Enlarge image

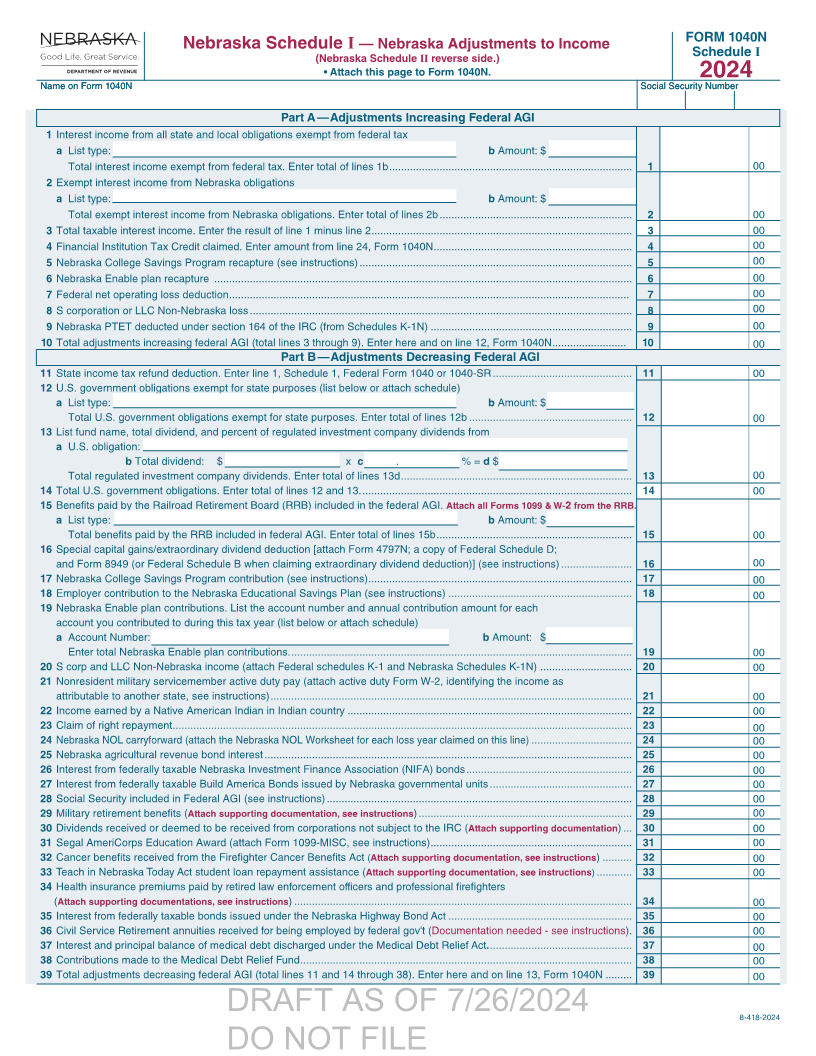

FORM 1040N

Nebraska Schedule I — Nebraska Adjustments to Income

(Nebraska Schedule IIreverse side.) Schedule I

• Attach this page to Form 1040N. 2024

Name on Form 1040N Name on Form 1040N SocialSocial SecuritySecurNumberity Number

Part A — Adjustments Increasing Federal AGI

1 Interest income from all state and local obligations exempt from federal tax

a List type: b Amount: $

Total interest income exempt from federal tax. Enter total of lines 1b .................................................................................. 1 00

2 Exempt interest income from Nebraska obligations

a List type: b Amount: $

Total exempt interest income from Nebraska obligations. Enter total of lines 2b ................................................................. 2 00

3 Total taxable interest income. Enter the result of line 1 minus line 2 ........................................................................................ 3 00

4 Financial Institution Tax Credit claimed. Enter amount from line 24, Form 1040N ................................................................... 4 00

5 Nebraska College Savings Program recapture (see instructions) ............................................................................................ 5 00

6 Nebraska Enable plan recapture ............................................................................................................................................. 6 00

7 Federal net operating loss deduction ....................................................................................................................................... 7 00

8 S corporation or LLC Non-Nebraska loss ................................................................................................................................. 8 00

