Enlarge image

*246651*

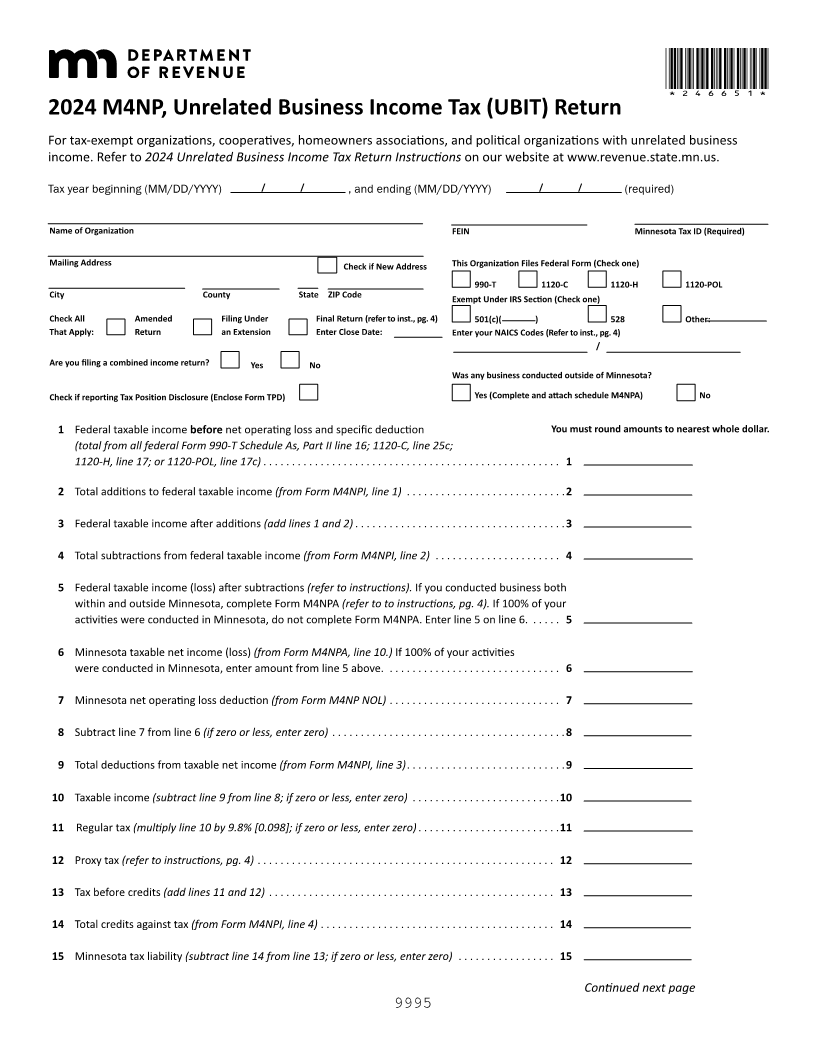

2024 M4NP, Unrelated Business Income Tax (UBIT) Return

For tax-exempt organizations, cooperatives, homeowners associations, and political organizations with unrelated business

income. Refer to 2024 Unrelated Business Income Tax Return Instructions on our website at www.revenue.state.mn.us.

Tax year beginning (MM/DD/YYYY) / / , and ending (MM/DD/YYYY) / / (required)

Name of Organization FEIN Minnesota Tax ID (Required)

Mailing Address Check if New Address This Organization Files Federal Form (Check one)

990-T 1120-C 1120-H 1120-POL

City County State ZIP Code Exempt Under IRS Section (Check one)

Check All Amended Filing Under Final Return (refer inst., pg. to 4) 501(c)( ) 528 Other:

That Apply: Return an Extension Enter Close Date: Enter your NAICS Codes (Refer to inst., pg. 4)

/

Are you filing a combined income return?Yes No

Was any business conducted outside of Minnesota?

Check if reporting Tax Position Disclosure (Enclose Form TPD) Yes (Complete and attach schedule M4NPA) No

1 Federal taxable incomebefore net operating loss and specific deduction You must round amounts to nearest whole dollar.

(total from all federal Form 990-T Schedule As, Part II line 16; 1120-C, line 25c;

1120-H, line 17; or 1120-POL, line 17c) ... ...... ..... ....... ..... ...... ..... ..... ...... .... 1

