Enlarge image

*247111*

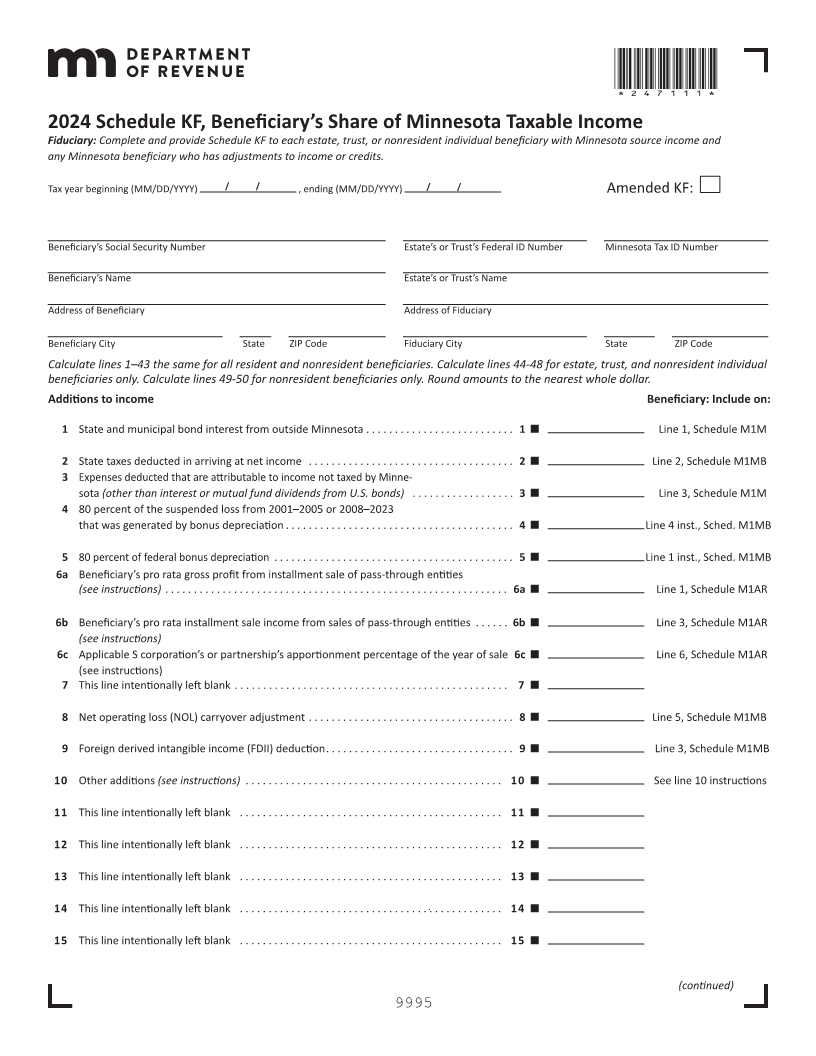

2024 Schedule KF, Beneficiary’s Share of Minnesota Taxable Income

Fiduciary: Complete and provide Schedule KF to each estate, trust, or nonresident individual beneficiary with Minnesota source income and

any Minnesota beneficiary who has adjustments to income or credits.

Tax year beginning (MM/DD/YYYY) / / , ending (MM/DD/YYYY) / / Amended KF:

Beneficiary’s Social Security Number Estate’s or Trust’s Federal ID Number Minnesota Tax ID Number

Beneficiary’s Name Estate’s or Trust’s Name

Address of Beneficiary Address of Fiduciary

Beneficiary City State ZIP Code Fiduciary City State ZIP Code

Calculate lines 1–43 the same for all resident and nonresident beneficiaries. Calculate lines 44-48 for estate, trust, and nonresident individual

beneficiaries only. Calculate lines 49-50 for nonresident beneficiaries only. Round amounts to the nearest whole dollar.

