Enlarge image

1 1

2 4 6 8 10 12 14 16 18 20 22 24 26 28 30 32 34 36 38 40 42 44 46 48 50 52 54 56 58 60 62 64 66 68 70 72 74 76 78 80 82 84 86

3 NEAR FINAL DRAFT 8/1/24 3

4 4

5 5

6 *244911*6

7 7

8 Do not use staples on anything you submit. 8

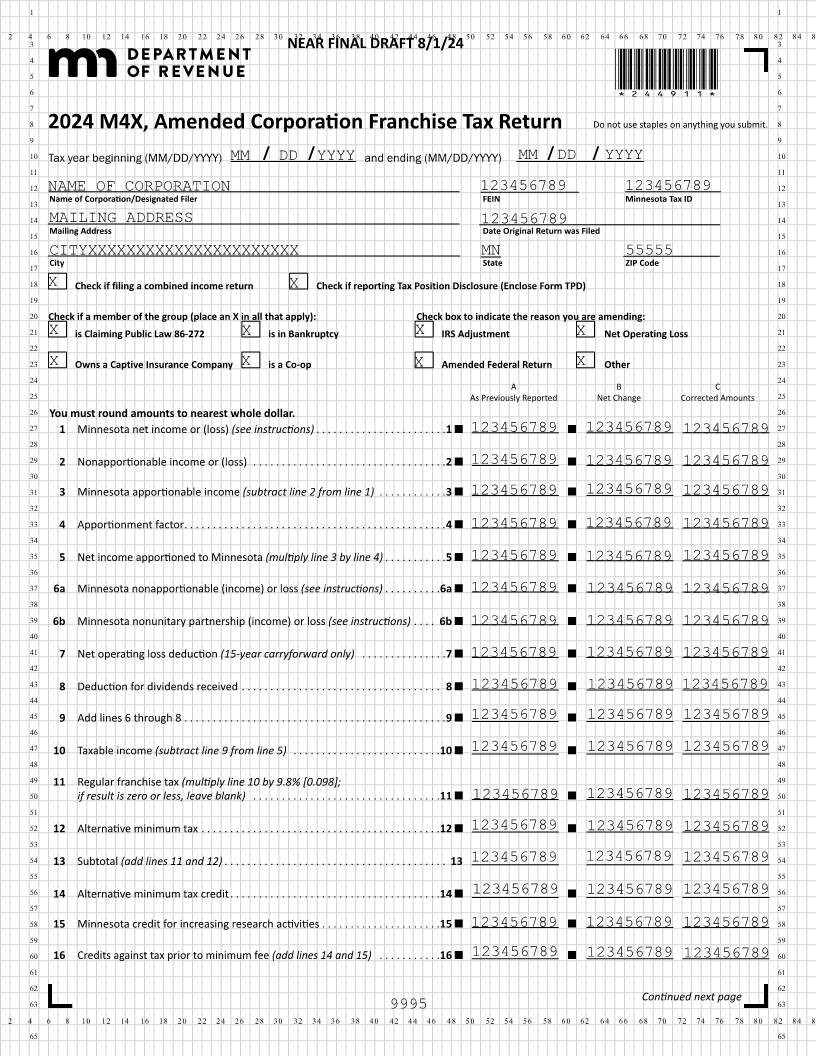

2024 M4X, Amended Corporation Franchise Tax Return

9 9

10 Tax year beginning (MM/DD/YYYY) MM / DD /YYYY and ending (MM/DD/YYYY) /MM DD / YYYY 10

11 11

12 NAME OF CORPORATION 123456789 123456789 12

13 Name of Corporation/Designated Filer FEIN Minnesota Tax ID 13

14 MAILING ADDRESS 123456789 14

15 Mailing Address Date Original Return was Filed 15

16 16

17 CITYXXXXXXXXXXXXXXXXXXXXXX City MN State 55555ZIP Code 17

18 X Check if filing a combined income return X Check if reporting Tax Position Disclosure (Enclose Form TPD) 18

19 19

20 Check if a member of the group (place an X in all that apply): Check box to indicate the reason you are amending: 20

21 X is Claiming Public Law 86-272 X is in Bankruptcy X IRS Adjustment X Net Operating Loss 21

22 22

23 X Owns a Captive Insurance Company X is a Co-op X Amended Federal Return X Other 23

24 24

A B C

25 As Previously Reported Net Change Corrected Amounts 25

26 You must round amounts to nearest whole dollar. 26

27 1 Minnesota net income or (loss)(see instructions) . . . . . . . . . . . . . . . . . . . . .1 . . 123456789 123456789 123456789 27

28 28

29 2 Nonapportionable income (loss) or . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2 . . . 123456789 123456789 123456789 29

30 30

31 3 Minnesota apportionable income (subtract line 2 from line 1) . . . . . . . . . . . 3 . 123456789 123456789 123456789 31

32 32

33 4 Apportionment factor . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4 . . . .123456789 123456789 123456789 33

34 34

35 5 Net apportionedincome to Minnesota (multiply line 3 by line 4) . . . . . . . . . . 5 . 123456789 123456789 123456789 35

36 36

37 6a Minnesota nonapportionable (income) loss or (see instructions) . . . . . . . . . 6a . 123456789 123456789 123456789 37

38 38

39 6b Minnesota nonunitary partnership (income) or loss (see instructions) . . . . 6b 123456789 123456789 123456789 39

40 40

41 7 Net operating loss deduction (15-year carryforward only) . . . . . . . . . . . . . . 7 . 123456789 123456789 123456789 41

42 42

43 8 Deduction received for dividends . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8 . . . 123456789 123456789 123456789 43

44 44

45 9 lines Add 6 through 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9 . . . .123456789 123456789 123456789 45

46 46

47 10 Taxable income (subtract line 9 from line 5) . . . . . . . . . . . . . . . . . . . . . . . .10 . . 123456789 123456789 123456789 47

48 48

49 11 Regular franchise tax (multiply line 10 by 9.8% [0.098]; 49

50 if result is zero or less, leave blank) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .11 . . . 123456789 123456789 123456789 50

51 51

52 12 Alternative minimum tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .12 . . . . 123456789 123456789 123456789 52

53 53

54 13 Subtotal (add lines 11 and 12) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13. . 123456789 123456789 123456789 54

55 55

56 14 Alternative minimum tax credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .14 . . . 123456789 123456789 123456789 56

57 57

58 15 Minnesota credit for increasing research activities . . . . . . . . . . . . . . 15 . . . . 123456789. . . 123456789 123456789 58

59 59

60 16 Credits against tax prior to fee minimum (add lines 14 and 15) . . . . . . . . . . 16 . 123456789 123456789 123456789 60

61 61

62 62

63 Continued next page 63

9995

2 4 6 8 10 12 14 16 18 20 22 24 26 28 30 32 34 36 38 40 42 44 46 48 50 52 54 56 58 60 62 64 66 68 70 72 74 76 78 80 82 84 86

65 65