- 5 -

Enlarge image

|

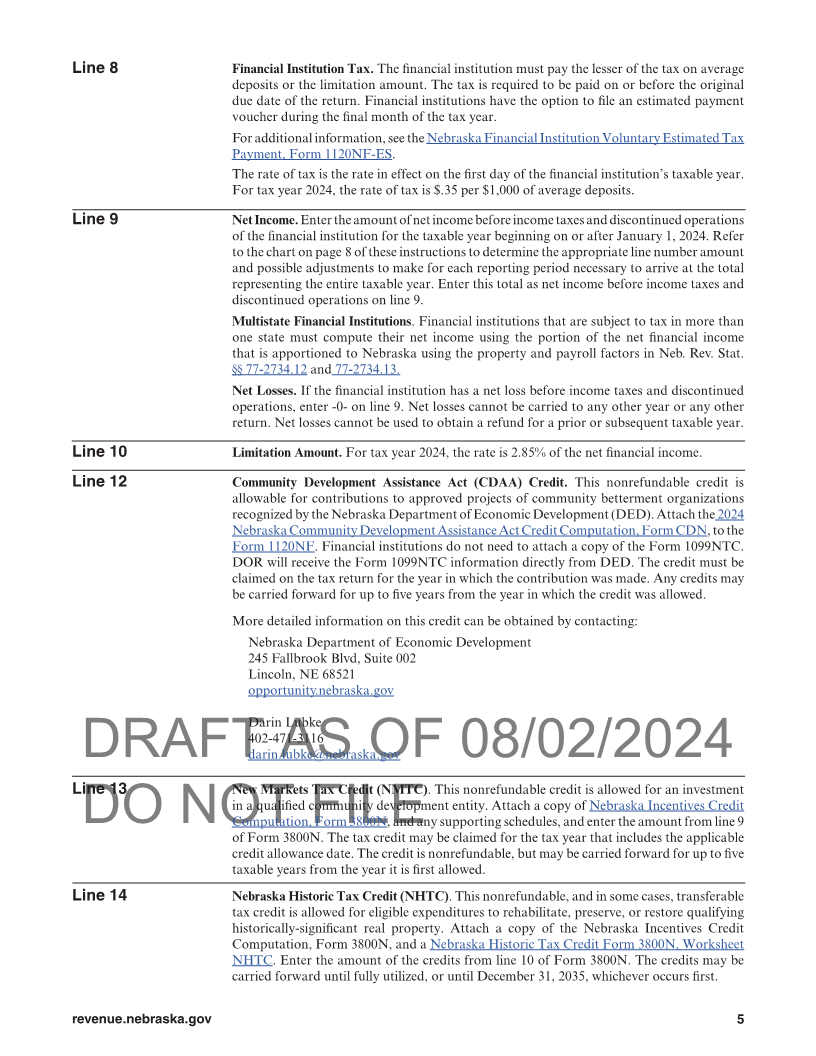

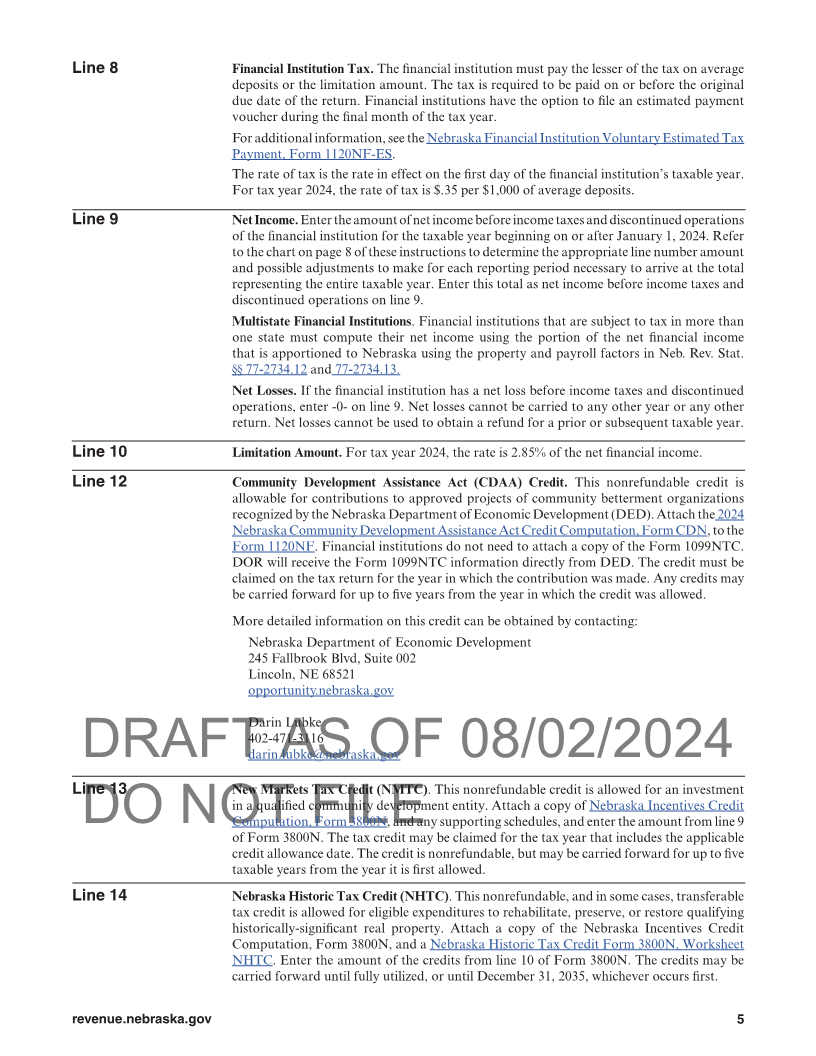

Line 8 Financial Institution Tax. The financial institution must pay the lesser of the tax on average

deposits or the limitation amount. The tax is required to be paid on or before the original

due date of the return. Financial institutions have the option to file an estimated payment

voucher during the final month of the tax year.

For additional information, see the Nebraska Financial Institution Voluntary Estimated Tax

Payment, Form 1120NF-ES.

The rate of tax is the rate in effect on the first day of the financial institution’s taxable year.

For tax year 2024, the rate of tax is $.35 per $1,000 of average deposits.

