Enlarge image

NEAR FINAL DRAFT 8/30/24

*241331*

2024 Schedule M1NR, Nonresidents/Part-Year Residents

Before you complete this schedule, read the instructions and complete lines 1 through 11 of Form M1.

Your First Name and Initial Your Last Name Your Social Security Number

Spouse’s First Name and Initial Spouse’s Last Name Spouse’s Social Security Number

Residency (Place an X in one box and enter other state of residency)

You: Full-year Nonresident Part-Year Resident from to State of Residency:

(MM/DD/YYYY) (MM/DD/YYYY)

Your Spouse: Full-year Nonresident Part-Year Resident from to State of Residency:

(MM/DD/YYYY) (MM/DD/YYYY)

A. Total Amount B. Minnesota Portion

1 Wages, salaries, tips, etc. (from line 1z of federal Form 1040 or 1040-SR) ... ..... ....... 1

2 Taxable interest and ordinary dividend income (lines 2b and 3b of Form 1040 or 1040-SR) . 2

3 Business income or loss (from line 3 of federal Schedule 1) ... ...... ..... ....... ..... . 3

4 Capital gain or loss (from line 7 of Form 1040 or 1040-SR) . ..... ..... ...... ..... ...... 4

5 IRA distributions, pensions, and annuities (from lines 4b and 5b of Form 1040 or 1040-SR) . 5

6 Net income from rents, royalties, partnerships, S corporations,

estates, and trusts (from line 5 of federal Schedule 1) ... ...... ..... ....... ..... ...... 6

7 Farm income or loss (from line 6 of federal Schedule 1) .... ...... ..... ...... ..... .... 7

8 Other income (add lines 6b of Form 1040 or 1040-SR and

lines 1, 2a, 4, 7, and 9 of federal Schedule 1) .. ...... ...... ...... ..... ...... ...... .. 8

9 Interest and dividends from non-Minnesota state or municipal bonds

(add lines 1 and 2 of Schedule M1M) .. ..... ...... ...... ..... ...... ...... ..... .... 9

10 Bonus depreciation addition from line 1 of Schedule M1MB .. ...... ...... ..... ....... 10

11 If you entered an amount on line 10 of Schedule M1REF, see instructions . . . . . . . . . . . . . . . 11

12 Suspended loss from line 4 of Schedule M1MB ... ...... ...... ..... ...... ...... ..... 12

13 Other required adjustments from Schedules M1M, M1MB, and M1AR (see instructions) ... 13

14 This line intentionally left blank ... ...... ..... ....... ..... ...... ..... ..... ...... .. 14

15 Add lines 1 through 14 for each column ... ...... ..... ....... ..... ...... ..... ..... . 15

If your Minnesota gross income is below $14,575 see instructions.

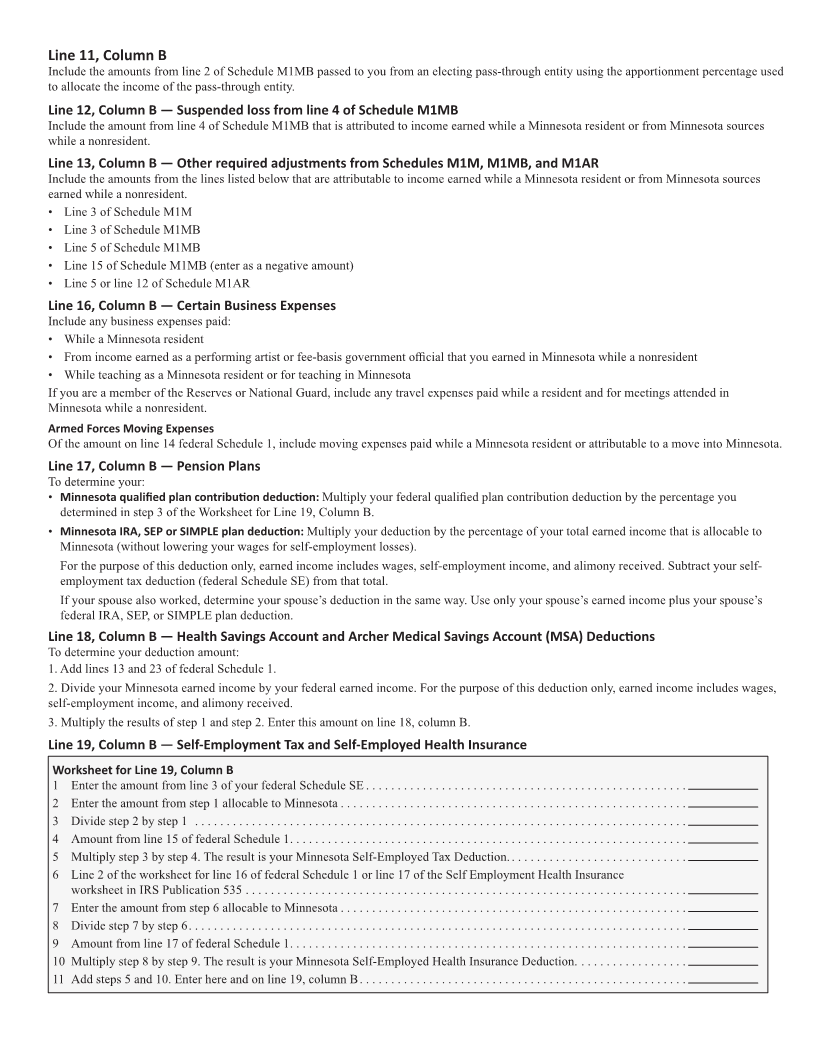

16 Educator expenses, certain business expenses, and Armed Forces moving expenses

(add lines 11, 12, and 14 of federal Schedule 1) ... ...... ..... ....... ..... ...... ..... 16

17 Self-employed SEP, SIMPLE, and qualified plans and IRA deduction

(add lines 16 and 20 of federal Schedule 1) ... ...... ..... ...... ..... ...... ..... .... 17

18 Health savings account and Archer MSA deductions

(add lines 13 and 23 of federal Schedule 1) ... ...... ..... ...... ..... ...... ..... .... 18

19 One-half of self-employment tax and self-employed health insurance

(add lines 15 and 17 of federal Schedule 1) ... ...... ..... ...... ..... ...... ..... .... 19

20 Deductions for alimony paid and student loan interest

(see instructions for line 20, column B) ... ..... ...... ...... ..... ...... ..... ...... .. 20

9995