- 9 -

Enlarge image

|

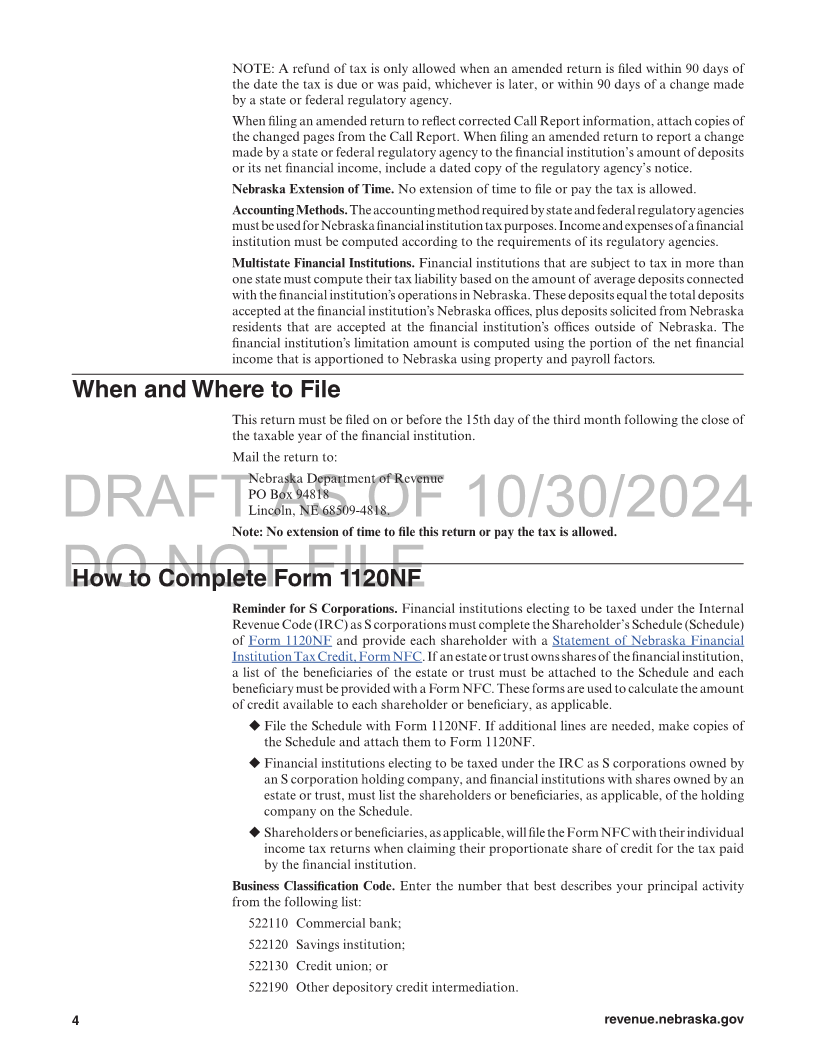

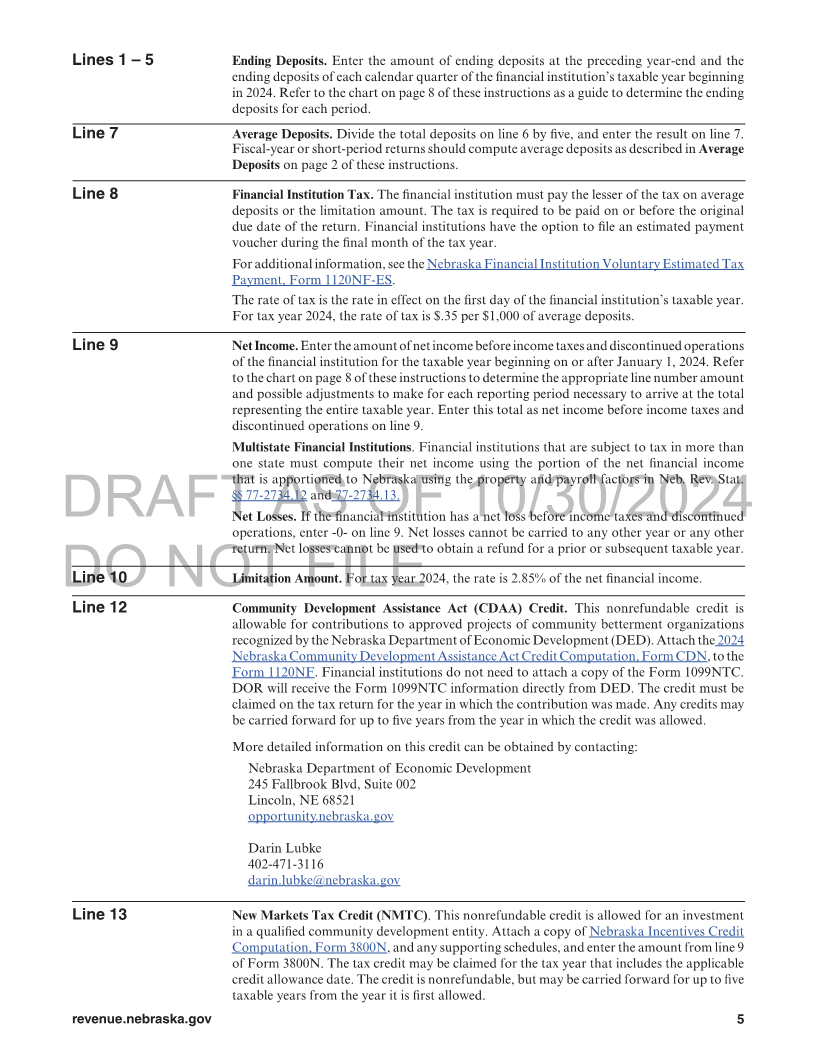

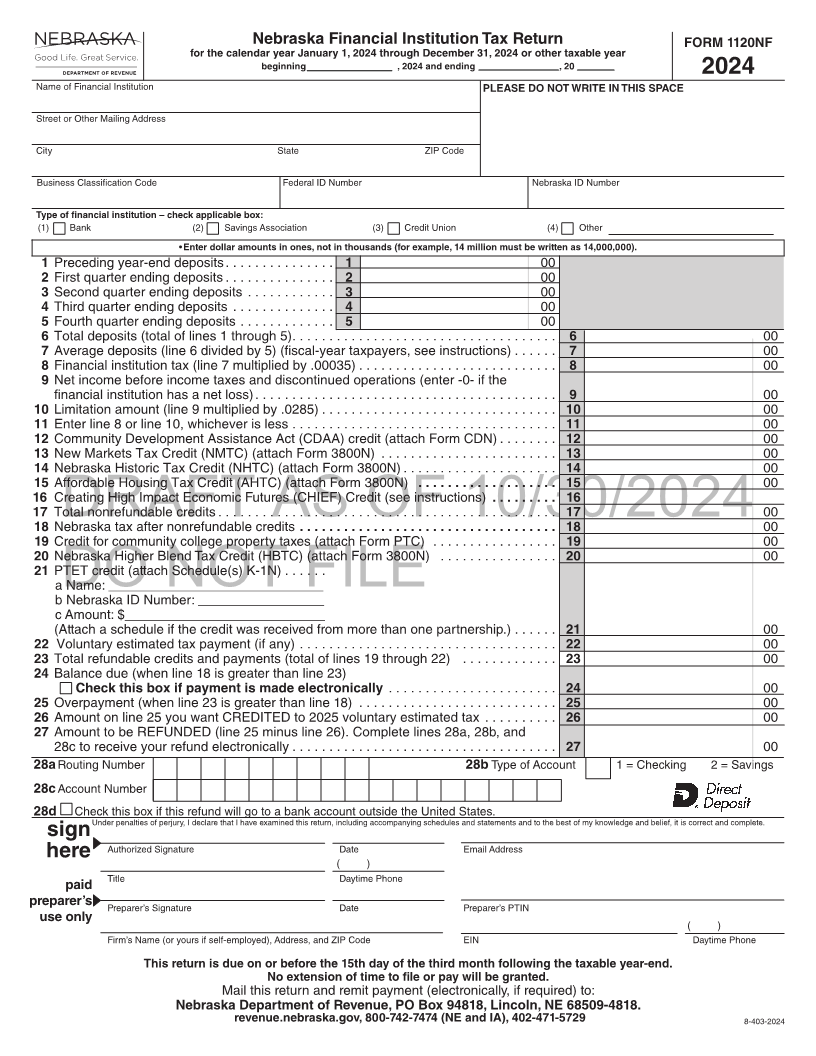

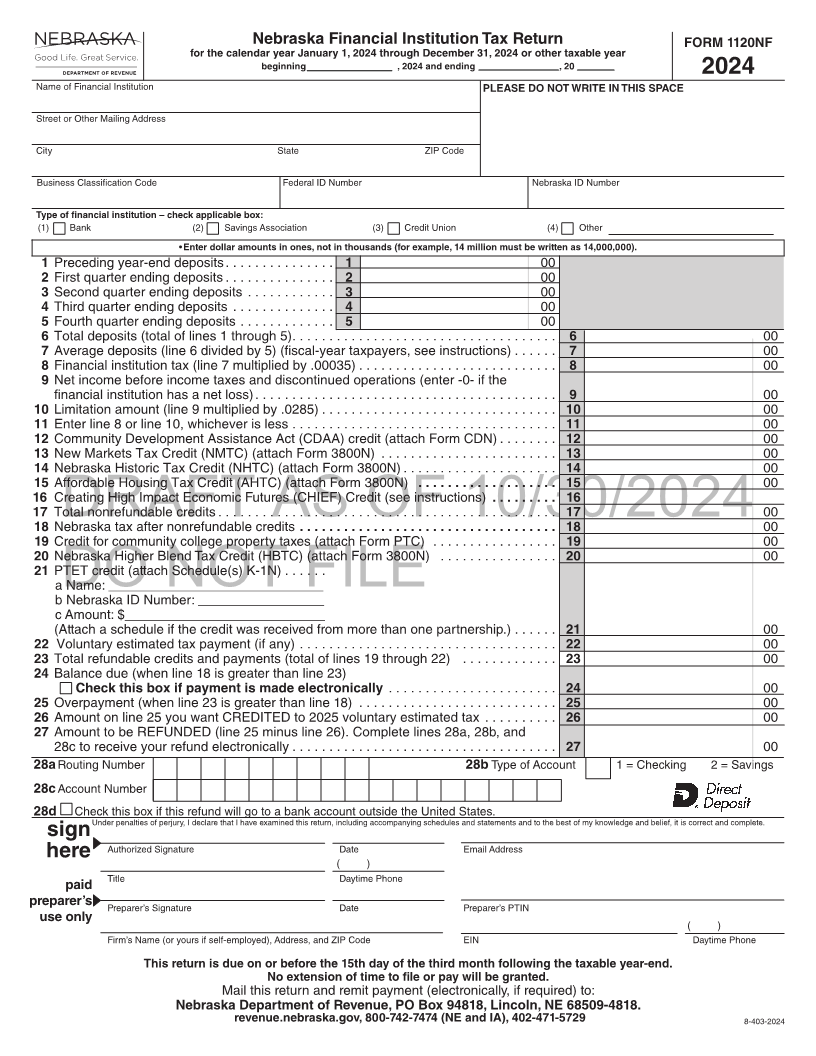

Nebraska Financial Institution Tax Return FORM 1120NF

for the calendar year January 1, 2024 through December 31, 2024 or other taxable year

beginning , 2024 and ending , 20

2024

Name of Financial Institution PLEASE DO NOT WRITE IN THIS SPACE

Street or Other Mailing Address

City State ZIP Code

Business Classification Code Federal ID Number Nebraska ID Number

Type of financial institution – check applicable box:

(1) Bank (2) Savings Association (3) Credit Union (4) Other

• Enter dollar amounts in ones, not in thousands (for example, 14 million must be written as 14,000,000).

1 Preceding year-end deposits ............... 1 00

2 First quarter ending deposits ............... 2 00

3 Second quarter ending deposits ............ 3 00

4 Third quarter ending deposits .............. 4 00

5 Fourth quarter ending deposits ............. 5 00

6 Total deposits (total of lines 1 through 5) .................................... 6 00

7 Average deposits (line 6 divided by 5) (fiscal-year taxpayers, see instructions) ...... 7 00

8 Financial institution tax (line 7 multiplied by .00035) ........................... 8 00

9 Net income before income taxes and discontinued operations (enter -0- if the

