Enlarge image

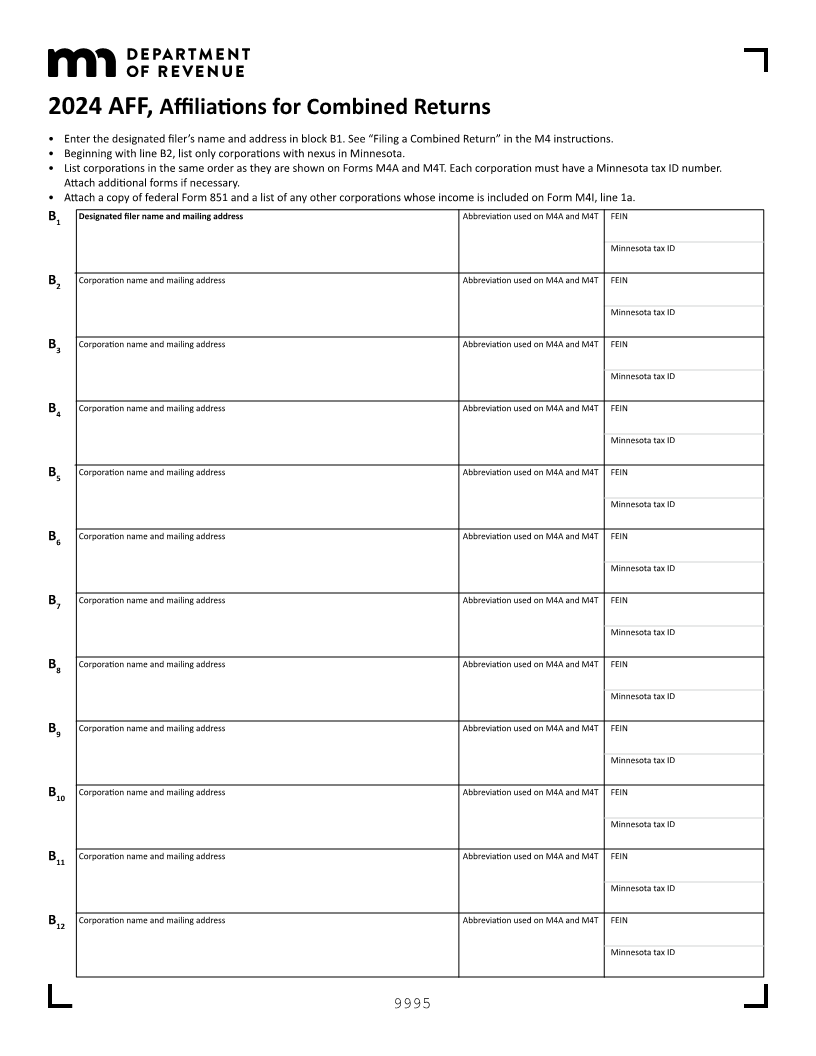

2024 AFF, Affiliations for Combined Returns

• Enter the designated filer’s name and address in block B1. See “Filing a Combined Return” in the M4 instructions.

• Beginning with line B2, list only corporations with nexus in Minnesota.

• List corporations in the same order as they are shown on Forms M4A and M4T. Each corporation must have a Minnesota tax ID number.

Attach additional forms if necessary.

• Attach a copy of federal Form 851 and a list of any other corporations whose income is included on Form M4I, line 1a.

B1 Designated filer name and mailing address Abbreviation used on M4A and M4T FEIN

Minnesota tax ID

B2 Corporation name and mailing address Abbreviation used on M4A and M4T FEIN

Minnesota tax ID

B3 Corporation name and mailing address Abbreviation used on M4A and M4T FEIN

Minnesota tax ID

B4 Corporation name and mailing address Abbreviation used on M4A and M4T FEIN

Minnesota tax ID

B5 Corporation name and mailing address Abbreviation used on M4A and M4T FEIN

Minnesota tax ID

B6 Corporation name and mailing address Abbreviation used on M4A and M4T FEIN

Minnesota tax ID

B7 Corporation name and mailing address Abbreviation used on M4A and M4T FEIN

Minnesota tax ID

B8 Corporation name and mailing address Abbreviation used on M4A and M4T FEIN

Minnesota tax ID

B9 Corporation name and mailing address Abbreviation used on M4A and M4T FEIN

Minnesota tax ID

B10 Corporation name and mailing address Abbreviation used on M4A and M4T FEIN

Minnesota tax ID

B11 Corporation name and mailing address Abbreviation used on M4A and M4T FEIN

Minnesota tax ID

B12 Corporation name and mailing address Abbreviation used on M4A and M4T FEIN

Minnesota tax ID

9995