1 1 1 1 1 1 0 0 0

114 116 2 2 1 1 1 1 1 1 0 0 0

116 118 2 2 1 1 1 1 1 1 1 0 0

118 120 2 2 2 1 1 1 1 1 1 0 0

120 122 2 2 2 1 1 1 1 1 1 1 0

122 124 2 2 2 2 1 1 1 1 1 1 0

124 126 2 2 2 2 1 1 1 1 1 1 1

126 127 2 2 2 2 2 1 1 1 1 1 1

127 129 2 2 2 2 2 1 1 1 1 1 1

129 131 2 2 2 2 2 1 1 1 1 1 1

131 133 2 2 2 2 2 2 1 1 1 1 1

133 135 3 2 2 2 2 2 1 1 1 1 1

135 137 3 2 2 2 2 2 2 1 1 1 1

137 138 3 3 2 2 2 2 2 1 1 1 1

138 140 3 3 2 2 2 2 2 2 1 1 1

140 142 3 3 3 2 2 2 2 2 1 1 1

142 144 3 3 3 2 2 2 2 2 2 1 1

144 146 3 3 3 3 2 2 2 2 2 1 1

146 148 3 3 3 3 2 2 2 2 2 2 1

148 150 3 3 3 3 3 2 2 2 2 2 1

150 151 3 3 3 3 3 2 2 2 2 2 2

151 153 3 3 3 3 3 3 2 2 2 2 2

153 155 4 3 3 3 3 3 2 2 2 2 2

155 157 4 3 3 3 3 3 3 2 2 2 2

157 159 4 4 3 3 3 3 3 2 2 2 2

159 161 4 4 3 3 3 3 3 3 2 2 2

161 162 4 4 4 3 3 3 3 3 2 2 2

162 164 4 4 4 3 3 3 3 3 3 2 2

164 166 4 4 4 4 3 3 3 3 3 2 2

166 and over Use Table 8 on page 9 for Married Persons

19

|

Enlarge image | Looking for Additional Information? No matter what the tax topic, the OTC invites you to visit us at tax.ok.gov to get any additional information you might need. Still can’t find what you need? Contact our Taxpayer Resource Center at 405.521.3160. |