Enlarge image

*246251*

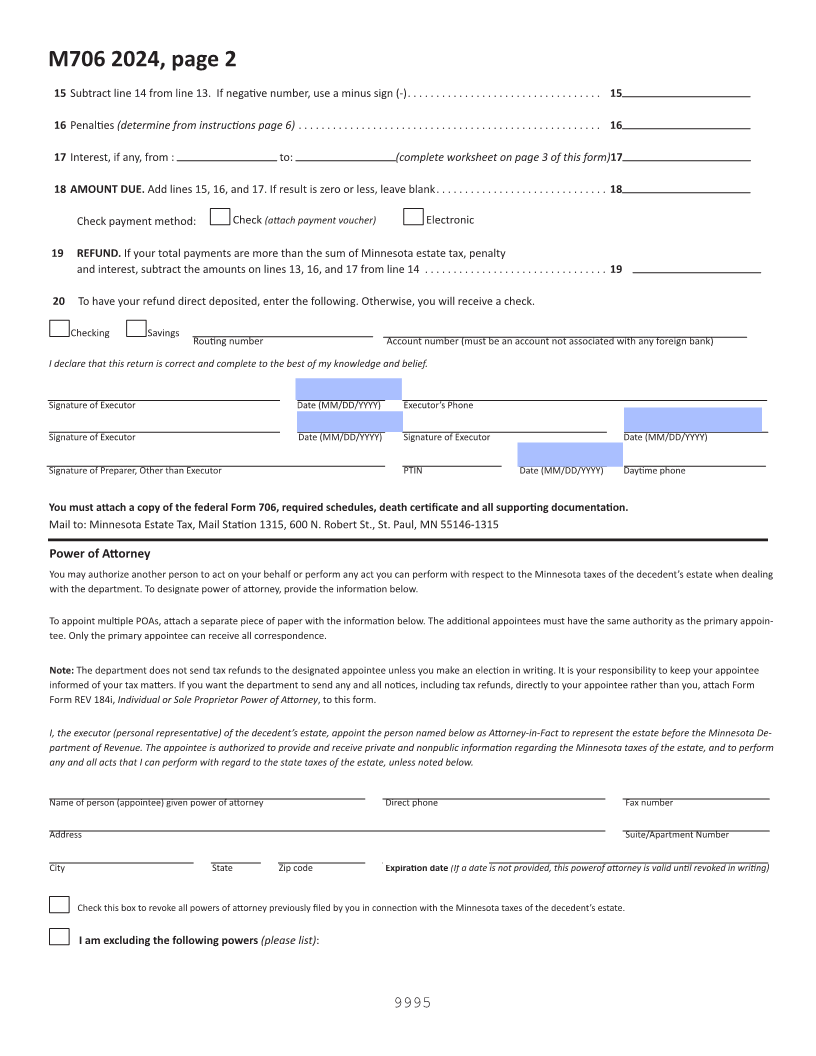

2024 Form M706, Estate Tax Return

Check box if amended return

For estates of a decedent whose date of death is in calendar year 2024 (Attach an explanation of change)

Decedent’s First Name, Middle Initial Last Name Decedent’s Social Security Number

/ /

Last Home Address Date of Death (MM/DD/YYYY)

City State ZIP Code Decedent’s Estate or Trust EIN

Executor’s first name, middle initial Executor’s Last Name Executor’s Social Security Number

Name of Firm (If Applicable) Executor’s Phone

Address City State ZIP Code

If filing under a federal filing extension, enter the extended due date (MM/DD/YYYY) (attach IRS approval): / /

(MM/DD/YYYY)

Check if:

You are electing the qualified small business property deduction You are electing the qualified farm property deduction

You received an extension for paying tax The decedent was a nonresident

You are filing a Tax Position Disclosure (enclose Form TPD) Round amounts to the nearest whole dollar.

1 Federal tentative taxable (fromestatefederal Form 706 line (3)(a)) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2 a Federal taxable gifts (from federal Form 706 line 4) . . . . . . . . . . . . . . . 2a

b Portion of line 2a made within three years of death . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2b

3 Any deduction taken for death taxes paid to a(fromforeignfederalcountryForm 706, Schedule K) . . . . . . . . . 3

4 Minnesota-Only QTIP property allowed on previously deceased spouse’s . . . . . . . . . . . . . . . . estate tax4 return

5 Add lines 1, 2b, 3, and 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

6a Minnesota 2024 estate tax exclusion . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .6a 3,000,000

6b Enter the total value of any deduction for qualified small business

property or qualified farm property on Schedules M706Q, part 7, line 8 (Attach Schedule M706Q) . . . . . . . . . 6b

7 Minnesota-Only QTIP Property. Enter the amount from Worksheet(on page 3 ofAthis form) . . . . . . . . . . . . . . 7

8 Add lines 6a, 6b, . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . and 78

9 Subtract line 8 from line 5. This is your Minnesota taxable estate. If result . . . . . . . . is9zero or less, leave blank

10 Determine value by applying the amount on line 9 to the 2024 rate table in the instructions. . . . . . . . . . . . . . 10

11 Multiply line 10 by the amount calculated on Worksheet B, step 7, on page 3 of this form . . . . . . . . . . . . . . . . 11

12 Nonresident decedent tax credit (determine from instructions, page 6) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

13 Minnesota estate tax (subtract line 12 from line 11). If result is zero or less, leave blank . . . . . . . . . . . . . . . . . . 13

14 Total payments, including any extension payments, made prior to filing this return . . . . . . . . . . . . . . . . . . . . . . 14

9995