2 Total additions to federal taxable income (from Form M4NPI, line 1) .... ...... ...... ..... ...... . 2

3 Federal taxable income after additions (add lines 1 and 2) ... ...... ..... ....... ..... ...... ..... 3

4 Total subtractions from federal taxable income (from Form M4NPI, line 2) ... ...... ..... ...... .. 4

5 Federal taxable income (loss) after subtractions (refer to instructions). If you conducted business both

within and outside Minnesota, complete Form M4NPA (refer to to instructions, pg. 4). If 100% of your

activities were conducted in Minnesota, do not complete Form M4NPA. Enter line 5 on line 6. ... .. 5

6 Minnesota taxable net (loss)income (from Form M4NPA, 10.)line If 100% activitiesyour of

were conducted in Minnesota, enter amount from line 5 above. ... ...... ..... ...... ..... ..... 6

7 Minnesota net operating deductionloss (from Form M4NP NOL) ..... ...... ....... ..... ..... .. 7

8 Subtract from 7 line 6line (if zero or less, enter zero) .. ...... ...... ..... ...... ..... ...... ..... 8

9Total deductions from taxable net income (from Form M4NPI, line 3) ... ...... ..... ....... ..... .. 9

10 Taxable income (subtract line 9 from line 8; if zero or less, enter zero) .... ..... ...... ..... ...... 10

11 Regular tax (multiply line 10 by 9.8% [0.098]; or less, zero if enter zero) ... ...... ..... ....... .... 11

12 taxProxy (refer to instructions, pg. 4) ... ...... ..... ....... ..... ...... ..... ..... ...... .... 12

13 Tax before credits (add lines 11 and 12) ... ...... ..... ....... ..... ...... ..... ..... ...... .. 13

14 Total credits against tax (from Form M4NPI, line 4) ... ...... ..... ....... ..... ...... ..... .... 14

15 Minnesota tax liability (subtract line 14 from line 13; if zero or less, enter zero) .... ....... ..... . 15

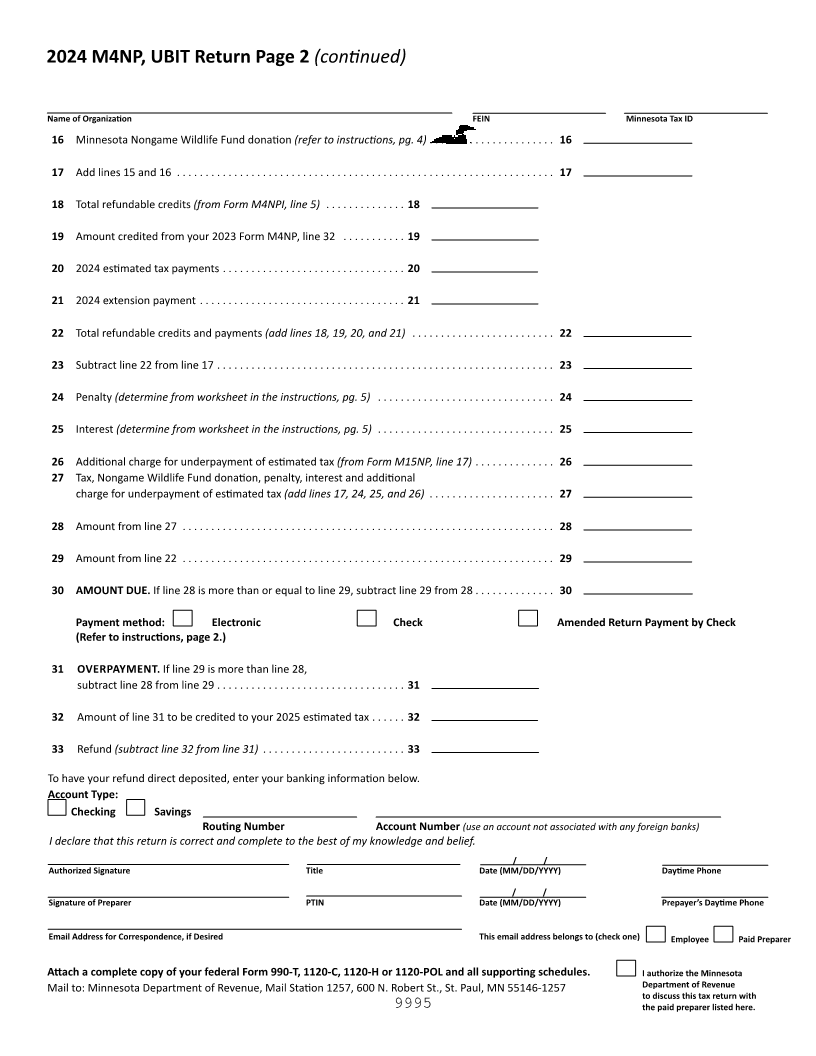

Continued next page

9995