Enlarge image

1 1

2 4 6 8 10 12 14 16 18 20 22 24 26 28 30 32 34 36 38 40 42 44 46 48 50 52 54 56 58 60 62 64 66 68 70 72 74 76 78 80 82 84 86

3 3

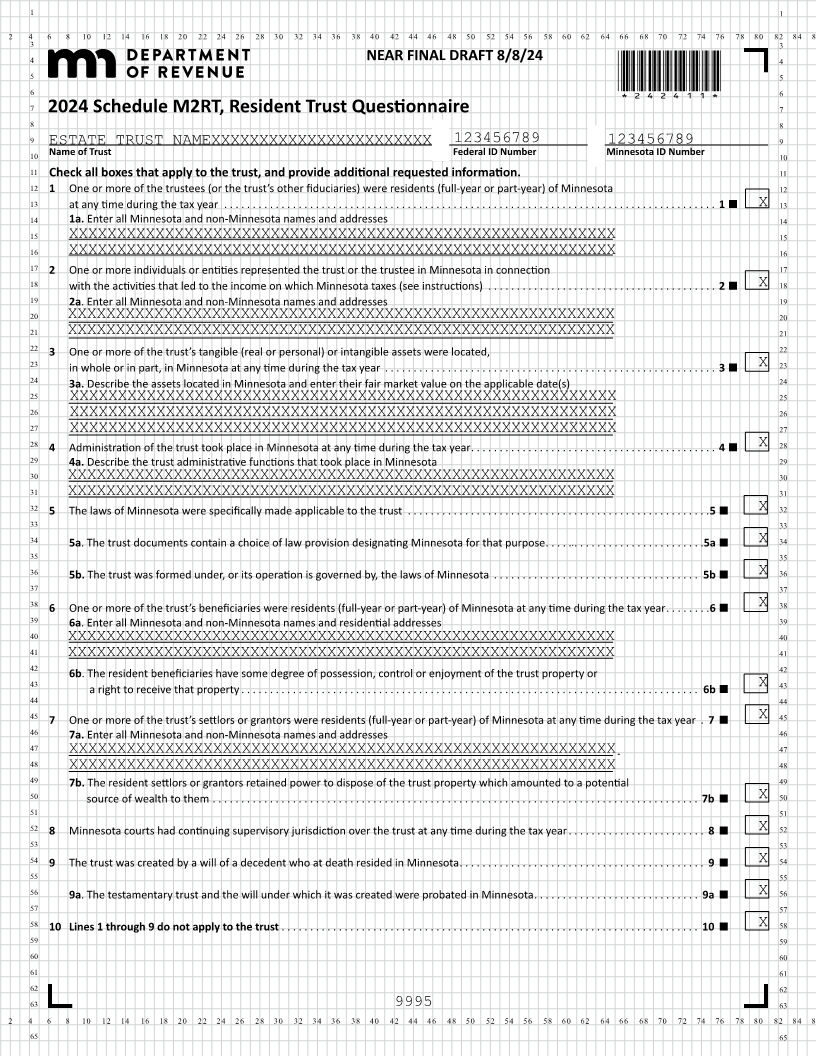

4 NEAR FINAL DRAFT 8/8/24 4

5 5

6 *242411*6

7 2024 Schedule M2RT, Resident Trust Questionnaire 7

8 8

9 ESTATE TRUST NAMEXXXXXXXXXXXXXXXXXXXXXXX 123456789 123456789 9

10 Name of Trust Federal ID Number Minnesota ID Number 10

11 Check all boxes that apply to the trust, and provide additional requested information. 11

12 1 One or more of the trustees (or the trust’s other fiduciaries) were residents (full-year or part-year) of Minnesota 12

13 at any time during the tax year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 X 13

14 1a. Enter all Minnesota and non-Minnesota names and addresses 14

15 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 15

16 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 16

17 2 One or more individuals or entities represented the trust or the trustee in Minnesota in connection 17

18 with the activities that led to the income on which Minnesota taxes (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2 X 18

19 2a. Enter all Minnesota and non-Minnesota names and addresses 19

20 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 20

21 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 21

22 3 One or more of the trust’s tangible (real or personal) or intangible assets were located, 22

23 in whole or in part, in Minnesota at any time during the tax year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 X 23

24 3a. Describe the assets located in Minnesota and enter their fair market value on the applicable date(s) 24

25 25

XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX

26 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 26

27 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 27

28 4 Administration of the trust took place in Minnesota at any time during the tax year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4 X 28

29 4a. Describe the trust administrative functions that took place in Minnesota 29

30 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 30

31 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 31

32 5 The laws of Minnesota were specifically made applicable to the trust . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5 X 32

33 33

34 5a. The trust documents contain a choice lawof provision designating Minnesota for that purpose . . . . . . . . . . . . . . . . . . . . . . . . . . . .5a X 34

35 35

36 5b. The wastrust formed under, operationits or by, theis governed laws Minnesotaof . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5b X 36

37 37

38 6 One or more of the trust’s beneficiaries were residents (full-year or part-year) of Minnesota at any time during the tax year . . . . . . . . 6 X 38

39 6a. Enter all Minnesota and non-Minnesota names and residential addresses 39

40 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 40

41 41

XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX

42 42

6b. The resident beneficiaries have some degree of possession, control or enjoyment of the trust property or

43 X 43

a right to receive that property . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6b

44 44

45 7 One or more of the trust’s settlors or grantors were residents (full-year or part-year) of Minnesota at any time during the tax year . 7 X 45

46 7a. Enter all Minnesota and non-Minnesota names and addresses 46

47 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 47

48 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 48

49 7b. The resident settlors or grantors retained power to dispose of the trust property which amounted to a potential 49

50 source of wealth to them . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7b X 50

51 51

52 8 Minnesota courts had continuing supervisory jurisdiction over the trust at any time during the tax year . . . . . . . . . . . . . . . . . . . . . . . . 8 X 52

53 53

54 9 The trust was created by a will of a decedent who at death resided in Minnesota . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9 X 54

55 55

56 9a. The testamentary trust and the will under which it was created were probated in Minnesota . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9a X 56

57 57

58 10 Lines 1 through 9 do not apply to the trust . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10 X 58

59 59

60 60

61 61

62 62

63 9995 63

2 4 6 8 10 12 14 16 18 20 22 24 26 28 30 32 34 36 38 40 42 44 46 48 50 52 54 56 58 60 62 64 66 68 70 72 74 76 78 80 82 84 86

65 65