Enlarge image

1 1

2 4 6 8 10 12 14 16 18 20 22 24 26 28 30 32 34 36 38 40 42 44 46 48 50 52 54 56 58 60 62 64 66 68 70 72 74 76 78 80 82 84 86

3 3

4 NEAR FINAL DRAFT 8/1/24 4

5 5

6 *241641* 6

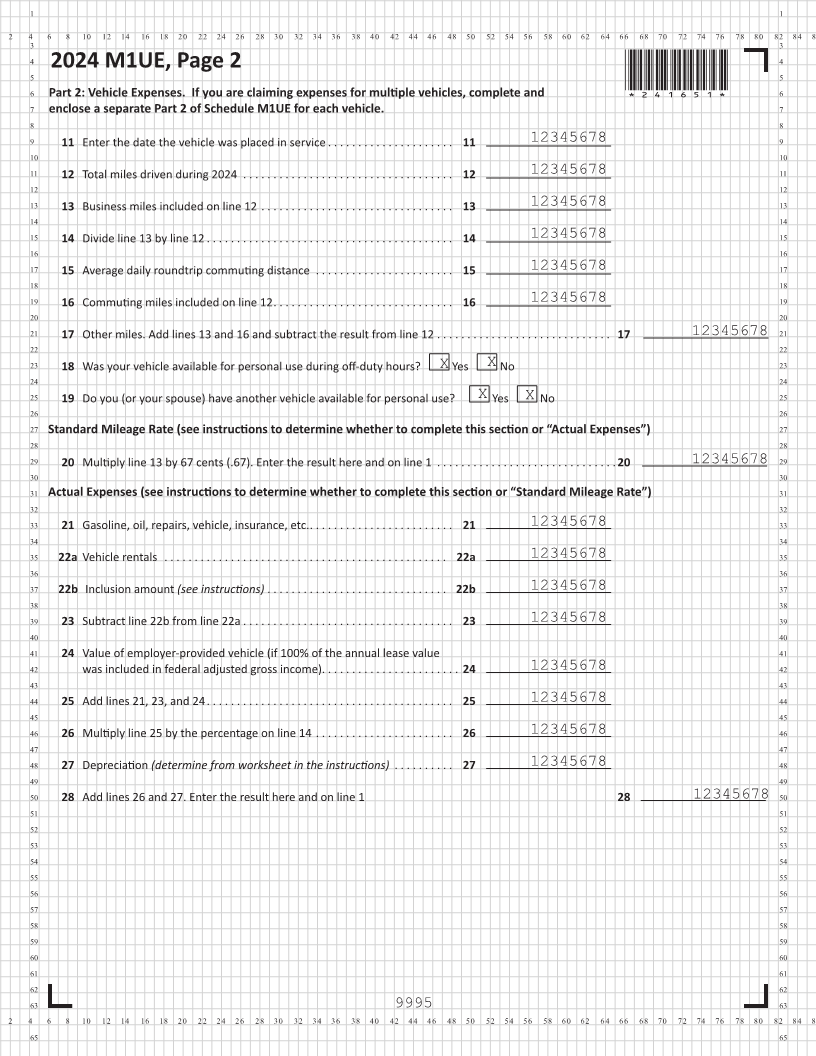

7 2024 Schedule M1UE, Unreimbursed Employee Business Expenses 7

8 8

9 Before you complete this schedule, read the instructions to see if you are eligible. 9

10 10

11 FirstYour YOURName and Initial FIRST NAME, INIT YOURLast Name LAST NAMEXXXXXX Social999999999Security Number 11

12 12

13 Part 1: Your Expenses Column A Column B 13

14 1 Vehicle expenses from line 20 or line 28 (see instructions if you incurred 14

15 expenses for more than one vehicle) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .1. 12345678 15

16 16

17 2 Parking fees, tolls, and transportation that did not involve overnight 17

18 travel or commuting from work (see instructions) . . . . . . . . . . . . . . . . . . . . . 2 12345678 18

19 19

20 3 Travel expenses that did involve overnight travel, including lodging 20

21 and transportation. Do not include meals . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 12345678 21

22 22

23 4 Business expenses not included above. Do not include meals . . . . . . . . . . 4 12345678 23

24 24

25 5 Meals (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5 12345678 25

26 26

27 6 Column A: lines Add 1 through 4. Column B:Enter the amount 5from line 6 12345678 12345678 27

28 28

29 7 Enter reimbursements from your employer that were 29

30 not included in box 1 of your federal Form W-2 (see instructions) . . . . . . . . 7 12345678 12345678 30

31 31

32 8 Subtract line 7 from line 6. If zero or less, enter 0 . . . . . . . . . . . . . . . . . . . . 8 12345678 12345678 32

33 33

34 9 Column A: Enter the amount 8.line from Column B:Multiply line 8 by 50% 34

35 (0.50). Employees covered by U.S. Department of Transportation 35

36 service limits, multiply line 8 by 80% (0.80). . . . . . . . . . . . . . . . . . . . . . . . . . 9 12345678 12345678 36

37 37

38 10 Add the amounts on line 9 of both columns. 38

39 Enter the total here and include on line 20 of Schedule M1SA . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10 12345678 39

40 40

41 41

42 Continued 42

43 43

44 44

45 45

46 46

47 47

48 48

49 49

50 50

51 51

52 52

53 53

54 54

55 55

56 56

57 57

58 58

59 59

60 60

61 61

62 62

63 9995 63

2 4 6 8 10 12 14 16 18 20 22 24 26 28 30 32 34 36 38 40 42 44 46 48 50 52 54 56 58 60 62 64 66 68 70 72 74 76 78 80 82 84 86

65 65