Enlarge image

NEAR FINAL DRAFT 8/1/24

*241381*

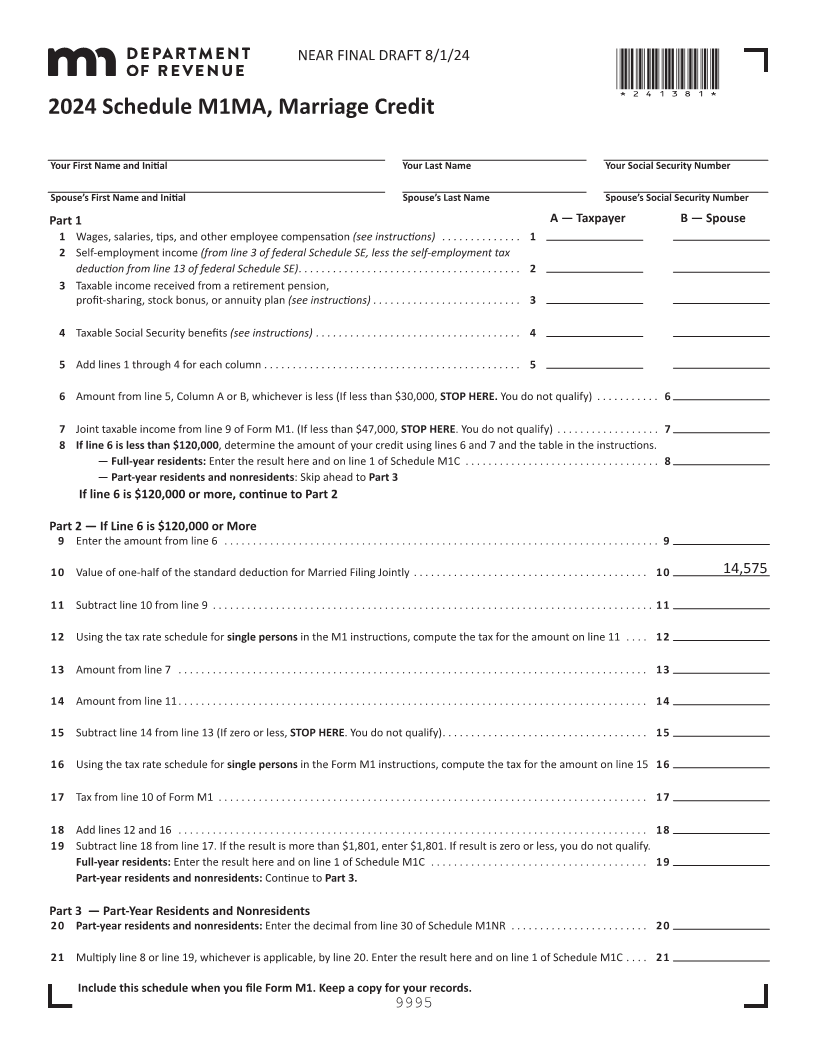

2024 Schedule M1MA, Marriage Credit

Your First Name and Initial Your Last Name Your Social Security Number

Spouse’s First Name and Initial Spouse’s Last Name Spouse’s Social Security Number

Part 1 A — Taxpayer B — Spouse

1 Wages, salaries, tips, and other employee compensation (see instructions) . . . . . . . . . . . . . . 1

2 Self-employment income (from line 3 of federal Schedule SE, less the self-employment tax

deduction from line 13 of federal Schedule SE) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3 Taxable income received from a retirement pension,

profit-sharing, stock bonus, or annuity plan (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Taxable Social Security benefits (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

5 Add lines 1 through 4 for each column . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

6 Amount from line 5, Column A or B, whichever is less (If less than $30,000, STOP HERE. You do not qualify) . . . . . . . . . . . 6

7 taxableJoint from income 9line M1.Form of less (If than $47,000, STOP HERE. You qualify)not do ... ...... ..... .... 7