financial institution has a net loss) ......................................... 9 00

10 Limitation amount (line 9 multiplied by .0285) ................................ 10 00

11 Enter line 8 or line 10, whichever is less .................................... 11 00

12 Community Development Assistance Act (CDAA) credit (attach Form CDN) ........ 12 00

13 New Markets Tax Credit (NMTC) (attach Form 3800N) ........................ 13 00

14 Nebraska Historic Tax Credit (NHTC) (attach Form 3800N) ..................... 14 00

15 Affordable Housing Tax Credit (AHTC) (attach Form 3800N) ................... 15 00

16 Creating High Impact Economic Futures (CHIEF) Credit (see instructions) ......... 16

17 Total nonrefundable credits .............................................. 17 00

18 NebraskaDRAFTtax after nonrefundable creditsAS ................................... OF18 10/30/202400

19 Credit for community college property taxes (attach Form PTC) ................. 19 00

20 Nebraska Higher Blend Tax Credit (HBTC) (attach Form 3800N) ................ 20 00

21 PTET credit (attach Schedule(s) K-1N) ......

a Name: _____________________________

b Nebraska ID Number: _________________ DO NOT FILE

c Amount: $___________________________

(Attach a schedule if the credit was received from more than one partnership.) . ..... 21 00

22 Voluntary estimated tax payment (if any) ................................... 22 00