9 Nebraska PTET deducted under section 164 of the IRC (from Schedules K-1N) .................................................................... 9 00

10 Total adjustments increasing federal AGI (total lines 3 through 9). Enter here and on line 12, Form 1040N ......................... 10 00

Part B — Adjustments Decreasing Federal AGI

11 State income tax refund deduction. Enter line 1, Schedule 1, Federal Form 1040 or 1040-SR ............................................... 11 00

12 U.S. government obligations exempt for state purposes (list below or attach schedule)

a List type: b Amount: $

Total U.S. government obligations exempt for state purposes. Enter total of lines 12b ....................................................... 12 00

13 List fund name, total dividend, and percent of regulated investment company dividends from

a U.S. obligation:

b Total dividend: $ x c . % = d$

Total regulated investment company dividends. Enter total of lines 13d .............................................................................. 13 00

14 Total U.S. government obligations. Enter total of lines 12 and 13. ........................................................................................... 14 00

15 Benefits paid by the Railroad Retirement Board (RRB) included in the federal AGI.Attach all Forms 1099 & W- 2from the RRB.

a List type: b Amount: $

Total benefits paid by the RRB included in federal AGI. Enter total of lines 15b .................................................................. 15 00

16 Special capital gains/extraordinary dividend deduction [attach Form 4797N; a copy of Federal Schedule D;

and Form 8949 (or Federal Schedule B when claiming extraordinary dividend deduction)] (see instructions) ........................ 16 00

17 Nebraska College Savings Program contribution (see instructions) ......................................................................................... 17 00

18 Employer contribution to the Nebraska Educational Savings Plan (see instructions) .............................................................. 18 00

19 Nebraska Enable plan contributions. List the account number and annual contribution amount for each

account you contributed to during this tax year (list below or attach schedule)

a Account Number: b Amount: $

Enter total Nebraska Enable plan contributions. ................................................................................................................... 19 00

20 S corp and LLC Non-Nebraska income (attach Federal schedules K-1 and Nebraska Schedules K-1N) ............................... 20 00

21 Nonresident military servicemember active duty pay (attach active duty Form W-2, identifying the income as

attributable to another state, see instructions) .......................................................................................................................... 21 00

22 Income earned by a Native American Indian in Indian country ................................................................................................ 22 00

23 Claim of right repayment ........................................................................................................................................................... 23 00

24 Nebraska NOL carryforward (attach the Nebraska NOL Worksheet for each loss year claimed on this line) .................................. 24 00

25 Nebraska agricultural revenue bond interest ............................................................................................................................ 25 00

26 Interest from federally taxable Nebraska Investment Finance Association (NIFA) bonds ........................................................ 26 00

27 Interest from federally taxable Build America Bonds issued by Nebraska governmental units ................................................ 27 00

28 Social Security included in Federal AGI (see instructions) ....................................................................................................... 28 00

29 Military retirement benefits (Attach supporting documentation, see instructions) ........................................................................ 29 00

30 Dividends received or deemed to be received from corporations not subject to the IRC (Attach supporting documentation) ... 30 00

31 Segal AmeriCorps Education Award (attach Form 1099-MISC, see instructions) .................................................................... 31 00

32 Cancer benefits received from the Firefighter Cancer Benefits Act (Attach supporting documentation, see instructions) .......... 32 00

33 Teach in Nebraska Today Act student loan repayment assistance (Attach supporting documentation, see instructions) ............ 33 00

34 Health insurance premiums paid by retired law enforcement officers and professional firefighters

(Attach supporting documentations, see instructions) .................................................................................................................. 34 00

35 Interest from federally taxable bonds issued under the Nebraska Highway Bond Act .............................................................. 35 00

36 Civil Service Retirement annuities received for being employed by federal gov't (Documentation needed - see instructions) . 36 00

37 Interest and principal balance of medical debt discharged under the Medical Debt Relief Act . ................................................ 37 00

38 Contributions made to the Medical Debt Relief Fund ................................................................................................................ 38 00

39 Total adjustments decreasing federal AGI (total lines 11 and 14 through 38). Enter here and on line 13, Form 1040N ......... 39 00

DRAFT AS OF 7/26/2024 8-418-2024

DO NOT FILE