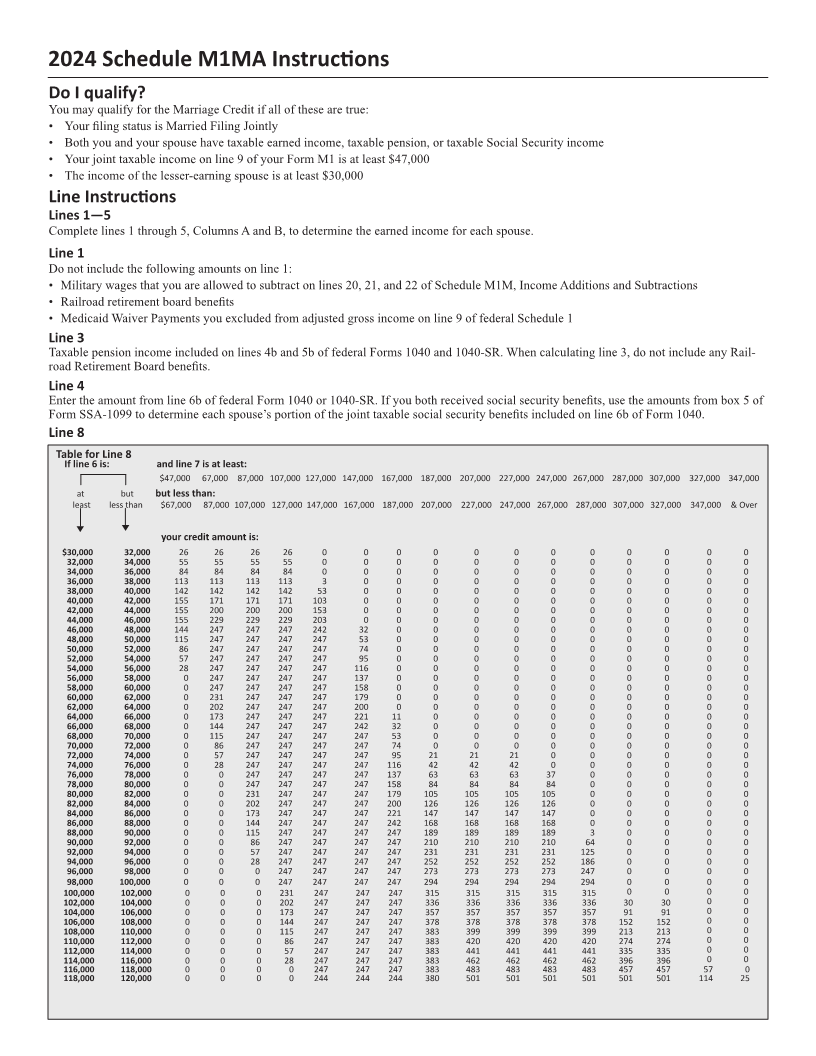

8 If line 6 is less than $120,000 determine , the amount andof credit 6 using lines your and7 the table in the instructions.

— Full-year residents: Enter the result here and on line 1 of Schedule M1C .... ....... ..... ..... ...... ...... . 8

— Part-year residents and nonresidents: Skip ahead to Part 3

If line 6 is $120,000 or more, continue to Part 2

Part 2 — If Line 6 is $120,000 or More

9 Enter the amount from line 6 .... ...... ..... ...... ..... ....... ..... ..... ...... ...... ..... ...... ...... .... 9

10 Value of one-half of the standard deduction for Married Filing Jointly ... ...... ..... ....... ..... ...... ..... .... 10 14,575

11 Subtract line 10 from line 9 ... ...... ..... ....... ..... ...... ..... ..... ...... ...... ...... ..... ...... ..... . 11

12 theUsing tax rate schedule for single persons in the instructions, M1 compute the tax thefor amount on .11 line ... 12

13 Amount from line 7 ... ..... ...... ...... ..... ...... ..... ...... ..... ...... ...... ...... ..... ...... ...... 13

14 Amount from line 11... ...... ..... ....... ..... ...... ..... ..... ...... ...... ...... ..... ...... ..... ...... 14

15Subtract line zero 14 from (If or less, 13 line STOP HERE. do You qualify)...not ...... ..... ....... ..... ...... .... 15

16 Using the tax rate schedule for single persons in the Form M1 instructions, compute the tax for the amount on line 15 16

17 Tax from line 10 of Form M1 ... ...... ..... ....... ..... ...... ..... ..... ...... ...... ...... ..... ...... .... 17

18 Add lines 12 and 16 . ..... ..... ...... ..... ....... ..... ...... ..... ..... ...... ...... ...... ...... ..... ... 18

19 Subtract line 18 from line 17. If the result is more than $1,801, enter $1,801. If result is zero or less, you do not qualify.

Full-year residents: Enter the result here and on line 1 of Schedule M1C ...... ...... ...... ..... ..... ...... .... 19

Part-year residents and nonresidents: Continue to Part 3.

Part 3 — Part-Year Residents and Nonresidents

20 Part-year residents and nonresidents: Enter the decimal Scheduleline 30 of from M1NR . ...... ..... ..... ....... 20

21 Multiply line 8 or line 19, whichever is applicable, by line 20. Enter the result here and on line 1 of Schedule M1C ... . 21

Include this schedule when you file Form M1. Keep a copy for your records.

9995