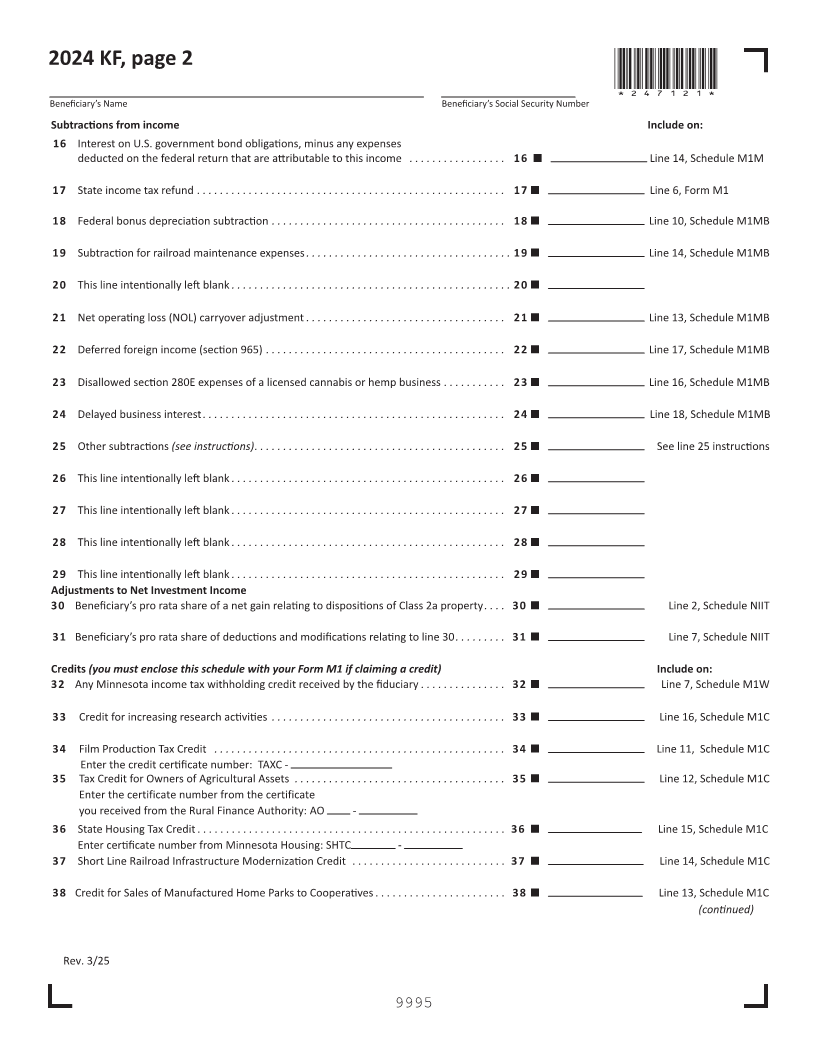

Additions to income Beneficiary: Include on:

1 State and municipal bond interest from outside Minnesota ... ...... ..... ....... ..... 1 Line 1, Schedule M1M

2 State taxes deducted in arriving at net income .... ...... ...... ..... ...... ...... ... 2 Line 2, Schedule M1MB

3 Expenses deducted that are attributable to income not taxed by Minne-

sota (other than interest or mutual fund dividends from U.S. bonds) . . . . . . . . . . . . . . . . . . 3 Line 3, Schedule M1M

4 80 percent of the suspended loss from 2001–2005 or 2008–2023

that was generated by bonus depreciation ... ...... ..... ....... ..... ...... ..... ... 4 Line 4 inst., Sched. M1MB

5 80 percent of federal bonus depreciation ... ...... ..... ....... ..... ...... ..... ..... 5 Line 1 inst., Sched. M1MB

6a Beneficiary’s pro rata gross profit from installment sale of pass-through entities

....... ..... ..... ... ...... ...... ...... ..... ...... ..... instructions) ......(see 6a Line Schedule1, M1AR

6b Beneficiary’s pro rata installment sale income from sales of pass-through entities . . . . . . 6b Line 3, Schedule M1AR

(see instructions)

6c Applicable S corporation’s partnership’sor apportionment percentage theof year of sale 6c Line 6, Schedule M1AR

(see instructions)

7 This line intentionally left blank . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

8 Net operating loss (NOL) carryover adjustment ... ...... ....... ..... ..... ...... .... 8 Line 5, Schedule M1MB

9 Foreign derived intangible income (FDII) deduction ... ...... ..... ....... ..... ...... . 9 Line 3, Schedule M1MB

10 Other additions (see instructions) . ...... ..... ...... ..... ....... ..... ..... ..... 10 See line 10 instructions

11 This line intentionally left blank .. ..... ....... ..... ...... ..... ...... ..... ..... 11

12 This line intentionally left blank .. ..... ....... ..... ...... ..... ...... ..... ..... 12

13 This line intentionally left blank .. ..... ....... ..... ...... ..... ...... ..... ..... 13

14 This line intentionally left blank .. ..... ....... ..... ...... ..... ...... ..... ..... 14

15 This line intentionally left blank .. ..... ....... ..... ...... ..... ...... ..... ..... 15

(continued)

9995