Enlarge image

1 1

2 4 6 8 10 12 14 16 18 20 22 24 26 28 30 32 34 36 38 40 42 44 46 48 50 52 54 56 58 60 62 64 66 68 70 72 74 76 78 80 82 84 86

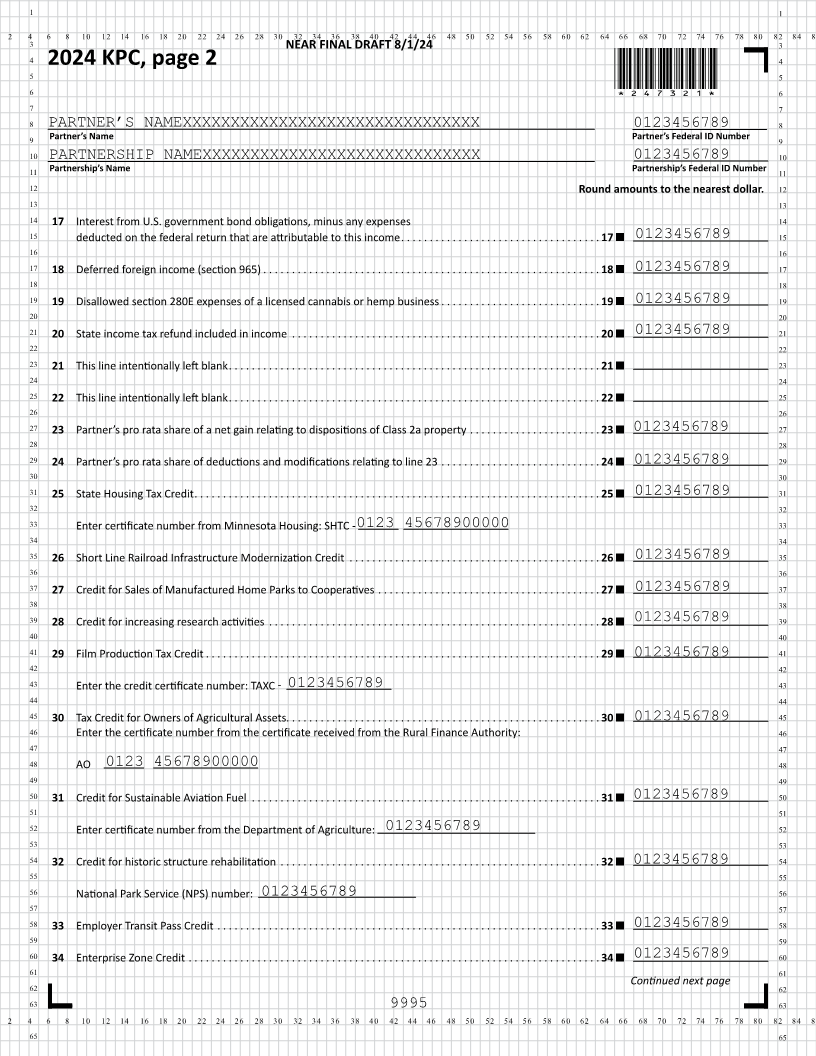

3 NEAR FINAL DRAFT 8/1/24 3

4 4

5 5

6 *247311*6

7 7

8 8

2024 KPC, Partner’s Share of Income, Credits

9 9

10 and Modifications 10

Partnership: Complete and provide Schedule KPC to each corporate or partnership partner. For individual, estate and trust partners, use Schedule KPI instead.

11 11

12 12

13 Tax year beginning (MM/DD/YYYY) MM / DD /YYYY and ending (MM/DD/YYYY) MM / DD / YYYY Amended KPC: X 13

14 14

15 1234567890 0123456789 0123456789 15

16 Partner’s Federal ID Number Parternship’s Federal ID Number Partnership’s Minnesota ID 16

17 PARTNER’S NAME PARTNERSHIP’S NAME 17

18 Partner’s Name Partnership’s Name 18

19 MAILING ADDRESS MAILING ADDRESS 19

20 Mailing Address Mailing Address 20

21 CITYXXXXXXXXXX MN XXXXX CITY MN 12345 21

22 City State ZIP Code City State ZIP Code 22

23 23

24 Entity Partner of X CorporationS X CorporationC X Exempt X Partnership Partner’s Distributiv e 24

25 (check one box): Organization Share: XXXXXXX % 25

26 26

27 Round amounts to the nearest dollar. 27

28 Corporate and Partnership Partners 28

29 1 Nonapportionable Minnesota source income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 0123456789 29

30 30

31 2 Total nonapportionable income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2 0123456789 31

32 32

33 3 Partnership’s minimum fee . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 0123456789 33

34 34

35 4 Interest income exempt from federal tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4 0123456789 35

36 36

37 5 State taxes deducted in arriving at partnership’s net income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5 0123456789 37

38 6 Expenses deducted that are attributable to income not taxed by Minnesota 38

39 (other than interest or mutual fund dividends from U.S. bonds) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6 0123456789 39

40 40

41 7 100% of partner’s distributive share of federal bonus depreciation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7 0123456789 41

42 42

43 8 Foreign-derived intangible income (FDII) deduction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8 0123456789 43

44 44

45 9 This line intentionally left blank . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9 45

46 46

47 10a Partner’s pro rata gross profit from installment sales of pass-through . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10a 0123456789 47

48 businesses (see instructions) 48

49 10b Partner’s pro rata installment sale income from pass-through . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10b 0123456789 49

50 businesses (see instructions) 50

51 11 This line intentionally left blank . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11 51

52 52

53 12 This line intentionally left blank . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12 53

54 54

55 13 This line intentionally left blank . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13 55

56 56

57 14 This line intentionally left blank . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14 57

58 58

59 15 This line intentionally left blank . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15 59

60 60

61 16 This line intentionally left blank . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16 61

62 Continued next page 62

63 9995 63

2 4 6 8 10 12 14 16 18 20 22 24 26 28 30 32 34 36 38 40 42 44 46 48 50 52 54 56 58 60 62 64 66 68 70 72 74 76 78 80 82 84 86

65 65