Enlarge image

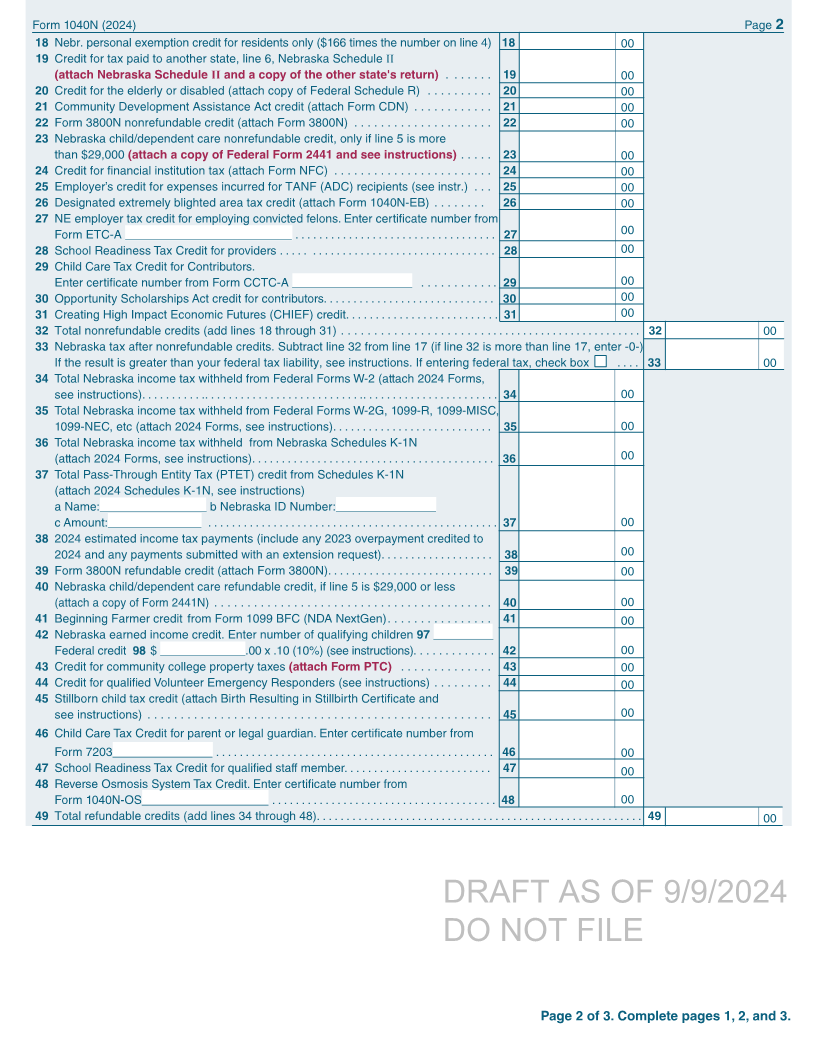

FORM 1040N

Nebraska Individual Income Tax Return

for the taxable year January 1, 2024 through December 31, 2024 or other taxable year:

, 2024 through , 2024

Your First Name and Middle Initial Last Name Please Do Not Write In This Space

If a Joint Return, Spouse’s First Name and Middle Initial Last Name

Current Mailing Address (Number and Street or PO Box)

Please Type or Print City State ZIP Code

Your Social Security Number Spouse’s Social Security Number High School District Code

During 2024, did you receive, sell, exchange, gift, or otherwise dispose of a digital asset or a financial interest in a digital asset? Yes No

(1) Farmer/Rancher (2) Active Military (1) Deceased Taxpayer(s)

(first name & date of death):

1 Federal Filing Status:

(1) Single (3) Married, filing separately – Spouse’s SSN: (4) Head of Household

(2) Married, filing jointly and Full Name (5) Qualifying surviving spouse (QSS)

2a Check if YOU were: (1) 65 or older (2) Blind 2bCheck here if someone (such as your parent) can claim you or

SPOUSE was: (3) 65 or older (4) Blind your spouse as a dependent: (1) You (2) Spouse

3 Type of Return:

(1) Resident (2) Partial-year resident from / , 2024 to / , 2024 (attach Schedule III)

(3) Nonresident (attach Schedule III)

4 Nebraska personal exemptions . (Enter 1 in each line of 4a or 4b that applies):

a Yourself. If someone can claim you as a dependent, leave blank . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4.a ______

b Spouse. Married filing jointly returns, if someone can claim your spouse as a dependent leave blank . . . . . . 4.b ______

c Dependents, if more than three, see instructions Dependent's

First Name Last Name Social Security Number

Total number of

dependents listed . . . . 4 c ______

Total Nebraska personal exemptions – add lines 4a, 4b, and 4c . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

5 Federal adjusted gross income (AGI) (line 11, Federal Form 1040 or 1040-SR) Do not leave blank . . . . . . . . . 5 00

6 Nebraska standard deduction (if you checked any boxes on line 2a or 2b above,

see instructions; otherwise, enter $8,350 if single; $16,700 if married, filing jointly or

qualifying surviving spouse; $8,350 if married, filing separately; or $12,250 if head of

household) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6 00

7 Total itemized deductions (line 17, Federal Schedule A – see instructions) . . . . . . .7 00

8 State and local income taxes (line 5a, Schedule A, Federal Form 1040 or 1040-SR) 8 00

9 Nebraska itemized deductions (line 7 minus line 8) . . . . . . . . . . . . . . . . . . . . . . . . . 9 00

10 Nebraska standard deduction or the Nebraska itemized deductions, whichever is greater

(the larger of line 6 or line 9) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10 00

11 Nebraska income before adjustments (line 5 minus line 10) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11 00

12 Adjustments increasing federal AGI (line 10, from attached Nebraska Schedule I) . 12. 00

13 Adjustments decreasing federal AGI (line 39, from attached Nebraska Schedule I) 13 00

14 Nebraska Taxable Income (enter line 11 plus line 12 minus line 13) . If less than -0-, enter -0- . Residents

complete lines 15 and 16 . Partial-year residents and nonresidents complete Nebr . Sch . III before continuing . 14 00

15 Nebraska income tax (Partial-year residents and nonresidents enter the result

from line 9, Nebraska Schedule III . Paper filers may use the Nebraska Tax Table .

All others must use Tax Calculation Schedule .) . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15 00

16 Nebraska other tax calculation:

a Federal Tax on Lump-Sum Distributions (Federal Form 4972) 16 a $ ___________

b Federal tax on early distributions (lesser of Federal DRAFT AS OF 9/ /20249

Form 5329 or line 8, Sch . 2, Federal Form 1040 or 1040-SR) 16 b $ ___________

c Total (add lines 16a and 16b) . . . . . . . . . . . . . . . . . . . . . . . 16 c $ ___________DO NOT FILE

Residents multiply line 16c by 29 .6% (x .296) and enter the result on line 16 .

Partial-year residents and nonresidents enter the result from line 10,

Nebraska Schedule III . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16 00

17 Total Nebraska tax before Nebraska personal exemption credit (add lines 15 and 16) .

Do not pay the amount on this line . Pay the amount from line 53 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17 00

Page 1 of 3. Complete pages 1, 2, and 3.

8-417-2024