Enlarge image

1 1

2 4 6 8 10 12 14 16 18 20 22 24 26 28 30 32 34 36 38 40 42 44 46 48 50 52 54 56 58 60 62 64 66 68 70 72 74 76 78 80 82 84 86

3 NEAR FINAL DRAFT 8/1/24 3

4 4

5 5

6 *244411* 6

7 7

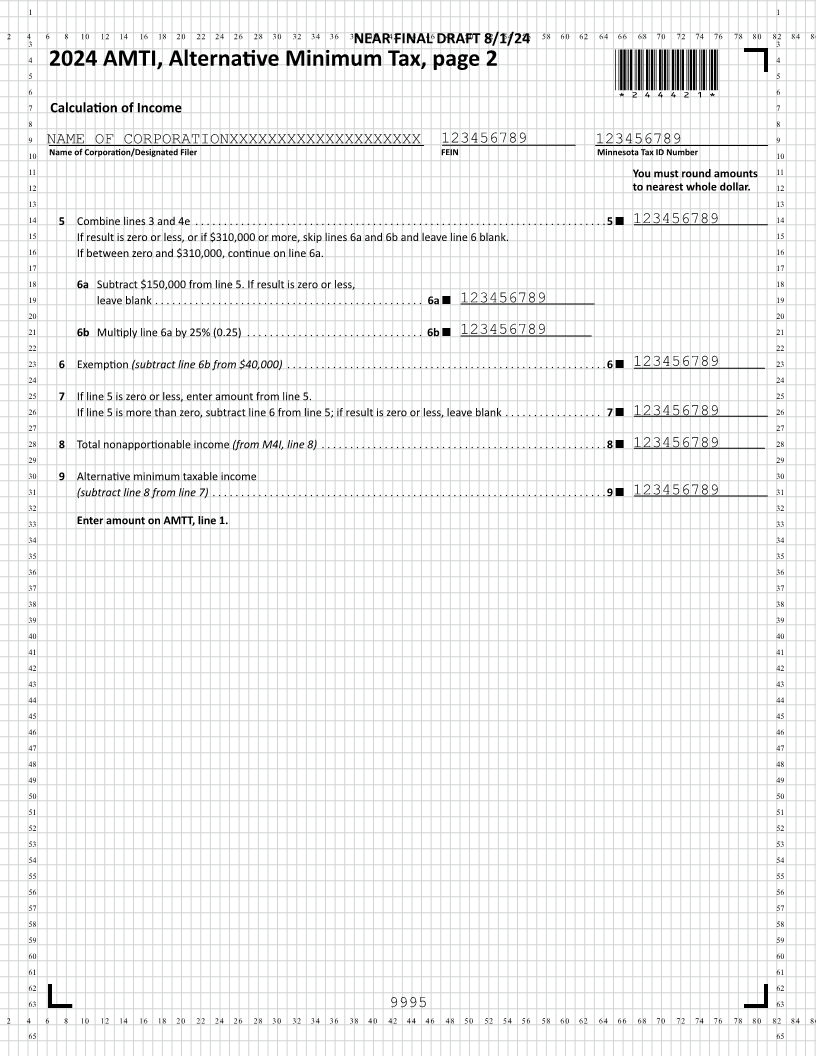

AMTI Alternative2024 Minimum Tax ,

8 8

9 Calculation of Income 9

10 10

11 NAME OF CORPORATIONXXXXXXXXXXXXXXXXXXXX 123456789 123456789 11

12 Name of Corporation/Designated Filer FEIN Minnesota Tax ID Number 12

13 You must round amounts 13

14 to nearest whole dollar. 14

15 15

16 1 Minnesota net income (from M4I, line 7) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 123456789 16

17 2 Adjustments and preferences 17

18 a Depreciation of post-1986 property . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2a 123456789 18

19 19

20 b Amortization of certified pollution control facilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2b 123456789 20

21 21

22 c Amortization of mining exploration and development costs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2c 123456789 22

23 23

24 d Amortization of circulation expenditures (personal holding companies only) . . . . . . . . . . . . . . . . . . . . . . . . 2d 123456789 24

25 25

26 e Adjusted gain or loss . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2e 123456789 26

27 27

28 f Long-term contracts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2f 123456789 28

29 29

30 g Merchant marine capital construction funds . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2g 123456789 30

31 31

32 hSection deduction833(b) (Blue Cross, Blue Shield, and similar type organizations only) . . . . . . . . . . . . . . . 2h . 123456789 32

33 33

34 i Tax shelter farm activities (personal service corporations only) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2i 123456789 34

35 35

36 j Passive activities (closely held corporations and personal service corporations only) . . . . . . . . . . . . . . . . . . . . 2j 123456789 36

37 37

38 k Loss limitations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2k 123456789 38

39 39

40 l Intangible drilling costs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2l 123456789 40

41 41

42 m Other adjustments and preferences . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2m 123456789 42

43 43

44 3 Pre-adjustment alternative minimum taxable income. Combine lines 1 through 2m . . . . . . . . . . . . . . . . . . . . . . 3 123456789 44

45 45

46 4 Adjusted current earnings (ACE) adjustment 46

47 a ACE from line 9 of the ACE worksheet . . . . . . . . . . . . . . . . . . . . . . . . . . 4a 123456789 47

48 b Subtract line 3 from line 4a. If line 3 exceeds line 4a, 48

49 enter the difference as a negative amount. (See instructions) . . . . . . . .4b 123456789 49

50 50

51 c Multiply line 4b by 75% (0.75). Enter the result as a positive amount . .4c 123456789 51

52 d Enter the excess, if any, of the corporation’s total increases in 52

53 AMTI from prior year ACE adjustments over its total reductions in 53

54 AMTI from prior year ACE adjustments. See instructions. . . . . . . . . . . 4d 123456789 54

55 Note: You must enter an amount on line 4d (even if line 4b is positive) 55

56 e ACE adjustment 56

57 • If line 4b is zero or more, enter the amount from line 4c 57

58 • If line 4b is less than zero, enter the smaller of line 4c or line 4d as a negative amount . . . . . . . . . . . . . . .4e 123456789 58

59 59

60 60

61 61

62 Continued next page 62

63 63

9995

2 4 6 8 10 12 14 16 18 20 22 24 26 28 30 32 34 36 38 40 42 44 46 48 50 52 54 56 58 60 62 64 66 68 70 72 74 76 78 80 82 84 86

65 65