Enlarge image

1 1

2 4 6 8 10 12 14 16 18 20 22 24 26 28 30 32 34 36 38 40 42 44 46 48 50 52 54 56 58 60 62 64 66 68 70 72 74 76 78 80 82 84 86

3 3

4 NEAR FINAL DRAFT 8/1/24 4

5 5

6 *241391* 6

7 7

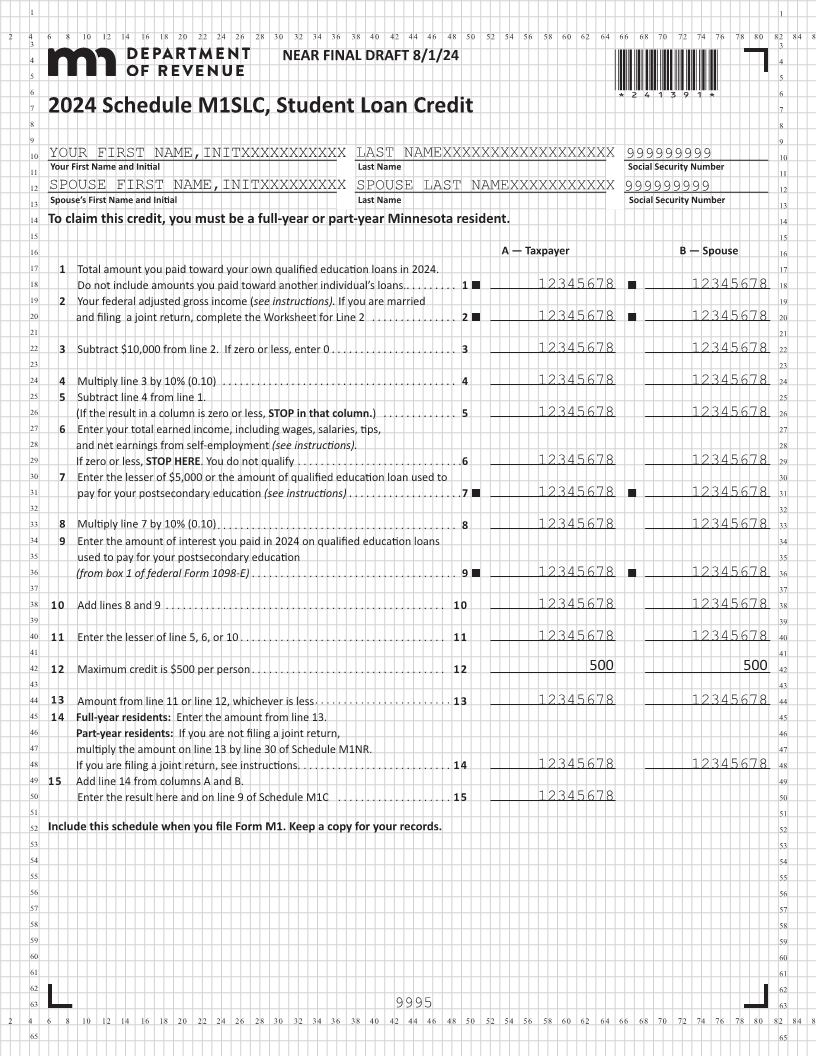

2024 Schedule M1SLC, Student Loan Credit

8 8

9 9

10 YOUR FIRST NAME,INITXXXXXXXXXXX LAST NAMEXXXXXXXXXXXXXXXXXX 999999999 10

11 Your First Name and Initial Last Name Social Security Number 11

12 SPOUSE FIRST NAME,INITXXXXXXXXX SPOUSE LAST NAMEXXXXXXXXXXX 999999999 12

13 Spouse’s First Name and Initial Last Name Social Security Number 13

14 To claim this credit, you must be a full-year or part-year Minnesota resident. 14

15 15

16 A — Taxpayer B — Spouse 16

17 1 Total amount you paid toward your own qualified education loans in 2024. 17

18 Do not include amounts you paid toward another individual’s loans. . . . . . . . . . 1 12345678 12345678 18

19 2 Your federal adjusted gross income (see instructions). If you are married 19

20 and filing a joint return, complete the Worksheet for Line 2 . . . . . . . . . . . . . . . 2 12345678 12345678 20

21 21

22 3 Subtract $10,000 from line 2. If zero or less, enter 0 . . . . . . . . . . . . . . . . . . . . . . 3 12345678 12345678 22

23 23

24 4 Multiply line 3 by 10% (0.10) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4 12345678 12345678 24

25 5 Subtract line 4 from line 1. 25

26 (If the result in a column is zero or less, STOP in that column.) . . . . . . . . . . . . . 5 12345678 12345678 26

27 6 Enter your total earned income, including wages, salaries, tips, 27

28 and net earnings from self-employment (see instructions). 28

29 If zero or less, STOP HERE. You do not qualify .. ..... ....... ..... ...... .... 6 12345678 12345678 29

30 7 Enter the lesser of $5,000 or the amount of qualified education loan used to 30

31 pay for postsecondaryyour education (see instructions) . . . . . . . . . . . . . . . . . . . .7 12345678 12345678 31

32 32

33 8 Multiply line 7 by 10% (0.10)... ...... ..... ....... ..... ...... ..... ..... 8 12345678 12345678 33

34 9 Enter the amount of interest you paid in 2024 on qualified education loans 34

35 used to pay for your postsecondary education 35

36 (from box 1 of federal Form 1098-E) ... ...... ..... ....... ..... ...... .... 9 12345678 12345678 36

37 37

38 10 Add lines 8 and 9 ... ...... ..... ....... ..... ...... ..... ..... ...... . 10 12345678 12345678 38

39 39

40 11 Enter the lesser of line 5, 6, or 10 ... ...... ..... ....... ..... ...... .... 11 12345678 12345678 40

41 41

42 12 Maximum credit $500is per person... ...... ..... ....... ..... ...... .. 12 500 500 42

43 43

44 13 Amount from line 11 or line 12, whichever is less... ...... ..... ....... ... 13 12345678 12345678 44

45 14 Full-year residents: amountthe Enter 13.from line 45

46 Part-year residents: If you are not filing a joint return, 46

47 multiply the amount on line 13 by line 30 of Schedule M1NR. 47

48 If you are filing a joint return, see instructions. ... ...... ..... ....... ..... 14 12345678 12345678 48

49 15 Add line 14 from columns A and B. 49

50 the Enter result andhere on line 9 Schedule of ......M1C ...... ..... ... 15 12345678 50

51 51

52 Include this schedule when you file Form M1. Keep a copy for your records. 52

53 53

54 54

55 55

56 56

57 57

58 58

59 59

60 60

61 61

62 62

63 9995 63

2 4 6 8 10 12 14 16 18 20 22 24 26 28 30 32 34 36 38 40 42 44 46 48 50 52 54 56 58 60 62 64 66 68 70 72 74 76 78 80 82 84 86

65 65