Enlarge image

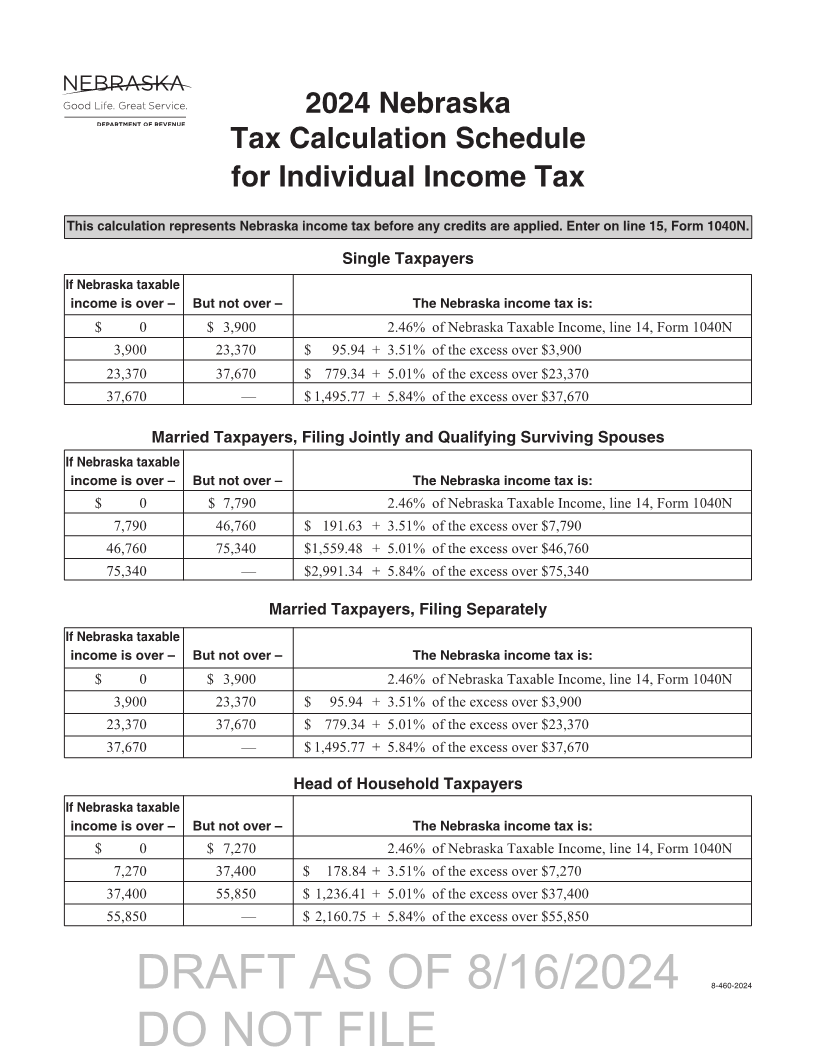

2024 Nebraska

Tax Calculation Schedule

for Individual Income Tax

This calculation represents Nebraska income tax before any credits are applied. Enter on line 15, Form 1040N.

Single Taxpayers

If Nebraska taxable

income is over – But not over – The Nebraska income tax is:

$ 0 $ 3,900 2.46% of Nebraska Taxable Income, line 14, Form 1040N

3,900 23,370 $ 95.94 + 3.51% of the excess over $3,900

23,370 37,670 $ 779.34 + 5.01% of the excess over $23,370

37,670 –– $ 1,495.77 + 5.84% of the excess over $37,670

Married Taxpayers, Filing Jointly and Qualifying Surviving Spouses

If Nebraska taxable

income is over – But not over – The Nebraska income tax is:

$ 0 $ 7,790 2.46% of Nebraska Taxable Income, line 14, Form 1040N

7,790 46,760 $ 191.63 + 3.51% of the excess over $7,790

46,760 75,340 $1,559.48 + 5.01% of the excess over $46,760

75,340 –– $2,991.34 + 5.84% of the excess over $75,340

Married Taxpayers, Filing Separately

If Nebraska taxable

income is over – But not over – The Nebraska income tax is:

$ 0 $ 3,900 2.46% of Nebraska Taxable Income, line 14, Form 1040N

3,900 23,370 $ 95.94 + 3.51% of the excess over $3,900

23,370 37,670 $ 779.34 + 5.01% of the excess over $23,370

37,670 –– $ 1,495.77 + 5.84% of the excess over $37,670

Head of Household Taxpayers

If Nebraska taxable

income is over – But not over – The Nebraska income tax is:

$ 0 $ 7,270 2.46% of Nebraska Taxable Income, line 14, Form 1040N

7,270 37,400 $ 178.84 + 3.51% of the excess over $7,270

37,400 55,850 $ 1,236.41 + 5.01% of the excess over $37,400

55,850 –– $ 2,160.75 + 5.84% of the excess over $55,850

8-460-2024

DRAFT AS OF 8/16/2024

DO NOT FILE