Enlarge image

NEAR FINAL DRAFT 8/1/24

*241151*

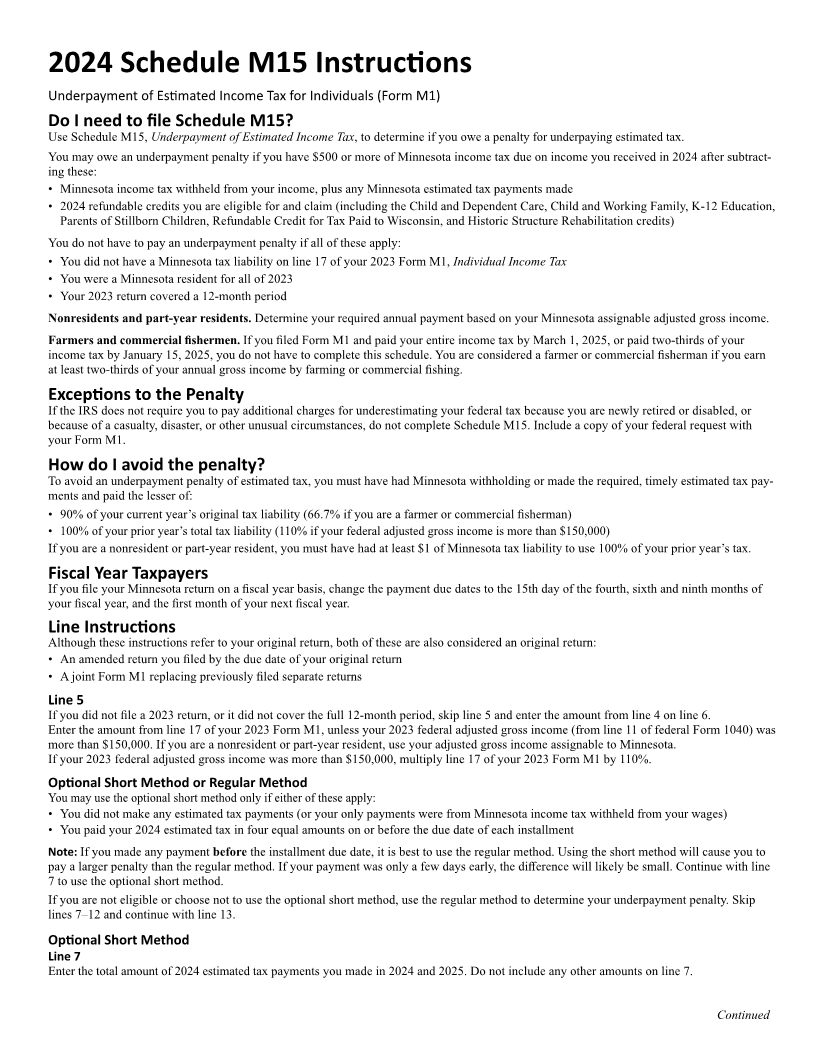

2024 Schedule M15, Underpayment of Estimated Income Tax

For Individuals (Form M1)

Your First Name and Initial Last Name Social Security Number

Required Annual Payment

1 Minnesota income tax for 2024 (from line 17 of Form M1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2 Minnesota withholding and credits for 2024 (add lines 20 and 22 of Form M1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3 Subtract line 2 from line 1 . If less than $500, STOP HERE; you do not owe an underpayment penalty . . . . . . . . . . 3

4 Multiply line 1 by 90% (.90). Farmers and commercial fishermen: Multiply line 1 by 66.7% (.667) . . . . . . . . . . . . . 4

5 Minnesota income tax for 2023 (from line 17 of Form M1). See instructions if your 2023 federal adjusted

gross income was more than $150,000 or if you did not file a 2023 return . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

6 Required annual payment. Amount from line 4 or line 5, whichever is less . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .6. .

• If line 6 is less than or equal to line 2, STOP HERE; you do not owe an underpayment penalty.

• If line 6 is more than line 2, continue with line 7 or line 13, depending on which method you use.

Optional Short Method (see instructions to determine which method to use)

7 Quarterly estimated tax payments you made for 2024 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

8 Add line 2 and line 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

9 Total underpayment for the year. Subtract line 8 from line 6

(if result is zero or less, STOP HERE; you do not owe an underpayment penalty) . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

10 Multiply line 9 by 2% (.02) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

11 • If the amount on line 9 will be paid on or after April 15, 2025, enter 0.

• If the amount was paid before April 15, 2025, use the following computation

and enter the result on line 11:

Number of days

Amount on line 9 paid before 4/15/25

x x .000137 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

12 Penalty. Subtract 11 line 10. Enterfrom line result here and on line of Form M1 27 . . . . . . . . . . . . . . . . . . . . . .12. .

A B C D

Regular Method April 15, 2024 June 15, 2024 Sept . 15, 2024 Jan . 15, 2025

13 Enter 25% (.25) of line 6 in each column OR use the

annualized income installment worksheet on the

back of this form . If you use the worksheet or

are a farmer or fisherman, see instructions . . . . . . . . . . . . 13

14 Credits. instructionsSee . . . . . . . . . . . . . . . . . . . . . . . . . . 14. .

15 Overpayment. If line 14 is more than line 13, subtract

line 13 from line 14. Enter the result here and add it

to line 14 in the next column. Overpayments in any

quarter following an underpayment must first be

applied to making up previous underpayments . . . . . . . . . 15

16 Underpayment. If line 14 is less than line 13,

subtract line 14 from line 13. Enter the result

here and go to line 17 below . . . . . . . . . . . . . . . . . . . . . . . . 16

17 Enter the date of payment or April 15, 2025,

whichever is earlier (see instructions) . . . . . . . . . . . . . . . . . 17

18 Number of days between the payment due date

and the date on line 17 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18

19 Divide line 18 by 365. The result is a decimal . . . . . . . . . . . 19 . . . .

20 Multiply line 19 by 5% (.05). Enter as a decimal . . . . . . . . . 20 . . . .

21 Multiply line 20 by line 16 . . . . . . . . . . . . . . . . . . . . . . . . . . 21

22 Penalty. columns Add A-D 21. Enteron line result here and line 27 on of Form M1 . . . . . . . . . . . . . . . . . . . . . . .22. .

You must include this schedule with your Form M1.

9995