Enlarge image

2024 Wisconsin Form 5S Instructions

Table of Contents

General Instructions ................................................................................................................... 2

Definitions .............................................................................................................................. 2

Franchise or Income Tax ........................................................................................................ 3

Termination of Tax-Option (S) Treatment ............................................................................... 3

Election Out of Wisconsin Tax-Option Treatment ................................................................... 4

Additional Information on Wisconsin Treatment of Tax-Option (S) Corporations ..................... 4

Who Must File? ...................................................................................................................... 5

When and Where to File ......................................................................................................... 6

Corporations and Shareholders Subject to Wisconsin Tax-Option (S) Law ............................. 7

Period Covered by Return ...................................................................................................... 7

Accounting Methods and Elections ......................................................................................... 8

Payment of Estimated Tax ...................................................................................................... 9

Disclosure of Related Entity Expenses and Reportable Transactions ..................................... 9

IRS Adjustments, Amended Returns, Claims for Refund, and Final Returns .........................11

Other Types of Taxes and Returns ........................................................................................12

Penalties for Not Filing or Filing Incorrect Returns .................................................................14

Obtaining Forms and Assistance ...........................................................................................14

Interest Charge Domestic International Sales Corporations (IC-DISCs) ................................15

Conformity with Internal Revenue Code and Exceptions ...........................................................15

How to Report Differences .....................................................................................................22

Specific Instructions for Form 5S...............................................................................................23

Items A Through J .................................................................................................................23

Part I – Calculation of Tax Due or Refund .............................................................................26

Schedule Q – Additional Tax on Certain Built-In Gains ......................................................29

Schedule S – Economic Development Surcharge ..............................................................31

Additional Information, Answer Questions, Pass-Through Entity Representative, Third Party

Designee, Signatures, and Supplemental Schedules ............................................................34

Part II Schedule 5K – Shareholder's Pro Rata Share Items ...................................................36

Part II Schedule 5K, Columns (b) Through (d) ...................................................................36

