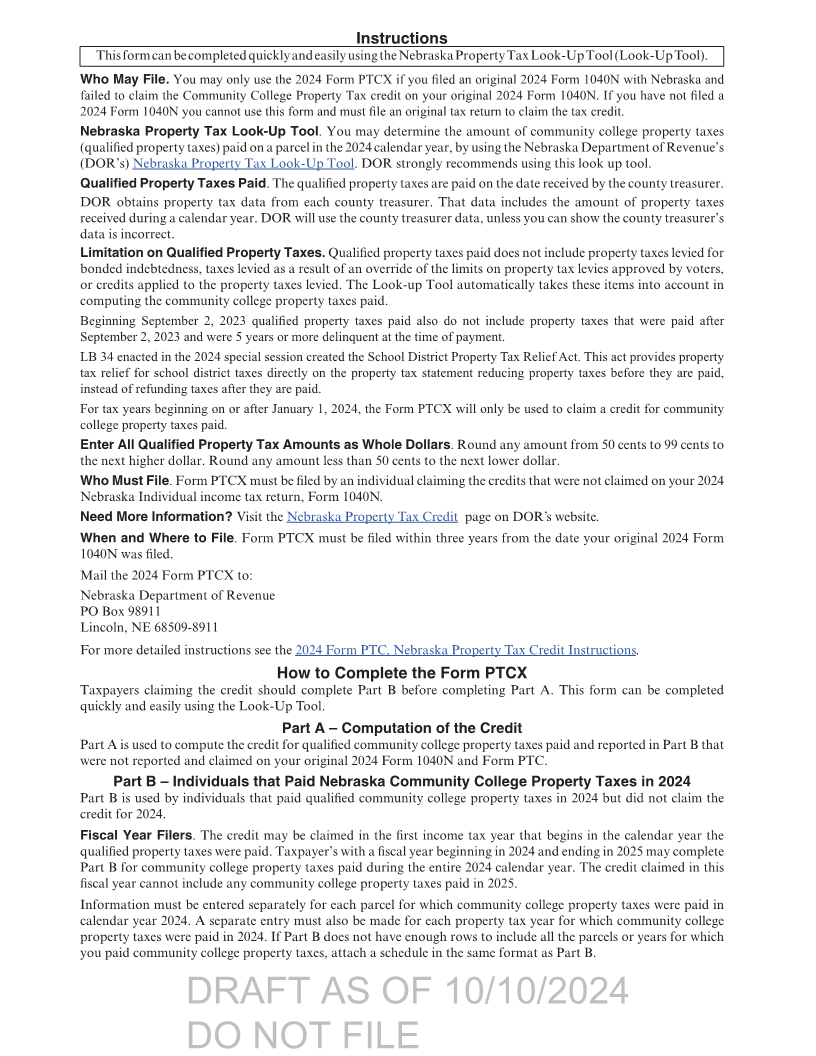

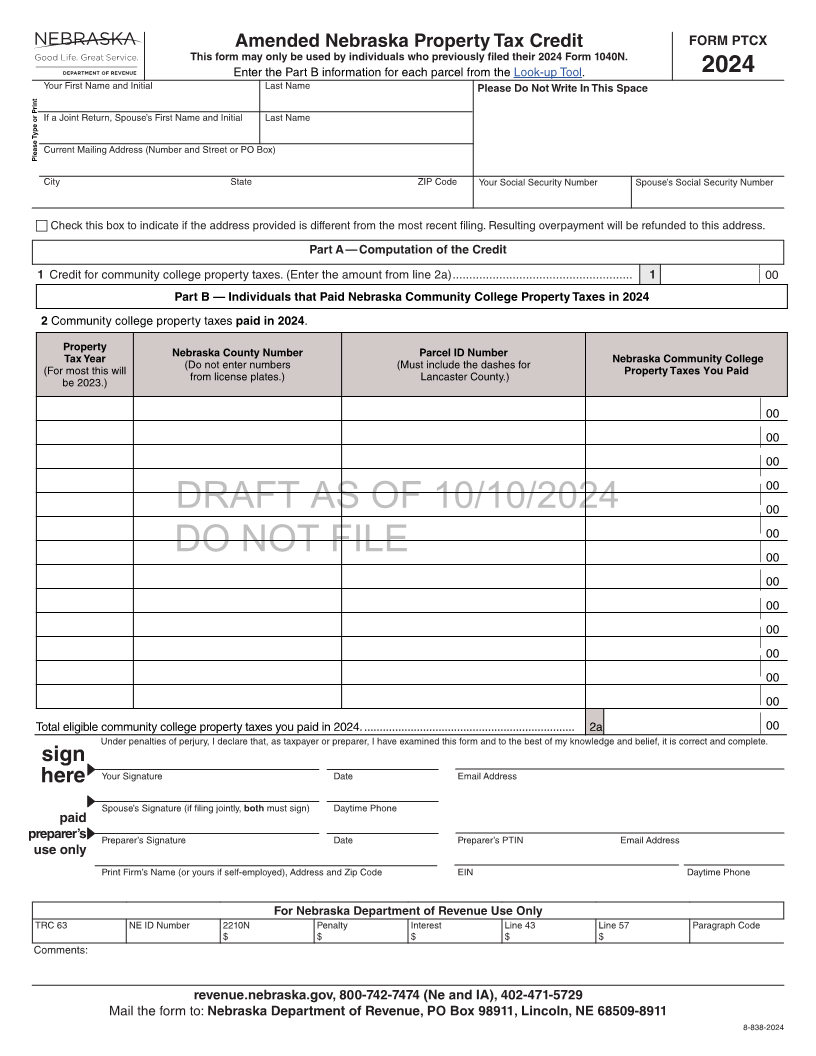

Enlarge image

Amended Nebraska Property Tax Credit FORM PTCX

This form may only be used by individuals who previously filed their 2024 Form 1040N.

Enter the Part B information for each parcel from the Look-up Tool. 2024

Your First Name and Initial Last Name Please Do Not Write In This Space

If a Joint Return, Spouse’s First Name and Initial Last Name

Please Type or Print Current Mailing Address (Number and Street or PO Box)

City State ZIP Code Your Social Security Number Spouse’s Social Security Number

c Check this box to indicate if the address provided is different from the most recent filing. Resulting overpayment will be refunded to this address.

Part A — Computation of the Credit

1 Credit for community college property taxes. (Enter the amount from line 2a) ...................................................... 1 00

Part B — Individuals that Paid Nebraska Community College Property Taxes in 2024

2 Community college property taxes paid in 2024.

Property Nebraska County Number Parcel ID Number Nebraska Community College

Tax Year (Do not enter numbers (Must include the dashes for Property Taxes You Paid

(For most this will from license plates.) Lancaster County.)

be 2023.)

00

00

00

00

DRAFT AS OF 10/10/2024 00

00

DO NOT FILE 00

00

00

00

00

00

00

Total eligible community college property taxes you paid in 2024. .................................................................... 2a 00

Under penalties of perjury, I declare that, as taxpayer or preparer, I have examined this form and to the best of my knowledge and belief, it is correct and complete.

sign

here Your Signature Date Email Address

Spouse’s Signature (if filing jointly, both must sign) Daytime Phone

paid

preparer’s Preparer’s Signature Date Preparer’s PTIN Email Address

use only

Print Firm’s Name (or yours if self-employed), Address and Zip Code EIN Daytime Phone

For Nebraska Department of Revenue Use Only

TRC 63 NE ID Number 2210N Penalty Interest Line 43 Line 57 Paragraph Code

$ $ $ $ $

Comments:

revenue.nebraska.gov, 800-742-7474 (Ne and IA), 402-471-5729

Mail the form to: Nebraska Department of Revenue, PO Box 98911, Lincoln, NE 68509-8911

8-838-2024