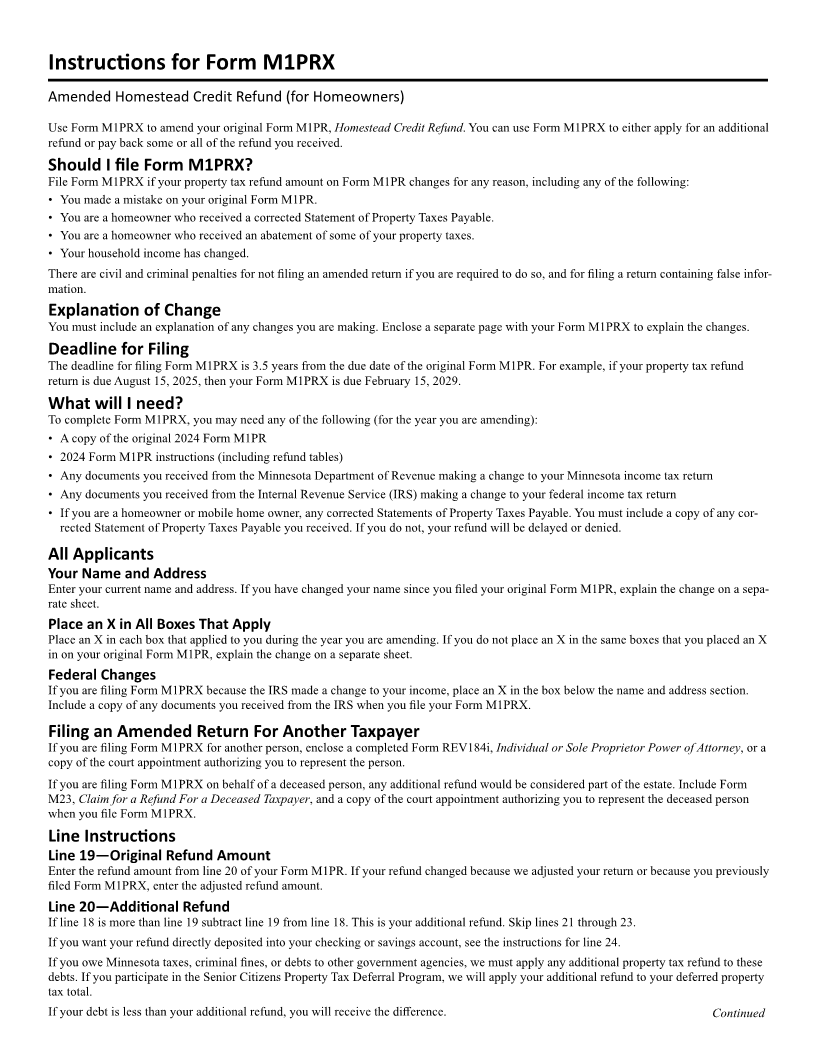

Enlarge image

NEAR FINAL DRAFT 8/1/24

*245811*

2024 Form M1PRX, Amended Homestead Credit Refund

You will need the 2024 Form M1PR instructions, including refund tables, to complete this form. Do not use staples on anything you submit.

Your First Name and Initial Last Name Your Social Security Number Your Date of Birth (MM/DD/YYYY)

If a Joint Return, Spouse’s First Name and Initial Spouse’s Last Name Spouse’s Social Security Number Spouse’s Date of Birth

Check if Address is: New Foreign

Current Home Address

Check if Mobile Homeowner

City State ZIP Code

Department use only:

Effective interest date:

Property ID Number County where property is located

Check this box if your income changed because of a federal adjustment. Enclose a complete copy of the federal adjustment.

1 Federal adjusted gross income M1, Form instructionssee (from line of 1 notdid if you M1)file Form . . . . . . . . . . . 1

2 Nontaxable Social Security and/or Railroad Retirement Board benefits (see instructions) . . . . . . . . . . . . . . . . . . . . . 2

3 Deduction for contributions to a qualified retirement plan instructions)(see . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Total government assistance payments (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

5 Co-occupant Income (from line 13 of Worksheet 5 - Co-occupant Income. If negative, enter as a negative) . . . . . . 5

6 Additional Nontaxable Income. Add the amounts on column B below (see instructions) . . . . . . . . . . . . . . . . . . . . . 6

A — Type of Income B — Income Amount

a1 b1

a2 b2

a3 b3

7 Add lines 1 through 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

Subtraction for 65 or older (born before January 2, 1960) or disabled:

8

If you (or your spouse if filing a joint return) are age 65 or older or are disabled, enter $5,050: . . . . . . . . . . . . . . . 8

Check the box if you or your spouse are: (A) 65 or Older (B) Disabled

9 Dependent Subtraction: Enter your subtraction for dependents (use worksheet in instructions) . . . . . . . . . . . . . . 9

Number of dependents: Names and Social Security numbers:

10 Retirement Account Subtraction (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

11 Total other subtractions (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

Subtraction type

12 Add lines 8 through 11 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

13 Subtract line 12 from line 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

9995