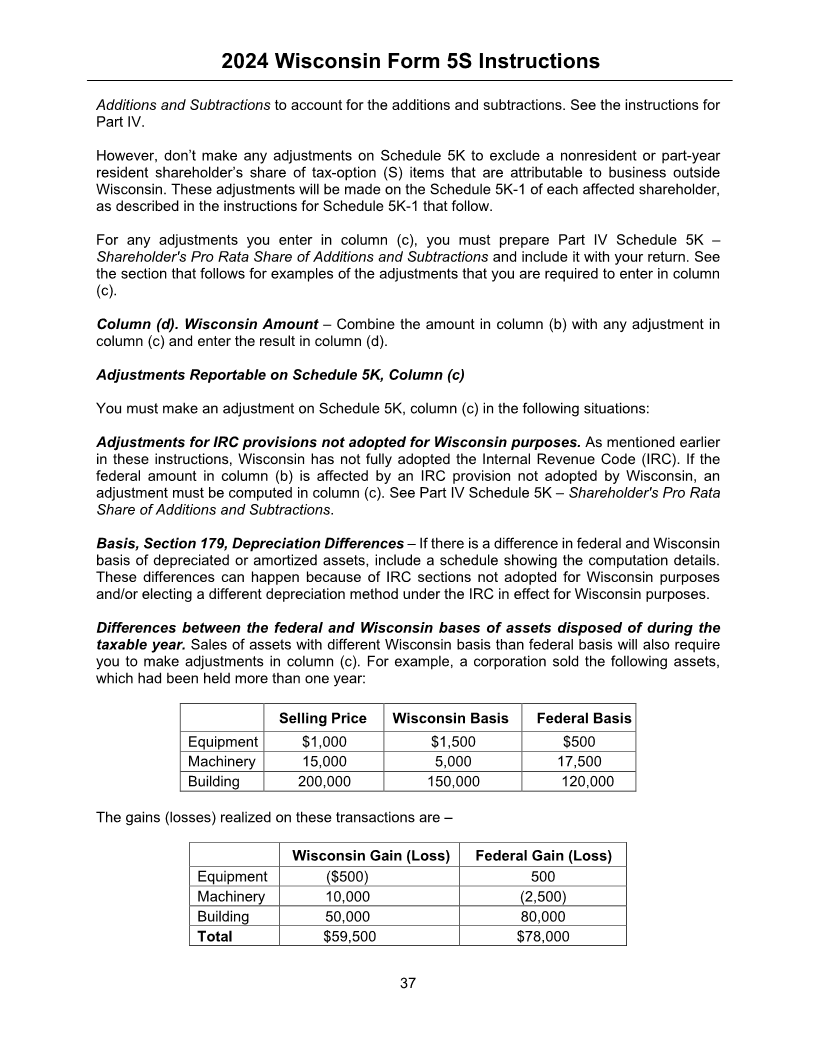

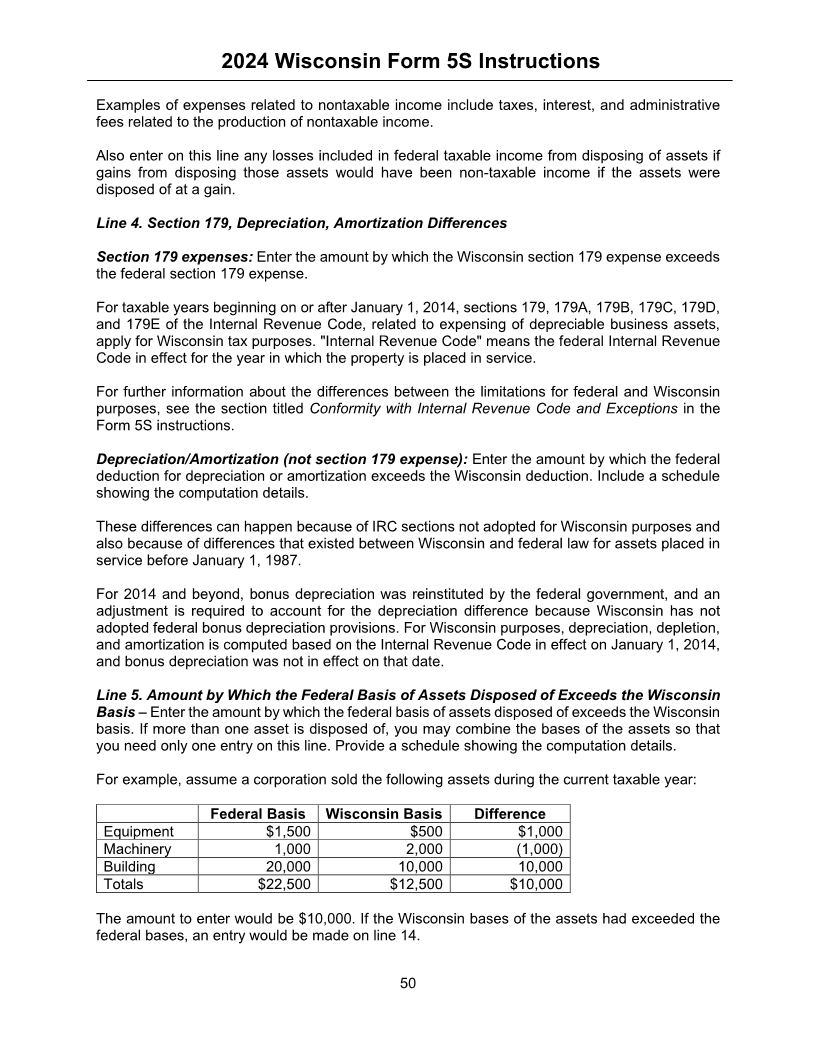

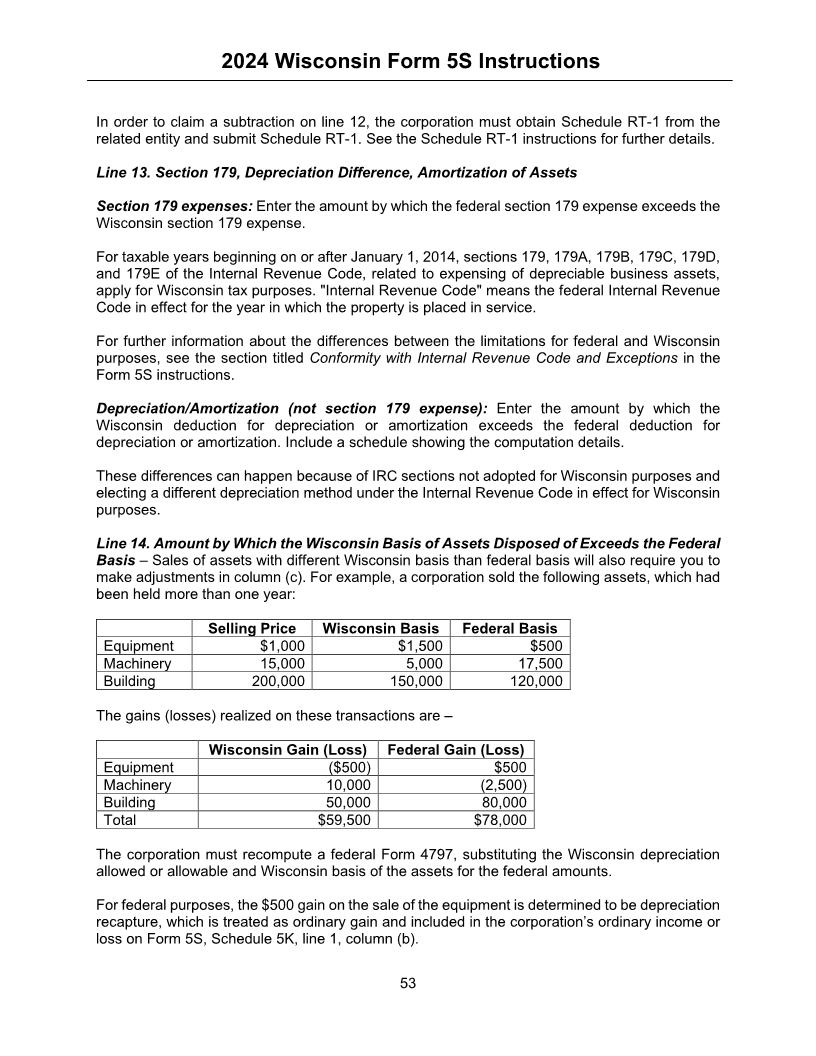

Adjustments Reportable on Schedule 5K, Column (c) ........................................................37

Part III – Schedule 5M – Analysis of Wisconsin Accumulated Adjustments Account and Other

Adjustments Account .............................................................................................................44

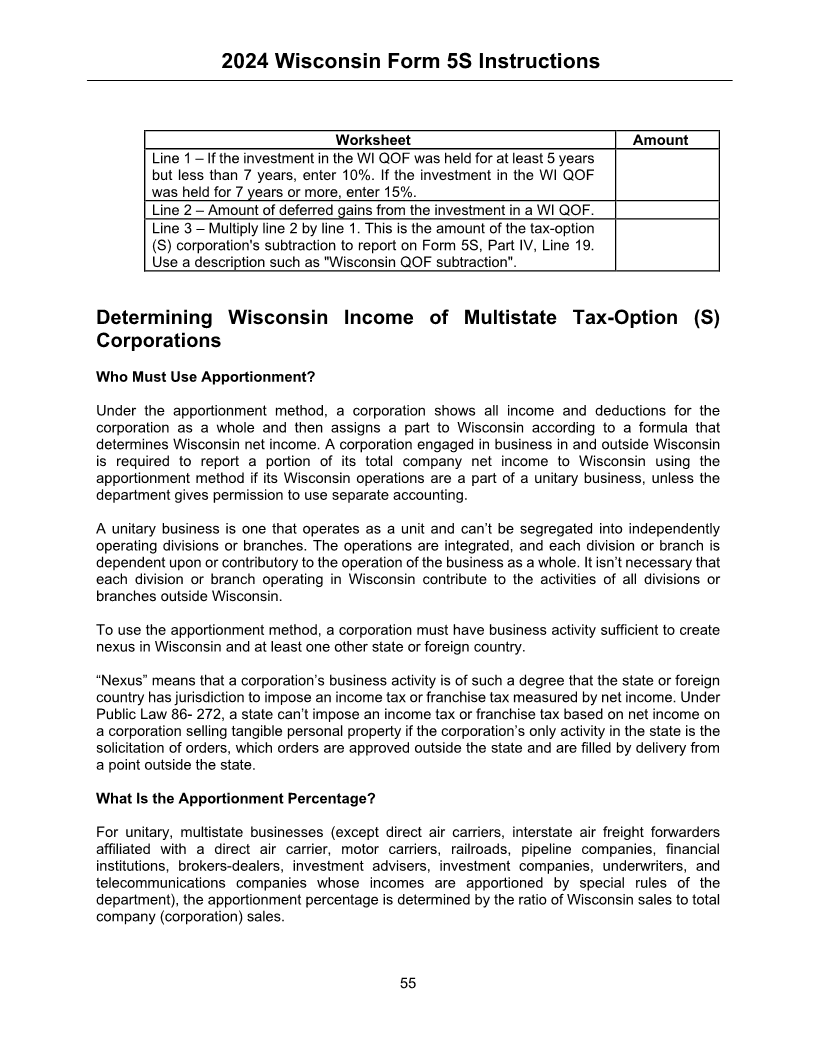

Part IV – Schedule 5K - Shareholder's Pro Rata Share of Additions and Subtractions ..........47

Determining Wisconsin Income of Multistate Tax-Option (S) Corporations ................................55

Who Must Use Apportionment? .............................................................................................55

What Is the Apportionment Percentage? ...............................................................................55

What Is Nonapportionable Income? .......................................................................................56

Corporate Partners or LLC Members .....................................................................................56

Separate Accounting .............................................................................................................57

IC-154 (R. 07-24)