Enlarge image

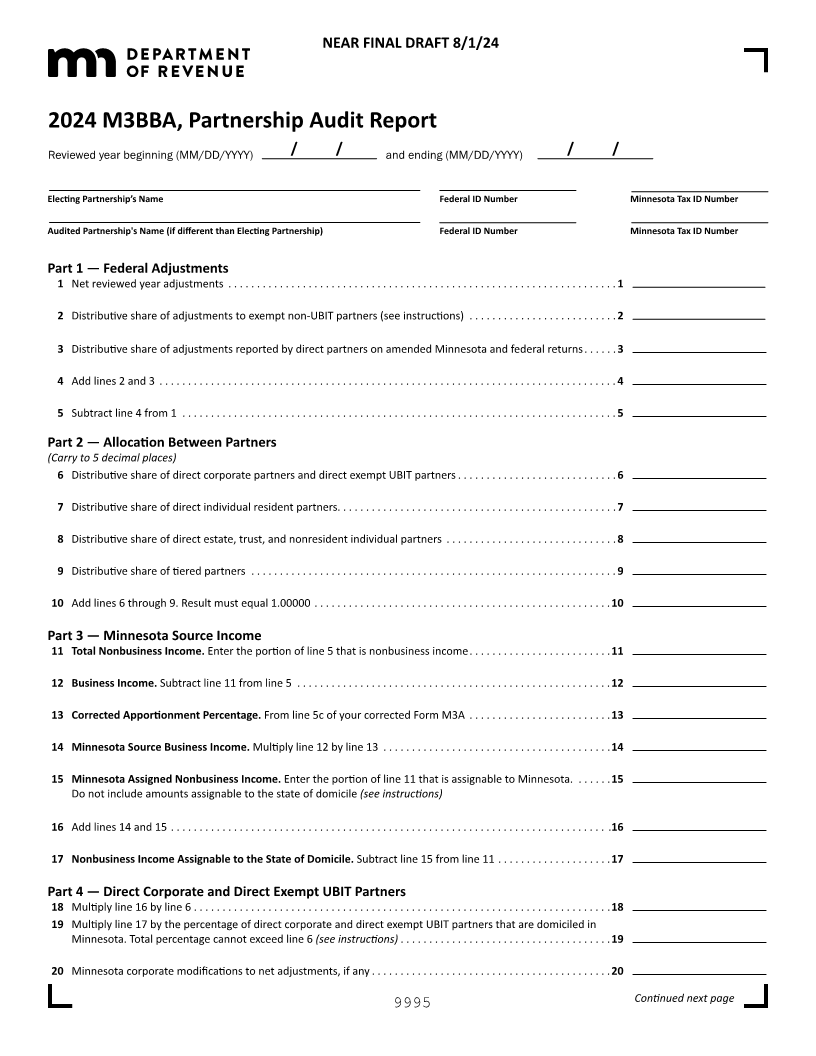

NEAR FINAL DRAFT 8/1/24

2024 M3BBA, Partnership Audit Report

Reviewed year beginning (MM/DD/YYYY) / / and ending (MM/DD/YYYY) / /

Electing Partnership’s Name Federal ID Number Minnesota Tax ID Number

Audited Partnership's Name (if different than Electing Partnership) Federal ID Number Minnesota Tax ID Number

Part 1 — Federal Adjustments

1 Net reviewed year adjustments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2Distributive share adjustmentsof to exempt non-UBIT partners instructions)(see . . . . . . . . . . . . . . . . . . . . . . . . 2. .

3 Distributive share of adjustments reported by direct partners on amended Minnesota and federal returns . . . . . . 3

4 Add lines 2 and 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

5 Subtract line 4 from 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

Part 2 — Allocation Between Partners

(Carry to 5 decimal places)

6Distributive share directof corporate partners and direct exempt partnersUBIT . . . . . . . . . . . . . . . . . . . . . . . . . . 6. .

7 Distributive share of direct individual resident partners . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

8 Distributive share of direct estate, trust, and nonresident individual partners . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

9 Distributive share of tiered partners . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

10 Add through6 lines 9. Result must equal 1.00000 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .10 . . . .

Part 3 — Minnesota Source Income

Total11 Nonbusiness Income. Enter the portion line of 5 that incomeis nonbusiness . . . . . . . . . . . . . . . . . . . . . . .11 . .

12 Business Income. Subtract line 11 from line 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

13 Corrected Apportionment Percentage. From line 5c of your corrected Form M3A . . . . . . . . . . . . . . . . . . . . . . . . . 13

14 Minnesota Source Business Income. Multiply line 12 by line 13 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

15 Minnesota Assigned Nonbusiness Income. Enter the portion of that11 line is assignable to Minnesota. . . . . . 15.

Do not include amounts assignable to the state of domicile (see instructions)

16 Add lines 14 and 15 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .16

17 Nonbusiness Income Assignable to the State of Domicile. Subtract line 15 from line 11 . . . . . . . . . . . . . . . . . . . . 17

Part 4 — Direct Corporate and Direct Exempt UBIT Partners

18 Multiply line 16 by line 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18

19 Multiply line 17 by the percentage of direct corporate and direct exempt UBIT partners that are domiciled in

Minnesota. Total percentage cannot exceed line 6 (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19

20 Minnesota corporate modifications to net adjustments, if any . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20

Continued next page

9995