Enlarge image

1 1

2 4 6 8 10 12 14 16 18 20 22 24 26 28 30 32 34 36 38 40 42 44 46 48 50 52 54 56 58 60 62 64 66 68 70 72 74 76 78 80 82 84 86

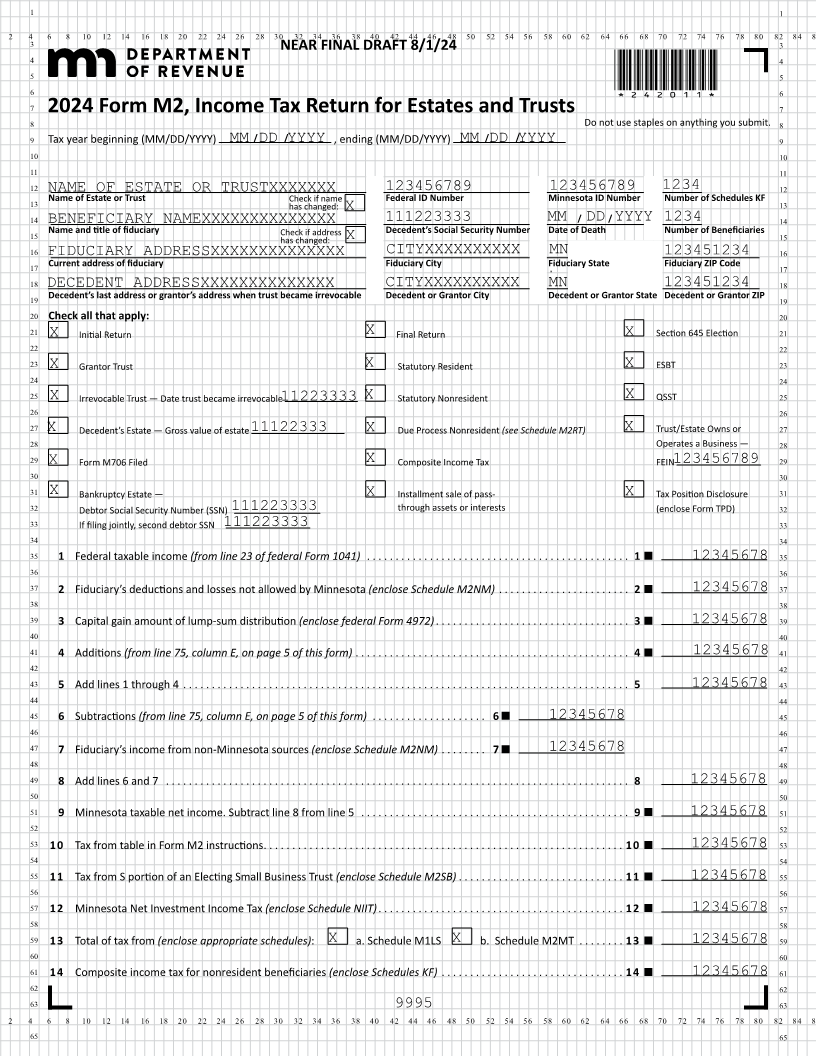

3 NEAR FINAL DRAFT 8/1/24 3

4 4

5 5

6 *242011*6

7 7

2024 Form M2, Income Tax Return for Estates and Trusts

8 Do not use staples on anything you submit. 8

9 Tax year beginning (MM/DD/YYYY) MM/DD/YYYY , ending (MM/DD/YYYY) MM/DD/YYYY 9

10 10

11 11

12 NAME OF ESTATE OR TRUSTXXXXXXX 123456789 123456789 1234 12

13 Name of Estate or Trust Check if name Federal ID Number Minnesota ID Number Number of Schedules KF 13

has changed: X

14 BENEFICIARY NAMEXXXXXXXXXXXXXX 111223333 MM / DD/YYYY 1234 14

15 Name and title of fiduciary Check if address Decedent’s Social Security Number Date of Death Number of Beneficiaries 15

has changed: X

16 FIDUCIARY ADDRESSXXXXXXXXXXXXXX CITYXXXXXXXXXX MN 123451234 16

17 Current address of fiduciary Fiduciary City Fiduciary State Fiduciary ZIP Code 17

18 DECEDENT ADDRESSXXXXXXXXXXXXXX CITYXXXXXXXXXX MN 123451234 18

19 Decedent’s last address or grantor’s address when trust became irrevocable Decedent or Grantor City Decedent or Grantor State Decedent or Grantor ZIP 19

20 Check all that apply: 20

21 X Initial Return X Final Return X Section 645 Election 21

22 22

23 X Grantor Trust X Statutory Resident X ESBT 23

24 24

25 X Irrevocable Trust — Date trust became irrevocable 11223333 X Statutory Nonresident X QSST 25

26 26

27 X Decedent’s Estate — Gross value of estate 11122333 X Due Process Nonresident (see Schedule M2RT) X Trust/Estate Owns or 27

28 Operates a Business — 28

29 X Form M706 Filed X Composite Income Tax FEIN 123456789 29

30 30

31 X Bankruptcy Estate — X Installment sale of pass- X Tax Position Disclosure 31

32 Debtor Social Security Number (SSN) 111223333 through assets interestsor (enclose Form TPD) 32

33 If filing jointly, second debtor SSN 111223333 33

34 34

35 1 Federal taxable income (from line 23 of federal Form 1041) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 12345678 35

36 36

37 2 Fiduciary’s deductions and losses not allowed by Minnesota (enclose Schedule M2NM) . . . . . . . . . . . . . . . . . . . . . . . 2 12345678 37

38 38

39 3 Capital gain amount of lump-sum distribution (enclose federal Form 4972) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 12345678 39

40 40

41 4 Additions (from line 75, column E, on page 5 of this form) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4 12345678 41

42 42

43 5 Add lines 1 through 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5 12345678 43

44 44

45 6 Subtractions (from line 75, column E, on page 5 of this form) . . . . . . . . . . . . . . . . . . . . 6 12345678 45

46 46

47 7 Fiduciary’s income non-Minnesotafrom sources (enclose Schedule M2NM) . . . . . . . . 7 12345678 47

48 48

49 8 Add lines 6 and 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8 12345678 49

50 50

51 9 Minnesota taxable net income. Subtract line 8 from line 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9 12345678 51

52 52

53 10 Tax from table in Form M2 instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10 12345678 53

54 54

55 11 Tax from S portion of an Electing Small Business Trust (enclose Schedule M2SB) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11 12345678 55

56 56

57 12 Minnesota Net Investment Income Tax (enclose Schedule NIIT) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12 12345678 57

58 58

59 13 Total of tax from (enclose appropriate schedules): X a. Schedule M1LS X b. Schedule M2MT . . . . . . . . 13 12345678 59

60 60

61 14 Composite income tax for nonresident beneficiaries (enclose Schedules KF) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14 12345678 61

62 62

63 9995 63

2 4 6 8 10 12 14 16 18 20 22 24 26 28 30 32 34 36 38 40 42 44 46 48 50 52 54 56 58 60 62 64 66 68 70 72 74 76 78 80 82 84 86

65 65