Enlarge image

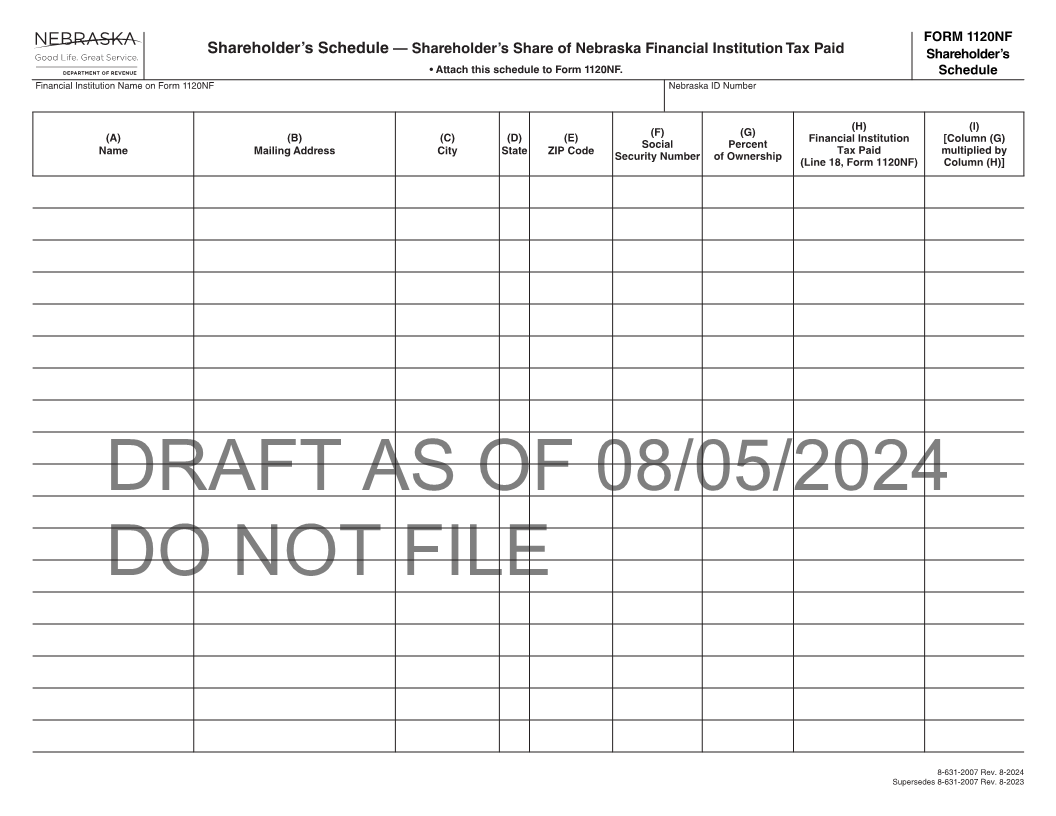

FORM 1120NF

Shareholder’s Schedule — Shareholder’s Share of Nebraska Financial Institution Tax Paid Shareholder’s

• Attach this schedule to Form 1120NF. Schedule

Financial Institution Name on Form 1120NF Nebraska ID Number

(A) (B) (C) (D) (E) (F) (G) (H) (I)

Name Mailing Address City State ZIP Code Social Percent Financial Institution [Column (G)

Security Number of Ownership Tax Paid multiplied by

(Line 18, Form 1120NF) Column (H)]

DRAFT AS OF 08/05/2024

DO NOT FILE

8-631-2007 Rev. 8-2024

Supersedes 8-631-2007 Rev. 8-2023