Enlarge image

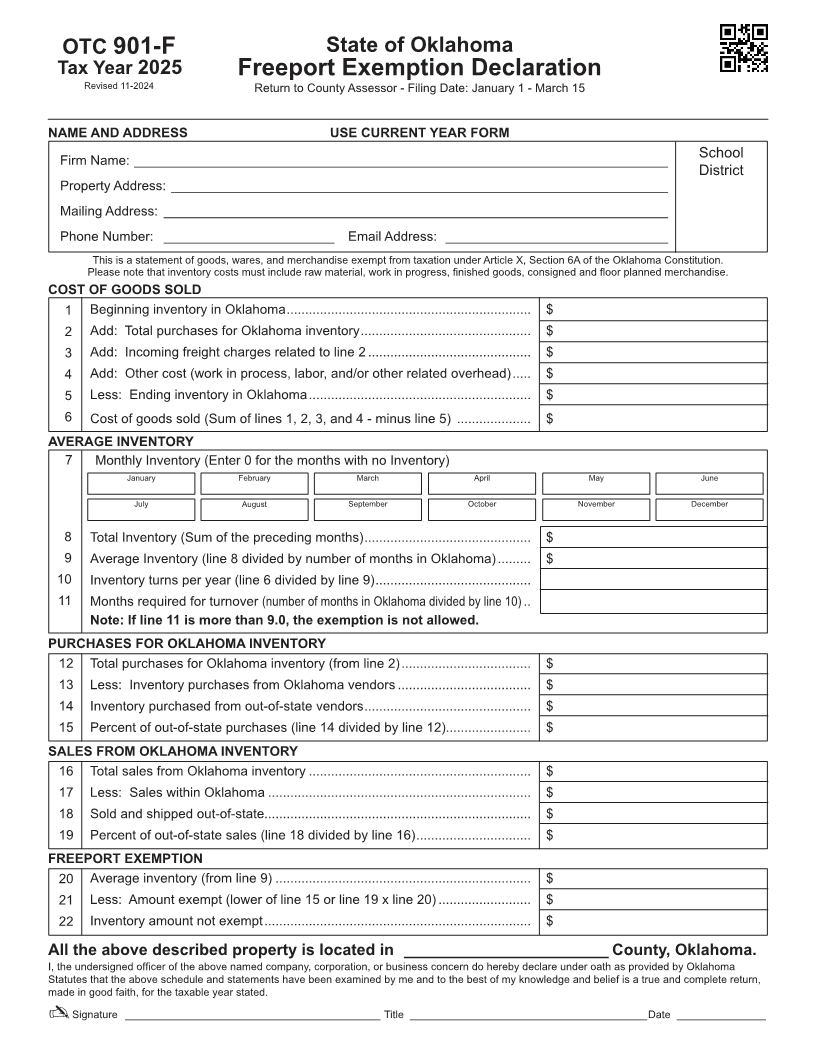

OTC 901-F State of Oklahoma Tax Year 2025 Freeport Exemption Declaration Revised 11-2024 Return to County Assessor - Filing Date: January 1 - March 15 NAME AND ADDRESS USE CURRENT YEAR FORM School Firm Name: ________________________________________________________________________ District Property Address: ___________________________________________________________________ Mailing Address: ____________________________________________________________________ Phone Number: _______________________ Email Address: ______________________________ This is a statement of goods, wares, and merchandise exempt from taxation under Article X, Section 6A of the Oklahoma Constitution. Please note that inventory costs must include raw material, work in progress, finished goods, consigned and floor planned merchandise. COST OF GOODS SOLD 1 Beginning inventory in Oklahoma .................................................................. $ 2 Add: Total purchases for Oklahoma inventory .............................................. $ 3 Add: Incoming freight charges related to line 2 ............................................ $ 4 Add: Other cost (work in process, labor, and/or other related overhead) ..... $ 5 Less: Ending inventory in Oklahoma ............................................................ $ 6 Cost of goods sold (Sum of lines 1, 2, 3, and 4 - minus line 5) .................... $ AVERAGE INVENTORY 7 Monthly Inventory (Enter 0 for the months with no Inventory) January February March April May June July August September October November December 8 Total Inventory (Sum of the preceding months) ............................................. $ 9 Average Inventory (line 8 divided by number of months in Oklahoma) ......... $ 10 Inventory turns per year (line 6 divided by line 9) .......................................... 11 Months required for turnover (number of months in Oklahoma divided by line 10) .. Note: If line 11 is more than 9.0, the exemption is not allowed. PURCHASES FOR OKLAHOMA INVENTORY 12 Total purchases for Oklahoma inventory (from line 2) ................................... $ 13 Less: Inventory purchases from Oklahoma vendors .................................... $ 14 Inventory purchased from out-of-state vendors ............................................. $ 15 Percent of out-of-state purchases (line 14 divided by line 12)....................... $ SALES FROM OKLAHOMA INVENTORY 16 Total sales from Oklahoma inventory ............................................................ $ 17 Less: Sales within Oklahoma ....................................................................... $ 18 Sold and shipped out-of-state........................................................................ $ 19 Percent of out-of-state sales (line 18 divided by line 16) ............................... $ FREEPORT EXEMPTION 20 Average inventory (from line 9) ..................................................................... $ 21 Less: Amount exempt (lower of line 15 or line 19 x line 20) ......................... $ 22 Inventory amount not exempt ........................................................................ $ All the above described property is located in _______________________ County, Oklahoma. I, the undersigned officer of the above named company, corporation, or business concern do hereby declare under oath as provided by Oklahoma Statutes that the above schedule and statements have been examined by me and to the best of my knowledge and belief is a true and complete return, made in good faith, for the taxable year stated. ✍ Signature ___________________________________________ Title ________________________________________Date _______________