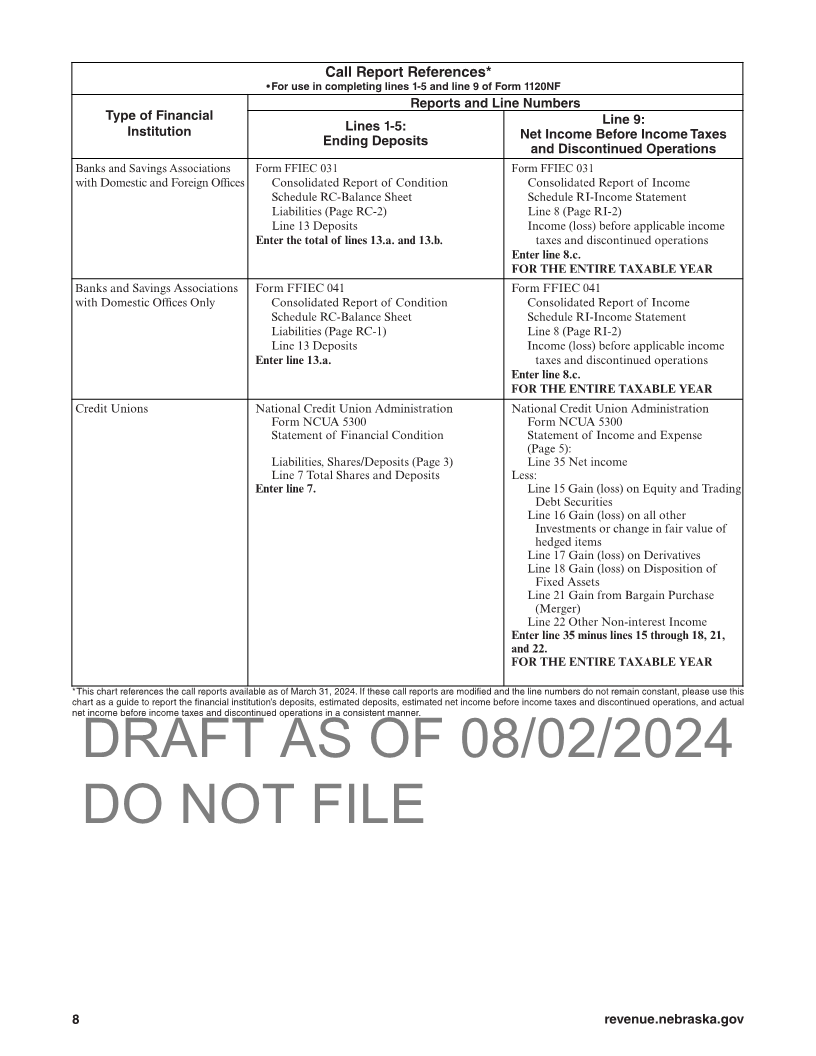

Line 9 Net Income. Enter the amount of net income before income taxes and discontinued operations

of the financial institution for the taxable year beginning on or after January 1, 2024. Refer

to the chart on page 8 of these instructions to determine the appropriate line number amount

and possible adjustments to make for each reporting period necessary to arrive at the total

representing the entire taxable year. Enter this total as net income before income taxes and

discontinued operations on line 9.

Multistate Financial Institutions. Financial institutions that are subject to tax in more than

one state must compute their net income using the portion of the net financial income

that is apportioned to Nebraska using the property and payroll factors in Neb. Rev. Stat.

§§ 77-2734.12 and 77-2734.13.

Net Losses. If the financial institution has a net loss before income taxes and discontinued

operations, enter -0- on line 9. Net losses cannot be carried to any other year or any other

return. Net losses cannot be used to obtain a refund for a prior or subsequent taxable year.

Line 10 Limitation Amount. For tax year 2024, the rate is 2.85% of the net financial income.

Line 12 Community Development Assistance Act (CDAA) Credit. This nonrefundable credit is

allowable for contributions to approved projects of community betterment organizations

recognized by the Nebraska Department of Economic Development (DED). Attach the 2024

Nebraska Community Development Assistance Act Credit Computation, Form CDN, to the

Form 1120NF. Financial institutions do not need to attach a copy of the Form 1099NTC.

DOR will receive the Form 1099NTC information directly from DED. The credit must be

claimed on the tax return for the year in which the contribution was made. Any credits may

be carried forward for up to five years from the year in which the credit was allowed.

More detailed information on this credit can be obtained by contacting:

Nebraska Department of Economic Development

245 Fallbrook Blvd, Suite 002

Lincoln, NE 68521

opportunity.nebraska.gov

Darin Lubke

402-471-3116

darin.lubke@nebraska.gov

DRAFT AS OF 08/02/2024

Line 13 New Markets Tax Credit (NMTC). This nonrefundable credit is allowed for an investment

in a qualified community development entity. Attach a copy of Nebraska Incentives Credit

Computation, Form 3800N, and any supporting schedules, and enter the amount from line 9

DO NOT FILEof Form 3800N. The tax credit may be claimed for the tax year that includes the applicable

credit allowance date. The credit is nonrefundable, but may be carried forward for up to five

taxable years from the year it is first allowed.

Line 14 Nebraska Historic Tax Credit (NHTC). This nonrefundable, and in some cases, transferable

tax credit is allowed for eligible expenditures to rehabilitate, preserve, or restore qualifying

historically-significant real property. Attach a copy of the Nebraska Incentives Credit

Computation, Form 3800N, and a Nebraska Historic Tax Credit Form 3800N, Worksheet

NHTC. Enter the amount of the credits from line 10 of Form 3800N. The credits may be

carried forward until fully utilized, or until December 31, 2035, whichever occurs first.

revenue.nebraska.gov 5

|