23Total refundable credits and payments (total of lines 19 through 22) ............. 23 00

24 Balance due (when line 18 is greater than line 23)

Check this box if payment is made electronically ....................... 24 00

25Overpayment (when line 23 is greater than line 18) ........................... 25 00

26Amount on line 25 you want CREDITED to 2025 voluntary estimated tax .......... 26 00

27Amount to be REFUNDED (line 25 minus line 26). Complete lines 28a, 28b, and

28c to receive your refund electronically .................................... 27 00

28a Routing Number 28b Type of Account 1 = Checking 2 = Savings

28c Account Number

28d Check this box if this refund will go to a bank account outside the United States.

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements and to the best of my knowledge and belief, it is correct and complete.

sign

Authorized Signature Date Email Address

here

( )

Title Daytime Phone

paid

preparer’s Preparer’s Signature Date Preparer’s PTIN

use only

( )

Firm’s Name (or yours if self-employed), Address, and ZIP Code EIN Daytime Phone

This return is due on or before the 15th day of the third month following the taxable year-end.

No extension of time to file or pay will be granted.

Mail this return and remit payment (electronically, if required) to:

Nebraska Department of Revenue, PO Box 94818, Lincoln, NE 68509-4818.

revenue.nebraska.gov, 800-742-7474 (NE and IA), 402-471-5729 8-403-2024

|