Enlarge image

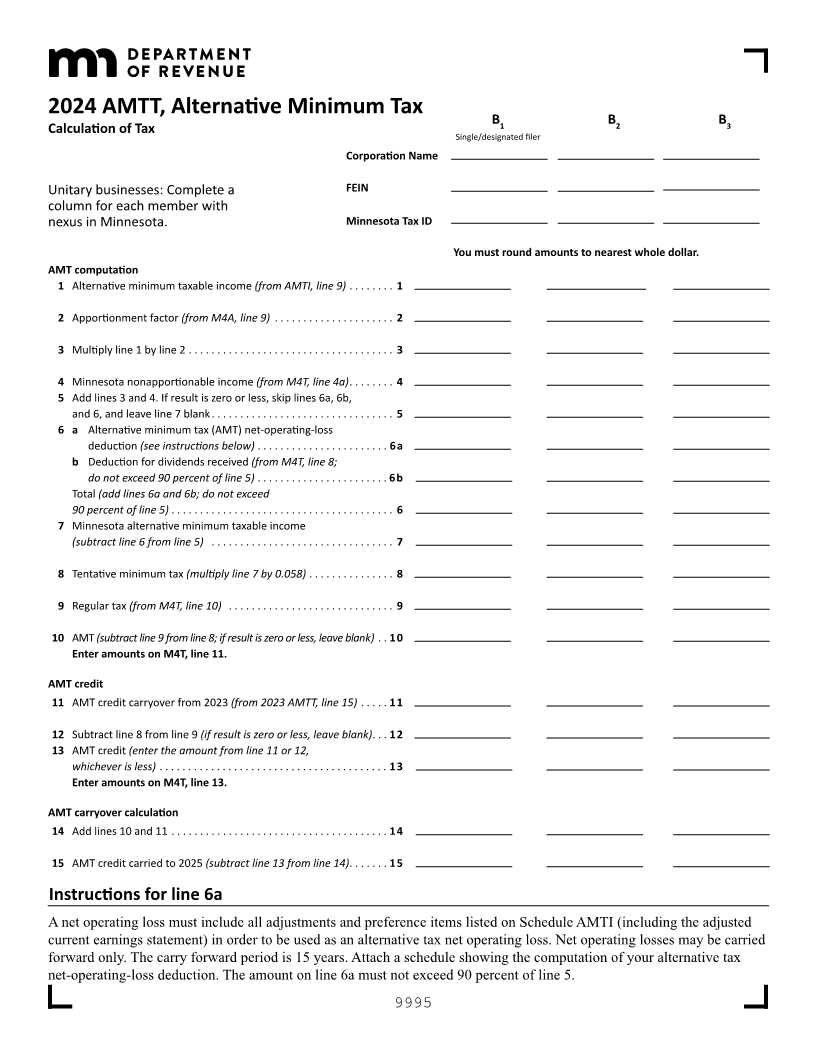

2024 AMTT, Alternative Minimum Tax

Calculation of Tax B1 B2 B3

Single/designated filer

Corporation Name

Unitary businesses: Complete a FEIN

column for each member with

nexus in Minnesota. Minnesota Tax ID

You must round amounts to nearest whole dollar.

AMT computation

1Alternative minimum taxable income (from AMTI, line 9) . . . . . . . . 1

2 Apportionment factor (from M4A, line 9) . . . . . . . . . . . . . . . . . . . . . 2

3 Multiply line 1 by line 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Minnesota nonapportionable income (from M4T, line 4a) . . . . . . . . 4

5 Add lines 3 and 4. If result is zero or less, skip lines 6a, 6b,

and and6, leave 7 blankline . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

6 a Alternative taxminimum net-operating-loss(AMT)

deduction (see instructions below) . . . . . . . . . . . . . . . . . . . . . . . 6a

b Deduction for dividends received (from M4T, line 8;

do not exceed 90 percent of line 5) . . . . . . . . . . . . . . . . . . . . . . . 6b

Total (add lines 6a and 6b; do not exceed

90 percent of line 5) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

7 Minnesota alternative minimum taxable income

(subtract line 6 from line 5) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

8 Tentative minimum tax (multiply line 7 by 0.058) . . . . . . . . . . . . . . . 8

9 Regular tax (from M4T, line 10) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

10 AMT (subtract line 9 from line 8; if result is zero or less, leave blank) . . 10

Enter amounts on M4T, line 11.

AMT credit

11 AMT credit carryover from 2023 (from 2023 AMTT, line 15) . . . . . 11

12 Subtract line 8 from line 9 (if result is zero or less, leave blank) . . . 12

13 AMT credit (enter the amount from line 11 or 12,

whichever is less) .. ..... ....... ..... ...... ...... ..... .... 13

Enter amounts on M4T, line 13.

AMT carryover calculation

14 Add lines 10 and 11 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

15 AMT credit carried to 2025 (subtract line 13 from line 14) . . . . . . . 15

Instructions for line 6a

A net operating loss must include all adjustments and preference items listed on Schedule AMTI (including the adjusted

current earnings statement) in order to be used as an alternative tax net operating loss. Net operating losses may be carried

forward only. The carry forward period is 15 years. Attach a schedule showing the computation of your alternative tax

net-operating-loss deduction. The amount on line 6a must not exceed 90 percent of line 5.

9995