Enlarge image

NEAR FINAL DRAFT 8/30/24

*241551*

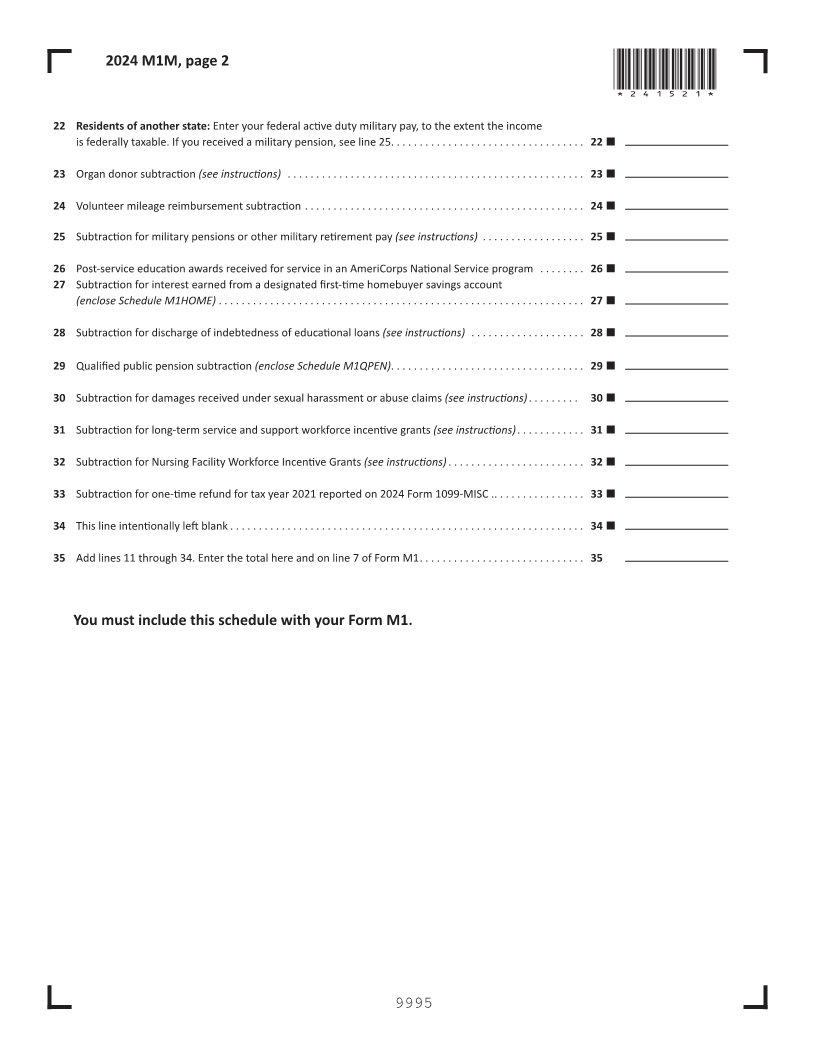

2024 Schedule M1M, Income Additions and Subtractions

Complete this schedule to determine line 2 and line 7 of Form M1.

Your First Name and Initial Your Last Name Your Social Security Number

Additions to Income

1 Interest from municipal bonds of another state or its governmental units

included on line 2a of federal Form 1040 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2 Federally tax-exempt dividends from mutual funds investing in bonds of another state

or its governmental units included on line 2a of federal Form 1040 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3 Expenses deducted on your federal return attributable to income not taxed

by Minnesota (other than interest or mutual fund dividends from U.S. bonds) . . . . . . . . . . . . . . . . . . . . . . . . 3

4Capital gain portion aof distributionlump-sum (from line 6 of federal Form 4972; enclose Form 4972) . . . 4

5 Addition from line 7 of Schedule M1HOME (enclose Schedule M1HOME) . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

6 Distributions from higher education savings accounts K-12 for tuitionused (see instructions) . . . . . . . . . . . 6.

7 This intentionallyline left blank . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .7. . . .

8 This intentionallyline left blank . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .8. . . .

9 This intentionallyline left blank . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9. . . .

10 Add lines 1 through 9 . Enter the total here and on line 2 of Form M1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

Subtractions from Income

11 If you are not filing Schedule M1SA, and your charitable contributions

were more than $500, see instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

12 Social Security benefit subtraction (determine from worksheet in instructions) . . . . . . . . . . . . . . . . . . . . . . . 12

13 Education expenses you paid for your qualifying children in grades K–12 (see instructions)

Enter the name and grade of each child on the line below . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

14 Net interest or mutual fund dividends from U.S. bonds (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

15 Subtraction for contributions to a qualified education savings plan (enclose Schedule M1529) . . . . . . . . . . 15

16 Subtraction for persons age 65 or older, or permanently and totally disabled (enclose Schedule M1R) . . . 16

17 Railroad Retirement Board benefits (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17

18 If you are a resident of Michigan or North Dakota filing Form M1 only to receive a refund of all Minnesota

tax withheld, enter the amount from line 1 of Form M1. If the amount is zero or less, enter 0 . . . . . . . . . . 18

• Place an X in one box to indicate the reciprocity state

of which you were a resident during 2024 . . . . . . . . . . . . . . . . . . . . . . . . Michigan North Dakota

19 Subtraction of reservation income for American Indians (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . 19

20 Federal active-duty military pay received for services performed while a Minnesota

resident, to the extent the income is federally taxable. If you received a military pension, see line 25 . . . . 20

21 Minnesota National Guard members and reservists: See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21.

9995